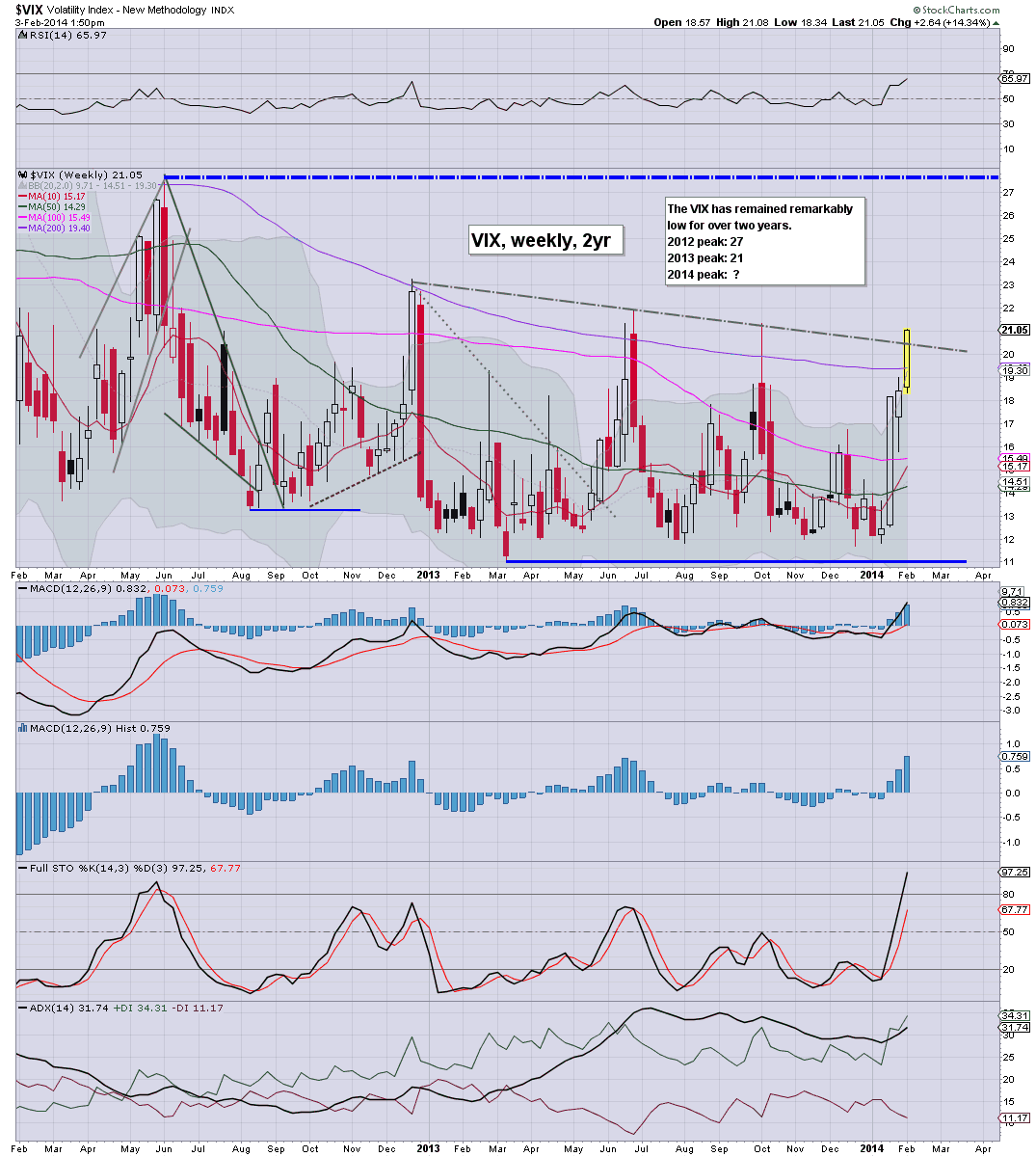

With the sp' breaking <1770, the market spiralled lower. The VIX settled +16.5% @ 21.44, the highest daily close since late Dec' 2012. If sp' slips to the target zone 1710/1690, there looks to be VIX upside to around 25/27.

vix'60min

vix'daily3

vix'weekly

Summary

*Without question, volatility has finally returned to the US equity markets. We have equities headed for the low sp'1700s - where the 200 day MA is lurking, but more importantly, we're set for a possible hit of the lower weekly bollinger - currently in the 1680s.

