With the indexes seeing some weakness into the close, the VIX recovered moderate losses, and closed +5.3% @ 15.51. Despite the minor jump higher, it would seem likely the VIX will drift lower across the first half of March.

VIX'60min

VIX'daily3

Summary

I can understand how some bears were getting mildly excited at the closing hour action. The decline in the indexes, going red, and with the VIX jumping into the close..yet, it was probably largely due to end-month trading issues.

I would be VERY surprised if the VIX explodes back into the 18/19s any time soon.

In fact, I'd have to believe the VIX will decline back into the 12s..if not even the 11s by late March/early April. That would certainly be the case if my upside target of sp'1550/60 is achieved.

Underlying MACD cycle for the VIX is down. Bulls should look for a bearish cross (black line below red) in the coming 2-3 days.

more later..on the indexes

Thursday, 28 February 2013

Closing Brief

The market slipped lower into the close. The bulls took most of the day to break the key sp'1520 line..but its done now, and despite the weak close, the sp' looks set to break into the 1550s by mid-March. With higher dollar, both Oil and precious metals took a major hit.

Dow

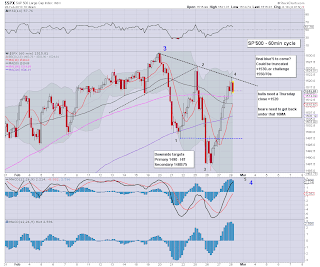

sp'60min

Trans

Summary

*a little weakness in the closing hour, but I don't think its anything for the bears to get excited about. There just doesn't seem to be any power on the downside, is there?

--

Suffice to say, I can really understand what must be real disappointment out there in bear land. Bears get two major waves lower to sp'1485..and now we're back to a relentless climb.

Normal service has indeed resumed..fuelled by POMO.

The next key target zone is sp'1550/60..which looks set to be hit in March/April.

I will be a lot more comfortable with a re-short in sp'1550s. Subsequent downside target would be the lower bollinger (weekly cycle), which by late April/early May will be somewhere around 1425/00 - where there is also that unfilled ES gap.

--

more later..on the VIX.

Dow

sp'60min

Trans

Summary

*a little weakness in the closing hour, but I don't think its anything for the bears to get excited about. There just doesn't seem to be any power on the downside, is there?

--

Suffice to say, I can really understand what must be real disappointment out there in bear land. Bears get two major waves lower to sp'1485..and now we're back to a relentless climb.

Normal service has indeed resumed..fuelled by POMO.

The next key target zone is sp'1550/60..which looks set to be hit in March/April.

I will be a lot more comfortable with a re-short in sp'1550s. Subsequent downside target would be the lower bollinger (weekly cycle), which by late April/early May will be somewhere around 1425/00 - where there is also that unfilled ES gap.

--

more later..on the VIX.

3pm update - minor chop into the close

The indexes are comfortably holding moderate gains, with the sp' above the pretty important 1520 line. There is simply no power to the downside, and it really looks like we're back to melt mode for a few weeks. Oil has noticeably snapped lower, the strong dollar is not helping!

--

You could switch on clown finance TV for the closing hour, but why not watch the eagles instead?

---

sp'60min

sp'daily5

Summary

The underlying MACD (blue bar histogram) cycle is now ticking higher for a third day. We could easily crawl higher for another week...or two.

That would get us into mid-March...sp'1550s, which will likely prove to be a brick wall.

Then we will see if the POMO $ is enough to break through the steel reinforced concrete.- of what many are seeing as a giant triple top, spanning 13 years.

back after the close

--

--

You could switch on clown finance TV for the closing hour, but why not watch the eagles instead?

---

sp'60min

sp'daily5

Summary

The underlying MACD (blue bar histogram) cycle is now ticking higher for a third day. We could easily crawl higher for another week...or two.

That would get us into mid-March...sp'1550s, which will likely prove to be a brick wall.

