With the indexes failing to hold opening gains, the VIX battled higher, and with the sp @ 1610, the VIX broke last Thursdays high of 18.51. The VIX closed +8.9% @ 18.59. Daily trend is clearly back to the upside, but for VIX 20s, equity bears will surely need to see sp <1598.

VIX'60min

VIX'daily3

Summary

The equity bears saw a major achievement with the VIX breaking a new high today, and that was with the sp' 12pts higher than last Thursday.

I still think VIX'20 will be difficult to achieve, but clearly, any price action <sp'1598, and the VIX is going to achieve major break through.

more later..on the indexes

Wednesday, 12 June 2013

Closing Brief

The market opened in a moderately good state, but the gains failed very quickly, and it turned into a day where the market consistently ground lower - much like the action of last Wed/Thursday. Critical support remains sp'1598. Overnight trading action will be...important.

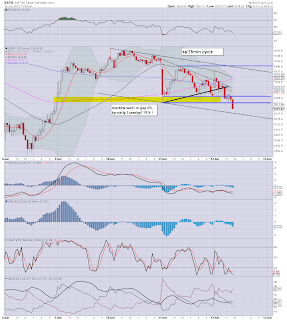

sp'15min

sp'60min

Summary

The closing hour price action is again suggestive of a floor, but that was the case throughout much of the day.

It is still kinda unusual to actually see a series of micro down-cycles, where the bounces are never very much.

All things considered, this market remains on the edge of a VERY tall cliff. Any break below 1598, and it all unravels.

--

*I hold index (underwater) longs overnight, seeking an exit in the 1625/30 area on the next bounce..if we get one tomorrow.

--

sp'15min

sp'60min

Summary

The closing hour price action is again suggestive of a floor, but that was the case throughout much of the day.

It is still kinda unusual to actually see a series of micro down-cycles, where the bounces are never very much.

All things considered, this market remains on the edge of a VERY tall cliff. Any break below 1598, and it all unravels.

--

*I hold index (underwater) longs overnight, seeking an exit in the 1625/30 area on the next bounce..if we get one tomorrow.

--

3pm update - battle into the close

Regardless of where we close, the bears have achieved a lot today. The opening rally was not only entirely negated, but we've broken lower to within 1% of the key low of sp'1598. VIX has come very close to taking out the highs from last Thursday.

sp'60min

vix'60min

Summary

Another closing hour that will be critical for both sides, although arguably the bears could sustain a little ramp into the close.

Bulls really need a close in the 1630s, but that's surely well out of range. Right now, even a close in the 1620s will be difficult.

Rough day for Mr Market, the lack of any significant QE is probably not helping.

--

3.19pm.. sp'1611s, and VIX takes out the high from last Thursday - when sp'1598.

So, we're just 13pts away from taking out the critical low.

Any moderate overnight gap lower will be enough to open the door to havoc tomorrow.

The line in the sand is absolutely clear...1598. Anything below that, and its 'sell at any price' time.

3.29pm. market trying to floor again, at the price cluster zone of sp'1610. If you look back to last week, you'll see what I mean. 'moderate support' here.

3.38pm.. market still trying...a break >1615 would be...something for the bulls, although that is 22pts below the open!

triangle?

The sp'1630s sure look a long ways up for tomorrow.

*to be clear, I will hold LONG overnight (yes,..its ugly underwater). seeking an exit on any gap up - if we get one.

3.46pm..well, battle continues. Very hard to say how we'll trade into the close.

All I know is that 1598 is the key line, if it fails..market going to unravel.

On the bulls side, the hourly index/vix charts look floored/maxed out.

back at the close.

sp'60min

vix'60min

Summary

Another closing hour that will be critical for both sides, although arguably the bears could sustain a little ramp into the close.

Bulls really need a close in the 1630s, but that's surely well out of range. Right now, even a close in the 1620s will be difficult.

Rough day for Mr Market, the lack of any significant QE is probably not helping.

