Despite the main indexes closing moderately higher, the VIX managed to close slightly higher. The VIX peaked in late afternoon @ 17.96, but slipped into the close, settling 1.8% higher @ 17.67

VIX'60min

VIX'daily

VIX, weekly

Summary

Today's follow through was useful, however minor it was. The closing hour was a little tease to the bears, and the VIX just missed breaking into the 18s.

The bigger daily and weekly charts offer such enormous upside potential, but that has been the case since the VIX lows in August.

The big question remains

How many more days, weeks, or months until the VIX explodes?

That is of course impossible to know, but there are certainly some clues out there. The underlying MACD on the big weekly cycle is still battling higher. Look at the leading line (black), and see what happened the last time it crossed the 0 threshold in late July 2011.

For now, the doomer bears will just have to dream of a move from VIX teens..into the 40s.

Yet, such a move would occur over just a few weeks, rather than months. So, once it gets going, its going to surprise many at how fast it develops.

More later..on the indexes.

Thursday, 20 December 2012

Closing Brief

The market closed moderately higher, lead once again by the Transports and the Rus'2000 small cap. The higher VIX though, most certainly did not confirm the index gains. The market remains a little twitchy, despite what would normally be a quiet lead into the Christmas trading week.

Dow'60min

Sp'60min

Trans'60min

Summary

A bit of a choppy day, I suppose bears can at least be relieved we didn't break the two day 1448 high - although other indexes have already taken that equivalent level out

It remains the case that until we are back below the recent sp'1413 low, bears can't be confident.

--

The usual bits and pieces across the evening.

Dow'60min

Sp'60min

Trans'60min

Summary

A bit of a choppy day, I suppose bears can at least be relieved we didn't break the two day 1448 high - although other indexes have already taken that equivalent level out

It remains the case that until we are back below the recent sp'1413 low, bears can't be confident.

--

The usual bits and pieces across the evening.

3pm update - twitchy into the close?

The market remains close to the recent 1448 high, bears need a close in the mid 1430s to maintain at least a narrow buffer zone. There is a possible baby bear flag on the hourly index charts, but considering the latest general upside action, its unreliable.

sp'60min

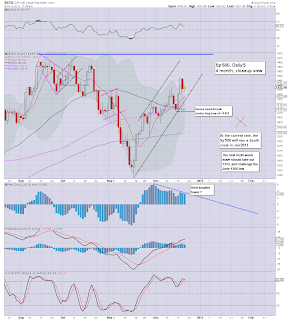

sp'daily5

Summary

I'm not sure of the exact time, but there is a vote on Boehners plan B' later this evening. From what I gather, that is not expected to pass, in which case Mr market might get a little bit rattled for the Friday open.

Regardless of potential after hours action, the imminent issue is whether we see an extended ramp into the close. I find it difficult to imagine we'll close above the recent two day peak.

Bears dearly need at least a fractional close in the red.

--

Gold has certainly seen a bounce off the primary 158 target.

However, if we see any significant moves <sp'1400 early next year, I find it very hard to believe GLD will remain in the 150s.

UPDATE 8.20pm A touch of weakness.

Would be good to see that bear flag confirmed by the close, but thats <1436 or so.

UPDATE 3.25pm, VIX at the high of the day, taking out the high from Dec'5

VIX making a break for it.

sp'60min

sp'daily5

Summary

I'm not sure of the exact time, but there is a vote on Boehners plan B' later this evening. From what I gather, that is not expected to pass, in which case Mr market might get a little bit rattled for the Friday open.

Regardless of potential after hours action, the imminent issue is whether we see an extended ramp into the close. I find it difficult to imagine we'll close above the recent two day peak.

Bears dearly need at least a fractional close in the red.

--

Gold has certainly seen a bounce off the primary 158 target.

However, if we see any significant moves <sp'1400 early next year, I find it very hard to believe GLD will remain in the 150s.

UPDATE 8.20pm A touch of weakness.

Would be good to see that bear flag confirmed by the close, but thats <1436 or so.

UPDATE 3.25pm, VIX at the high of the day, taking out the high from Dec'5

VIX making a break for it.

2pm update - day trading bears get the kick

We're seeing a moderate little spike to the upside, and doubtless, all those bearish day traders have just got short-stopped out. The VIX remains a touch higher, and there are still a lot of twitchy algo-bots out there. Seeking late afternoon weakness.

sp'daily5

vix'daily

Summary

Looking for a turn lower after 2.30pm, at least a flat close, if not red indexes.

Transports and Rus'2000 remain the stronger indexes.

--

On the contrary side, if we do manage to break above the recent 1448 high, then once again, bears are right back to square one.

Two hours to go, that is plenty of time to see this nonsense reverse.

