With the sp' breaking into the 1740s - a level that seemed 'difficult by year end' just last week, the VIX ended the week -3.3% @ 13.04, after a morning low of 12.34. Across the week, the VIX declined by 17%, with the VIX now almost 50% lower from just 8 trading days ago.

VIX'60min

VIX'daily3

VIX'weekly

Summary

A mere two weeks ago the question was whether the equity bears could achieve a weekly VIX close in the 20s - which would have been a major achievement.

Here we are, with a VIX weekly close in the 13s, having broken back into the 12s earlier today. It is a huge failure for the bears, and based on previous cycles, it will likely be some months before the next VIX spike.

I have to now assume that the summer 2012 VIX high of 27 will not be surpassed in the remainder of the year.

--

more later..on the indexes

Friday, 18 October 2013

Closing Brief

The main indexes battled higher into the weekend, with the sp +11pts @ 1744. The two leaders - Trans/R2K, closed up 1.2% and 1.1% respectively. The outlook for the rest of the year looks very bullish..and the bigger monthly cycles are showing increasingly bullish price momentum.

sp'60min

Summary

For many, it was another very tough week. No doubt more posters and traders of the bearish persuasion will have thrown in the towel this week.

Considering the bigger weekly and monthly cycles - which are both back to outright bullish, I can only conclude we are headed higher....much higher.

Have a good weekend

-

*the weekend post will be on the US weekly index cycles

sp'60min

Summary

For many, it was another very tough week. No doubt more posters and traders of the bearish persuasion will have thrown in the towel this week.

Considering the bigger weekly and monthly cycles - which are both back to outright bullish, I can only conclude we are headed higher....much higher.

Have a good weekend

-

*the weekend post will be on the US weekly index cycles

3pm update - 4000 posts before sp'4000

The main indexes are battling for a powerful weekly close, with gains of 2.5% for most indexes. The VIX has recovered from the early low of 12.34, now at 13.25. Yet..the VIX is to be dismissed now. The market looks set for further gains in the weeks..and months ahead.

sp'weekly8 - mid term bullish outlook

Summary

It has been one hell of a week...

The political drama has ended (at least for a few months). Normal service has resumed. The QE continues.

...the market is rallying, and will keep rallying until the QE fuel stops.

--

This is the 4000th post since I joined the party 18 months ago. I can only hope I'll make it to the big 10k..and where will the sp' be then ? How about 4K?

--

I think GOOG says everything we need to know about the current market state...

GOOG, monthly, 10yr

A huge gain on what are good profit margins..and likely very significant continued growth in the years ahead.

-

3.25pm...sp'1742, pretty incredible really, but last weeks closing weekly spike-floor candles were warning of a turn. The only thing that really needs to catch up is the Dow.

Equity bulls should be seeking a weekly close in the 15800s this Nov/Dec. That should be enough to confirm much higher levels.

Dow, weekly.

*Clown finance TV going all out to celebrate their 'Queen cheer leader'. Similarly, Mr Market has come a long way since the early 1990s.

sp'weekly8 - mid term bullish outlook

Summary

It has been one hell of a week...

The political drama has ended (at least for a few months). Normal service has resumed. The QE continues.

...the market is rallying, and will keep rallying until the QE fuel stops.

--

This is the 4000th post since I joined the party 18 months ago. I can only hope I'll make it to the big 10k..and where will the sp' be then ? How about 4K?

--

I think GOOG says everything we need to know about the current market state...

GOOG, monthly, 10yr

A huge gain on what are good profit margins..and likely very significant continued growth in the years ahead.

-

3.25pm...sp'1742, pretty incredible really, but last weeks closing weekly spike-floor candles were warning of a turn. The only thing that really needs to catch up is the Dow.

Equity bulls should be seeking a weekly close in the 15800s this Nov/Dec. That should be enough to confirm much higher levels.

Dow, weekly.

*Clown finance TV going all out to celebrate their 'Queen cheer leader'. Similarly, Mr Market has come a long way since the early 1990s.

2pm update - relentless...simply relentless

The main indexes are building upon early morning gains, with the sp' seemingly making a charge for next resistance in the 1750s. Yet...for those carefully watching..something exceptionally unusual is possibly beginning...something that could be simply unbelievable across the next 2 or 3 years.

sp'daily5

Summary

Sp'1744s...and no sign of it stopping.

