Despite the main indexes closing lower by around 1%, the VIX actually closed moderately lower. The VIX, being what is it - a mere calculation based on option prices, is a very quirky indicator. So far -it could be said at least, VIX suggests virtually no fear in the market.

Bears will need to seek a VIX of 20 next week just to begin any kind of major move higher.

VIX'60min

VIX, daily, rainbow

VIX, weekly

Summary

A fair few traders will be bemused at the weakness in the VIX today, I myself was one of them. Yet, we've seen this kind of thing before, where the VIX lags declining indexes for a few days, only to snap 20/25% higher 'sooner or later'.

As noted, any bear out there should be seeking a move to VIX '20 no later than next Wednesday. That should in itself open the door to the first attempt for VIX 24/25 by the end of next week.

The longer term VIX weekly cycle is still suggestive - at least from a price/wave perspective, of a move into the 30s/40s within the next month or so. Yet, we'll need to see a good weekly close over the weekly 10MA - currently 20.72, to confirm any such bearish outlook.

A VIX '21 by the close of next week, if SP can close under the broad up trend channel of 1340, looks viable.

Friday, 6 July 2012

Closing Brief - a somewhat bearish Friday

Moderate declines to close the week, although one primary concern for the bears is that the VIX still closed red.

More importantly, the weekly cycles are closing red for the week, a little follow through early next week, and things might get 'interesting'.

IWM

Dow

Sp

Summary

So, sp'1354 to close the week, having declined from the Tuesday peak of 1374. Is the top in for wave'2 yet? We won't know until we break back below sp'1320. Only then will the broad up trend be fully broken. A break into the 1310s..should in theory open the door to a swift move to sp'1225/00 with 2-3 weeks.

*I added a further short position in the closing hour, from the equivalent of sp'1353. First target is 1335/30, no later than next Tuesday.

--

Bit and pieces across the evening..and weekend.

More importantly, the weekly cycles are closing red for the week, a little follow through early next week, and things might get 'interesting'.

IWM

Dow

Sp

Summary

So, sp'1354 to close the week, having declined from the Tuesday peak of 1374. Is the top in for wave'2 yet? We won't know until we break back below sp'1320. Only then will the broad up trend be fully broken. A break into the 1310s..should in theory open the door to a swift move to sp'1225/00 with 2-3 weeks.

*I added a further short position in the closing hour, from the equivalent of sp'1353. First target is 1335/30, no later than next Tuesday.

--

Bit and pieces across the evening..and weekend.

3pm update - place your bets for the last hour

The closing hour, and it looks like we'll close within the bear flag I noted in the last hour. A close under the hourly 10MA of 1359 should be considered 'enough' for the bears.

The weekly index charts - if we close at these levels, will all look bearish for next week.

Yet..the VIX is still failing to confirm the declines, and that remains my primary concern.

sp'60min

sp, daily'5

Summary

So...bears want to see at least a close no higher than 1357/59, anything under that would be at least something useful to end the week. A moderately 'green' VIX will also be important.

What is clear today, the 80k jobs data is not good for the bulls to claim 'good growth', but neither is it dire enough to assure them of QE3 in August. Besides, the Bernanke can't possibly do QE with the markets a mere 4% from the recent highs.

More after the close

--

update 3.20pm EST

added a new short position from sp'1353.

The VIX looks pretty low right now, and the 15min index cycle..

So I'm shorting within the mid-range of the baby bear flag...first target is the lower channel on the daily cycle of 1335/30 by Mon/Tue

The weekly index charts - if we close at these levels, will all look bearish for next week.

Yet..the VIX is still failing to confirm the declines, and that remains my primary concern.

sp'60min

sp, daily'5

Summary

So...bears want to see at least a close no higher than 1357/59, anything under that would be at least something useful to end the week. A moderately 'green' VIX will also be important.

What is clear today, the 80k jobs data is not good for the bulls to claim 'good growth', but neither is it dire enough to assure them of QE3 in August. Besides, the Bernanke can't possibly do QE with the markets a mere 4% from the recent highs.

More after the close

--

update 3.20pm EST

added a new short position from sp'1353.

The VIX looks pretty low right now, and the 15min index cycle..

