With the main indexes weak across the day, the VIX managed to finally hold onto some gains, settling +7.4% @ 12.72. Near term trend though is still very choppy, and if the sp'1715/25 zone is hit, VIX could again briefly slip into the 11s.

VIX'60min

VIX'daily3

Summary

So, moderate gains for the VIX, but it still remains in the bizarrely low 12s. Even the 14/15s remain 'difficult' in the very near term.

Its going to take some kind of major market upset just to briefly break back into the 20s. Right now, that doesn't look viable until mid September.

-

more later..on the indexes

Tuesday, 6 August 2013

Closing Brief

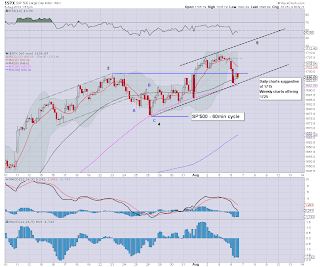

The main indexes all closed lower, but the declines were relatively moderate, with the sp -10pts @ 1697. The market leaders - Trans/R2K, closed -1.3% and -1.0% respectively. A final small wave to the sp'1715/25 target zone still seems likely within the next two trading days.

sp'60min

Summary

As I've seen a few hundred times in the past few years, the morning declines levelled out by 11am..and then it was merely a case of when..not if...the latter day recovery would begin.

With the sp' closing above the important lower channel line, it would seem we'll get another wave higher across Wed/Thursday.

*considering there is a mid-sized QE of $3bn on Thursday, I'll be inclined to wait until that is out of the way.

--

the usual bits and pieces across the evening

sp'60min

Summary

As I've seen a few hundred times in the past few years, the morning declines levelled out by 11am..and then it was merely a case of when..not if...the latter day recovery would begin.

With the sp' closing above the important lower channel line, it would seem we'll get another wave higher across Wed/Thursday.

*considering there is a mid-sized QE of $3bn on Thursday, I'll be inclined to wait until that is out of the way.

--

the usual bits and pieces across the evening

3pm update - closing hour recovery?

The market remains moderately lower, with the sp at 1696.VIX is +7% or so, but is still in the 12s. Hourly charts are still offering significant upside across Wed/Thursday, so long as the market can close today >1695. Metals remain weak, Gold -$17

sp'60min

VIX'60min

Summary

*VIX is making a play to take out the morning high, but from an hourly cycle perspective, it looks maxed out.

--

Lets be clear, any daily close <1695 will be bearish, and suggestive that a multi-week high is already in.

Otherwise, its another wave higher to the sp'1715/25 target zone across the next day or two.

-

So..which side we close of sp'1695 will be important.

I'm guessing on the upper side..and I am indeed..still waiting!

--

sp'60min

VIX'60min

Summary

*VIX is making a play to take out the morning high, but from an hourly cycle perspective, it looks maxed out.

--

Lets be clear, any daily close <1695 will be bearish, and suggestive that a multi-week high is already in.

Otherwise, its another wave higher to the sp'1715/25 target zone across the next day or two.

-

So..which side we close of sp'1695 will be important.

I'm guessing on the upper side..and I am indeed..still waiting!

--

2pm update - still waiting

The market is holding together after the minor morning washout, with the sp'500 set to close in the low 1700s. Whether the close is red or green, it would still seem a further wave to the prime target zone of sp'1715/25 is likely. Metals remain very weak, with Gold -$17

sp'60min

Summary

Clearly, if we break the lower channel..which at the close would be <1695, then its possible we've already topped out on this 7 week up wave.

As it is, I'm guessing no. One further push upward, and those sp'1720s look just about viable by late Wed/early Thursday.

-

I remain...in no hurry.

*first downside..once I do get short, will be the rising 50 day MA...in the sp'1660/55 area.

That will suffice for an initial minor'1 lower.

--

AAPL, remains an interesting one..not least with it having hit the 200 day MA today.

Perhaps another hit tomorrow in the 470/75 area..before a major fail/rollover, which would sync up with the main market.

sp'60min

Summary

Clearly, if we break the lower channel..which at the close would be <1695, then its possible we've already topped out on this 7 week up wave.

As it is, I'm guessing no. One further push upward, and those sp'1720s look just about viable by late Wed/early Thursday.

-

I remain...in no hurry.

*first downside..once I do get short, will be the rising 50 day MA...in the sp'1660/55 area.

That will suffice for an initial minor'1 lower.

--

AAPL, remains an interesting one..not least with it having hit the 200 day MA today.

Perhaps another hit tomorrow in the 470/75 area..before a major fail/rollover, which would sync up with the main market.

1pm update - tricksy market

The hourly index charts are offering significant upside into Wed/Thursday. One further new high into the sp'1720s looks very viable. Precious metals remain weak, with Gold -$17. Oil is similarly weak, -1%, but will likely recover with the main market.

sp'60min

Summary

Any doubt now? It certainly looks like this was a sub'4 of a final fifth wave.