--

A good example of what is going on...AMZN. A loss making retailer...but Mr Market doesn't care.

There is NO WHERE ELSE FOR THE MONEY TO GO, so even the over-valued stocks are going to ramp from here.

AMZN, weekly.

If a loss maker can rise almost 1000% in four years..what will the profitable ones do into 2015/16..if things merely 'hold together' ?

One trillion of new Fed money..per year...with no end.

The biggest hyper-ramp..the markets have ever seen....is very likely only just beginning.

sp'daily5

Summary

Sp'1744s...and no sign of it stopping.

--

A good example of what is going on...AMZN. A loss making retailer...but Mr Market doesn't care.

There is NO WHERE ELSE FOR THE MONEY TO GO, so even the over-valued stocks are going to ramp from here.

AMZN, weekly.

If a loss maker can rise almost 1000% in four years..what will the profitable ones do into 2015/16..if things merely 'hold together' ?

One trillion of new Fed money..per year...with no end.

The biggest hyper-ramp..the markets have ever seen....is very likely only just beginning.

1pm update - just another hour of upside

The main indexes are really pushing hard for a daily close in the sp'1740s. There is simply nothing bearish out there, and with the giant GOOG hitting the big $1000 level, the cheer leaders on clown finance TV are starting to suggest 'upside into end year'.

sp'daily5

Summary

There is little to add. Again, I can only note that the world index charts are telling the real story. Huge breakouts on just about all of them...and with the debt ceiling nonsense now fading away...the market is back to normal service.

*equity bears should keep in mind next week begins with a sig' QE-pomo, and there is jobs data early Tuesday.

Green shoots of autumn?

sp'daily5

Summary

There is little to add. Again, I can only note that the world index charts are telling the real story. Huge breakouts on just about all of them...and with the debt ceiling nonsense now fading away...the market is back to normal service.

*equity bears should keep in mind next week begins with a sig' QE-pomo, and there is jobs data early Tuesday.

Green shoots of autumn?

12pm update - mini moon ramp..on a full moon

The main indexes are generally holding moderate gains, although the Dow is again somewhat laggy. Metals are a touch lower, whilst Oil is +0.4%. VIX is melting lower, -8% in the 12.40s..a weekly close in the 11s is just about viable. Notable mover remains GOOG, breaking to $1007.

sp'monthly3e - bare bones

Summary

Sometimes, its best to strip all the nonsense lines, counts, and labels away, on a non-log (arithmetic) scale..and just stare.

Go stare at the above..and then ask yourself...which part of this market is currently bearish?

--

*I can only suggest anyone still in denial (don't deny it!), to go read the world monthly index posting I did last weekend. ALL world indexes are bullish, and set for gains of 20/30% into spring 2014.

It still bemuses me how no one seems to give a damn about any of that though.

--

VIX update from Mr T.

time for tea!

sp'monthly3e - bare bones

Summary

Sometimes, its best to strip all the nonsense lines, counts, and labels away, on a non-log (arithmetic) scale..and just stare.

Go stare at the above..and then ask yourself...which part of this market is currently bearish?

--

*I can only suggest anyone still in denial (don't deny it!), to go read the world monthly index posting I did last weekend. ALL world indexes are bullish, and set for gains of 20/30% into spring 2014.

It still bemuses me how no one seems to give a damn about any of that though.

--

VIX update from Mr T.

time for tea!

11am update - opex chop

With the sp' hitting 1741 - a level that many analysts thought 'somewhat possible by year end', we're set for some price chop to wrap up the week. Metals are weak, Oil is weak, but battling to hold moderate gains. VIX looks set to close the week in the low 12s..possibly even the 11s.

sp'daily5

vix'daily3

Summary

It remains tiresome to many, but hey..we're not going down... ALL cycles are bullish.

What is even more laughable is the notion that even if the Fed taper QE - the originally suggested 10-15bn next spring (the new target date for many), what does it matter? The Fed would still be printing 700/800bn a year..most of it funnelling into equities. Where else do you think that amount of money is going to go?