BTU continues to rollover..forming what might be a right shoulder.

Bears need a few daily closes <25 to be sure of the H/S formation though.

sp'daily5

vix'daily

Summary

Looking for a turn lower after 2.30pm, at least a flat close, if not red indexes.

Transports and Rus'2000 remain the stronger indexes.

--

On the contrary side, if we do manage to break above the recent 1448 high, then once again, bears are right back to square one.

Two hours to go, that is plenty of time to see this nonsense reverse.

BTU continues to rollover..forming what might be a right shoulder.

Bears need a few daily closes <25 to be sure of the H/S formation though.

12pm update - Metals getting the hammer

Whilst the main indexes remain moderately choppy, what does stand out today are the metals. Gold is down around $30, with Silver declining over 4% -$1.40. These are the biggest moves in a long while, but certainly are not unexpected.

GLD, daily

SLV, daily

Summary

An interesting day so far, not least because of the dynamic moves in the metals market.

Moody Gold bugs

No doubt the gold maniacs - those insane non-traders who only tolerate talk of 'Gold will go UP', will be touting 'its the cartel'. Err, no..its a natural move..and certainly was predictable from a technical chart-perspective.

Gold is testing the 158s...but since SLV is already below the equivalent support level, GLD probably won't be able to hold the 158s, at least on a multi-week basis.

-

As for the main market....

sp'daily5

Nothing exciting yet, but a close in the 1420s seems very possible.

time for lunch

--

UPDATE 12.50pm I'm looking for a second spiky weekly candle. I could tolerate 1425 tomorrow, but anything 1415< would be much better.

As things are, I still think if we can take out the key 1398 low, we have a real chance at freefall to the 200 MA @ 1200 in early January.

That would make for one hell of a 'buy the dip' level in anticipation of increased QE from the Bernanke and Draghi in early Spring.

UPDATE - Euro.

Today is panning out much like yesterday, opening gains, but the Euro is weakening, and the USD is picking up a little strength into the affternoon.

Seeking 1.29s by end year

GLD, daily

SLV, daily

Summary

An interesting day so far, not least because of the dynamic moves in the metals market.

Moody Gold bugs

No doubt the gold maniacs - those insane non-traders who only tolerate talk of 'Gold will go UP', will be touting 'its the cartel'. Err, no..its a natural move..and certainly was predictable from a technical chart-perspective.

Gold is testing the 158s...but since SLV is already below the equivalent support level, GLD probably won't be able to hold the 158s, at least on a multi-week basis.

-

As for the main market....

sp'daily5

Nothing exciting yet, but a close in the 1420s seems very possible.

time for lunch

--

UPDATE 12.50pm I'm looking for a second spiky weekly candle. I could tolerate 1425 tomorrow, but anything 1415< would be much better.

As things are, I still think if we can take out the key 1398 low, we have a real chance at freefall to the 200 MA @ 1200 in early January.

That would make for one hell of a 'buy the dip' level in anticipation of increased QE from the Bernanke and Draghi in early Spring.

UPDATE - Euro.

Today is panning out much like yesterday, opening gains, but the Euro is weakening, and the USD is picking up a little strength into the affternoon.

Seeking 1.29s by end year

11am update - morning chop

Mr Market is trying to battle higher, but there is a lot of weakness out there. Certainly, even the bull maniacs who were crazy bullish at the Tuesday close, are now getting a bit twitchy. There remains significant chance of a close in the sp'1420s.

sp'daily5

VIX, daily2, rainbow

Summary

Look at the MACD (blue bar histogram) cycle, we have possible third lower tower, despite the recent rise in prices.

Now, price action is of course more important than any indicator, but there is a growing weakness out there.

Until we break <1413 though, can't be confident of anything.

-

VIX is a touch lower, but I'd look for a close 17.75/18.00 Note that despite the current decline, VIX is still green on the rainbow chart. A close in the 18s..is viable.

*Mr $ is back to evens, equity bears really should be seeking USD 80> to close the year.

UPDATE 11.25am Gold approaching the target 158..however, SLV already broken the equivilent support.

There really isn't much support until the summer lows

Gold maniacs will be screaming 'cartal manipulation' for the rest of the week. ..sigh.

sp'daily5

VIX, daily2, rainbow

Summary

Look at the MACD (blue bar histogram) cycle, we have possible third lower tower, despite the recent rise in prices.

Now, price action is of course more important than any indicator, but there is a growing weakness out there.

Until we break <1413 though, can't be confident of anything.

-

VIX is a touch lower, but I'd look for a close 17.75/18.00 Note that despite the current decline, VIX is still green on the rainbow chart. A close in the 18s..is viable.

*Mr $ is back to evens, equity bears really should be seeking USD 80> to close the year.

