With the equity markets closing broadly flat, the VIX is still in 'melt lower' mode, and closed -1% @ 14.21. Near term trend looks weak, but VIX is very susceptible to a brief gap higher, at least into the mid 15s. Anything >16 though, currently looks very unlikely this month.

VIX'60min

VIX'daily3

Summary

So....despite a touch of weakness in equities after the FOMC minutes were released, the VIX still managed to lose another 1%, although it did at least hold the 14s.

Daily charts are still generally downward, and there is still NO clear turn/levelling phase. On any basis though, the MACD (blue bar histogram) is at a severely low area, and that is one reason why I'm open to a brief VIX spike, but we may only be looking at 7-10%..at most.

more later..on those resilient equity indexes.

Wednesday, 10 July 2013

Closing Brief

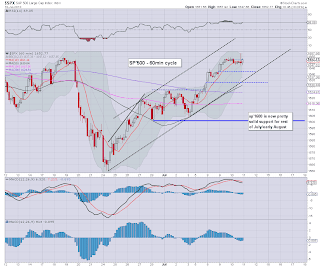

The main indexes traded in a very narrow range, even after the FOMC minutes were released. The sp'500 closed effectively flat @ 1652, whilst the 'old leader' Transports, -0.7%. There looks to be moderate opportunity for the bears to knock the market back to test the 50 day MA in the low 1630s.

sp'60min

Summary

So, a rather dull end to the day. Certainly, the bears again appear to be lacking any power, although no doubt many are waiting to hear what the Bernanke has to say..this very hour.

Daily charts are still pushing higher, but on any basis, the market has risen 97pts in just 12 trading days..all on very low volume.

We're surely due some minor retracement...yes?

--

*I am short from sp'1654, and holding overnight. Seeking an exit in the low 1630s by the Friday close.

--

sp'60min

Summary

So, a rather dull end to the day. Certainly, the bears again appear to be lacking any power, although no doubt many are waiting to hear what the Bernanke has to say..this very hour.

Daily charts are still pushing higher, but on any basis, the market has risen 97pts in just 12 trading days..all on very low volume.

We're surely due some minor retracement...yes?

--

*I am short from sp'1654, and holding overnight. Seeking an exit in the low 1630s by the Friday close.

--

3pm update - significant weakness into the close

The FOMC minutes pleased the market...for a few minutes. The break >1654 no doubt short-stopped some bears out. Yet..perhaps the real reaction is coming now..and the market is on the decline. Significant risk of weakness all the way into the close..with a Thursday gap lower.

sp'15min

Summary

*I am short from sp'1654, seeking an exit in the low 1630s.

--

All the smaller cycles are currently now in bearish config', a gap fill down to the 1630 area doesn't seem to be that bold of a target.

--

In the bears favour, there is no sig' QE tomorrow.

Bears should be looking for a VIX close in the 15s

Won't be easy, but thats what I am looking for.

--

3.21pm... market is battling it out, a bit stuck at 1648...

Downside target is the 50 day MA...1630 by Friday.

3.33pm... sp'1652...hmm, bears really need a close >1650, if not <1647. The threat remains of a Bernanke spike to 1660s.

Regardless, I will hold short overnight, and see how we open tomorrow.

sp'15min

Summary

*I am short from sp'1654, seeking an exit in the low 1630s.

--

All the smaller cycles are currently now in bearish config', a gap fill down to the 1630 area doesn't seem to be that bold of a target.

--

In the bears favour, there is no sig' QE tomorrow.

Bears should be looking for a VIX close in the 15s

Won't be easy, but thats what I am looking for.

--

3.21pm... market is battling it out, a bit stuck at 1648...

Downside target is the 50 day MA...1630 by Friday.

3.33pm... sp'1652...hmm, bears really need a close >1650, if not <1647. The threat remains of a Bernanke spike to 1660s.

Regardless, I will hold short overnight, and see how we open tomorrow.

