With the US indexes breaking new lows around lunch time, the VIX did make a new high, but with the long awaited index bounce finally coming in late afternoon, the VIX did indeed close slightly red. A further move lower for around 2-4 trading hours seems very likely during early Tuesday.

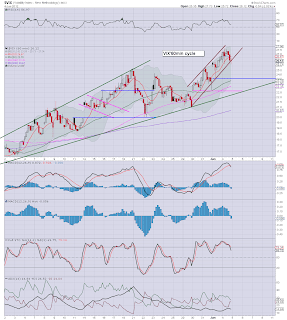

VIX'60min

VIX, daily - bullish outlook

VIX, weekly

Summary

Looking for VIX 24/23 sometime Tuesday, and then one last lunge higher across Wed/Thursday, probably to around 29, maybe even briefly 30/31 - if the market gets a little twitchy about the usual EU concerns.

More later...

Monday, 4 June 2012

Closing Brief

The market did indeed finally see a bounce, and the close was moderately positive for the bulls. Tuesday could certainly open a touch lower, but I'm looking for a gap higher, maybe as high as +1% into the sp'1290s. Given a few hours, a re-short around that level should be good for a Wed/Thursday exit in the low 1260s/50s.

VIX closing red confirms the short term outlook, a VIX in the lows 24s early Tuesday would match up nicely with sp'1290s.

Lets look at those hourly cycles...

IWM

Dow

SP

Summary

The bounce is probably almost half way done already, but we're dealing with such tiny cycles, its really very tricky to guess. Last Friday I was looking for a bounce to 1295/1300, I've lowered that to around 1285/95.

More later, looking at Volatility, and those daily index cycles

VIX closing red confirms the short term outlook, a VIX in the lows 24s early Tuesday would match up nicely with sp'1290s.

Lets look at those hourly cycles...

IWM

Dow

SP

Summary

The bounce is probably almost half way done already, but we're dealing with such tiny cycles, its really very tricky to guess. Last Friday I was looking for a bounce to 1295/1300, I've lowered that to around 1285/95.

More later, looking at Volatility, and those daily index cycles

3pm update - rally into the close?

Despite being a Permabear, I am indeed riding this mini ramp wave. A bounce was indeed very overdue, although its unlikely to last very long, late Tuesday morning or so. We could see quite a little truck load of bears get stopped out in this closing hour, causing reverse cascade UP all the way into the close.

Sp'60min

VIX'60min

Summary

Bounce underway, target is 1285/90. We could still climb to 1300 - it'd certainly make for a more normal 'hit the big level, then fall away' scenario.

With the VIX red, we could easily rally for 2-4 more trading hours. Bears had all day to close out...its possible they could be real annoyed at the Tuesday morning if we gap up 1% for some nonsense 'rumour' reason.

More after the close.

Sp'60min

VIX'60min

Summary

Bounce underway, target is 1285/90. We could still climb to 1300 - it'd certainly make for a more normal 'hit the big level, then fall away' scenario.

With the VIX red, we could easily rally for 2-4 more trading hours. Bears had all day to close out...its possible they could be real annoyed at the Tuesday morning if we gap up 1% for some nonsense 'rumour' reason.

More after the close.

2pm update - technical bounce...still due

Well...if the blue count is correct (see sp'60min chart), then wave'4 peaked at 1334. In terms of a micro-count, we are due minute wave'4 UP of minor wave'5 - if that makes any sense! What matters is that we remain in big wave'1 down, from sp'1415....which started May'1st..making 5 lousy weeks for the bulls.

Sp'60min

Vix'60min

Summary

Looking for a VIX pullback to around 25/24..maybe even briefly 23s. I am still looking for one final VIX lunge higher to around the 29 level - with SP around 1260/40. This seems quite feasible by late Wednesday - or early Thursday - just before the Bernanke speaks.

Will the next main wave'2 UP, be started by the Bernanke speaking...hinting of 'all necessary measures will be taken'?

Stay tuned.

Sp'60min

Vix'60min

Summary

Looking for a VIX pullback to around 25/24..maybe even briefly 23s. I am still looking for one final VIX lunge higher to around the 29 level - with SP around 1260/40. This seems quite feasible by late Wednesday - or early Thursday - just before the Bernanke speaks.

Will the next main wave'2 UP, be started by the Bernanke speaking...hinting of 'all necessary measures will be taken'?

Stay tuned.

1pm update - the slow slide...can't last forever

The market remains in a slow motion melt lower. So far, there is still a noticeable lack of panic or concern.

Sp'60min

Summary

....still seeking a bounce into the 1290s, which right now seems not possible until early Tuesday. At some point....we're going to break higher and stop out a lot of bears. Even if its just for 2-4 hours, the bounce could easily be in the style of last Thursday - where we jumped 20pts off the floor in just a few hours.