--

3.19pm.. sp'1611s, and VIX takes out the high from last Thursday - when sp'1598.

So, we're just 13pts away from taking out the critical low.

Any moderate overnight gap lower will be enough to open the door to havoc tomorrow.

The line in the sand is absolutely clear...1598. Anything below that, and its 'sell at any price' time.

3.29pm. market trying to floor again, at the price cluster zone of sp'1610. If you look back to last week, you'll see what I mean. 'moderate support' here.

3.38pm.. market still trying...a break >1615 would be...something for the bulls, although that is 22pts below the open!

triangle?

The sp'1630s sure look a long ways up for tomorrow.

*to be clear, I will hold LONG overnight (yes,..its ugly underwater). seeking an exit on any gap up - if we get one.

3.46pm..well, battle continues. Very hard to say how we'll trade into the close.

All I know is that 1598 is the key line, if it fails..market going to unravel.

On the bulls side, the hourly index/vix charts look floored/maxed out.

back at the close.

2pm update - holding steady

The main market is holding onto the floor of sp'1615. With two hours to go, bulls still should be desperate for a daily close back in the 1630s. Anything under that would be a major problem. VIX is cooling down a little, +4% in the upper 17s.

sp'60min

vix'60min

Summary

Things look stable, and so far, the VIX is suggestive that the indexes have indeed floored.

Yet the mood out there isn't exactly great.

The big question then, can the bulls claw up 10pts by the close? Two hours is certainly plenty of time.

--

*I'm holding long from this morning, and would prefer an exit before the close. Holding overnight..after todays further wave lower, doesn't seem like the best idea.

--

2.26pm. a new low of sp'1614, with the VIX testing the earlier high. Bulls just seem unable to muster any power.

Is this merely a replay of last Wed/Thursday, but from a slightly level?

2.32pm.. sp'1630s now look right off the agenda. Bulls will be lucky to get 1625 by the close.

Next key support, the 50 day MA @ sp'1510

Not looking good for those on the long side.

sp'60min

vix'60min

Summary

Things look stable, and so far, the VIX is suggestive that the indexes have indeed floored.

Yet the mood out there isn't exactly great.

The big question then, can the bulls claw up 10pts by the close? Two hours is certainly plenty of time.

--

*I'm holding long from this morning, and would prefer an exit before the close. Holding overnight..after todays further wave lower, doesn't seem like the best idea.

--

2.26pm. a new low of sp'1614, with the VIX testing the earlier high. Bulls just seem unable to muster any power.

Is this merely a replay of last Wed/Thursday, but from a slightly level?

2.32pm.. sp'1630s now look right off the agenda. Bulls will be lucky to get 1625 by the close.

Next key support, the 50 day MA @ sp'1510

Not looking good for those on the long side.

1pm update - floored..maybe

The market has seen some significant morning weakness, but its quite possibly just floored @ sp'1615. The bulls should be 'desperate' for a daily close >1630. Anything under that, and the daily charts won't bode well for Thursday, despite the looming QE.

sp'15min

Summary

15min cycle chart looks floored, and is set to go positive cycle around 2pm.

So, 1 hour to battle higher..and then see what kind of snap/upside the bulls can muster.

--

*I am long (naturally underwater) from sp'1624. It won't take much of an up cycle to get to evens, but the 1630s look a long way up.

VIX hourly looks..maxed out

Bulls really need this afternoon to go almost entirely their way.

1.09pm... Bulls need to push here..and NOT stop!

First target...an hourly close >1630. A daily close >1635 would more than suffice.

VIX update from Mr T

stay tuned

sp'15min

Summary

15min cycle chart looks floored, and is set to go positive cycle around 2pm.

So, 1 hour to battle higher..and then see what kind of snap/upside the bulls can muster.

--

*I am long (naturally underwater) from sp'1624. It won't take much of an up cycle to get to evens, but the 1630s look a long way up.

VIX hourly looks..maxed out

Bulls really need this afternoon to go almost entirely their way.