2pm update - awaiting the fed chatter

The main market is seeing a micro up cycle play out, and we're back at sp'1651. The wall is a very obvious 1654, whilst downside is also very obvious at 1630. With the Bernanke due to speak after the market closes, a tricky few hours are ahead.

sp'15min

Summary

So...will it break >1654 ?

If if does, a brief jump into the 1660s looks viable, and that might make for a fast spike top...if we then see some selling into strength.

--

*I remain on the sidelines, but am seriously considering a short, the target would indeed be sp'1630, with a day or two.

**on the bears side...no significant QE until next Friday (opex)...a full SIX trading days away.

2.05pm....sp'1657...equity shorts getting short-stopped....bears on the run.

*I remain watching...

2.21pm... Market still battling higher...but its looking pretty toppy right now.

Am watching the MACD cycle...that will probably be maxed out within 30mins or so.

UPDATE 2.35pm... I'm short the main indexes from sp'1654.

Smaller 5/15min cycles look pretty maxed out, and the 60min/daily are similarly due 'some level' of retracement.

The one think I am keeping in mind...no sig' QE for the next six days. Bears have a window..its time for them to appear.

15min cycle, offering two nice spikes..suggestive of a top...

Naturally, those bears who got short-stopped with the earlier move >1654 will be mad as hell, if we close somewhat lower.

sp'15min

Summary

So...will it break >1654 ?

If if does, a brief jump into the 1660s looks viable, and that might make for a fast spike top...if we then see some selling into strength.

--

*I remain on the sidelines, but am seriously considering a short, the target would indeed be sp'1630, with a day or two.

**on the bears side...no significant QE until next Friday (opex)...a full SIX trading days away.

2.05pm....sp'1657...equity shorts getting short-stopped....bears on the run.

*I remain watching...

2.21pm... Market still battling higher...but its looking pretty toppy right now.

Am watching the MACD cycle...that will probably be maxed out within 30mins or so.

UPDATE 2.35pm... I'm short the main indexes from sp'1654.

Smaller 5/15min cycles look pretty maxed out, and the 60min/daily are similarly due 'some level' of retracement.

The one think I am keeping in mind...no sig' QE for the next six days. Bears have a window..its time for them to appear.

15min cycle, offering two nice spikes..suggestive of a top...

Naturally, those bears who got short-stopped with the earlier move >1654 will be mad as hell, if we close somewhat lower.

1pm update - market holding together

It is indeed an embarrassment to the bears, that the move from 1653 to 1649 constituted an entire 'down cycle'. Sp' is back @ 1650, and where it goes from here, seems entirely dependent upon how the algo-bots interpret the looming Fed-speak.

sp'15min

Summary

With the morning QE out of the way, things are a little simpler from here.

The next significant QE($3bn or more) is not until next Friday. The bears have SIX trading days to knock this market back lower.

--

*I am considering a short, but any break >1654, and that will completely dissuade me.

sp'15min

Summary

With the morning QE out of the way, things are a little simpler from here.

The next significant QE($3bn or more) is not until next Friday. The bears have SIX trading days to knock this market back lower.

--

*I am considering a short, but any break >1654, and that will completely dissuade me.

12pm update - micro up cycle due

The market is continuing to see very minor chop. Sp'1654 is likely to hold for the next few days, and the market looks set to use the FOMC/Bernanke as an excuse to wash out a few of the hyper-bulls. Oil is holding significant gains, and is on the edge of breaking $106

sp'15min

Summary

Market is very much in a holding pattern, ahead of the FOMC minutes release at 2pm.

Being a QE day, I'm naturally very cautious, and for the moment, I'm inclined to sit this nonsense out for another day or two.

Certainly, the 15min cycle looks a lousy level to short from.

VIX update from Mr T.

time for lunch

sp'15min

Summary

Market is very much in a holding pattern, ahead of the FOMC minutes release at 2pm.

