With strong equity gains in the morning, the VIX was ground lower (intra low 15.94)... but with renewed equity weakness.. the VIX strongly rebounded, settling +8.4% @ 20.08. Near term outlook is offering the 22/25 zone, along with sp'2000.

VIX'60min

VIX'daily3

Summary

*a notable fourth consecutive daily net gain for the VIX

--

Suffice to say.. a pretty dynamic day for the VIX, knocked lower... but with a very strong latter day rebound.

With a daily close above the key 20 threshold, secondary target zone of 22/25 is now likely, before the broader equity market begins a new up wave into early 2015.

On any 'fair' outlook though, VIX looks set to max out next week.. and then cool into the new year.

--

more later...on the indexes

Thursday, 11 December 2014

Closing Brief

US equities closed with moderate gains, and well below the earlier highs.. sp +9pts @ 2035 (intra high 2055). The two leaders - Trans/R2K, settled higher by 0.8% and 0.4% respectively. Near term outlook is offering another wave lower, a primary target of sp'2000 by next Wednesday.

sp'60min

Summary

A very entertaining closing hour, with two thirds of the morning gains evaporating.

Perhaps even more telling, despite the net daily gains, VIX has already broke back into the 20s.

--

With the dynamic moves today.. a full set of updates to wrap up the day.. across the evening...

sp'60min

Summary

A very entertaining closing hour, with two thirds of the morning gains evaporating.

Perhaps even more telling, despite the net daily gains, VIX has already broke back into the 20s.

--

With the dynamic moves today.. a full set of updates to wrap up the day.. across the evening...

3pm update - just another crazy bounce

Regardless of the close, it has been a typically crazy day in market land. Despite notable major declines in some other world markets, the US market still managed another strong bounce. Outlook remains for sp'2000, before the FOMC... and then up into next year.

sp'60min

VIX'60min

Summary

*equity bears should be aiming for a daily close, at least under the hourly 10MA... anything in the 2030s would be a bonus.. considering the earlier high of 2055.

-

Current price action is starting to get rather entertaining.. with a rather dramatic 2pm candle. The rats are starting to finally realise.. today (much like Tuesday).. was just another stupid bounce.

--

Target remains. sp'2000, before next Wed' FOMC.

-

3.04pm.. WTIC Oil fails to hold $60.... ...

welcome to the $59s.....next soft support 57/55.

sp'60min

VIX'60min

Summary

*equity bears should be aiming for a daily close, at least under the hourly 10MA... anything in the 2030s would be a bonus.. considering the earlier high of 2055.

-

Current price action is starting to get rather entertaining.. with a rather dramatic 2pm candle. The rats are starting to finally realise.. today (much like Tuesday).. was just another stupid bounce.

--

Target remains. sp'2000, before next Wed' FOMC.

-

3.04pm.. WTIC Oil fails to hold $60.... ...

welcome to the $59s.....next soft support 57/55.

2pm update - initial signs of a turn

The smaller 60/15min equity cycles are offering the first sign that we have a somewhat lower high of sp'2055. Without question though, all indexes remain significantly higher, and this is a rough day for those holding short from yesterday. VIX is clawing back some of the losses, -10% in the 16.60s.

sp'60min

sp'daily3 - fib retrace

Summary

Overall, it remains pretty crazy, but so far at least.. it does count as a lower high of sp'2055.

Whether you want to call today's move a sub'4.. or whatever... I'll hold to primary target of sp'2000, but that is clearly out of range until next week.

--

Notable weakness... coal miners, BTU -5.4% in the $7.30s..... 'grander' target remains the $5 level.

Strength.. retail... HD, M, both higher by other 2%.

-

2.07pm.. sp'2047...

Equity bears should be seeking a close under the hourly 10MA.... 2043

2.30pm.. sp'2042.... broken hourly 10MA... VIX rapidly rising.... the rats are bailing

2.50pm... starting to get real amusing... VIX turning positive. ... major reversal underway

sp'60min

sp'daily3 - fib retrace

Summary

Overall, it remains pretty crazy, but so far at least.. it does count as a lower high of sp'2055.

Whether you want to call today's move a sub'4.. or whatever... I'll hold to primary target of sp'2000, but that is clearly out of range until next week.

--

Notable weakness... coal miners, BTU -5.4% in the $7.30s..... 'grander' target remains the $5 level.

Strength.. retail... HD, M, both higher by other 2%.

-

2.07pm.. sp'2047...

