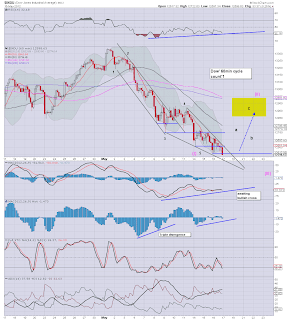

With the break of VIX 21, the next target was 24, but its possible we're now stuck in the low 22s. Despite the market closing weak today, the VIX only managed to close near the opening level. There is clearly NO sign of a trend change yet though, Bulls will need to see VIX break back under 21 to feel confident in any multi-day bounce/rally.

VIX, 60min

VIX, daily, rainbow (elder impulse)

VIX, daily, bullish outlook

Summary

Todays close was still bullish for the VIX - especially on the daily charts, where there is zero sign of a trend change. However, we are now in the lower part of the original target zone of 22/25. Considering the main indexes have fallen for 11 days, a bounce is seemingly likely to begin in the next few days.

One issue is that even when we do get a bounce in the indexes, just how far back will the VIX retrace? The daily 10MA is now up to almost 20, a brief move under that seems possible, so maybe we're looking for something in the low 19s/18s.

More later, dealing with the Daily Index Cycles

Wednesday, 16 May 2012

Closing Brief

A rough day for those holding long from the previous few days, and even for those who went long in the mid sp'1330s today who are already underwater. However, the 60min cycle is showing a number of signs suggesting there is a reasonable chance for a break higher - the minor wave'2 of 3.

IWM'60min

Sp'60min, count'1

Dow'60min

Summary

So, what about Thursday and Friday? I've seen in a fair few places people suggest max-pain is sp'1380. Clearly, we're not going up to that level across the next two days. A tough battle to 1350 remains a fair target though, considering it is opex, with what are at least marginally oversold conditions, and we have the Facebook hysteria of course.

Sp'1422 is now a long way up. Almost a 100pt fall across 11 trading days. A typical fib' retacement of 50% of that move would be 50pts..to around 1375/80 - which is exactly where the severe resistance is. Further, the H/S formation chart I've posted a great deal would similarly support a target in the 1370/80.

Were this day'3 or 5 of a down cycle - and I was long (and underwater!), I would be really concerned. However, we are 11 days down - that is just 1 short of the July/August 2011 collapse wave move of 12 days.

We ARE due a significant bounce.

--

More across the evening, dealing with the VIX, Daily Index Charts, and the bigger picture - which is always a good thing to keep in mind.

IWM'60min

Sp'60min, count'1

Dow'60min

Summary

So, what about Thursday and Friday? I've seen in a fair few places people suggest max-pain is sp'1380. Clearly, we're not going up to that level across the next two days. A tough battle to 1350 remains a fair target though, considering it is opex, with what are at least marginally oversold conditions, and we have the Facebook hysteria of course.

Sp'1422 is now a long way up. Almost a 100pt fall across 11 trading days. A typical fib' retacement of 50% of that move would be 50pts..to around 1375/80 - which is exactly where the severe resistance is. Further, the H/S formation chart I've posted a great deal would similarly support a target in the 1370/80.

Were this day'3 or 5 of a down cycle - and I was long (and underwater!), I would be really concerned. However, we are 11 days down - that is just 1 short of the July/August 2011 collapse wave move of 12 days.

We ARE due a significant bounce.

--

More across the evening, dealing with the VIX, Daily Index Charts, and the bigger picture - which is always a good thing to keep in mind.

3pm update - bulls against the wall

The chop fest continues, but with a distinct downward slant. Yet again the early morning gains have failed to hold, and we're now back in danger of spiralling again, although the sell-side volumn is simply still not there.

Sp'60min, count'1

Summary

A somewhat messy afternoon. I shall hold overnight into Thursday regardless, I'm long from sp'1334 which is at least a reasonable level ( I can only imagine how many were going long at 1360/50), first target by Friday late morning remains 1350/55.

I do like the narrowing wedge on the 60min chart. It suggest we have a fair chance of snapping to the upside no later than Friday afternoon. Considering we have opex Friday, and the biggest IPO of all time, I'm still holding to the wave'2 outlook.

Bulls would prefer a close over that 10MA of 1334

More after the close.