Being a QE day, I'm naturally very cautious, and for the moment, I'm inclined to sit this nonsense out for another day or two.

Certainly, the 15min cycle looks a lousy level to short from.

VIX update from Mr T.

time for lunch

11am update - tricky downside...on a QE day

The market does look tired, and the June'18 high of sp'1654 is holding the line so far. Hourly index charts are offering downside into Thur/Friday, with the primary target being the gap-fill zone of 1632/30.

sp'60min

Summary

*I am increasingly tempted to launch a short, whilst the 1654 line is looking like a strong wall.

Yet..today is a QE day, and there is no doubt that $3bn of new 'benny bux' are looking for a home right now.

For the moment, I'm just going to watch.

The default 'safer' trade is a new long from the low sp'1630s...but that won't be today.

sp'60min

Summary

*I am increasingly tempted to launch a short, whilst the 1654 line is looking like a strong wall.

Yet..today is a QE day, and there is no doubt that $3bn of new 'benny bux' are looking for a home right now.

For the moment, I'm just going to watch.

The default 'safer' trade is a new long from the low sp'1630s...but that won't be today.

10am update - tired market

The market has opened with some micro-chop. Hourly indexes look rather exhausted, after a 93pt rally from the sp'1560 low - a mere 12 trading days ago. Precious metals are already starting to cool down, but Oil is holding significant gains in the $105s

sp'60min

vix'60min

Summary

Hourly index/VIX charts are offering latter day downside.

However, I sure won't be shorting this, whilst the primary/mid-term trend is clearly upward.

-

*there is an obvious gap at the sp'1632/30 zone, that might be hit Thurs/Friday, and would be valid place to go long.

10.23am...support failed..hence the little snap...

sp'1min

Target is sp'1630 by late Thursday.

sp'60min

vix'60min

Summary

Hourly index/VIX charts are offering latter day downside.

However, I sure won't be shorting this, whilst the primary/mid-term trend is clearly upward.

-

*there is an obvious gap at the sp'1632/30 zone, that might be hit Thurs/Friday, and would be valid place to go long.

10.23am...support failed..hence the little snap...

sp'1min

Target is sp'1630 by late Thursday.

Pre-Market Brief

Good morning. Futures are a touch lower, sp -2pts, we're set to open at 1650. Precious metals are again higher, Gold +$8. Oil is significantly higher, with WTIC in the $105s. There is 'moderate' opportunity for the bears today, with the FOMC minutes due this afternoon.

sp'60min

VIX'60min

Summary

We have a $3bn QE in the morning, so bears face that little problem again.

Yet, the FOMC minutes later at 2pm, might be enough to give the market the excuse to sell lower into Thursday.

There will be strong support around the rising 50 day :@ 1630. I do not expect anything lower than that this week.

--

*I remain on the sidelines, but am seeking to pick up an index/Oil long position.

Video update from Mr Carboni...

Have a good Wednesday!

sp'60min

VIX'60min

Summary

We have a $3bn QE in the morning, so bears face that little problem again.

Yet, the FOMC minutes later at 2pm, might be enough to give the market the excuse to sell lower into Thursday.

There will be strong support around the rising 50 day :@ 1630. I do not expect anything lower than that this week.

--

*I remain on the sidelines, but am seeking to pick up an index/Oil long position.

Video update from Mr Carboni...

Have a good Wednesday!

Equities cruising higher

Another day higher for the US indexes, and the broad mid-term up trend is right back on track. With the sp' in the 1650s, the 1700s are barely 3% away, and that is viable even before this month concludes. With ongoing QE-pomo, bears face incessant problems.

sp'weekly8 - near term bullish outlook

Summary

Is there any doubt now that the recent down wave is indeed complete?

I am still seeing a few out there suggest this is going to unravel imminently, but..no, I just don't see that. After all, QE continues, the mainstream delusion that 'everything is okay' is holding, and we're in what are typically 'sleepy' trading months.