Equity bears should be seeking a close under the hourly 10MA.... 2043

2.30pm.. sp'2042.... broken hourly 10MA... VIX rapidly rising.... the rats are bailing

2.50pm... starting to get real amusing... VIX turning positive. ... major reversal underway

12pm update - holding gains

Equities are holding almost all of the morning gains, with the sp' in the low 2050s. VIX has significantly cooled, -11% in the low 16s. Metals are back to flat, whilst energy prices are weak, Nat' gas -0.6%, with Oil -0.8%.

sp'60min

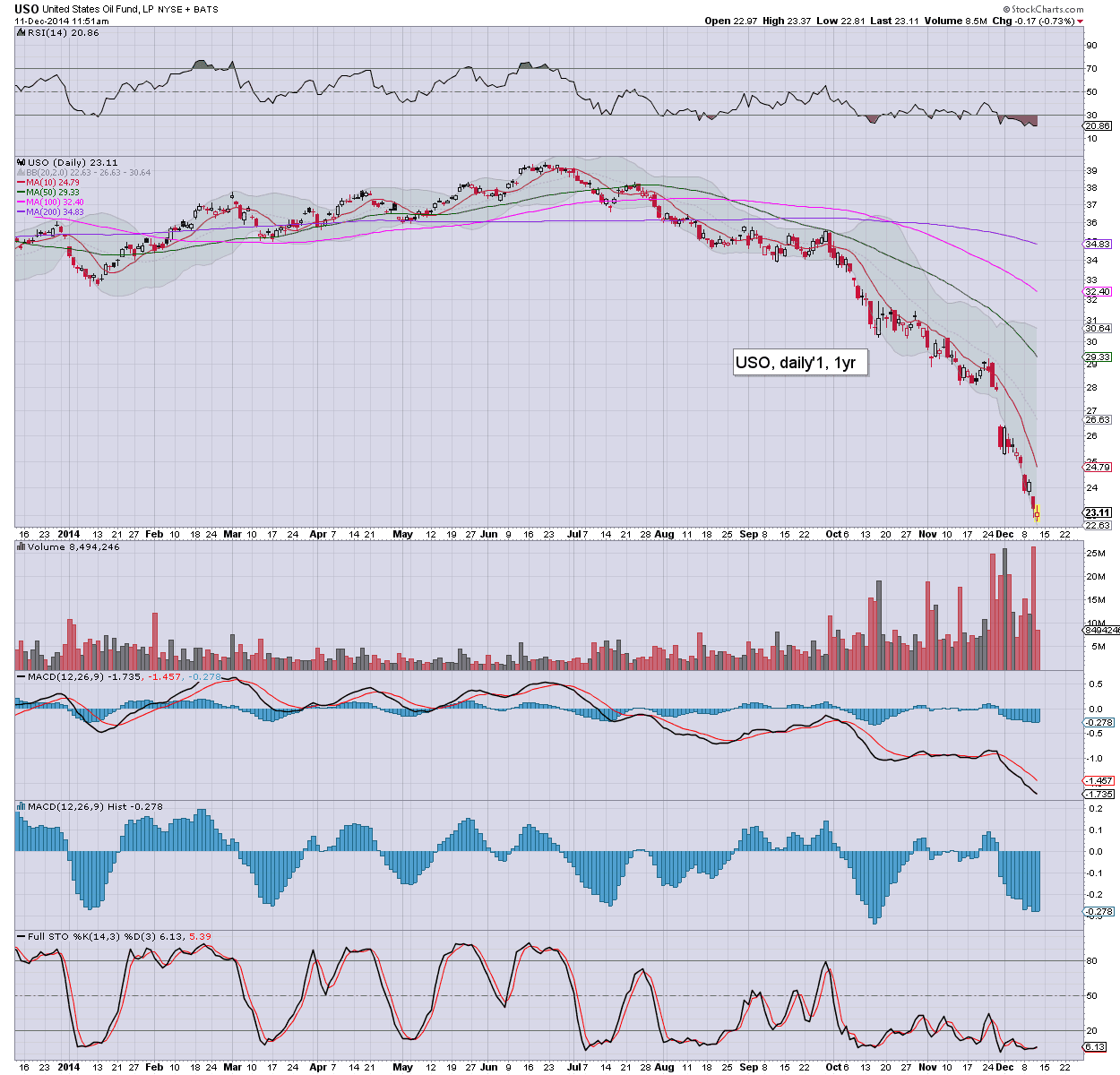

USO, daily

Summary

We have two marginally spiky-top candles on the sp'500, but still.. no clear sign of this latest up wave maxing out. A bounce this morning was certainly no surprise, but not of this magnitude.. or duration.

Regardless, primary downside target remains sp'2000.. but with this mornings gains, that is not viable until next week.

--

As for Oil... according to finviz, we hit a low of $60.09, but considering that OPEC will not likely announce any initial threat to reduce supplies.. at least until January... sub 60s still look due.

--

VIX update from Mr T.

