Market held up into the close, but both the 15/60 minute micro-cycles are due to fall. It really makes little difference, we ARE due to put in one final move lower to around 1265/55 by late Wednesday/early Thursday.

...closing hourly cycles...

IWM

Dow

Sp

Summary

The Bernanke speaks Thursday 10am...until then, we could see all of tomorrow..and early Thursday slide lower.

...ohh, and congrats to FB holders, only -4% today.

Tuesday, 5 June 2012

3pm update - time to rollover..one last time

As the grey rainy gloom covers the city once again (matches my mood)...Mr Market is set to rollover again this closing hour. There is no longer any reason why any semi-sane bull should be holding long right now, not least overnight into tomorrow.

The only issue is how low is the final wave tomorrow. Just a touch under 1265, or maybe a brief move into the 1250s?

Sp'15min

sp'60min

Summary

I bailed on index-longs just 30mins ago, I'm sitting out the next wave lower. I need a break from this nonsense, and besides, this last minute wave of 5' might not be that much. Hard to say, so I'm not going to play this next round.

More after the close.

The only issue is how low is the final wave tomorrow. Just a touch under 1265, or maybe a brief move into the 1250s?

Sp'15min

sp'60min

Summary

I bailed on index-longs just 30mins ago, I'm sitting out the next wave lower. I need a break from this nonsense, and besides, this last minute wave of 5' might not be that much. Hard to say, so I'm not going to play this next round.

More after the close.

2pm update - still crawling higher

If we're going to hit the low 1290s...it'll be in this hour. A hit of 1290/92..and we could start to rollover in the closing hour - setting up a late Wed/Thur' move to the 1250s.

Those still long should be well aware of the underlying weakness still in this market. With the Bernanke still to speak this Thursday (10am), there remains some real potential for one last minute wave lower.

Sp'15min

Summary

*Still long, but looking to close out this hour. Even though I think we could fall 30/40pts in the next 1-2 trading days, I am not really in the mood to take another position today.

--

Those still long should be well aware of the underlying weakness still in this market. With the Bernanke still to speak this Thursday (10am), there remains some real potential for one last minute wave lower.

Sp'15min

Summary

*Still long, but looking to close out this hour. Even though I think we could fall 30/40pts in the next 1-2 trading days, I am not really in the mood to take another position today.

--

1pm update - waiting...urgh

A somewhat tiresome day, still waiting for sp'1290/92 to hit.

sp'15min

sp'60min fib levels

vix'60min

*nothing else to add right now...back later....

sp'15min

sp'60min fib levels

vix'60min

*nothing else to add right now...back later....

12pm update - sp'1290s..just about still viable

These crazy little cycles are arguably pointless to try to predict with precision. Looks like we may yet be seeing a wave'4 comprised of 5, rather than 3 waves. So, 1290s are still viable by 2-3pm. A fall, as low as 1250s remains a very real threat to the bulls by late Wednesday/early Thursday.

Sp'15min

VIX'60min

Summary

The VIX remains red, so the bulls still have that going for them.

*I'm still long, looking to exit around 1290/92, am not sure if I'll switch to a short position if we get to that point.

--

time for lunch....

Sp'15min

VIX'60min

Summary

The VIX remains red, so the bulls still have that going for them.

*I'm still long, looking to exit around 1290/92, am not sure if I'll switch to a short position if we get to that point.

--

time for lunch....

11am update - rolling over?

Market starting to show weakness again as the 15min cycle peaks at the base of the target zone of 1285. That may well be it for the bulls for today. Next target lower - and final low of wave'1 would be a minor break under the 1265 low from yesterday.

Sp'15min

Sp'60min

Summary

Still in the bulls favour though is the 60min cycle, which could still in theory rally for a few more hours, but it sure ain't looking good right now.

The only chance of hitting 1292/95 now is if we have a wave'4 that is comprised of 5 minute waves up, rather than the usual 123/abc type.

Regardless, we are close to concluding main wave'1 down - on the daily cycle.

Sp'15min

Sp'60min

Summary

Still in the bulls favour though is the 60min cycle, which could still in theory rally for a few more hours, but it sure ain't looking good right now.

The only chance of hitting 1292/95 now is if we have a wave'4 that is comprised of 5 minute waves up, rather than the usual 123/abc type.

Regardless, we are close to concluding main wave'1 down - on the daily cycle.

10am update - waiting for one last move lower

Market is getting pushed upward by the underlying 60min cycle which remains oversold. With the red VIX, bulls look to be in control this morning

Sp'15min

Sp'60min - fib levels

VIX'60min

Summary

If the 15min chart is any clue, we are due to hit somewhere between 1285/95 within the next few hours, that might easily be the top of minute wave'4 (of the fifth)...and then we fall away into the close and put in one final low Wednesday - below 1265.

The 38% fib of 1292 would be a prime target in the next few hours. it'd certainly fit right into the target range.

It is a somewhat sickening thought, but everything is setting up for a large 1-2 week ramp post Bernanke speech this Thursday.

More later.