Then we will see if the POMO $ is enough to break through the steel reinforced concrete.- of what many are seeing as a giant triple top, spanning 13 years.

back after the close

--

2pm update - indexes breaking higher

With no power to the downside, the market has broken higher, and normal service - 'algo bot melt' has resumed. VIX is on a slow..but consistent decline. It would seem the bulls can now look to the sp'1550s at least by mid-March.

sp'60min

vix'60min

Summary

We've just seen a VERY clear snap higher when we broke the declining resistance line @ 1520/21

All that's left for the bulls is 1525 and then 1530, but really, I don't think it matters if that's hit today..or even tomorrow.

*I will merely sit back..and watch this nonsense play out into mid-March.

Blue wave'5 - were it to be the very last wave higher..won't be too much..maybe 2-4% higher. - more on that later though.

--

It has to be said, for the bears..I can understand the great disappointment out there, but then, we should be used to it.

Ohh..to top it all.. the new POMO schedule is issued by the NY Fed at 2pm.

sp'60min

vix'60min

Summary

We've just seen a VERY clear snap higher when we broke the declining resistance line @ 1520/21

All that's left for the bulls is 1525 and then 1530, but really, I don't think it matters if that's hit today..or even tomorrow.

*I will merely sit back..and watch this nonsense play out into mid-March.

Blue wave'5 - were it to be the very last wave higher..won't be too much..maybe 2-4% higher. - more on that later though.

--

It has to be said, for the bears..I can understand the great disappointment out there, but then, we should be used to it.

Ohh..to top it all.. the new POMO schedule is issued by the NY Fed at 2pm.

12pm update - tricky Thursday

There is something of a real little battle going on today. The indexes are still moderately higher, but the bulls are not seeing enough significant follow through. Yet, neither are bears seeing any power to the downside..yet.

sp'60min

vix'60min

Summary

The threshold levels are clear...

Bulls need to break into the 1520s. 1522 would be a clear break above resistance, but then..bulls still need to clear 1525..and then 1530.

Arguably, the only 'safe' long..is taken, when we see 1531

--

Contrary, the bears need to break below sp'1515..and preferably 1510.

The VIX..is flat, but its not exactly inspiring me to feel remotely bearish right now.

--

*I remain on the sidelines, after a lack of bearish signals at the open, I'm somewhat reluctant to get involved in this nonsense today.

Lets be clear.. the daily index charts - from a pure price perspective, are highly suggestive that a multi-day decline is...complete. The power of yesterdays ramp - especially in the transports..is more likely than not, to suggest we'll be breaking into the sp'1530s within the next day or so.

--

VIX update..from the Godfather

Indeed, a few spiky up days..and now normal service seems to be resuming. Urghh

UPDATE 1pm ...sp' is trying to break the declining resistance. I guess you could say its a bullish pennant, or some kinda triangle forming..which will snap to the upside.

I've updated the count..I think its safe to say we can ditch any hope of a fifth wave lower..and instead..we're in wave'1 UP..of what might be a final wave higher.

There just isn't the power on the downside. Monday had some real reason for the decline, today...just doesn't have anything.

As ever.. for those who are hitting buttons today..good stops are vital.

UPDATE 1.25pm..well, there goes the line in the sand..and hence a snap higher.

Game over bears..at least for a week or two.

sp'60min

vix'60min

Summary

The threshold levels are clear...

Bulls need to break into the 1520s. 1522 would be a clear break above resistance, but then..bulls still need to clear 1525..and then 1530.

Arguably, the only 'safe' long..is taken, when we see 1531

--

Contrary, the bears need to break below sp'1515..and preferably 1510.

The VIX..is flat, but its not exactly inspiring me to feel remotely bearish right now.

--

*I remain on the sidelines, after a lack of bearish signals at the open, I'm somewhat reluctant to get involved in this nonsense today.

Lets be clear.. the daily index charts - from a pure price perspective, are highly suggestive that a multi-day decline is...complete. The power of yesterdays ramp - especially in the transports..is more likely than not, to suggest we'll be breaking into the sp'1530s within the next day or so.

--

VIX update..from the Godfather

Indeed, a few spiky up days..and now normal service seems to be resuming. Urghh

UPDATE 1pm ...sp' is trying to break the declining resistance. I guess you could say its a bullish pennant, or some kinda triangle forming..which will snap to the upside.

