Hmm, not a good end to the day for the bulls. However, selling vol' was arguably light, and overall there was no real drama today. The main delusion that 'everything is gonna be okay' seems still intact.

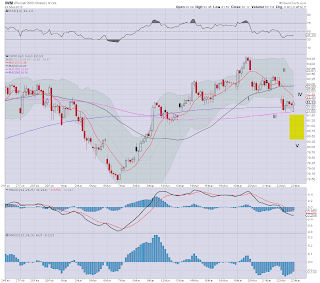

IWM 60min cycle

We have a clear secondary bear flag on IWM and across most of the other indexes. A further move lower early Friday seems highly likely. That might make for a very clean 5 micro-waves lower, and then maybe that's that, before the next major wave high to sp'1440.

SP Daily

Sp' remains still very strong overall from a daily perspective. However, it is due to go negative cycle (see MACD) Friday. Overall, the daily is pretty bearish.

*I've left an old count on that chart, right now, no idea what to think. Did we really put in a top at the 1414 level?

VIX Daily

VIX is set to go positive cycle Friday, the first major line will be upper bol' of 20.

In Closing

Short term cycles are bearish across the board. It would seem we make another new short term low this Friday, and then maybe we truly start to complete a floor.

The notion we open up 0.75% or more Friday, and keep going up is viable, but..considering the daily cycles, the odds are highly against it. If the market really wants to wreck the bears weekend, it will gap this market back over the 10 MA on the 60min cycle tomorrow, and trend upward...ALL day.

more later....

Thursday, 22 March 2012

Thursday Trouble, Buy the Dip?

So, the market is a little lower, and now the 60min cycle is looking like its flooring for a few hours at least. VIX had a 10% jump, but thats tailing off right now a bit.

SP' 60min cycle

It is now paramount that the bulls get this market back over 1400 quickly. A close of 1395 or lower, and there could be further problems tomorrow.

The 60min cycle does offer the opportunity now for a bounce, so lets see what the algo-bots decide. Will they be happy to buy above 1400, or keep selling into each of the micro-rallies?

yours...

not yet on suicide watch.

SP' 60min cycle

It is now paramount that the bulls get this market back over 1400 quickly. A close of 1395 or lower, and there could be further problems tomorrow.

The 60min cycle does offer the opportunity now for a bounce, so lets see what the algo-bots decide. Will they be happy to buy above 1400, or keep selling into each of the micro-rallies?

yours...

not yet on suicide watch.

WTIC: baby bull flag, a challenge to $117

Oil is still relentlessly showing considerable strength. Over the last few days we've seen talk of Saudi Arabia ordering 11 super tankers of oil to be sent to the US to bring prices down. Huh? Why would they want or care for lower prices. Its just more nonsense talk.

WTIC - daily

If we see 118/119 within the next few weeks we could call it a confirmation that the 140s - with a test of the 2008 high of 147 is coming.

Oh yeah, that's right, rising oil prices, that's got to be a green shoot for this Spring!

WTIC - daily

If we see 118/119 within the next few weeks we could call it a confirmation that the 140s - with a test of the 2008 high of 147 is coming.

Oh yeah, that's right, rising oil prices, that's got to be a green shoot for this Spring!

NYSE 52wk highs - a warning?

Ohoh, this might be a real problem for the near term continued up trend.

NYSE 52wk highs

I have never highlighted this chart before, on a quiet day like today, it might be offering a warning to the bulls. It looks like we have negative divergence.

The market itself still looks broadly okay for further up moves, but we are certainly seeing a possible warning. We'll only know in a few more days. A move under SP'1390 would be short term confirmation of some kind of new down cycle.

Good wishes for Thursday

NYSE 52wk highs

I have never highlighted this chart before, on a quiet day like today, it might be offering a warning to the bulls. It looks like we have negative divergence.

The market itself still looks broadly okay for further up moves, but we are certainly seeing a possible warning. We'll only know in a few more days. A move under SP'1390 would be short term confirmation of some kind of new down cycle.

Good wishes for Thursday

Whats going on with Japan?

Hmm, I was not planning to highlight Japan of all things this evening, but take a look at this...

Nikkei, daily

The Nikkei is up an almost disturbing 25% since the start of the year. So, err...confirmation of Q4 GDP -2.5% was good news huh? I'm not sure what to think as we are coming up to last summers high. You can see clearly how last July we put in a top, then a lower high, before the dive bomb - along with all world indexes, into early August.

Nikkei - Monthly, a breakout?

.

Japanese stocks are of course still some 65% lower than a few decades ago, but we do have what appears to be a bull flag on the monthly cycle. We'll need April and May to show good follow through to the upside to confirm this.

11k doesn't seem too far away, and would be the first soft confirmation of 'bigger things to come'. 12,000 would be one major wall to break over though. Can we get another 20% across the spring and by late summer? Japan remains one of the indexes I am keeping a close eye on. Further up moves in the Asian indexes would certainly help the bullish case for SP'1550 later this year.

Nikkei, daily

The Nikkei is up an almost disturbing 25% since the start of the year. So, err...confirmation of Q4 GDP -2.5% was good news huh? I'm not sure what to think as we are coming up to last summers high. You can see clearly how last July we put in a top, then a lower high, before the dive bomb - along with all world indexes, into early August.

Nikkei - Monthly, a breakout?

.

Japanese stocks are of course still some 65% lower than a few decades ago, but we do have what appears to be a bull flag on the monthly cycle. We'll need April and May to show good follow through to the upside to confirm this.

11k doesn't seem too far away, and would be the first soft confirmation of 'bigger things to come'. 12,000 would be one major wall to break over though. Can we get another 20% across the spring and by late summer? Japan remains one of the indexes I am keeping a close eye on. Further up moves in the Asian indexes would certainly help the bullish case for SP'1550 later this year.

Oyasuminasai !

Subscribe to:

Comments (Atom)