1.09pm... Bulls need to push here..and NOT stop!

First target...an hourly close >1630. A daily close >1635 would more than suffice.

VIX update from Mr T

stay tuned

12pm update - market struggling

The market is really starting to struggle. Opening gains of 10pts have entirely failed, and the sp is now -6 @ 1619. With the 1622 floor being taken out, the next soft support is somewhere in the 1615/10 area. VIX is showing some power, up around 5%.

sp'15min

Summary

Well, Mr Market is looking real weak.

The recent high of 1648 now looks a considerable way up.

The last warning the bulls will get would be a VIX breaking into the 20s.

--

time for lunch

Hourly charts... we've hit the key 61% fib level.

Frankly, bulls should be desperate to get a daily close >1630, otherwise, tomorrow is not looking so good!

12.10pm So, we've hit 1617...a full 20pts below the opening high.

Despite the current down cycle, I still don't really see any major concern out there.

Right now..only two things would rattle me out of my long position.

1. VIX 20s

2. SP <1598.

--

Arguably, if we see either of those two things, bulls need to make a run for it...regardless of price.

12.25pm.. market trying to floor around 1617/16. 15min cycle looks close to turning, but then it looked like that an hour ago.

Long afternoon ahead for the bulls, a daily close >1630 will be pretty important.

12.35pm Bulls need this hour to close >1620, that should allow 1630s within 2hrs.

sp'15min

Summary

Well, Mr Market is looking real weak.

The recent high of 1648 now looks a considerable way up.

The last warning the bulls will get would be a VIX breaking into the 20s.

--

time for lunch

Hourly charts... we've hit the key 61% fib level.

Frankly, bulls should be desperate to get a daily close >1630, otherwise, tomorrow is not looking so good!

12.10pm So, we've hit 1617...a full 20pts below the opening high.

Despite the current down cycle, I still don't really see any major concern out there.

Right now..only two things would rattle me out of my long position.

1. VIX 20s

2. SP <1598.

--

Arguably, if we see either of those two things, bulls need to make a run for it...regardless of price.

12.25pm.. market trying to floor around 1617/16. 15min cycle looks close to turning, but then it looked like that an hour ago.

Long afternoon ahead for the bulls, a daily close >1630 will be pretty important.

12.35pm Bulls need this hour to close >1620, that should allow 1630s within 2hrs.

11am update - traditional floor

Often it is the case that the market will floor around 11am. With the opening gains having largely failed, the bulls are back in the borderline zone. Yet...I sure don't see any power on the bearish side right now. Perhaps a day of sideways price action, before Thursday upside.

sp'15min

Summary

So..a failed opening rally, and we're only 3pts from breaking the floor.

--

*I was looking to go long this morning, but am holding off, not because I don't think we'll go up, but I have 'other issues' going on today.

--

Urghh, sp'1624s...its looking real dicey now.

11.18am.. still slipping.. 1623. 1pt to go

11.20am.. LONG index. from sp'1624

11.35am..well, we're holding the line..and 5/15min cycles look floored.

Hourly charts offer significant upside potencial. No turn..yet...but I think there is very high chance of 1635 within a few hours.

I remain heavy long, and now its the waiting game again.

sp'15min

Summary

So..a failed opening rally, and we're only 3pts from breaking the floor.

--

*I was looking to go long this morning, but am holding off, not because I don't think we'll go up, but I have 'other issues' going on today.

--

Urghh, sp'1624s...its looking real dicey now.

11.18am.. still slipping.. 1623. 1pt to go

11.20am.. LONG index. from sp'1624

11.35am..well, we're holding the line..and 5/15min cycles look floored.

Hourly charts offer significant upside potencial. No turn..yet...but I think there is very high chance of 1635 within a few hours.

I remain heavy long, and now its the waiting game again.