I've updated the count..I think its safe to say we can ditch any hope of a fifth wave lower..and instead..we're in wave'1 UP..of what might be a final wave higher.

There just isn't the power on the downside. Monday had some real reason for the decline, today...just doesn't have anything.

As ever.. for those who are hitting buttons today..good stops are vital.

UPDATE 1.25pm..well, there goes the line in the sand..and hence a snap higher.

Game over bears..at least for a week or two.

11am update - rejection at the declining line

Minor chop so far today, although there is a little weakness starting to appear. VIX is back to slightly green, but its still minor noise, +1%. Dollar is now climbing, and this is putting renewed downward pressure on the metals.

sp'60min

vix'60min

Summary

I'm admittidly very concerned about re-shorting this..even though we've not yet seen a break above key resistance.

Any move >1525..and then 1530, opens up a good 2-3% higher, which would really nail anyone shorting at these levels.

--

At is is..I'm still sitting back, but I'm getting real annoyed already!

UPDATE 11.07am.. this is the problem...

15min cycle looks floored..and is now trying to burst higher...>1520,, and make a challenge the recent high of 1525

-

The problem for the bears is 'what excuse' will we decline on today? Monday had the Italian elections/EU index sell off...today..there doesn't seem to be anything.

I'm sitting back, with no immediate plan to re-short,..annoyed..as I often am..with this nasty market.

sp'60min

vix'60min

Summary

I'm admittidly very concerned about re-shorting this..even though we've not yet seen a break above key resistance.

Any move >1525..and then 1530, opens up a good 2-3% higher, which would really nail anyone shorting at these levels.

--

At is is..I'm still sitting back, but I'm getting real annoyed already!

UPDATE 11.07am.. this is the problem...

15min cycle looks floored..and is now trying to burst higher...>1520,, and make a challenge the recent high of 1525

-

The problem for the bears is 'what excuse' will we decline on today? Monday had the Italian elections/EU index sell off...today..there doesn't seem to be anything.

I'm sitting back, with no immediate plan to re-short,..annoyed..as I often am..with this nasty market.

10am update - bears have a problem

The market opens with some minor chop, but with the Chicago PMI coming in reasonably, we're busting above yesterdays highs. VIX is now -1%, after opening +2%. Those bears still short..have a serious problem right now.

sp'60min

vix'60min

Summary

It would appear we're not going any lower.

I won't be re-shorting this...way too much risk. all thats left is sp'1525..and then 1530, and it now looks like those will taken out.

-

Looks like we'll now be on a straight algo-bot melt to sp'1550/70s by mid/late March

After all..everything is fixed...right ?

*new POMO schedule announced today.

--

CNBC about to wheel on Laszlo 'the ruler' Birinyi, who will be touting sp'1800s this year.

Hmm, will that make for 'hysteria' top. I'm not saying 1800s are going to be hit, but when you start seeing permabulls like that being brought on, its just like when AAPL was going to hit $1000...last September.

--

Urgh..what a mind frak this is turning out..market now reversing...

Its a bit messy...and we did get an EXACT hit/rejection on the declining trend.

sp'60min

vix'60min

Summary

It would appear we're not going any lower.

I won't be re-shorting this...way too much risk. all thats left is sp'1525..and then 1530, and it now looks like those will taken out.

-

Looks like we'll now be on a straight algo-bot melt to sp'1550/70s by mid/late March

After all..everything is fixed...right ?

*new POMO schedule announced today.

--

CNBC about to wheel on Laszlo 'the ruler' Birinyi, who will be touting sp'1800s this year.

Hmm, will that make for 'hysteria' top. I'm not saying 1800s are going to be hit, but when you start seeing permabulls like that being brought on, its just like when AAPL was going to hit $1000...last September.

--

Urgh..what a mind frak this is turning out..market now reversing...

Its a bit messy...and we did get an EXACT hit/rejection on the declining trend.