Sp'60min, count'1

Summary

A somewhat messy afternoon. I shall hold overnight into Thursday regardless, I'm long from sp'1334 which is at least a reasonable level ( I can only imagine how many were going long at 1360/50), first target by Friday late morning remains 1350/55.

I do like the narrowing wedge on the 60min chart. It suggest we have a fair chance of snapping to the upside no later than Friday afternoon. Considering we have opex Friday, and the biggest IPO of all time, I'm still holding to the wave'2 outlook.

Bulls would prefer a close over that 10MA of 1334

More after the close.

2pm update - another choppy day

Another choppy day in the markets. I suppose it could merely be a holding day, with further falls tomorrow, or it is a standard turn day - lots of chop, and then a fairly significant move upwards the following day.

Sp'60min, count'1

Summary

Being long sure is not easy, yet despite the recent micro-cycle lower to sp'1327, I'm actually not too concerned. Look at the MACD (blue bar histogram) cycle, there is some very interesting divergence there. There remain few sellers..but few buyers also.

As noted earlier, bulls will want a close over the 10MA, now at sp'1335

Holding index longs into Facebook-Friday.

Sp'60min, count'1

Summary

Being long sure is not easy, yet despite the recent micro-cycle lower to sp'1327, I'm actually not too concerned. Look at the MACD (blue bar histogram) cycle, there is some very interesting divergence there. There remain few sellers..but few buyers also.

As noted earlier, bulls will want a close over the 10MA, now at sp'1335

Holding index longs into Facebook-Friday.

1pm update - holding long into Facebook Friday

So...I'm long from an hour ago, around the sp'1334 level. Market is still largely in churn mode, but we are holding above the recent low. So long as that holds into the close, bulls can probably look forward to 1350/55 by Friday lunch time. A VIX red close would be a useful confirmation for those long.

SP'60min, count'1

Sp'daily cycle - bearish outlook

Summary

Minor' wave'1 - if that's what it was, lasted 10 days, wave'2 - which 'if' the floor is in, will probably last 3-5 days. That would make sense in terms of time. I had considered whether Friday might be a peak, but that seems unlikely.

My plan is to look for sp'1350/55 for a first exit..and then re-long again on the next 15min cycle pullback. Right now, 1350s look more likely Friday than tomorrow, but it won't take much for this market to start a reverse cascade upwards to kick all the bears out.

The big question - if today is the start of wave'2 UP, how high do we go? The H/S formation would suggest 1370 at least...and there is huge resistance at the 1380/85 level.

*bulls should seek a close above the hourly 10MA - currently sp'1336

More across the afternoon.

SP'60min, count'1

Sp'daily cycle - bearish outlook

Summary

Minor' wave'1 - if that's what it was, lasted 10 days, wave'2 - which 'if' the floor is in, will probably last 3-5 days. That would make sense in terms of time. I had considered whether Friday might be a peak, but that seems unlikely.

My plan is to look for sp'1350/55 for a first exit..and then re-long again on the next 15min cycle pullback. Right now, 1350s look more likely Friday than tomorrow, but it won't take much for this market to start a reverse cascade upwards to kick all the bears out.

The big question - if today is the start of wave'2 UP, how high do we go? The H/S formation would suggest 1370 at least...and there is huge resistance at the 1380/85 level.

*bulls should seek a close above the hourly 10MA - currently sp'1336

More across the afternoon.

12pm update - due a new wave up

These 15min cycles are really messing with traders on both sides this week. For the bulls, we are at least holding above the recent low. The Bears are seeing the VIX hold above 20/21, and the sp' is a mere few points above the 1328 low (although futures last night were 1323)

SP'15min

SP'60min, count'1

Summary

*just went long at 11.54am

The closer we get to opex Facebook-Friday, I'm more confident to go long. It is VERY important though we don't break below previous lows, although I realise it depends on what index you are watching. IWM (rus'2000 small cap) has often held the lows better than SP/Dow.

SP'15min

SP'60min, count'1

Summary

*just went long at 11.54am

The closer we get to opex Facebook-Friday, I'm more confident to go long. It is VERY important though we don't break below previous lows, although I realise it depends on what index you are watching. IWM (rus'2000 small cap) has often held the lows better than SP/Dow.

11am update - still watching

This mornings rally is certainly stronger than yesterday - and bodes well for the overall near term idea of a rally into opex Facebook-Friday.