10am update - morning chop

The market opens in the mid 1630s, but the gains look a little shaky. Hourly index charts are offering very significant upside into the Friday close, but the near term 5/15min cycles are bearish for this morning. We could easily (briefly) be in the 1620s.

sp'15min

sp'60min

Summary

Bulls need to hold yesterdays low of sp'1622. I suppose 1615 at the close of today would still be 'acceptable' as part of a larger bull flag.

The safer 'long' trade is one after the indexes have put in a daily close >1640. That looks possible today, and is especially supported on the hourly charts.

--

*I remain on the sidelines, but will look to pick up a index-long block..perhaps later this morning.

I'm in no hurry though!

10.03am...sp'1629..so.....bulls now have a 7pt buffer zone.

10.07am.. VIX goes green, but I don't think it'll last for long.

I remain on standby to take a new index-long block.

10.25am.. market looks like its stabilised, but I think I'm going to sit this out.

--

sp'15min

sp'60min

Summary

Bulls need to hold yesterdays low of sp'1622. I suppose 1615 at the close of today would still be 'acceptable' as part of a larger bull flag.

The safer 'long' trade is one after the indexes have put in a daily close >1640. That looks possible today, and is especially supported on the hourly charts.

--

*I remain on the sidelines, but will look to pick up a index-long block..perhaps later this morning.

I'm in no hurry though!

10.03am...sp'1629..so.....bulls now have a 7pt buffer zone.

10.07am.. VIX goes green, but I don't think it'll last for long.

I remain on standby to take a new index-long block.

10.25am.. market looks like its stabilised, but I think I'm going to sit this out.

--

Pre-Market Brief

Good morning. Futures are somewhat higher, sp +10pts, we're set to open around 1636. Metals are flat, Oil is a touch higher (ahead of EIA report). USD is similarly a little higher. Bulls need a positive daily close today, to get things back on track.

sp'60min

vix'60min

Summary

So, we're going to open a fair bit higher in the mid 1630s.

Certainly, the 1648 high doesn't look possible today, but I'm guessing it will be hit...and surpassed tomorrow, leading to a weekly close somewhere in the 1660/70s.

--

Bears still appear largely powerless, and even when we do gap lower, the declines are never built upon.

-

*I will consider an index and/or Oil (USO) long later this morning. I certainly won't chase the open higher. I'll wait for the next 15min down cycle.

--

Morning video from Oscar...

--

updates across the day

9.40am..market opens as expected.. a touch of weakness out there.. Oil..black candle

No reason why we won't cycle down to sp'1630 again within an hour or two.

sp'60min

vix'60min

Summary

So, we're going to open a fair bit higher in the mid 1630s.

Certainly, the 1648 high doesn't look possible today, but I'm guessing it will be hit...and surpassed tomorrow, leading to a weekly close somewhere in the 1660/70s.

--

Bears still appear largely powerless, and even when we do gap lower, the declines are never built upon.

-

*I will consider an index and/or Oil (USO) long later this morning. I certainly won't chase the open higher. I'll wait for the next 15min down cycle.

--

Morning video from Oscar...

--

updates across the day

9.40am..market opens as expected.. a touch of weakness out there.. Oil..black candle

No reason why we won't cycle down to sp'1630 again within an hour or two.

Market on the edge

After putting in a very natural floor at sp'1598 last week, the market ramped to 1648, but has now seen two consecutive days of weakness. If the bulls can't hold the 1620s early Wednesday, then the 1598 low looks exceptionally vulnerable. If that fails, primary target zone is 1550/30.

sp'weekly'7 - the high is in @ 1687

sp'weekly'8 - one further high, then down

Summary

Today was a good day in the bunker. The irony is that despite the market having a rather significant down day, I actually made money on the long side. How crazy is that for a self-proclaimed 'permabear' ? Tis become an ever more twisted world.

I still favour the second scenario/chart. Obviously, the key level is now sp'1598. Any close under that, and I will revert to trading the first chart/scenario...on the short side.