Pre-Market Brief

Good morning. Futures have been quiet overnight, the sp is +2pts, we're set to open around 1517. Gold is already -$7, although Silver is flat. Stock highlight so far...GRPN -25%.

sp'60min

vix'60min

Summary

I am considering a re-short in the opening 30 minutes

see previous post for full details.

--

Awaiting- data...

GDP (second reading): +0.1% vs -0.1% (first reading)

Jobless claims: 344k

Chicago PMI:

As noted...lets see if we get a red reversal candle on the VIX 15/60min charts in the opening 30 minutes.

--

Something for your viewing pleasure,..from Ron Walker...

updates..in the opening 30mins !

--

UPDATE 9.40...nothing bearish yet...nothing at all.

awaiting PMI number. It if comes in 'reasonable', this market has a chance at >1525..in which case..can't be short.

UPDATE 9.45 Chicago PMI : 56.8 , pretty reasonably bullish

Indexes testing yesterdays high

I am NOT re-shorting here

sp'60min

vix'60min

Summary

I am considering a re-short in the opening 30 minutes

see previous post for full details.

--

Awaiting- data...

GDP (second reading): +0.1% vs -0.1% (first reading)

Jobless claims: 344k

Chicago PMI:

As noted...lets see if we get a red reversal candle on the VIX 15/60min charts in the opening 30 minutes.

--

Something for your viewing pleasure,..from Ron Walker...

updates..in the opening 30mins !

--

UPDATE 9.40...nothing bearish yet...nothing at all.

awaiting PMI number. It if comes in 'reasonable', this market has a chance at >1525..in which case..can't be short.

UPDATE 9.45 Chicago PMI : 56.8 , pretty reasonably bullish

Indexes testing yesterdays high

I am NOT re-shorting here

A delicate situation

The main indexes closed significantly higher, with the VIX -12%. What is now clear is that the opening 30 minutes of Thursday will be pivotal as to how we'll trade into the weekend. Bulls need to keep pushing >sp'1522, and then >1530, or there is still the opportunity of a fast collapse to the original sp'1480 fib/target zone.

sp'daily4 - bearish scenario

sp'daily2, rainbow

sp'60min

Summary

First, regarding the daily'4 chart..

After today's significant ramp higher, I've updated it with the assumption that minor wave'4 (black) is complete. Although we don't really have confirmation of that until sp'1530 is broken above.

What I just want to emphasise though is that even if we do decline tomorrow - and into Friday, I'd still expect at least one further up cycle into mid-March.

Rainbow madness

The rainbow (Elder Impulse) daily chart for the sp' is a really bizarre mess. The last 7 trading days have seen some severe flips in the signal. In theory, its again possible that we'll open a touch higher, only to drop heavily later in the day. Yet, Monday had the bearish excuse of the Italian elections, what might be the excuse tomorrow?

The Permabear Plan

I'm going to be keeping a VERY sharp eye on the hourly charts in the opening 30 minutes of Thursday.

If I'm going to take a new index re-short, I want to see a red hollow reversal candle on the VIX - as we saw early Monday. I'll also want to see opening weakness in equities or a failed opening minor rally - with perhaps a few black/fail candles on indexes like IWM or Transports.

So long as we don't break >sp'1525, I'll keep an open mind on re-shorting early tomorrow.

--

*Bonus chart*

Copper, weekly, 2yr

I wanted to again highlight Copper, as its a good barometer of the commodity market, and in many ways, its also important for at least some equities.

As you can see, Copper remains a mere 8 cents from breaking under the very important 3.50 level. Any move into the 3.40s - whether tomorrow/Friday, or indeed, the weeks to come, would be a real warning of general market weakness.

Looking ahead

Thursday has a trio of very important pieces of econ-data that will give Mr Market the excuse to move. Interestingly, we have GDP - second reading (market is expecting a revised number of 0.5%, vs -0.1%), and the usual weekly jobless numbers. However, perhaps most important of all is the Chicago PMI number. Its currently @ 55, bears should be seeking a recessionary sub'50 number. If the latter were the case, we'd likely see a very spooked market.