--

As for the VIX, today's close was an important one, and we're just a little shy of the 2013 high of 21.91. That looks set to be broken within the next day or two..and then perhaps a challenge of the 2012 high of the 27s.

VIX looks set to peak somewhere in the 25/27 zone, whilst sp'1710/1690s...within the next 3-7 trading days.

--

more later..on the indexes

Monday, 3 February 2014

Closing Brief

Equity indexes all closed strongly lower, sp -40pts @ 1741. The two leaders - Trans/R2K, both fell a very significant -3.2%. The primary downside target remains 1710/1690, which looks viable within a few days. VIX confirms the underlying market 'minor trembling'.

sp'60min

Summary

So..despite Sunday night/pre-market futures - offering minor gains..they sure didn't hold for more than a few minutes this morning.

With the ISM data tipping the market <sp'1770, we have a confirmation of the bear flags (see on hourly/daily charts), and we're now well on the way to the target zone.

To all those on the short side..congrats...there is more to come.

What will be important is making a good exit in the low 1700s..possible 1680s..later this week/early next week.

-

the usual bits and pieces across the evening.

sp'60min

Summary

So..despite Sunday night/pre-market futures - offering minor gains..they sure didn't hold for more than a few minutes this morning.

With the ISM data tipping the market <sp'1770, we have a confirmation of the bear flags (see on hourly/daily charts), and we're now well on the way to the target zone.

To all those on the short side..congrats...there is more to come.

What will be important is making a good exit in the low 1700s..possible 1680s..later this week/early next week.

-

the usual bits and pieces across the evening.

3pm update - major victory for the bears

Regardless of the exact close, the bears have achieved an enormous victory today, with a decisive break of sp'1770..all the way into the mid 1740s. It seems we're just a few days away from testing the 200 day MA of 1707..if not even the lower weekly bollinger - now in the upper 1680s.

sp'daily5

vix'daily3

Summary

There is ZERO doubt now. We're headed for the 200 day MA...if not the lower weekly bol.

A hit of the latter - whether later this week..or next...will arguably confirm 1850 was a key inter'3 top of the giant wave from Oct'2011.

That has huge implications for the next few months, but more on that...across the evening.

-

3.03pm...Rats selling into the close....no one wants to buy until sp'1707...at least.

Mainstream cheer leaders are looking worried...'where is Yellen?' I'm sure they'll be screaming later this week.

3.32pm.. minor chop... VIX holding 21. Without question...a hugely important day for the bears.

What will be interesting is the power and style of the bounce..from 1710/1690.

3.48pm...rats are selling into the close...1730s look viable....even VIX 22s.

Holding to primary target downside..1710/1690...with VIX 25/27

sp'daily5

vix'daily3

Summary

There is ZERO doubt now. We're headed for the 200 day MA...if not the lower weekly bol.

A hit of the latter - whether later this week..or next...will arguably confirm 1850 was a key inter'3 top of the giant wave from Oct'2011.

That has huge implications for the next few months, but more on that...across the evening.

-

3.03pm...Rats selling into the close....no one wants to buy until sp'1707...at least.

Mainstream cheer leaders are looking worried...'where is Yellen?' I'm sure they'll be screaming later this week.

3.32pm.. minor chop... VIX holding 21. Without question...a hugely important day for the bears.

What will be interesting is the power and style of the bounce..from 1710/1690.

3.48pm...rats are selling into the close...1730s look viable....even VIX 22s.

Holding to primary target downside..1710/1690...with VIX 25/27

2pm update - proceeding on track

US equities are well on the way to a hit of the sp'1710/1690 target zone. Considering the current momentum, that seems very probable this week. VIX looks set to take out the 2013 June high of 21.91. Gold is catching the 'safety bid', +$13.

sp'weekly7b

vix'weekly

Summary

Great stuff huh? lol

--

Further downside of 50pts, seems likely within days.

2.07pm... it is increasingly amusing seeing the cheer leaders on clown finance TV get rattled at the ongoing declines.

VIX getting close to taking out last years high...that'll be a major achievement..its coming.

2.33pm...minor index chop...whilst the VIX is holding the 20s...for the first time since Oct'2013.

Bears have nothing to fear now...well..except QE tomorrow/Wed', but any such bounces are to be shorted.

*bond yields remain an issue...a move to 10yr' 2.50/40 seems an easy target later this week.