I should note, I have a primary target zone of sp'1550/30 on weekly'7, but at the same time, the lower weekly bollinger would be the primary price target. The latter is a rising target though, and will be around sp'1550 by mid July.

In all recent multi-week down cycles, the lower weekly bollinger band has been hit on most indexes, and that is why I keep highlighting it.

Looking ahead

There is the usual EIA (oil) report at 10.30am, but perhaps more interestingly there is the US treasury budget. Market is seeking a monthly deficit of $110bn, clearly the US fiscal position is stable...and...strong. There is no significant QE-pomo this Wednesday.

In terms of Wednesday trading, I will be looking for an index and/or Oil long. However, it greatly depends on how we open and trade in the first 30 mins. If bulls can't hold the 1620s, then a test of the recent 1598 low looks likely, and if that's the case, I don't think it'll hold.

If the market opens flat...or a touch lower, I'll look to go long, but like today, it will be dependent largely on the 'market mood'.

Goodnight from London

sp'weekly'7 - the high is in @ 1687

sp'weekly'8 - one further high, then down

Summary

Today was a good day in the bunker. The irony is that despite the market having a rather significant down day, I actually made money on the long side. How crazy is that for a self-proclaimed 'permabear' ? Tis become an ever more twisted world.

I still favour the second scenario/chart. Obviously, the key level is now sp'1598. Any close under that, and I will revert to trading the first chart/scenario...on the short side.

I should note, I have a primary target zone of sp'1550/30 on weekly'7, but at the same time, the lower weekly bollinger would be the primary price target. The latter is a rising target though, and will be around sp'1550 by mid July.

In all recent multi-week down cycles, the lower weekly bollinger band has been hit on most indexes, and that is why I keep highlighting it.

Looking ahead

There is the usual EIA (oil) report at 10.30am, but perhaps more interestingly there is the US treasury budget. Market is seeking a monthly deficit of $110bn, clearly the US fiscal position is stable...and...strong. There is no significant QE-pomo this Wednesday.

In terms of Wednesday trading, I will be looking for an index and/or Oil long. However, it greatly depends on how we open and trade in the first 30 mins. If bulls can't hold the 1620s, then a test of the recent 1598 low looks likely, and if that's the case, I don't think it'll hold.

If the market opens flat...or a touch lower, I'll look to go long, but like today, it will be dependent largely on the 'market mood'.

Goodnight from London

Daily Index Cycle update

The main indexes opened lower, rallied into early afternoon, but then saw some rather significant weakness into the close. The sp' closed -16.7pts (1.0%) @ 1626, a mere 4pts from the opening low. Near term trend looks weak, bulls need to hold the sp'1620s early tomorrow.

R2K

sp'daily5

Trans

Summary

So, we saw some rather good swings in the market today. The opening decline was something many were looking for today, and we have filled the gap in the 1625/22 zone. Naturally, the market ramped pretty hard to sp'1640, but has now put in a lower high.

The bulls might have a VERY serious problem if early Wednesday takes out todays low of sp'1622 - a mere 4pts lower.

The big level remains sp'1598. Frankly, if the market breaks that, there is really no support until the lower bollinger on the weekly charts - currently @ sp'1480. That is indeed a very significant 145pts lower.

How we trade tomorrow will shape the next few days..if not the next few of weeks.

a little more later...

R2K

sp'daily5

Trans

Summary

So, we saw some rather good swings in the market today. The opening decline was something many were looking for today, and we have filled the gap in the 1625/22 zone. Naturally, the market ramped pretty hard to sp'1640, but has now put in a lower high.

The bulls might have a VERY serious problem if early Wednesday takes out todays low of sp'1622 - a mere 4pts lower.

The big level remains sp'1598. Frankly, if the market breaks that, there is really no support until the lower bollinger on the weekly charts - currently @ sp'1480. That is indeed a very significant 145pts lower.

How we trade tomorrow will shape the next few days..if not the next few of weeks.

a little more later...

Subscribe to:

Comments (Atom)