*picked up a index-call block just earlier. Considering the cycle and price...this doesn't look too bad an entry for a 4-8 hour hold - probably into early Tuesday.

--

Ohh, and its another great day for Facebook...

More later!

Sp'60min

Summary

....still seeking a bounce into the 1290s, which right now seems not possible until early Tuesday. At some point....we're going to break higher and stop out a lot of bears. Even if its just for 2-4 hours, the bounce could easily be in the style of last Thursday - where we jumped 20pts off the floor in just a few hours.

*picked up a index-call block just earlier. Considering the cycle and price...this doesn't look too bad an entry for a 4-8 hour hold - probably into early Tuesday.

--

Ohh, and its another great day for Facebook...

More later!

12pm update - the chop continues

There still seems to be some serious gloomy overhang from last Friday, yet we're still down only half of what overnight futures (dow -125) were at the low.

I'm still waiting for this bounce,..it will come, shorting here...is too high risk. Considering the moody market, VIX is kinda weak.

Sp'15min

Sp'60min

Summary

Bulls would like a close today over the hourly 10MA, thats viable, not least since it'll be as low as 1275/73 by the close.

Considering the daily cycle (today is only day'2 since the bear flag was confirmed)...more downside..still expected..after the next bounce!

I'm still waiting for this bounce,..it will come, shorting here...is too high risk. Considering the moody market, VIX is kinda weak.

Sp'15min

Sp'60min

Summary

Bulls would like a close today over the hourly 10MA, thats viable, not least since it'll be as low as 1275/73 by the close.

Considering the daily cycle (today is only day'2 since the bear flag was confirmed)...more downside..still expected..after the next bounce!

11am update - chop choppy chop

Market remains a real chop-fest, its probably starting to annoy both bulls and bears alike. From a 60min cycle perspective, we're still due a bounce. I sure won't be short with the cycles like this.

Sp'15min

VIX'60min

Summary

First bounce target remains somewhere in the low sp'1290s... a bounce as high as 1300 is still possible.

As ever..bears should keep an eye on the VIX..which is now slipping back from its morning high - which interestingly was a new high for this wave'1.

*FB having another lousy day, awww. Fair value remains $4

More in the next hour

Sp'15min

VIX'60min

Summary

First bounce target remains somewhere in the low sp'1290s... a bounce as high as 1300 is still possible.

As ever..bears should keep an eye on the VIX..which is now slipping back from its morning high - which interestingly was a new high for this wave'1.

*FB having another lousy day, awww. Fair value remains $4

More in the next hour

10am update - choppy open

Hmm, a choppy opening half hour. Any bounce might be a minute '4 of a final fifth lower. The real tricky aspect will be how low does the fifth go. The weekly chart suggest as low as 1225 is viable this week.

Of major importance this week...the Bernanke who speaks on Thursday. That will probably be a desisive part of this week.

Factory orders: -0.6% vs 0.1% expected.. ... not pretty.

Sp15min

sp'60min

Summary

Any bounce today - when it finally does start, should last at least a fair few hours, maybe all of today. I'd be a little surprised if it lasted into Tuesday.

Regardless, a re-short around 1295/1300 sure would be tempting, if we get that high.

--

Of major importance this week...the Bernanke who speaks on Thursday. That will probably be a desisive part of this week.

Factory orders: -0.6% vs 0.1% expected.. ... not pretty.

Sp15min

sp'60min

Summary

Any bounce today - when it finally does start, should last at least a fair few hours, maybe all of today. I'd be a little surprised if it lasted into Tuesday.

Regardless, a re-short around 1295/1300 sure would be tempting, if we get that high.

--

Pre-Market Brief - overnight recovery

Good morning. The bears are going to be real annoyed already and the market hasn't even opened yet. Early overnight losses of dow-125 have now swung to +5pts or so. I've no idea why this is the case, the trend looks slowly upward, so it looks like it was based on no news.

Sp'60min

Summary

From a cycle perspective, both the 15/60min cycles are VERY oversold (see blue bar histogram at base of chart). We could easily see 2-4 hours of upside to start this week, before a fail around the 10MA - which by the end of today will be around 1280/82.

So, a brief break - as high as 1295/1300 is viable today. Depending on the action, I will probably look to short any early ramp. All the bigger cycles suggest further losses, with a near term target in the 1225 area.

As usual, more across the day.

Sp'60min

Summary

From a cycle perspective, both the 15/60min cycles are VERY oversold (see blue bar histogram at base of chart). We could easily see 2-4 hours of upside to start this week, before a fail around the 10MA - which by the end of today will be around 1280/82.

So, a brief break - as high as 1295/1300 is viable today. Depending on the action, I will probably look to short any early ramp. All the bigger cycles suggest further losses, with a near term target in the 1225 area.

As usual, more across the day.

Subscribe to:

Comments (Atom)