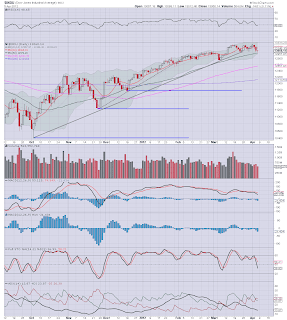

Whilst the Sunday futures wheel is now up to speed, lets consider one of the bigger bearish cycles I been highlighting for some weeks.

VIX weekly

VIX is 16.70, translating current futures to VIX, we're probably looking at..

min' 10% 1.7 : 18.40

15% 2.5 : 19.20

VIX @ the 20.00 level would make sense..as an intra-day high, especially if we can break into the 1370s.

-

The point I've been making for some weeks is the MACD (blue bar) cycle, its been inexorably cycling back up, its sure taken longer than expected, not least when it broke what had appeared to be a floor, in the second week or March.

So, the only issue is how high can the VIX go across the next few days?

Upper bol' is still almost 30, although the daily upper bol is 16.82, essentially where we're are already.

VIX Daily, rainbow

So, eyes to the VIX Monday., could...get interesting. Certainly, it should be a great open for anyone who was buying Puts on Thursday.

Key issue: Bulls will want to see an opening black candle in the first 30 minutes on the hourly charts, that might suggest its merely a brief shake out, and then up we crawl..for rest of the week.

Bears just need to see a 10% gain hold across Monday, and that will open the door, to more interesting levels.

*I see a lot of chatter about the 1360s /65/70 level. Personally, right now, I'm still guessing the 1370s will hold, but hey, if we do see 1360s, there sure is a lot of empty air down to 1300...or 1250.

--

**futures wheel showing the same loss as Friday. Sp'500 will open around 1385

Sunday, 8 April 2012

They're all coming out of the cave this weekend

A very quiet weekend

London city has been grey all weekend, and it matches my mood perfectly. Being on the wrong side of this market is never easy, especially whilst knowing that when the futures wheel opens later tonight at 11pm UK time, it'll probably show a pretty deep red colour all across the finviz futures page.

Monday looks set to open significantly lower, if the Friday futures wheel was correct, then we'll be down around 15/20pts... to around sp'1380 by late morning. A little minor bounce, and then tailing into the close, maybe we'll end sp'1375/70 - which are pretty key levels as I stated in my previous post.

Bulls all gone?

There is a fair bit of bearish hysteria across the various boards and sites this weekend, with endless charts suggesting a major wave lower is now underway. Very few sites and their regular posters seem to be touting a continuation of the current 6.25 month long rally. The bizarre fact remains that we're only sp'24pts off the recent high, and yet once again, many are going nuts over what is a mere 1.75% decline from the peak.

Dow, daily, near term

Dow 12800 looks a pretty reasonable 'best bear case' for Monday at some point. That would be a good 250pt fall, and then we'll just have to see how many of the algo-bots decide whether its dip-buying time again. 12300/11800 would be a pretty broad target range - were a new down wave to occur.

What about all those other top calls the doomers made?

The question that has to be asked, all those same posters touting doom this weekend, are largely the exact same ones who were calling a top at 1290, 1300, 1320, 1370, 1400...and now..1422. Maybe they'll call this one right? Sooner or later they'll be right, but I can't help but roll my eyes at what I've been reading.

The problem I have is that many of them were loading up with truck loads of TZA, ERY, or worse...more recently - the TVIX. Most of those holders are still 50..even 75% down on their positions. They need SP'1300 just to have a slim chance of getting back to breakeven.

Permabear..in a bad mood?

A bit, I will admit, but its more from seeing yet another long list of bloggers, and the main financial 'bearish sites' calling for a major wave lower...yet again..for probably the 6th or 7th time since last Octobers floor.

I'm indeed tired of much of this nonsense lately. As one of the 'bear team', it would of course be painfully ironic if I miss another huge down wave. However, at least Monday will be somewhat entertaining to watch.

More later this evening...perhaps.

London city has been grey all weekend, and it matches my mood perfectly. Being on the wrong side of this market is never easy, especially whilst knowing that when the futures wheel opens later tonight at 11pm UK time, it'll probably show a pretty deep red colour all across the finviz futures page.

Monday looks set to open significantly lower, if the Friday futures wheel was correct, then we'll be down around 15/20pts... to around sp'1380 by late morning. A little minor bounce, and then tailing into the close, maybe we'll end sp'1375/70 - which are pretty key levels as I stated in my previous post.

Bulls all gone?

There is a fair bit of bearish hysteria across the various boards and sites this weekend, with endless charts suggesting a major wave lower is now underway. Very few sites and their regular posters seem to be touting a continuation of the current 6.25 month long rally. The bizarre fact remains that we're only sp'24pts off the recent high, and yet once again, many are going nuts over what is a mere 1.75% decline from the peak.

Dow, daily, near term

Dow 12800 looks a pretty reasonable 'best bear case' for Monday at some point. That would be a good 250pt fall, and then we'll just have to see how many of the algo-bots decide whether its dip-buying time again. 12300/11800 would be a pretty broad target range - were a new down wave to occur.

What about all those other top calls the doomers made?

The question that has to be asked, all those same posters touting doom this weekend, are largely the exact same ones who were calling a top at 1290, 1300, 1320, 1370, 1400...and now..1422. Maybe they'll call this one right? Sooner or later they'll be right, but I can't help but roll my eyes at what I've been reading.

The problem I have is that many of them were loading up with truck loads of TZA, ERY, or worse...more recently - the TVIX. Most of those holders are still 50..even 75% down on their positions. They need SP'1300 just to have a slim chance of getting back to breakeven.

Permabear..in a bad mood?

A bit, I will admit, but its more from seeing yet another long list of bloggers, and the main financial 'bearish sites' calling for a major wave lower...yet again..for probably the 6th or 7th time since last Octobers floor.

I'm indeed tired of much of this nonsense lately. As one of the 'bear team', it would of course be painfully ironic if I miss another huge down wave. However, at least Monday will be somewhat entertaining to watch.

More later this evening...perhaps.

Subscribe to:

Comments (Atom)