Whilst the indexes closed largely flat, the VIX closed just under 1% higher @ 16.05. With just 3 weeks until the new year -and ZERO sign of a fiscal cliff agreement, Mr Market is completely in denial about what is coming. If the market does have it grossly wrong, and no agreement can be reached, a major re-pricing of equities will be necessary, and the VIX will explode.

VIX'60min

VIX'daily

Summary

First upside target is the mid 17s. If that can be achieved after the FOMC announcement this Wednesday, then there is the likelihood of 19s later this week.

VIX '20, a key threshold - and one even the clown finance TV networks recognise as important, still seems out of range in the immediate term.

What is clear, when we do see VIX 20+, it will be a massive warning of trouble, and then my mid-term target of the low sp'1200s will become the immediate target.

More later..on the indexes.

Monday, 10 December 2012

Closing Brief

A very dull day in the market. With trading volume at near zero, the algo-bots were in full control, and were thus able to melt everything slowly higher. It would appear the indexes will churn, with the constant threat of slow melt higher..all the way into the FOMC announcement @ 12.30pm Wednesday.

The closing hourly charts...

dow

sp

trans

Summary

A dull day, we remain (just) within small upward channels, and until we are back under the lows from last Wednesday - sp'1398, the bears have a real problem in that the algo-bots are merely able to melt this nonsense higher.

A few closes in the 1430s and I'd be worried. A few daily closes in the 1440s..and that'd arguably wreck my general bearish outlook.

So..in the grand picture..we're very close to the edge.

As things are..Mr Market is waiting for the Bernanke to deliver on Wednesday. One thing is for sure, we won't be trading flat on Wednesday afternoon.

--

The usual bits and pieces across the evening.

The closing hourly charts...

dow

sp

trans

Summary

A dull day, we remain (just) within small upward channels, and until we are back under the lows from last Wednesday - sp'1398, the bears have a real problem in that the algo-bots are merely able to melt this nonsense higher.

A few closes in the 1430s and I'd be worried. A few daily closes in the 1440s..and that'd arguably wreck my general bearish outlook.

So..in the grand picture..we're very close to the edge.

As things are..Mr Market is waiting for the Bernanke to deliver on Wednesday. One thing is for sure, we won't be trading flat on Wednesday afternoon.

--

The usual bits and pieces across the evening.

3pm update - closing hour weakness...probably

The market is looking tired, hovering at broadly the same levels as last Monday, and once again we're due 'some level' of down cycle. The first target would be last Wednesdays low of sp'1398. That is a mere 1.5% lower, so..its easily achievable within a single day.

sp'60min

sp'daily5

Summary

It remains..dull, but..as we're seeing, there IS weakness out there.

The question is..who thinks we're going to be trading in the sp'1430s any time soon?

..in that case...we go down.

--

UPDATE 3.30pm VIX melting slowly lower into the close. Bears will need ot take out the 17.50s later this week.

back after the close

sp'60min

sp'daily5

Summary

It remains..dull, but..as we're seeing, there IS weakness out there.

The question is..who thinks we're going to be trading in the sp'1430s any time soon?

..in that case...we go down.

--

UPDATE 3.30pm VIX melting slowly lower into the close. Bears will need ot take out the 17.50s later this week.

back after the close

2pm update - rolling over...slowly

The hourly index charts are all showing the same thing..a rollover, but its a slow one, and the formation could easily be a micro bull flag, within what remains a near term up trend. Bears will need to break <sp'1415 to break the up trend. Considering its only 3pts away, and the upside momentum us being lost..there is a chance of a weak closing hour.

sp'60min

vix'60min

Summary

Overall though, tt remains....dull.

VIX is due to go positive MACD (hourly) cycle in about 2-3 trading hours, so..any minor drama will not be until early tomorrow.

UPDATE 2.25pm, Note the 50 MA @ 1416. A close under that would be...useful.

sp'60min

vix'60min

Summary

Overall though, tt remains....dull.

VIX is due to go positive MACD (hourly) cycle in about 2-3 trading hours, so..any minor drama will not be until early tomorrow.

UPDATE 2.25pm, Note the 50 MA @ 1416. A close under that would be...useful.

1pm update - afternoon rollover?

There is still very little going on, but there is a tiny sign of a rollover on the hourly charts. Bears will need a close <sp'1415 to have any hope that the current melt up cycle is complete. VIX is still holding green, whilst Mr $ still trying to go green.

sp'60min

trans'60min

Summary

It remains..oh so quiet.

Best bear case..a close <1415, with VIX in the upper 16s.

--

sp'60min

trans'60min

Summary

It remains..oh so quiet.

Best bear case..a close <1415, with VIX in the upper 16s.

--

12pm update - sleepy Monday

No traders..no volume..no..nothing. The only marginally interesting aspect of today is that the dollar looks set to go green, and close higher for a fourth consecutive day. Everyone is clearly waiting for the FOMC on Wednesday.

sp'60min

trans'60min

Summary

Nothing needs to be added, its just..plain dull.

---

Its that time of year again though, when the hysteria can get hyper focused into a given sector. Looks like the rare Earths are back in fashion again. How many pump/dump stock pimping sites are back to touting REE and MCP again? Crazy maniacs.

wake me up..if something happens..

more later

sp'60min

trans'60min

Summary

Nothing needs to be added, its just..plain dull.