I'm still waiting. I want that 15min cycle floored before I'm hitting buttons. If market prices keep going up -whilst the cycle resets, I'll just sit this whole thing out, and wait for the next cycle peak to re-short for wave'3.

IWM'15min

IWM'60min

Summary

If yesterday was the conclusion of minor'1 of 3 , then 2 is underway. Anyone with 'serious money' would have a stop at the floor of sp'1328 (or 1323 if you consider overnight futures important).

An important issue I was just dwelling on (via daily cycle chart)..if wave'1 was 10 days, then wave'2 UP, should probably be at least 3, maybe 5 days. That would get us as far into the middle of next week. Something to consider into the weekend.

Facebook Friday...dow +150/175...looks very viable. For the bears, the whole sight will be a pitiful joke. A near 100 PE social media (not real 'production') stock, whose revenue source is entirely unreliable. The whole thing stinks of MySpace..and that never ended too well.

I'm still waiting. I want that 15min cycle floored before I'm hitting buttons. If market prices keep going up -whilst the cycle resets, I'll just sit this whole thing out, and wait for the next cycle peak to re-short for wave'3.

IWM'15min

IWM'60min

Summary

If yesterday was the conclusion of minor'1 of 3 , then 2 is underway. Anyone with 'serious money' would have a stop at the floor of sp'1328 (or 1323 if you consider overnight futures important).

An important issue I was just dwelling on (via daily cycle chart)..if wave'1 was 10 days, then wave'2 UP, should probably be at least 3, maybe 5 days. That would get us as far into the middle of next week. Something to consider into the weekend.

Facebook Friday...dow +150/175...looks very viable. For the bears, the whole sight will be a pitiful joke. A near 100 PE social media (not real 'production') stock, whose revenue source is entirely unreliable. The whole thing stinks of MySpace..and that never ended too well.

10am update - watching the rally

I am still waiting to go long, the 15/60 minute cycles are fine, but the 5min is at the top of its cycle, I am certainly not going long with the RSI in the 60s (5min cycle) ! If I miss out on a morning rally...so be it. I'm a nervous trader going long, so I have to see ALL cycles be floored before I start hitting buttons.

For most 'normal' traders though, it looks fine for today and into Friday. The mood does seem different today, even on the clown channels.

IWM, 5min

sp'60min,count'2

Summary

Look at the MACD cycle on the IWM 5min chart. So long as we don't break 77.50, I plan to go confidently long sometime today, probably around lunch time, at the next minor pull back.

What is clear though, only a maniac would be shorting right now.

For most 'normal' traders though, it looks fine for today and into Friday. The mood does seem different today, even on the clown channels.

IWM, 5min

sp'60min,count'2

Summary

Look at the MACD cycle on the IWM 5min chart. So long as we don't break 77.50, I plan to go confidently long sometime today, probably around lunch time, at the next minor pull back.

What is clear though, only a maniac would be shorting right now.

Pre-Market Brief

Good morning. Well the sun is shining in London city, those green shoots sure look nice today. It also looks like the market wants to make a little move upwards into opex Friday. Many posters out there yesterday were noting that it sure is looking like the market is ready to break upwards (for a possible wave'2 of 3)

Futures are marginally higher +0.3%... - we were almost -0.5% some 3 hours ago.

Sp'15min

Sp'60min H/S formation

Summary

I am looking to go long today. If we open significantly higher, I'll sit back and look to enter on the base of the next 15min down cycle. Yesterday the rallies never lasted more than an hour or so before rolling over. Today, I'm guessing they'll last longer and show more strength.

From a MACD cycle perspective, the 15min cycle is floored, and the 60min is showing some divergence, suggesting underlying downward momentum is weakening.

We have a few pieces of econ-data today (and tomorrow)...the FOMC minutes are issued at 2pm, and that will probably strengthen the rally...or we'll see yet another rollover.

However, its opex, we've the facebook hysteria still to come, we're at sp'1330, a move to at least the mid 1350s seems very viable. There are a few posters out there suggesting a move up as high as the 1390/95 level. I can't imagine anything higher than 1380/85.

The opening 10/15mins might easily be choppy, and we could still open a touch red. If so, look for black candles on the VIX, and hollow-red (reversal) candles on the indexes to appear. That'll be strong confirmation that the market is flooring..and will jump higher in the early morning (we saw the same thing occur last Wednesday and Friday).