--

time for tea, back at 2pm

sp'60min

USO, daily

Summary

We have two marginally spiky-top candles on the sp'500, but still.. no clear sign of this latest up wave maxing out. A bounce this morning was certainly no surprise, but not of this magnitude.. or duration.

Regardless, primary downside target remains sp'2000.. but with this mornings gains, that is not viable until next week.

--

As for Oil... according to finviz, we hit a low of $60.09, but considering that OPEC will not likely announce any initial threat to reduce supplies.. at least until January... sub 60s still look due.

--

VIX update from Mr T.

--

time for tea, back at 2pm

11am update - over extended nonsense

US equity indexes are all significantly higher, with the sp'500 having so far hit a high of 2054... which even to the bull maniacs.. should make little sense. Metals remain weak, Gold -$5, whilst Oil has clawed back most of the opening declines, -0.3%.

sp'15min

Summary

...so.. what is the 'excuse' for this? Frankly, this feels more crazy than the latter day Tuesday ramp.

Are the BoJ buying heavy this morning, is that it?

--

VIX remains sharply lower...

15min

--

Notable weakness: FCX -3% in the low $23s.. next support 20... and then 17. The latter seems likely, if Copper falls to the low $2s in early 2015.

sp'15min

Summary

...so.. what is the 'excuse' for this? Frankly, this feels more crazy than the latter day Tuesday ramp.

Are the BoJ buying heavy this morning, is that it?

--

VIX remains sharply lower...

15min

--

Notable weakness: FCX -3% in the low $23s.. next support 20... and then 17. The latter seems likely, if Copper falls to the low $2s in early 2015.

10am update - opening gains set to reverse

US equities open moderately higher, with the sp' retracing around half of yesterday's declines. A move back above sp'2050 looks highly unlikely. Broader downside target remains sp'2000.. whilst the FOMC clock is still ticking down. Oil and metals are both weak.

sp'15min

Summary

Resistance zone of 2044/48. Line in the sand is arguably 2050.. which itself is a mere 1.5% from the recent cycle high of 2079.

-

Seeking renewed downside after 11am.... a daily red close... VERY viable... along with VIX 19/20s.

--

Metals are weak... Gold -$9

GLD, daily

Overall price structure is still a bear flag... with a series of lower highs... and lower lows. $1130 as a key multi-year floor for Gold.... makes ZERO sense. We still look headed for 1000/900s.

-

Notable weakness: miners.... FCX -3.2%.. .see yesterday's 'fair value' post on the copper miners.

-

stay tuned!

10.07am... smaller 5/15min cycles... spiky candles.... first sign of this opening bounce...maxing out.

Eyes to the VIX...

-

10.24am.. sp'2050... well... right on the border. Considering the past few days of price action, it'd be real bizarre if we don't reverse from here.

Notable strength, airlines... DAL +4.5%

10.31am... sp'2054... crazy.... a mere 1.2% from breaking a new historic high.

sp'15min

Summary

Resistance zone of 2044/48. Line in the sand is arguably 2050.. which itself is a mere 1.5% from the recent cycle high of 2079.

-

Seeking renewed downside after 11am.... a daily red close... VERY viable... along with VIX 19/20s.

--

Metals are weak... Gold -$9

GLD, daily

Overall price structure is still a bear flag... with a series of lower highs... and lower lows. $1130 as a key multi-year floor for Gold.... makes ZERO sense. We still look headed for 1000/900s.

-

Notable weakness: miners.... FCX -3.2%.. .see yesterday's 'fair value' post on the copper miners.

-

stay tuned!

10.07am... smaller 5/15min cycles... spiky candles.... first sign of this opening bounce...maxing out.

Eyes to the VIX...

-

10.24am.. sp'2050... well... right on the border. Considering the past few days of price action, it'd be real bizarre if we don't reverse from here.

Notable strength, airlines... DAL +4.5%

10.31am... sp'2054... crazy.... a mere 1.2% from breaking a new historic high.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +8pts, we're set to open at 2034. Metals are a little weak, Gold -$6. Energy prices are bouncing, Nat' gas +0.8%, whilst Oil is +0.2%. Renewed weakness to sp'2000 looks highly probable.

sp'daily5

Summary

*awaiting jobs data and retail sales @ 8.30am

---

So, we're set to open a little higher. Call the opening gains a sub'4 (of 3) bounce... but I'd still guess we'll see a further wave lower later today

First key target remains the giant sp'2000 threshold. That still seems possible.. whether late today, tomorrow, or even next Mon/Tuesday.

What should be clear to most equity bears, this down wave is not likely to last beyond next Wednesday's FOMC. The clock IS ticking!

--

Good wishes For Thursday trading.

-

8.31 retail sales +0.7%.. a little better than expected.

Equities reclaw back early gains, sp +8pts.