Ohh, but there are still some dismissive of QE as affecting the equity market.

-

Today is a full moon..the 'hunters moon'. It may be appropriate to throw out some new charts later today. I'm sure some of them might amuse a few of you.

-

sp'daily5

vix'daily3

Summary

It remains tiresome to many, but hey..we're not going down... ALL cycles are bullish.

What is even more laughable is the notion that even if the Fed taper QE - the originally suggested 10-15bn next spring (the new target date for many), what does it matter? The Fed would still be printing 700/800bn a year..most of it funnelling into equities. Where else do you think that amount of money is going to go?

Ohh, but there are still some dismissive of QE as affecting the equity market.

-

Today is a full moon..the 'hunters moon'. It may be appropriate to throw out some new charts later today. I'm sure some of them might amuse a few of you.

-

10am update - new highs

Mr Market is headed to the moon. Some will contest that notion, yet..they are generally the same maniacs who were touting a default mere days ago. Its been a good week for the bulls, with index gains of around 2%..which makes for 3% so far this month.

sp'weekly8

vix'weekly

Summary

Right now, there is indeed a cluster of people touting 'the grand top is around 1750'. Hell, even Oscar himself is looking for 1750 or so in the current rally.

Regardless of what immediately comes after 1750s....so long as the QE keeps coming, we will 'broadly' keep climbing.

--

The weekly VIX chart is pretty amazing to reflect on...VIX has almost collapsed in half, from the 21s to the 12s.

-

*Metals looking weak..and Oil is failing to hold the opening gains of almost 0.7%. Having broken support yesterday, Oil looks set for another 3% lower.

10.36am...market cooling off a bit..but really..new highs..all the same were made.

AMZN..the hillarity continues..+3%..to the $320s.

A $500 stock..with consistent losses? Great market!

sp'weekly8

vix'weekly

Summary

Right now, there is indeed a cluster of people touting 'the grand top is around 1750'. Hell, even Oscar himself is looking for 1750 or so in the current rally.

Regardless of what immediately comes after 1750s....so long as the QE keeps coming, we will 'broadly' keep climbing.

--

The weekly VIX chart is pretty amazing to reflect on...VIX has almost collapsed in half, from the 21s to the 12s.

-

*Metals looking weak..and Oil is failing to hold the opening gains of almost 0.7%. Having broken support yesterday, Oil looks set for another 3% lower.

10.36am...market cooling off a bit..but really..new highs..all the same were made.

AMZN..the hillarity continues..+3%..to the $320s.

A $500 stock..with consistent losses? Great market!

Pre-Market Brief

Good morning. Futures are moderately higher, sp +5pts, we're set to open at a new historic high of 1738. Today is opex, so expect some price chop, especially in the closing hour. For the equity bulls, its been an amazing week. For the bears...it is merely a continuation of the post 2009 trading action.

sp'60min

Summary

As ever..don't get lost in the minor noise. Any brief down draft of 3, 5, even 10pts today will count for nothing, and will get bought up.

Sure, we could trade sideways for a bit, although the weekly charts are warning of a major snap higher next week (if you can believe that).

No doubt, sp'1750 will be a major resistance area..as many of the chartists agree on. Considering the continues though, I now see little reason why we won't just keep on battling higher.

--

Notable early movers...

CMG, +$30, to the 470s, on earnings.

GOOG, +$87 (9.5%) to $976, on slightly better than expected earnings.

No doubt the cheer leaders on clown finance TV will get mildly hysterical if it breaks $1000 today..or next week, not that it matters. The company itself has a superb balance sheet, and profit margins that most companies can only dream of.

-

Video update from Mr Permabull...

Thank the gods..its almost the weekend.

sp'60min

Summary

As ever..don't get lost in the minor noise. Any brief down draft of 3, 5, even 10pts today will count for nothing, and will get bought up.

Sure, we could trade sideways for a bit, although the weekly charts are warning of a major snap higher next week (if you can believe that).

No doubt, sp'1750 will be a major resistance area..as many of the chartists agree on. Considering the continues though, I now see little reason why we won't just keep on battling higher.

--

Notable early movers...

CMG, +$30, to the 470s, on earnings.

GOOG, +$87 (9.5%) to $976, on slightly better than expected earnings.