So I'm shorting within the mid-range of the baby bear flag...first target is the lower channel on the daily cycle of 1335/30 by Mon/Tue

2pm update - baby bear flag

Well, we have two hours still go, and the declines are still holding.

It looks like we have a little baby bear flag forming on the hourly index charts. Now, this could play out a few ways. Either we break below the flag into the close, or we just trundle sideways within the flag, or we see a closing mini ramp to around 1357/59.

Considering the recent hyper-ramp since last Thursday afternoon, the bears should be satisfied if we can close at these levels.

sp'60min

First soft resistance will be the 10MA at 1361.

Summary

Nothing much to add, aside from the issue that the VIX is still not confirming the index declines.

More later!

It looks like we have a little baby bear flag forming on the hourly index charts. Now, this could play out a few ways. Either we break below the flag into the close, or we just trundle sideways within the flag, or we see a closing mini ramp to around 1357/59.

Considering the recent hyper-ramp since last Thursday afternoon, the bears should be satisfied if we can close at these levels.

sp'60min

First soft resistance will be the 10MA at 1361.

Summary

Nothing much to add, aside from the issue that the VIX is still not confirming the index declines.

More later!

1pm update - twilight zone

So, we're lurking into the low sp'1350s, but that is still twilight zone territory for the bears. With the VIX only marginally higher, today's decline is to be largely dismissed.

Only a move back into the low 1320s would even remotely begin to suggest the current broad up trend is over.

sp, daily

vix, daily

*note the fail at the 10MA, and a black candle...that is lousy for the near term outlook for the bears.

Summary

A few chess pieces are moving around today, but anyone shorting here....urghh. Its neither a good level or a particularly good time.

Only a move back into the low 1320s would even remotely begin to suggest the current broad up trend is over.

sp, daily

vix, daily

*note the fail at the 10MA, and a black candle...that is lousy for the near term outlook for the bears.

Summary

A few chess pieces are moving around today, but anyone shorting here....urghh. Its neither a good level or a particularly good time.

12pm update - confusing mess..in a fearless market

Contrary to what many bears out there might wish to believe, nothing much has changed today, despite the current index declines.

The market has ZERO fear, there are no impulsive moves lower. Its just minor crawl lower, and the VIX is not confirming any of the index declines

sp' daily5

sp, weekly

Summary

We remain in a broad uptrend. Until we can break into the low 1320s, I can't take any decline seriously.

I suppose bears could claim the weekly charts are going to at least close the week 'bearish', but still, so long as the VIX remains flat...the bulls remain in control.

--

More later in the day, I'm getting really tired of this nonsense.

The market has ZERO fear, there are no impulsive moves lower. Its just minor crawl lower, and the VIX is not confirming any of the index declines

sp' daily5

sp, weekly

Summary

We remain in a broad uptrend. Until we can break into the low 1320s, I can't take any decline seriously.

I suppose bears could claim the weekly charts are going to at least close the week 'bearish', but still, so long as the VIX remains flat...the bulls remain in control.

--

More later in the day, I'm getting really tired of this nonsense.

11am update - daily cycles suggesting a turn

Well, maybe I'm just getting overly focused on the smaller cycles, so for this hour...lets just consider the daily 'rainbow' charts.

Indexes are showing a nice turn lower, but the VIX is still effectively flat. Neither indexes nor VIX are yet conclusive changes in trend, via a Green/Red candle.

Sp, daily, rainbow

VIX, daily rainbow

Summary

I suppose you could say a nice bearish rollover now is in progress. My primary concern is that the VIX is showing ZERO concern right now.

Bears are going to need VIX into the mid 20s..just to get a decent chance of breaking <1300 later next week.

Indexes are showing a nice turn lower, but the VIX is still effectively flat. Neither indexes nor VIX are yet conclusive changes in trend, via a Green/Red candle.

Sp, daily, rainbow

VIX, daily rainbow

Summary

I suppose you could say a nice bearish rollover now is in progress. My primary concern is that the VIX is showing ZERO concern right now.

Bears are going to need VIX into the mid 20s..just to get a decent chance of breaking <1300 later next week.