Oil has turned lower, -1.2%.. set to lose the $60 threshold this morning

sp'daily5

Summary

*awaiting jobs data and retail sales @ 8.30am

---

So, we're set to open a little higher. Call the opening gains a sub'4 (of 3) bounce... but I'd still guess we'll see a further wave lower later today

First key target remains the giant sp'2000 threshold. That still seems possible.. whether late today, tomorrow, or even next Mon/Tuesday.

What should be clear to most equity bears, this down wave is not likely to last beyond next Wednesday's FOMC. The clock IS ticking!

--

Good wishes For Thursday trading.

-

8.31 retail sales +0.7%.. a little better than expected.

Equities reclaw back early gains, sp +8pts.

Oil has turned lower, -1.2%.. set to lose the $60 threshold this morning

Two big commodities - Oil and Copper

The renewed collapse in WTIC Oil prices today was certainly dramatic, with Oil set to lose the $60 threshold. Next year is offering oil prices consistently trading within the $70/40 zone, which is extremely bullish for the world economy. Similarly, Copper remains broadly weak.

WTIC, monthly'2, rainbow

Copper, monthly

Summary

A new multi-year low for WTIC Oil of $60.43. The $60 threshold will no doubt break.. whether tomorrow, Friday..or early next year.. it should make little difference for those with eyes on the bigger picture.

Having fallen from the June high of $107, a significant bounce is very likely though, on the order of $10/15. So.. if we floor around $55.. then 65/70 looks a very reasonable short-term upside trade.

As for Copper... it is consistently trading under the key $3 threshold. Considering the strength in the US Dollar, and numerous other issues, renewed weakness to the 2.30/20s looks probable. If correct, that will have severe bearish implications for stocks such as FCX and TCK.

-

**Bonus chart**

CRB vs sp'500

Commodities are back to levels last seen in summer 2010.. when the sp'500 was around 1000. This great pull back from the high in 2011 makes for massively lower costs to everyone.

Further, the disparity between commodities and stocks has not been higher since 1999. At some point...the gap will largely close. My guess is that commodities will eventually recover as much of the new (QE) money finally starts to filter into the global system.

--

Late night update from Mr Permabull

--

Looking ahead

Along with the usual weekly jobs data, Thursday will see the only significant econ-data of the week... retail sales.

--

Goodnight from London

WTIC, monthly'2, rainbow

Copper, monthly

Summary

A new multi-year low for WTIC Oil of $60.43. The $60 threshold will no doubt break.. whether tomorrow, Friday..or early next year.. it should make little difference for those with eyes on the bigger picture.

Having fallen from the June high of $107, a significant bounce is very likely though, on the order of $10/15. So.. if we floor around $55.. then 65/70 looks a very reasonable short-term upside trade.

As for Copper... it is consistently trading under the key $3 threshold. Considering the strength in the US Dollar, and numerous other issues, renewed weakness to the 2.30/20s looks probable. If correct, that will have severe bearish implications for stocks such as FCX and TCK.

-

**Bonus chart**

CRB vs sp'500

Commodities are back to levels last seen in summer 2010.. when the sp'500 was around 1000. This great pull back from the high in 2011 makes for massively lower costs to everyone.

Further, the disparity between commodities and stocks has not been higher since 1999. At some point...the gap will largely close. My guess is that commodities will eventually recover as much of the new (QE) money finally starts to filter into the global system.

--

Late night update from Mr Permabull

--

Looking ahead

Along with the usual weekly jobs data, Thursday will see the only significant econ-data of the week... retail sales.

--

Goodnight from London

Daily Index Cycle update

US equities saw significant declines, with sp -33pts @ 2026 (intra low 2024). The two leaders - Trans/R2K, settled lower by -1.3% and -2.2% respectively. Near term outlook is bearish to sp'2000/1980, along with VIX in the low 20s.

sp'daily3 - fib retrace levels

R2K

Trans

Summary

Suffice to say, yesterday was indeed a nonsense 'bounce', and whether you want to call it a wave 2, B, or X.. or whatever.. it doesn't much matter.

We're headed broadly lower into next Wednesday's FOMC... at which point we'll surely see a key turn.. with renewed upside into end year, and at least the first half of January 2015.

--

Closing update from Riley

--

a little more later...

sp'daily3 - fib retrace levels

R2K

Trans

Summary

Suffice to say, yesterday was indeed a nonsense 'bounce', and whether you want to call it a wave 2, B, or X.. or whatever.. it doesn't much matter.

We're headed broadly lower into next Wednesday's FOMC... at which point we'll surely see a key turn.. with renewed upside into end year, and at least the first half of January 2015.

--

Closing update from Riley

--

a little more later...

Subscribe to:

Comments (Atom)