UPDATE 11.25am Gold approaching the target 158..however, SLV already broken the equivilent support.

There really isn't much support until the summer lows

Gold maniacs will be screaming 'cartal manipulation' for the rest of the week. ..sigh.

10am update - morning weakness

Despite the small attempt at an opening rally, the market is slipping lower. So far, its just a minor follow through, but a break into the sp'1420s is very viable as the day goes on. A VIX close in the 18s would be a warning of trouble tomorrow.

sp'60min

sp'daily5

Summary

A relatively quiet open, but there is certainly some good moves in individual stocks and commodities.

Of special note today is Gold, which is almost at my primary 158 target.

Considering equties aren't even below sp'1400, I'd look for GLD in the low 140s/130s in spring 2013. That is a very bold deflationary outlook though. First things first..lets see if 158 holds.

--

Keep an eye on a few of the stocks I been highlighting over the past few days...

BTU, ANR, HPQ, and GE. The last one, is especially presenting the most bearish individual chart out there.

UPDATE 10.22am ..Metal bugs are going to be mad as hell now...

SLV getting hammered..

There really isn't much of a floor until the summer lows

UPDATE Gold...

The big monthly chart is now seriously bearish..target would be the low 130s by early spring

sp'60min

sp'daily5

Summary

A relatively quiet open, but there is certainly some good moves in individual stocks and commodities.

Of special note today is Gold, which is almost at my primary 158 target.

Considering equties aren't even below sp'1400, I'd look for GLD in the low 140s/130s in spring 2013. That is a very bold deflationary outlook though. First things first..lets see if 158 holds.

--

Keep an eye on a few of the stocks I been highlighting over the past few days...

BTU, ANR, HPQ, and GE. The last one, is especially presenting the most bearish individual chart out there.

UPDATE 10.22am ..Metal bugs are going to be mad as hell now...

SLV getting hammered..

There really isn't much of a floor until the summer lows

UPDATE Gold...

The big monthly chart is now seriously bearish..target would be the low 130s by early spring

Pre-Market Brief

Good morning. Futures are flat, we're set to open around sp'1435. The econ-data so far today is not spooking the market.

Q3 GDP revision'2: 3.1%

Jobless: 361k, slightly upward.

--

sp'60min

sp'daily5

Summary

I think its now something of a race, to close the week flat. A flat weekly close would result in a second consecutive spiky candle on the weekly charts, which would be a pretty bearish outcome indeed!

--

So, the bears need to see a cumulative fall of around 22pts, to close tomorrow @ sp'1413..or lower.

--

Metals are weak again. Gold is -$11 @ GLD 160.5..so, there is around $25 to go before my 158 target.

Good wishes for Thursday trading.

Q3 GDP revision'2: 3.1%

Jobless: 361k, slightly upward.

--

sp'60min

sp'daily5

Summary

I think its now something of a race, to close the week flat. A flat weekly close would result in a second consecutive spiky candle on the weekly charts, which would be a pretty bearish outcome indeed!

--

So, the bears need to see a cumulative fall of around 22pts, to close tomorrow @ sp'1413..or lower.

--

Metals are weak again. Gold is -$11 @ GLD 160.5..so, there is around $25 to go before my 158 target.

Good wishes for Thursday trading.

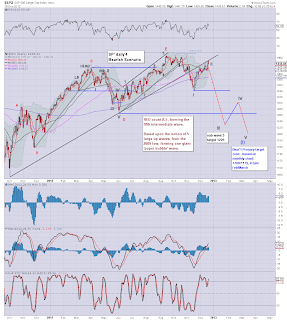

On the edge of a cliff

The main market saw some weakness in the afternoon, doubtless a result of political appearances, making the market again consider the issue of the fiscal cliff. If no agreement is reached by the end of this week, then Mr Market is going to have to significantly re-price itself.

sp'daily3 - news to come

sp'daily4 - original bearish outlook

sp'weekly

sp'monthly2 - Keltner channels

Summary

First, I want to be clear. Until we take out the recent sp'1413 low, no doomer bear can get the least bit confident..nor excited about potential declines into January.

With the move above the FOMC highs from last Wednesday, I think the 'serious money' should probably wait for this 1413 low to be decisively closed below.

--

The weekly chart is starting to look a little spiky, but really, I can't take it seriously yet, and even if we close Friday @ sp'1420, that would still be a net gain on the week.

The monthly chart is still showing two consecutive up candles, and the spike from the November low is a real problem for the bears. In many respects the 'super serious' bear money can't be short until that 1343 low is taken out.

Special note...