10am update - no idea

This is a really messed up market, and frankly, I've no idea right now.

We are already low on the hourly cycle, so its a VERY bad place to be adding new short positions. Yet the daily cycle is now rolling over, and suggestive of a multi-day move lower, perhaps a challenge of the lower channel of 1330s.

sp'60min

sp' daily5

Vix'60min

Summary

Its tempting to add to new short positions, but not with the hourly cycles as they presently are.

Even worse for the bears, VIX is barely green, +3/4%, Bears should have been looking for +10/15% at the open.

--

We could even see the indexes close green, that's how nasty today could close for the bears.

We are already low on the hourly cycle, so its a VERY bad place to be adding new short positions. Yet the daily cycle is now rolling over, and suggestive of a multi-day move lower, perhaps a challenge of the lower channel of 1330s.

sp'60min

sp' daily5

Vix'60min

Summary

Its tempting to add to new short positions, but not with the hourly cycles as they presently are.

Even worse for the bears, VIX is barely green, +3/4%, Bears should have been looking for +10/15% at the open.

--

We could even see the indexes close green, that's how nasty today could close for the bears.

Pre-Market Brief

Good morning. Futures were flat ahead of the jobs data, but are now showing dow -50pts..but its choppy action.

Frankly, the number is better than I was looking for, and is arguably NOT low enough for QE3 this August.

Jobs data: 80k, 8.2%,

sp'60min

sp, daily5

Summary

So, another arguably poor jobs number, but its not 'dire', so those hoping for guarenteed QE3 in August now have greater uncertainty in my view.

Right now, I'd prefer to re-short around 1385/90,

More across the day...

Frankly, the number is better than I was looking for, and is arguably NOT low enough for QE3 this August.

Jobs data: 80k, 8.2%,

sp'60min

sp, daily5

Summary

So, another arguably poor jobs number, but its not 'dire', so those hoping for guarenteed QE3 in August now have greater uncertainty in my view.

Right now, I'd prefer to re-short around 1385/90,

More across the day...

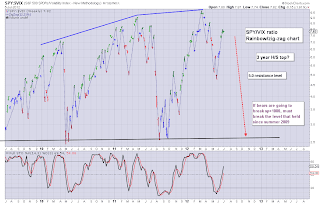

SPY/VIX ratio.. awaiting a key turn lower

To close the day, I'll end with something I don't often cover. With the indexes as high as they are..and the VIX..as low as it is, lets take a look at the SPY/VIX ratio. The following are a very strange type of chart, I like to call them the 'zig-zag rainbow' style of charts. They make use of the Elder impulse system, I think the coloured candles are especially useful!

SPY/VIX, 1yr, near term

Here is something to consider, if you didn't know anything else right now about the market, you'd surely say that this wedge is going to break to the downside, right? Whether you want to call it a wave'3, or whatever, the default reaction would be a move to the downside.

SPY/VIX, 10yr

The ten year chart gives a particularly stunning and clear overview of the crazy path from whence we came! Is it really a giant H/S formation for this market, as seen from this SPY/VIX chart?

One thing that any decent doomster/long term economic fundamentalist bear, needs to look for in the months ahead, a break under that blue line, the neckline. If I see a break under that later this year, we'll 'know' the 3.5 year 'rally of delusion' is finally over.

SPY/VIX, 3yr, outlook

I found it particularly interesting last month that we bounced just a touch under the 5.0 level in the previous down cycle. You can see in this chart that we'll usually get stuck around the 5.0 level - regardless of whether the trend is up..or down.

The current SPY/VIX up move is certainly a very strong one, and we're really not far off from breaking new highs. Bears will need to see a break under 4.7 in the weeks and months ahead for our first attempt to break the 2.5 neckline

Summary

So..what to make of those 3 kooky charts? With the SP' closing marginally lower today, and the VIX sitting at a lowly 17.50, what now?

I don't think this market is going to trade sideways this summer -as increasingly a lot of people seem to be saying. I am inherently biased of course, but does anyone out there really think sp'1266 was the low for the year? Seriously? With all the economic problems out there, no way do I see new lows not being attained in the months ahead.

