sp'daily5

VIX'daily3

Summary

Thursday was pretty similar to the previous three days, opening higher (if only fractionally), but then choppily cooling into the afternoon. Yesterday's low was broken, as the equity bears came close to fully filling last Friday's price gap of 2752/38. Its notable that whilst the sp'500 did settle lower for a fourth consecutive day, the Dow and Transports managed to settle higher.

The VIX remained rather subdued, and even though equities broke a new multi-day low, the VIX could not break a new high, and settled a little lower in the mid 16s.

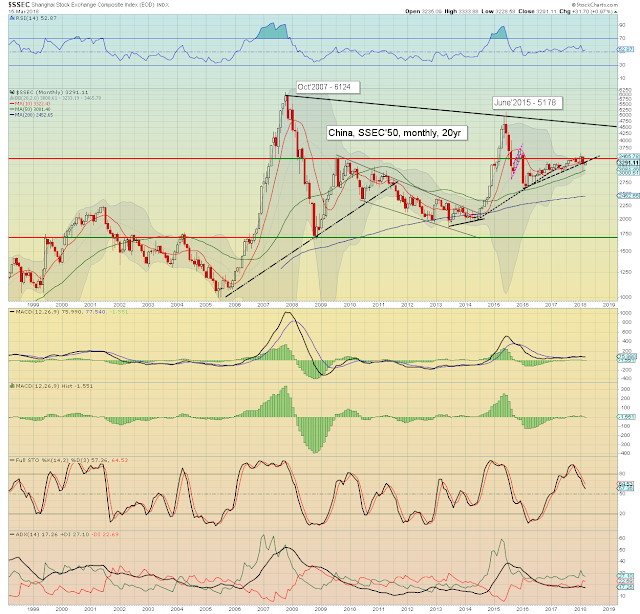

Bonus chart: China, monthly

Half way through the month, with the Shanghai comp' net higher by around 1.0% at 3291. Note the key 10MA at 3322. The equity bulls should be seeking a March settlement above that MA, to give renewed hope that a major push >3500 is coming.

--

|

| Spring is coming! |

--

Extra charts in AH (usually around 7pm EST) @ https://twitter.com/permabear_uk

Goodnight from London

--

If you value my work, subscribe to me.

For details: https://permabeardoomster.blogspot.co.uk/p/subscriptions.html