Both tomorrow and Friday see a considerable amount of econ-data released. We have a second/final revision for US Q3 GDP tomorrow, with the important Durable Goods Orders data on Friday. Both will be market moving, and obviously, the deflationary doomer bears should look for weakness in both data points.

So, with two trading days left of the week, lets see if we can somehow battle lower, and take out the key sp'1413 low. Were that to be achieved, we'd have TWO consecutive spiky candles on the weekly charts, and the original bearish outlook would be back in play.

Finally, it is important to note the fact we have the last option expiration of the year this Friday. This will likely lead to more choppy and dynamic price action.

--

Highly recommended viewing (I found this via Zerohedge). - Kyle Bass, at AmeriCatalysts

Kyle Bass remains a personal hero of mine. Just like Peter Schiff, Jim Rogers, Marc Faber, and Martin Armstrong, for the past few years, Bass says the things the mainstream media (but also the general populace) never want to hear. There are an awful lot of key issues in this hour long lecture/Q & A, but most notable, is the issue of Japan.

--

Bonus chart to end the day...

VIX, weekly, rainbow, 6yr

At some point the VIX is going to explode into the 30s..and 40s. The two main warning thresholds are clear...first 20..and then 27. If the VIX does break higher next month, it will make for one hell of a way to begin a new year.

Goodnight from London

sp'daily3 - news to come

sp'daily4 - original bearish outlook

sp'weekly

sp'monthly2 - Keltner channels

Summary

First, I want to be clear. Until we take out the recent sp'1413 low, no doomer bear can get the least bit confident..nor excited about potential declines into January.

With the move above the FOMC highs from last Wednesday, I think the 'serious money' should probably wait for this 1413 low to be decisively closed below.

--

The weekly chart is starting to look a little spiky, but really, I can't take it seriously yet, and even if we close Friday @ sp'1420, that would still be a net gain on the week.

The monthly chart is still showing two consecutive up candles, and the spike from the November low is a real problem for the bears. In many respects the 'super serious' bear money can't be short until that 1343 low is taken out.

Special note...

Both tomorrow and Friday see a considerable amount of econ-data released. We have a second/final revision for US Q3 GDP tomorrow, with the important Durable Goods Orders data on Friday. Both will be market moving, and obviously, the deflationary doomer bears should look for weakness in both data points.

So, with two trading days left of the week, lets see if we can somehow battle lower, and take out the key sp'1413 low. Were that to be achieved, we'd have TWO consecutive spiky candles on the weekly charts, and the original bearish outlook would be back in play.

Finally, it is important to note the fact we have the last option expiration of the year this Friday. This will likely lead to more choppy and dynamic price action.

--

Highly recommended viewing (I found this via Zerohedge). - Kyle Bass, at AmeriCatalysts

Kyle Bass remains a personal hero of mine. Just like Peter Schiff, Jim Rogers, Marc Faber, and Martin Armstrong, for the past few years, Bass says the things the mainstream media (but also the general populace) never want to hear. There are an awful lot of key issues in this hour long lecture/Q & A, but most notable, is the issue of Japan.

--

Bonus chart to end the day...

VIX, weekly, rainbow, 6yr

At some point the VIX is going to explode into the 30s..and 40s. The two main warning thresholds are clear...first 20..and then 27. If the VIX does break higher next month, it will make for one hell of a way to begin a new year.

Goodnight from London

Daily Index Cycle update

The main indexes closed somewhat lower, but it is notable that what are often the two leading indexes - the transports and Rus'2000, both held up, and closed slightly higher. We are still considerably above the closing level from last Friday, and bears remain weak until we are trading back <sp'1413

IWM, daily

SP, daily

Trans, daily

Summary

Most of the day saw minor..and quite boring chop. A few points higher, a few points lower, but with a few political appearances across the afternoon, the markets showed a little weakness, and slipped lower into the close.

Certainly, the closing declines are nothing for the bears to get excited about, but we're almost 1% away from the sp'1448 high.

What is absolutely clear, until we are back below the levels from last Friday - sp'1413, we remain in a very broad up trend.

If we do somehow break <sp'1413, the subsequent market moves could be very strong, with the VIX breaking above the key 20 threshold.

A little more later

IWM, daily

SP, daily

Trans, daily

Summary

Most of the day saw minor..and quite boring chop. A few points higher, a few points lower, but with a few political appearances across the afternoon, the markets showed a little weakness, and slipped lower into the close.

Certainly, the closing declines are nothing for the bears to get excited about, but we're almost 1% away from the sp'1448 high.

What is absolutely clear, until we are back below the levels from last Friday - sp'1413, we remain in a very broad up trend.

If we do somehow break <sp'1413, the subsequent market moves could be very strong, with the VIX breaking above the key 20 threshold.

A little more later

Subscribe to:

Comments (Atom)