I remain pretty confident we'll at least make a move lower to sp'1225/00 in the next month or so, but the key issue is whether we can break much lower..into the low 1100s....bounce for a few months..and then...collapse away.

Sp, monthly, scenarios

My best guess remains 'B', as in B for Ben.....and B for Bernanke ;)

--

As for Friday...I will hope that it will at least be somewhat entertaining. My jobs guess +30/35k, although I fear the market might easily ramp on 'hopes of further QE'. The 60min index cycles are certainly ready for a 4-6 hour up cycle. Anyway, we'll soon know.

Goodnight from the city of the Shard.

SPY/VIX, 1yr, near term

Here is something to consider, if you didn't know anything else right now about the market, you'd surely say that this wedge is going to break to the downside, right? Whether you want to call it a wave'3, or whatever, the default reaction would be a move to the downside.

SPY/VIX, 10yr

The ten year chart gives a particularly stunning and clear overview of the crazy path from whence we came! Is it really a giant H/S formation for this market, as seen from this SPY/VIX chart?

One thing that any decent doomster/long term economic fundamentalist bear, needs to look for in the months ahead, a break under that blue line, the neckline. If I see a break under that later this year, we'll 'know' the 3.5 year 'rally of delusion' is finally over.

SPY/VIX, 3yr, outlook

I found it particularly interesting last month that we bounced just a touch under the 5.0 level in the previous down cycle. You can see in this chart that we'll usually get stuck around the 5.0 level - regardless of whether the trend is up..or down.

The current SPY/VIX up move is certainly a very strong one, and we're really not far off from breaking new highs. Bears will need to see a break under 4.7 in the weeks and months ahead for our first attempt to break the 2.5 neckline

Summary

So..what to make of those 3 kooky charts? With the SP' closing marginally lower today, and the VIX sitting at a lowly 17.50, what now?

I don't think this market is going to trade sideways this summer -as increasingly a lot of people seem to be saying. I am inherently biased of course, but does anyone out there really think sp'1266 was the low for the year? Seriously? With all the economic problems out there, no way do I see new lows not being attained in the months ahead.

I remain pretty confident we'll at least make a move lower to sp'1225/00 in the next month or so, but the key issue is whether we can break much lower..into the low 1100s....bounce for a few months..and then...collapse away.

Sp, monthly, scenarios

My best guess remains 'B', as in B for Ben.....and B for Bernanke ;)

--

As for Friday...I will hope that it will at least be somewhat entertaining. My jobs guess +30/35k, although I fear the market might easily ramp on 'hopes of further QE'. The 60min index cycles are certainly ready for a 4-6 hour up cycle. Anyway, we'll soon know.

Goodnight from the city of the Shard.

Daily Index Cycle update

We remain in a very broad up trend on the daily cycle, but we're getting very close to being maxed out on any basis, and are at least due for some sort of minor 2-3% pullback - which could play out as soon as tomorrow.

IWM (representing rus'2000 small cap)

Sp, daily5

Transports

Summary

The Rus'2000 small cap index has had the craziest ramp of all indexes, its obviously close to breaking the March highs, but is now looking grossly overstretched.

Meanwhile, the transports closed again below the FOMC highs. Is the tranny still warning of underlying trouble?

Bulls can easily tolerate a fall as low as 1330 tomorrow, and STILL remain in an uptrend. The bears should be VERY concerned about that size of buffer zone.

Personally, I can't get back on the 'major declines' due, until we break 1330...and then see a few closes under sp'1305. Right now, 1305 looks some 'weeks away'.

A little more later...

IWM (representing rus'2000 small cap)

Sp, daily5

Transports

Summary

The Rus'2000 small cap index has had the craziest ramp of all indexes, its obviously close to breaking the March highs, but is now looking grossly overstretched.

Meanwhile, the transports closed again below the FOMC highs. Is the tranny still warning of underlying trouble?

Bulls can easily tolerate a fall as low as 1330 tomorrow, and STILL remain in an uptrend. The bears should be VERY concerned about that size of buffer zone.

Personally, I can't get back on the 'major declines' due, until we break 1330...and then see a few closes under sp'1305. Right now, 1305 looks some 'weeks away'.

A little more later...

Subscribe to:

Comments (Atom)