If so...we have general upside into tomorrow, and possibly early Thursday - when there is a sig' QE of $3bn.

The sp'1720s as an index short level..remain the target.

--

*yours...wrapped up in ATX power/SATA cables. Urghh

VIX update

back later

sp'60min

Summary

Any doubt now? It certainly looks like this was a sub'4 of a final fifth wave.

If so...we have general upside into tomorrow, and possibly early Thursday - when there is a sig' QE of $3bn.

The sp'1720s as an index short level..remain the target.

--

*yours...wrapped up in ATX power/SATA cables. Urghh

VIX update

back later

12pm update - latter day recovery

The market has found support on the lower channel, that goes back 8 trading days. The micro-count would suggest a final wave higher into Wed/Thursday, although the sp'1720s look difficult to hit, even with a lot of QE 'benny bux' looking for a new home.

sp'60min

Summary

Yes, the declines are kinda interesting, but once again, we've apparently floored at the traditional time of 11am.

Lets see if the bulls can manage a flat/fractionally higher close, which would set up the 1720s tomorrow.

--

As it is, I simply have no interest in getting involved in this nonsense right now.

'Tired of it', doesn't remotely cover it.

---

VIX update coming....

sp'60min

Summary

Yes, the declines are kinda interesting, but once again, we've apparently floored at the traditional time of 11am.

Lets see if the bulls can manage a flat/fractionally higher close, which would set up the 1720s tomorrow.

--

As it is, I simply have no interest in getting involved in this nonsense right now.

'Tired of it', doesn't remotely cover it.

---

VIX update coming....

11am update - moderate declines

Relative to what we've seen recently, the current declines are 'big', but really, the sp' is only lower by 0.7%..and a close back in the 1700s looks very viable. Precious metals are trying to bounce, Gold -$14, whilst Oil is -0.9% or so.

sp'60min

sp'daily5

Summary

Considering the past few weeks...I simply can't take the current declines seriously.

We're going to get some kind of latter day recovery, and a green close is entirely viable.

--

From a micro-wave count though, we're getting awfully close to a projected cycle peak.

For the moment, I still don't think this market merits getting involved with.

sp'60min

sp'daily5

Summary

Considering the past few weeks...I simply can't take the current declines seriously.

We're going to get some kind of latter day recovery, and a green close is entirely viable.

--

From a micro-wave count though, we're getting awfully close to a projected cycle peak.

For the moment, I still don't think this market merits getting involved with.

10am update - just another tease

The main indexes are moderately lower, but with two very significant QEs across today and Thursday, the bears will face persistent problems in managing a red close. Metals remain weak, with Gold -$20. Despite the index declines, VIX is only +3%.

sp'daily5

Summary

I suppose you could call this a sub'4 of 5 on the daily chart, but whatever it is, I find it hard to believe we won't claw back these opening declines.

Bears are very likely about to get a reminder of just what the QE-pomo is all about.

--

notable movers so far today: MGM, +5% or so on earnings I believe.

sp'daily5

Summary

I suppose you could call this a sub'4 of 5 on the daily chart, but whatever it is, I find it hard to believe we won't claw back these opening declines.

Bears are very likely about to get a reminder of just what the QE-pomo is all about.

--

notable movers so far today: MGM, +5% or so on earnings I believe.

Pre-Market Brief

Good morning. Futures are a touch lighter, sp -2pts, we're set to open around 1705. Precious metals are again the weak spot, with Gold -$12..although Silver is almost flat. Oil is a touch higher. With QE-pomo of $5bn today, it will again be difficult for the bears to sustain any momentum.

sp'60min

Summary

Once again, we're set to open a touch lower, but really, the market has been doing this for weeks now, and we still often close to the upside.

The large QE today should be a reminder of what the Fed is capable of, in keeping this charade going.

--

*I remain on the sidelines, and am not really expecting to get involved today. I really won't be interested until the sp'1720s, and even then, I want to see some sort of clear intra-day sign of a toppy-action.

Considering the lack of news this week, there seems little reason why the bears are going to be able to wrestle control back.

Update from Mr 'Permabull' Carboni

Can you believe it, he is still bullish, ;) I do agree with his call on Gold though.

sp'60min

Summary

Once again, we're set to open a touch lower, but really, the market has been doing this for weeks now, and we still often close to the upside.

The large QE today should be a reminder of what the Fed is capable of, in keeping this charade going.

--

*I remain on the sidelines, and am not really expecting to get involved today. I really won't be interested until the sp'1720s, and even then, I want to see some sort of clear intra-day sign of a toppy-action.

Considering the lack of news this week, there seems little reason why the bears are going to be able to wrestle control back.

Update from Mr 'Permabull' Carboni

Can you believe it, he is still bullish, ;) I do agree with his call on Gold though.

Subscribe to:

Comments (Atom)