Notable weakness: UAL, STX, both lower by around -4%.

sp'weekly7b

vix'weekly

Summary

Great stuff huh? lol

--

Further downside of 50pts, seems likely within days.

2.07pm... it is increasingly amusing seeing the cheer leaders on clown finance TV get rattled at the ongoing declines.

VIX getting close to taking out last years high...that'll be a major achievement..its coming.

2.33pm...minor index chop...whilst the VIX is holding the 20s...for the first time since Oct'2013.

Bears have nothing to fear now...well..except QE tomorrow/Wed', but any such bounces are to be shorted.

*bond yields remain an issue...a move to 10yr' 2.50/40 seems an easy target later this week.

Notable weakness: UAL, STX, both lower by around -4%.

1pm update - minor bounces... along the way

With sig' QE tomorrow and Wednesday, the equity bears face the usual threat, but the bigger force are the daily/weekly cycles..all pushing lower. Downside target zone remains sp'1710/1690..as early as this Friday. VIX is holding the 19s..comfortably above last weeks double top.

sp'60min

Summary

*busy start to the week....I'm glad I slept for 50 hours this weekend ;)

--

Suffice to say..any bounces are easily to be shorted.

-

For those interested in the bigger picture...

Dow'monthly

Borderline provisional break. Downside target would be 14000/13500..but that is likely 2-3 months out.

-

1.11pm... sp'1750... 60pts downside to go...that is around 3.25%.

1.21pm.. welcome to the 1740s....

anyone still doubt 1710/1690 now ? VIX +10% in the mid 20.30s.

--

1.33pm.... there can be NO excuses for surprise.

The break of 1770....there is no real support until 1710/1690 zone.

10yr t-bond.. <2.60% . 2.50/40s..with sp'1705/00 Friday?

sp'60min

Summary

*busy start to the week....I'm glad I slept for 50 hours this weekend ;)

--

Suffice to say..any bounces are easily to be shorted.

-

For those interested in the bigger picture...

Dow'monthly

Borderline provisional break. Downside target would be 14000/13500..but that is likely 2-3 months out.

-

1.11pm... sp'1750... 60pts downside to go...that is around 3.25%.

1.21pm.. welcome to the 1740s....

anyone still doubt 1710/1690 now ? VIX +10% in the mid 20.30s.

--

1.33pm.... there can be NO excuses for surprise.

The break of 1770....there is no real support until 1710/1690 zone.

10yr t-bond.. <2.60% . 2.50/40s..with sp'1705/00 Friday?

12pm update - equity bears should be delighted

With the sp'500 breaking into the 1750s already this week, equity

bears should be extremely pleased, and looking forwards to the rest of

the week. The door is now wide open to the downside target zone of

1710/1690 - where the 200 day MA..and the lower weekly bollinger are

lurking.

sp'daily5

sp'weekly7b

Summary

*VIX is still kinda stuck in the 19/20 resistance zone. A daily close >22, would be a break of the 2013 high, and open up 25/27 within 5-7 trading days.

--

What a great morning to start the week, yes?

We have a market that is broken, and all those bear flags on the daily cycles that I was babbling on about last week..have been confirmed.

Now it would seem..its just a matter of when we'll hit the 1710/1690 zone....not if.

I wonder what Yellen (who is being sworn in today) is thinking? Will she hit the print key at the next FOMC? Problem with that strategy, it'd send a clear signal to the market/mainstream...'the fed is boxed in..and can't escape'.

-

VIX update from Mr T

time for tea :)

-

12.04pm.. key support on the Dow monthly cycle....BUSTED.

Its over for the bulls..probably for some months. Confirmation (in my view)..if lower weekly bol' hit..currently 1689...and 1700 next week.

sp'daily5

sp'weekly7b

Summary

*VIX is still kinda stuck in the 19/20 resistance zone. A daily close >22, would be a break of the 2013 high, and open up 25/27 within 5-7 trading days.

--

What a great morning to start the week, yes?

We have a market that is broken, and all those bear flags on the daily cycles that I was babbling on about last week..have been confirmed.

Now it would seem..its just a matter of when we'll hit the 1710/1690 zone....not if.

I wonder what Yellen (who is being sworn in today) is thinking? Will she hit the print key at the next FOMC? Problem with that strategy, it'd send a clear signal to the market/mainstream...'the fed is boxed in..and can't escape'.

-

VIX update from Mr T

time for tea :)

-

12.04pm.. key support on the Dow monthly cycle....BUSTED.