Sp'15min

Sp'60min - fib levels

VIX'60min

Summary

If the 15min chart is any clue, we are due to hit somewhere between 1285/95 within the next few hours, that might easily be the top of minute wave'4 (of the fifth)...and then we fall away into the close and put in one final low Wednesday - below 1265.

The 38% fib of 1292 would be a prime target in the next few hours. it'd certainly fit right into the target range.

It is a somewhat sickening thought, but everything is setting up for a large 1-2 week ramp post Bernanke speech this Thursday.

More later.

Pre-Market Brief

Futures have swung from dow +50 to -50..and now we're back to -10, although the SP/Rus'2000 are still down 0.45%.

*ISM non-manufacturing data is due at 10am, with the service sector more likely to hold up better, if its a fairly steady number, then market could rally on it for a few hours.

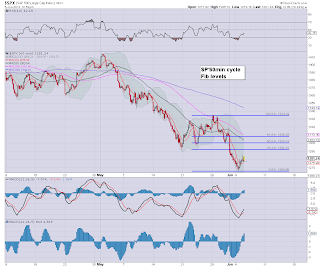

sp'60min

SP'daily, bearish, count'2

Summary

We must be getting close to the end of this 5 week cycle lower. From a cycle perspective, we are most certainly due to see a few hours upside this morning.

Right now, it looks like the Bernanke will be key, and a very possible major turning point - concluding wave'1 lower. How far will wave'2 (blue count) go? I'd guess at least 1340, maybe a little higher, but certainly not over 1380.

More across the day!

*ISM non-manufacturing data is due at 10am, with the service sector more likely to hold up better, if its a fairly steady number, then market could rally on it for a few hours.

sp'60min

SP'daily, bearish, count'2

Summary

We must be getting close to the end of this 5 week cycle lower. From a cycle perspective, we are most certainly due to see a few hours upside this morning.

Right now, it looks like the Bernanke will be key, and a very possible major turning point - concluding wave'1 lower. How far will wave'2 (blue count) go? I'd guess at least 1340, maybe a little higher, but certainly not over 1380.

More across the day!

Euro - just a little higher to go

The Euro has been surprisingly strong the last two trading days, yet one further wave lower still appears likely later this week.

Euro, daily

Euro, weekly

Summary

You can see on the daily chart a clear main wave'1 lower, with a minute wave'2, and what is currently a minute wave'4.

Target for Tuesday is a further minor gain, briefly breaking/testing the daily 10MA of 1.2529, maybe getting an intra-day peak of 1.26.

I am still looking for one fifth wave lower, with a target of 1.20/19, that would actually suggest index targets as low as sp'1225 by Thursday/Friday (with VIX 29/31). An interesting thought to sleep on.

Goodnight from London

Euro, daily

Euro, weekly

Summary

You can see on the daily chart a clear main wave'1 lower, with a minute wave'2, and what is currently a minute wave'4.

Target for Tuesday is a further minor gain, briefly breaking/testing the daily 10MA of 1.2529, maybe getting an intra-day peak of 1.26.

I am still looking for one fifth wave lower, with a target of 1.20/19, that would actually suggest index targets as low as sp'1225 by Thursday/Friday (with VIX 29/31). An interesting thought to sleep on.

Goodnight from London

Daily Cycle Update - nearing a floor

A very choppy and mixed day for the indexes. After 5 solid weeks of declines, we're getting real close to concluding this 'wave 1' down cycle.

IWM, daily, bearish

Nasdaq Comp, daily

SP' bearish, count'2

Transports

Summary

Both sp/iwm bearish outlooks have targets down in the 1225 zone. That seems a little low right now, and some fifth waves often fall short of what might be expected.

I certainly think there is still potential for 1225 late this week, but considering the micro 15/60 minute cycles, it just seems out of range. Assuming a small bounce to 1290/1300 by late tomorrow (best bull case)..1250 is a lot to ask for in the remainder of the week.

The Bernanke speaking this Thursday morning will be paramount, and I'm guessing the market will eventually begin a significant wave'2 higher. LTRO'3 or at least some serious hints of Fed 'further QE if necessary' would certainly help kick start a 75/100pt up cycle.

I remain long, holding overnight, looking to exit around 1290 tomorrow morning, and then re-short for the last move lower.

More later.

IWM, daily, bearish

Nasdaq Comp, daily

SP' bearish, count'2

Transports

Summary

Both sp/iwm bearish outlooks have targets down in the 1225 zone. That seems a little low right now, and some fifth waves often fall short of what might be expected.

I certainly think there is still potential for 1225 late this week, but considering the micro 15/60 minute cycles, it just seems out of range. Assuming a small bounce to 1290/1300 by late tomorrow (best bull case)..1250 is a lot to ask for in the remainder of the week.

The Bernanke speaking this Thursday morning will be paramount, and I'm guessing the market will eventually begin a significant wave'2 higher. LTRO'3 or at least some serious hints of Fed 'further QE if necessary' would certainly help kick start a 75/100pt up cycle.

I remain long, holding overnight, looking to exit around 1290 tomorrow morning, and then re-short for the last move lower.

More later.

Subscribe to:

Comments (Atom)