Lets see if February can close in a stinky way for those deluded bull maniacs ;)

Goodnight from London

sp'daily4 - bearish scenario

sp'daily2, rainbow

sp'60min

Summary

First, regarding the daily'4 chart..

After today's significant ramp higher, I've updated it with the assumption that minor wave'4 (black) is complete. Although we don't really have confirmation of that until sp'1530 is broken above.

What I just want to emphasise though is that even if we do decline tomorrow - and into Friday, I'd still expect at least one further up cycle into mid-March.

Rainbow madness

The rainbow (Elder Impulse) daily chart for the sp' is a really bizarre mess. The last 7 trading days have seen some severe flips in the signal. In theory, its again possible that we'll open a touch higher, only to drop heavily later in the day. Yet, Monday had the bearish excuse of the Italian elections, what might be the excuse tomorrow?

The Permabear Plan

I'm going to be keeping a VERY sharp eye on the hourly charts in the opening 30 minutes of Thursday.

If I'm going to take a new index re-short, I want to see a red hollow reversal candle on the VIX - as we saw early Monday. I'll also want to see opening weakness in equities or a failed opening minor rally - with perhaps a few black/fail candles on indexes like IWM or Transports.

So long as we don't break >sp'1525, I'll keep an open mind on re-shorting early tomorrow.

--

*Bonus chart*

Copper, weekly, 2yr

I wanted to again highlight Copper, as its a good barometer of the commodity market, and in many ways, its also important for at least some equities.

As you can see, Copper remains a mere 8 cents from breaking under the very important 3.50 level. Any move into the 3.40s - whether tomorrow/Friday, or indeed, the weeks to come, would be a real warning of general market weakness.

Looking ahead

Thursday has a trio of very important pieces of econ-data that will give Mr Market the excuse to move. Interestingly, we have GDP - second reading (market is expecting a revised number of 0.5%, vs -0.1%), and the usual weekly jobless numbers. However, perhaps most important of all is the Chicago PMI number. Its currently @ 55, bears should be seeking a recessionary sub'50 number. If the latter were the case, we'd likely see a very spooked market.

Lets see if February can close in a stinky way for those deluded bull maniacs ;)

Goodnight from London

Daily Index Cycle update

The main indexes opened a touch lower, but with Durable goods orders coming in better than expected, the Transports exploded higher, and everything else followed. It is now looking like the pull back may be complete, in which case we'll see sp>1530 within the next few days.

Dow

SP'daily5

Trans

Summary

The action in the transports was the real surprise of the day. It (briefly) broke back into the 6000s, and the daily gain of 2.9% is only matched by the yearly opening jump on Jan'2.

Dow is now around 100pts shy of its (adjusted) Oct'2007 high of 14178.

--

The underlying MACD (blue bar histogram) cycle on the daily charts ticked higher. Today is quite possibly day'1 of this new cycle, and we could easily crawl higher for the next week or two.

So..unless we see a rather muted/flat open tomorrow, with a red reversal candle on the VIX hourly chart, and opening weakness in equities / or a failed opening rally... we're going higher into mid-March.

With things now tricky from a bearish perspective, I am content to sit on the sidelines.

I'll detail my overview, and plan for tomorrow, in the final posting of the day...a little later.

Dow

SP'daily5

Trans

Summary

The action in the transports was the real surprise of the day. It (briefly) broke back into the 6000s, and the daily gain of 2.9% is only matched by the yearly opening jump on Jan'2.

Dow is now around 100pts shy of its (adjusted) Oct'2007 high of 14178.

--

The underlying MACD (blue bar histogram) cycle on the daily charts ticked higher. Today is quite possibly day'1 of this new cycle, and we could easily crawl higher for the next week or two.

So..unless we see a rather muted/flat open tomorrow, with a red reversal candle on the VIX hourly chart, and opening weakness in equities / or a failed opening rally... we're going higher into mid-March.

With things now tricky from a bearish perspective, I am content to sit on the sidelines.

I'll detail my overview, and plan for tomorrow, in the final posting of the day...a little later.

Subscribe to:

Comments (Atom)