Its over for the bulls..probably for some months. Confirmation (in my view)..if lower weekly bol' hit..currently 1689...and 1700 next week.

11am update - bearish breaks everywhere

The market has decisively broken, with a break of sp'1770, and also the taper'1 low of 1767. The VIX confirms it, with the first move into the 20s since early October 2013. Metals are catching a 'safety bid'.. Gold +$16. The door is now open to 1710/1690 by end week.

sp'daily5

vix'daily3

Summary

So...after a relatively flat open...the market has broken, and the bears are now in full control.

The BREAKS are decisive, so..I won't take any intra-day bounds seriously.

Any hope of a bounce to 1810/15...should be thrown out.

--

Enjoy..the ride.

11.13am... sp'1761...and it sure looks kinda ugly. This morning is setting the tone for the week ahead.

Yes..there will be micro bounces...but 1800s..bye bye...

The 200 day MA is only 3.5% lower. whilst the VIX will probably be 25 or so.

*provisional break on the Dow..monthly...and that is where people should be looking right now.

11.24am.. real ugly morning..and we have strong confirmation via the bigger monthly cycles.

We have a VERY entertaining week ahead. Will be interesting to see how fast this can unravel, and just how high the VIX can spike..when we're in the 1710/1690 zone.

Metals slowly building gains.. Gold +$18

-

11.32am.. so...we're holding significant gains...

The bear flags on the daily charts are confirmed...key lows been taken out..and now the mainstream will no doubt start talking about the 200 the day MA.... 1707.

For those with eyes on the bigger picture..the real action will likely be in April...

..as I like to say..'don't get lost in the minor noise!'

sp'daily5

vix'daily3

Summary

So...after a relatively flat open...the market has broken, and the bears are now in full control.

The BREAKS are decisive, so..I won't take any intra-day bounds seriously.

Any hope of a bounce to 1810/15...should be thrown out.

--

Enjoy..the ride.

11.13am... sp'1761...and it sure looks kinda ugly. This morning is setting the tone for the week ahead.

Yes..there will be micro bounces...but 1800s..bye bye...

The 200 day MA is only 3.5% lower. whilst the VIX will probably be 25 or so.

*provisional break on the Dow..monthly...and that is where people should be looking right now.

11.24am.. real ugly morning..and we have strong confirmation via the bigger monthly cycles.

We have a VERY entertaining week ahead. Will be interesting to see how fast this can unravel, and just how high the VIX can spike..when we're in the 1710/1690 zone.

Metals slowly building gains.. Gold +$18

-

11.32am.. so...we're holding significant gains...

The bear flags on the daily charts are confirmed...key lows been taken out..and now the mainstream will no doubt start talking about the 200 the day MA.... 1707.

For those with eyes on the bigger picture..the real action will likely be in April...

..as I like to say..'don't get lost in the minor noise!'

10am update - equity bulls in trouble

US equities begin the month with some minor weak chop. Metals are moderately higher, Gold +$4. Perhaps most notable, the VIX has already broken into the 19s - above last weeks double top, the 20s will be hit on any break <sp'1767.

sp'daily5

sp'weekly7b, HS

Summary

*ignoring the minor cycles this hour...

--

We have clear BEAR flags on the daily indexes.

The weekly charts offer 10MA resistance around 1810..and frankly, even 1800 looks difficult right now.

-

Key issue to note...the 200 day MA is now 1707, whilst the lower weekly bollinger has jumped to 1691.

Indeed..1710/1690 is the downside target zone, on any break <1767.

--

Notable movers: FB, TWTR, both +1-2%, although in the grand scheme of things, those are not exactly the most dynamic of moves.

-

10.01am lousy ISM data...51... that sure is not helping...indexes in real danger here.

...eyes to the VIX 19.16....!

We're starting to confirm the bear flags...and VIX is similarly confirming it.

The door..is opening to 1710/1690

10.13am...BREAK BREAK BREAK

All thats left now is 1767..to confirm it. VIX sure confirms the break.. 19.52

10.14am... TAPER'1 low...taken out.

Its GAME OVER bulls...game over. Time to wave the white flag..and come back another 60/80pts lower.

10.20am.. fast and dirty....the whole week ahead....

*not surprisingly, whilst the market has taken out key support, clown finance TV is more concerned with superbowl commercials.

10.26am... VIX 20s...another KEY break.

First time in the 20s..since early October..over 17 weeks ago!

It sure looks like we're headed for 1710/1690..by end of this week.