No doubt the cheer leaders on clown finance TV will get mildly hysterical if it breaks $1000 today..or next week, not that it matters. The company itself has a superb balance sheet, and profit margins that most companies can only dream of.

-

Video update from Mr Permabull...

Thank the gods..its almost the weekend.

Primary trend remains with the bulls

The US shutdown/debt ceiling issue was indeed nothing more than another round of petty political games. The market has already rallied 5% since the lows of last week, and the sp'1800s look a viable threshold to hit by late November. This market remains very much in favour of the bulls.

sp'weekly8 - mid term bullish outlook

sp'monthly

Summary

There is a lot that could be said right now, not least about all those doomer maniacs - and they ARE maniacs, who were confidently touting a US default. All of those same idiots will no doubt be drafting and re-dating the same 'omg, a zombie apocalypse is coming this weekend'..for February 2014, when the debt ceiling issue will again arise.

For now, I think I'll leave it at just that.

Looking ahead

There is no econ-data due tomorrow - with the shutdown over, econ-data should re-appear in full next week (see note'1). Friday should be a relatively headline-free day. Importantly, it is opex, and so some degree of price chop is likely.

*the next sig' QE-pomo is next Monday ($3-4bn).

Note'1: It was announced after the close of trading, that the Sept' monthly jobs data (due two weeks ago) will now be issued next Tuesday morning. Further, the Oct' jobs report - due Fri' Nov'1, will be delayed one week to Nov'8.

--

Whether we close the week in the sp'1720/30s..or even 40s..it really doesn't matter. The bulls are unquestionably in firm control of the market, never mind the fact that the QE fuel just keeps on flowing

Goodnight from London

sp'weekly8 - mid term bullish outlook

sp'monthly

Summary

There is a lot that could be said right now, not least about all those doomer maniacs - and they ARE maniacs, who were confidently touting a US default. All of those same idiots will no doubt be drafting and re-dating the same 'omg, a zombie apocalypse is coming this weekend'..for February 2014, when the debt ceiling issue will again arise.

For now, I think I'll leave it at just that.

Looking ahead

There is no econ-data due tomorrow - with the shutdown over, econ-data should re-appear in full next week (see note'1). Friday should be a relatively headline-free day. Importantly, it is opex, and so some degree of price chop is likely.

*the next sig' QE-pomo is next Monday ($3-4bn).

Note'1: It was announced after the close of trading, that the Sept' monthly jobs data (due two weeks ago) will now be issued next Tuesday morning. Further, the Oct' jobs report - due Fri' Nov'1, will be delayed one week to Nov'8.

--

Whether we close the week in the sp'1720/30s..or even 40s..it really doesn't matter. The bulls are unquestionably in firm control of the market, never mind the fact that the QE fuel just keeps on flowing

Goodnight from London

Daily Index Cycle update

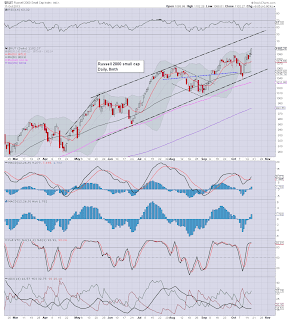

The main indexes generally closed with further gains, the sp +11pts @ 1733. Near term trend remains to the upside, and with the debt ceiling issue pushed out until Feb'2014, the market looks set for much higher levels. The R2K in the 1200s would likely equate to sp'1850/1900.

sp'daily5

Dow

R2K

Summary

The market just keeps on pushing higher.

The daily up trend is further supported by the weekly and monthly cycles. Frankly, everything is now almost entirely bullish.

With the QE fuel of $85bn a month continuing, and likely to last across much of 2014, the market looks set for the sp'1800s, possibly even the 1900s before year end.

--

a little more later...

sp'daily5

Dow

R2K

Summary

The market just keeps on pushing higher.

The daily up trend is further supported by the weekly and monthly cycles. Frankly, everything is now almost entirely bullish.

With the QE fuel of $85bn a month continuing, and likely to last across much of 2014, the market looks set for the sp'1800s, possibly even the 1900s before year end.

--

a little more later...

Subscribe to:

Comments (Atom)