The underlying MACD (green bar histogram) on the weekly index charts is ticking higher for the second week, and we're set to go positive cycle in about 2-3 weeks, certainly by early August.

One for the trash bin

Something I was considering in the past few weeks, and I'm certainly aware others have considered it too.

Trans, weekly'3

In my view..the H/S scenario is to be dismissed, with the break into the 6400s. Next key level are the 6600s, and if that is hit, then prime target zone is 7000/7200.

Looking ahead

There is wholesale trade data at 10am (not that the market will likely care), and the EIA oil report at 10.30am. What will be most important tomorrow are the FOMC minutes, released at 2pm. The last few occasions have seen the market drop rather significantly - on algo-bot interpretation of the Fed-speak. Further, the Bernanke is speaking around 4pm.

*there is mid-size QE of $3bn this Wednesday...bears beware!

--

With more QE tomorrow, the market will very likely be testing the 1660s. However, there is very stiff resistance at that level, and the market might easily use it - along with the FOMC minutes as an excuse for 2-3 day down cycle.

sp'daily6 - bollinger/keltner bands

If the market does sell down (briefly into Thurs/Friday), the 50 day MA @ sp'1628 should offer VERY strong support for the bulls.

*I am content on the sidelines, but seeking to pick up an index/Oil long.

Goodnight from London

sp'weekly8 - near term bullish outlook

Summary

Is there any doubt now that the recent down wave is indeed complete?

I am still seeing a few out there suggest this is going to unravel imminently, but..no, I just don't see that. After all, QE continues, the mainstream delusion that 'everything is okay' is holding, and we're in what are typically 'sleepy' trading months.

The underlying MACD (green bar histogram) on the weekly index charts is ticking higher for the second week, and we're set to go positive cycle in about 2-3 weeks, certainly by early August.

One for the trash bin

Something I was considering in the past few weeks, and I'm certainly aware others have considered it too.

Trans, weekly'3

In my view..the H/S scenario is to be dismissed, with the break into the 6400s. Next key level are the 6600s, and if that is hit, then prime target zone is 7000/7200.

Looking ahead

There is wholesale trade data at 10am (not that the market will likely care), and the EIA oil report at 10.30am. What will be most important tomorrow are the FOMC minutes, released at 2pm. The last few occasions have seen the market drop rather significantly - on algo-bot interpretation of the Fed-speak. Further, the Bernanke is speaking around 4pm.

*there is mid-size QE of $3bn this Wednesday...bears beware!

--

With more QE tomorrow, the market will very likely be testing the 1660s. However, there is very stiff resistance at that level, and the market might easily use it - along with the FOMC minutes as an excuse for 2-3 day down cycle.

sp'daily6 - bollinger/keltner bands

If the market does sell down (briefly into Thurs/Friday), the 50 day MA @ sp'1628 should offer VERY strong support for the bulls.

*I am content on the sidelines, but seeking to pick up an index/Oil long.

Goodnight from London

Daily Index Cycle update

The main indexes closed higher for the fourth consecutive day, with most indexes up around 0.75%. Near term trend remains outright bullish, but there is some resistance in the sp'1655/60 area. The sp'1700s arguably look a given, by early August.

sp'daily5

Summary

So..another day higher, and the bulls remain laughably in control. With ongoing QE, the bears face endless problems.

--

Even if the FOMC minutes - released tomorrow @ 2pm - or the Bernanke (who speaks later at 4pm), spooks the market, any pull back will likely be no lower than the 50 day MA, which will be around 1630 Thur/Friday.

a little more later...

sp'daily5

Summary

So..another day higher, and the bulls remain laughably in control. With ongoing QE, the bears face endless problems.

--

Even if the FOMC minutes - released tomorrow @ 2pm - or the Bernanke (who speaks later at 4pm), spooks the market, any pull back will likely be no lower than the 50 day MA, which will be around 1630 Thur/Friday.

a little more later...

Subscribe to:

Comments (Atom)