Good wishes for Wednesday trading!

Futures are marginally higher +0.3%... - we were almost -0.5% some 3 hours ago.

Sp'15min

Sp'60min H/S formation

Summary

I am looking to go long today. If we open significantly higher, I'll sit back and look to enter on the base of the next 15min down cycle. Yesterday the rallies never lasted more than an hour or so before rolling over. Today, I'm guessing they'll last longer and show more strength.

From a MACD cycle perspective, the 15min cycle is floored, and the 60min is showing some divergence, suggesting underlying downward momentum is weakening.

We have a few pieces of econ-data today (and tomorrow)...the FOMC minutes are issued at 2pm, and that will probably strengthen the rally...or we'll see yet another rollover.

However, its opex, we've the facebook hysteria still to come, we're at sp'1330, a move to at least the mid 1350s seems very viable. There are a few posters out there suggesting a move up as high as the 1390/95 level. I can't imagine anything higher than 1380/85.

The opening 10/15mins might easily be choppy, and we could still open a touch red. If so, look for black candles on the VIX, and hollow-red (reversal) candles on the indexes to appear. That'll be strong confirmation that the market is flooring..and will jump higher in the early morning (we saw the same thing occur last Wednesday and Friday).

Good wishes for Wednesday trading!

Market is heading lower....much lower

To end the day...lets conclude with the simplest of charts...

Sp'500, monthly cycle, simple' version

It is indeed a simple chart, but the trend IS clear. All the indicators are clear, they are all confirming a rollover into the summer. The natural target for this new 2-5 month down cycle would be the lower channel line (pink) of sp'1100. That is still a good 230pts lower, around 18%.

Goodnight from London

Sp'500, monthly cycle, simple' version

It is indeed a simple chart, but the trend IS clear. All the indicators are clear, they are all confirming a rollover into the summer. The natural target for this new 2-5 month down cycle would be the lower channel line (pink) of sp'1100. That is still a good 230pts lower, around 18%.

Goodnight from London

Daily Cycle Update

Another weak close for the US markets, but it sure was one chop fest of a day. I had really wanted to take a long-trade no less than three times, but the VIX never looked right, and each intra-day rally on the indexes only lasted an hour or so before rolling over.

So we have a very weak market, and the daily outlooks are looking fine for sp'1270 in the near term. I can't work out if we have even had wave'2 (black count) yet. If not, then this is one hell of a strong wave'1 down - and would bode for a really scary wave'3 - probably to the 1200/1150 zone by late June.

IWM, daily, bearish outlook

SP

Transports

Summary

Transports remains stuck in that incredibly tight range. The Tranny is a mere day from breaking through key support - which would be the ultimate warning to the bulls.

Both the SP'500/IWM bearish outlook charts are looking good.

Q. Are we still in wave'1 of the bigger (blue wave'3) ?

I don't know, and its one reason why I am both fearful to go long - even for day-trades, and also too worried to be holding short overnight from these levels. The fact that is it opex week - along with the crazy Facebook nonsense/hysteria IPO this Friday, just adds to the problem of what to do.

Personally, as noted earlier today, I will be VERY much more clear minded and feel more able to trade once we move into next week.

So we have a very weak market, and the daily outlooks are looking fine for sp'1270 in the near term. I can't work out if we have even had wave'2 (black count) yet. If not, then this is one hell of a strong wave'1 down - and would bode for a really scary wave'3 - probably to the 1200/1150 zone by late June.

IWM, daily, bearish outlook

SP

Transports

Summary

Transports remains stuck in that incredibly tight range. The Tranny is a mere day from breaking through key support - which would be the ultimate warning to the bulls.

Both the SP'500/IWM bearish outlook charts are looking good.

Q. Are we still in wave'1 of the bigger (blue wave'3) ?

I don't know, and its one reason why I am both fearful to go long - even for day-trades, and also too worried to be holding short overnight from these levels. The fact that is it opex week - along with the crazy Facebook nonsense/hysteria IPO this Friday, just adds to the problem of what to do.

Personally, as noted earlier today, I will be VERY much more clear minded and feel more able to trade once we move into next week.

Subscribe to:

Comments (Atom)