---

Its that time of year again though, when the hysteria can get hyper focused into a given sector. Looks like the rare Earths are back in fashion again. How many pump/dump stock pimping sites are back to touting REE and MCP again? Crazy maniacs.

wake me up..if something happens..

more later

11am update - back to zero volume melt

With no one trading..the algo-bots are melting this market higher. Transports is leading the way, and is busting higher on the daily chart, and looks set to hit 5200. VIX is a touch higher, and USD is recovering from the earlier moderate declines.

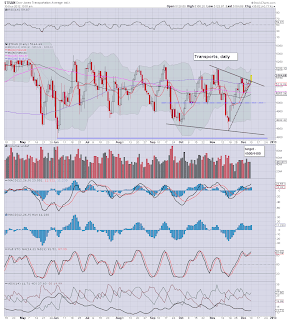

trans'daily

sp'daily

Summary

Its starting to look like today is a write off. No traders, zero volume..so..its merely melting higher this morning. It doesn't mean we can't close a touch lower, but on balance..we're more likely to close flat.

Dull dull dull.

At least the FOMC this Wednesday will probably inspire at least someone 'real' to buy..or sell something.

UPDATE 10.10am ..The H/S on the tranny is clearly busted, updated chart.

I suppose tranny might already be in a C' wave ? Hmm.. will have to keep a close eye on this.

Mr $ is about to go green..a fourth day closing higher..seems likely now. should at least keep the lid on metals/oils.

Trans'hourly

On any basis, we're on the upper end of yet another up cycle.

trans'daily

sp'daily

Summary

Its starting to look like today is a write off. No traders, zero volume..so..its merely melting higher this morning. It doesn't mean we can't close a touch lower, but on balance..we're more likely to close flat.

Dull dull dull.

At least the FOMC this Wednesday will probably inspire at least someone 'real' to buy..or sell something.

UPDATE 10.10am ..The H/S on the tranny is clearly busted, updated chart.

I suppose tranny might already be in a C' wave ? Hmm.. will have to keep a close eye on this.

Mr $ is about to go green..a fourth day closing higher..seems likely now. should at least keep the lid on metals/oils.

Trans'hourly

On any basis, we're on the upper end of yet another up cycle.

10am update - market seeking a direction

We're off and running, in what 'might' be the last proper trading week of the year. Market appears somewhat lost, and lacking any real direction. Bears need to push below sp'1410...that should then give us an idea of how much weakness is out there.

sp'60min

vix'60min

Summary

Opening minor chop, although at least from the short side, we're not massively gapping over last weeks 1423 high.

VIX is sporting a black fail candle, thats not exactly the best sign for bears.

--

Again, its a case of whether the underlying weakness starts to appear.

I remain short, seeking <1400...in the next few days.

UPDATE 10.20am... we sure are getting maxed out around here.

Easy short stop @ 1424, or even tighter 1420..right now.

Trans managed to re-test the high from last Monday, double top ?

sp'60min

vix'60min

Summary

Opening minor chop, although at least from the short side, we're not massively gapping over last weeks 1423 high.

VIX is sporting a black fail candle, thats not exactly the best sign for bears.

--

Again, its a case of whether the underlying weakness starts to appear.

I remain short, seeking <1400...in the next few days.

UPDATE 10.20am... we sure are getting maxed out around here.

Easy short stop @ 1424, or even tighter 1420..right now.

Trans managed to re-test the high from last Monday, double top ?

Pre-Market Brief

Good morning. Futures are a touch lower, sp -3pts, we're set to open around sp'1415. The smaller 15/60min trading cycles are due for some kind of move lower, but until we're back <1410, bears should be concerned that a break over last Mondays peak of 1423 is viable at any moment.

sp'60min

sp'daily5

VIX'60min

Summary

There is no significant econ-data until Thursday, when we have retail sales. However, there is the FOMC on Wednesday, which will clearly be the last major 'event' of the year.

Bears should be seeking a Monday close <sp'1410. That would suffice, and re-open the door to sub 1400s. I'm guessing we have a shot at 1375 later this week, thats feasible, and is only 2.5% lower.

We have a long week ahead, doubtless, it'll get a little wild on Wednesday...a Fed day, when Bernanke is expected to confirm 'naked/unsterilised' T-bond buying of 45bn commencing in January - in addition to the 40bn of MBS currently underway.

So, to be clear, I'm seeking one final small wave lower this week, before a final bounce into Christmas week. Whether that 'final bounce' makes a new high >1423, I can't guess.

What is clear, we'll VERY likely melt upward into Christmas week, after whatever level of decline we might see this week.

More across the day.

sp'60min

sp'daily5

VIX'60min

Summary

There is no significant econ-data until Thursday, when we have retail sales. However, there is the FOMC on Wednesday, which will clearly be the last major 'event' of the year.

Bears should be seeking a Monday close <sp'1410. That would suffice, and re-open the door to sub 1400s. I'm guessing we have a shot at 1375 later this week, thats feasible, and is only 2.5% lower.

We have a long week ahead, doubtless, it'll get a little wild on Wednesday...a Fed day, when Bernanke is expected to confirm 'naked/unsterilised' T-bond buying of 45bn commencing in January - in addition to the 40bn of MBS currently underway.

So, to be clear, I'm seeking one final small wave lower this week, before a final bounce into Christmas week. Whether that 'final bounce' makes a new high >1423, I can't guess.

What is clear, we'll VERY likely melt upward into Christmas week, after whatever level of decline we might see this week.

More across the day.

Subscribe to:

Comments (Atom)