*metals catching a 'safety' bid...Gold +$16..but still under old broken support.

--

10.34am...thats right people..we're on the way.

For those with some time..go check the bigger monthly charts.. Dow is set for the first break since late 2012

VIX looks pretty strong overall. Any daily close..even the 19s would be important.

sp'daily5

sp'weekly7b, HS

Summary

*ignoring the minor cycles this hour...

--

We have clear BEAR flags on the daily indexes.

The weekly charts offer 10MA resistance around 1810..and frankly, even 1800 looks difficult right now.

-

Key issue to note...the 200 day MA is now 1707, whilst the lower weekly bollinger has jumped to 1691.

Indeed..1710/1690 is the downside target zone, on any break <1767.

--

Notable movers: FB, TWTR, both +1-2%, although in the grand scheme of things, those are not exactly the most dynamic of moves.

-

10.01am lousy ISM data...51... that sure is not helping...indexes in real danger here.

...eyes to the VIX 19.16....!

We're starting to confirm the bear flags...and VIX is similarly confirming it.

The door..is opening to 1710/1690

10.13am...BREAK BREAK BREAK

All thats left now is 1767..to confirm it. VIX sure confirms the break.. 19.52

10.14am... TAPER'1 low...taken out.

Its GAME OVER bulls...game over. Time to wave the white flag..and come back another 60/80pts lower.

10.20am.. fast and dirty....the whole week ahead....

*not surprisingly, whilst the market has taken out key support, clown finance TV is more concerned with superbowl commercials.

10.26am... VIX 20s...another KEY break.

First time in the 20s..since early October..over 17 weeks ago!

It sure looks like we're headed for 1710/1690..by end of this week.

*metals catching a 'safety' bid...Gold +$16..but still under old broken support.

--

10.34am...thats right people..we're on the way.

For those with some time..go check the bigger monthly charts.. Dow is set for the first break since late 2012

VIX looks pretty strong overall. Any daily close..even the 19s would be important.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +4pts, we're set to open at 1786. Metals are a touch higher, Gold +$1. There remains decreasing threat of a move to the 1810/15 zone, whilst a clear break would be <1767 - the taper'1 low.

sp'60min

Summary

A new trading month begins, and despite likely opening gains, equity bulls are facing increasing pressure.

The weekly charts are weak, and will open with the third consecutive bearish candle, which has not occurred since Nov'2012.

*something to watch this morning, the monthly charts...as we open a new month, look to see how much closer the MACD cycle is getting to a rollover.

-

We have a long week ahead, the only QE-pomo to be concerned about is tomorrow and Wednesday, with the big jobs data..Friday.

-

9.04am.. market weakening... we're now set to open fractionally lower.

Since we're a mere 12pts (0.6%) from breaking the key floor of 1770..it really won't take much to spiral things lower. As I will keep noting, any break of 1767, should open up a fast move to 1710/1690 'within days'..if the break occurs.

9.23am... metals picking up.. Gold $5, whilst equities still slip, sp -2pts.

9.35am.. new month.. and the bulls look largely absent.

Lower weekly bol' jumps to 1691.... with the 200 day MA @ 1707..those are the key targets..on a break of 1767.

9.50am.. ohoh, VIX breaks 19s

Thats pretty important! Bulls are in trouble.

sp'60min

Summary

A new trading month begins, and despite likely opening gains, equity bulls are facing increasing pressure.

The weekly charts are weak, and will open with the third consecutive bearish candle, which has not occurred since Nov'2012.

*something to watch this morning, the monthly charts...as we open a new month, look to see how much closer the MACD cycle is getting to a rollover.

-

We have a long week ahead, the only QE-pomo to be concerned about is tomorrow and Wednesday, with the big jobs data..Friday.

-

9.04am.. market weakening... we're now set to open fractionally lower.

Since we're a mere 12pts (0.6%) from breaking the key floor of 1770..it really won't take much to spiral things lower. As I will keep noting, any break of 1767, should open up a fast move to 1710/1690 'within days'..if the break occurs.

9.23am... metals picking up.. Gold $5, whilst equities still slip, sp -2pts.

9.35am.. new month.. and the bulls look largely absent.

Lower weekly bol' jumps to 1691.... with the 200 day MA @ 1707..those are the key targets..on a break of 1767.

9.50am.. ohoh, VIX breaks 19s

Thats pretty important! Bulls are in trouble.

Subscribe to:

Comments (Atom)