With no comments from the EU, the market was in a much more sedate and comfortable mood. The indexes closed higher, with the VIX naturally slipping into the close, settling -7% @ 12.77 It would seem the sp'1570s will be hit, which might equate to VIX back in the mid 11s.

VIX'60min

VIX'daily3

Summary

Suffice to say, there sure doesn't seem any point in picking up VIX call option blocks yet. Indeed, if my index target of the sp'1570s occurs, we're probably looking at a Thursday/weekly close in the VIX 11s.

So..near term lower...but I'd have to believe we'll see VIX 20s by late April/early May.

How high can the VIX go in 2013?

Summer 2012 saw the VIX max out at 27, will the 2013 VIX peak be an even lower peak?

If the Fed keep printing, and if the black swans stay in their nests, then VIX might indeed go no higher than 23/25 this year.

Yet, a very long year is still ahead,.lets see how the VIX trades Wed/Thursday.

more later..on the indexes

Tuesday, 26 March 2013

Closing Brief

As expected, the market melted higher into the close, with the sp' comfortably in the 1560s VIX naturally slipped -7%. Oil was the notable leader again, climbing around 1.7%. Precious metals closed lower, but slightly off the lows.

sp'60min

Summary

So..we closed in the 1560s..and that keeps the door open to the 1570s for Wed/Thursday.

Daily MACD cycle could in theory climb for 2-4 days..which gets us into next week.

So..right now..bears probably going to need to wait until next Tue/Wed.

As I keep noting..there is NO hurry. Weekly charts ARE rolling over, despite the current rally. sp'1490/70s seem a given in my view.

more later...

sp'60min

Summary

So..we closed in the 1560s..and that keeps the door open to the 1570s for Wed/Thursday.

Daily MACD cycle could in theory climb for 2-4 days..which gets us into next week.

So..right now..bears probably going to need to wait until next Tue/Wed.

As I keep noting..there is NO hurry. Weekly charts ARE rolling over, despite the current rally. sp'1490/70s seem a given in my view.

more later...

3pm update - melt into the close

Market is holding gains of 0.6%, and with it being so quiet out there today, there is no reason why we can't melt higher into the close. Bears with short stops in the 1563-65 zone are in real trouble this closing hour.

sp'60min

Summary

No reason to expect the market to slip lower.

The micro-count on the hourly chart is very 'unreliable', yet, the daily chart MACD cycle is now ticking higher..so...up for 2-3 days...probably.

--

*Oil continues to ramp, and is now trading at the old broken neckline in the (USO) 34.40/50s.

back after the close

sp'60min

Summary

No reason to expect the market to slip lower.

The micro-count on the hourly chart is very 'unreliable', yet, the daily chart MACD cycle is now ticking higher..so...up for 2-3 days...probably.

--

*Oil continues to ramp, and is now trading at the old broken neckline in the (USO) 34.40/50s.

back after the close

2pm update - its quiet out there

With no EU comments to spook the market, its a much quieter day. There is no reason to think bears have any chance today, or indeed the rest of the week. USD is a touch higher, whilst Oil is the star of the day, +1.5%. Metals remain weak, but again look exhausted on the sell side.

sp'60min

USO, daily2

GLD'60min

Summary

Sp' hourly chart is offering a baby bull flag, that is opening the door to the 1570s Wed/Thursday.

--

We could melt higher into the close, and the HFT bots have a real chance to cause a short-stop cascade to the upside.

No point shorting here.

--

*The GLD chart is extremely child-like simple, but the point is clear. MACD cycle looks very low..and we're due to cycle up.

Price action looks like a bullish wedge/pennant. A break back into the 155s would open up a move that might help to challenge the key resistance around 158

-

USO/Oil sure is tempting re-short here..but whilst equities are still due to go higher, can't be shorting the Oil.

sp'60min

USO, daily2

GLD'60min

Summary

Sp' hourly chart is offering a baby bull flag, that is opening the door to the 1570s Wed/Thursday.

--

We could melt higher into the close, and the HFT bots have a real chance to cause a short-stop cascade to the upside.

No point shorting here.

--

*The GLD chart is extremely child-like simple, but the point is clear. MACD cycle looks very low..and we're due to cycle up.

Price action looks like a bullish wedge/pennant. A break back into the 155s would open up a move that might help to challenge the key resistance around 158

-

USO/Oil sure is tempting re-short here..but whilst equities are still due to go higher, can't be shorting the Oil.

12pm update - melting into the afternoon

Despite some arguably weak econ-data this morning, the market is holding onto gains, and it looks like it might even be able to close in the high 1560s. A few hours of algo-bot melt would no doubt trigger a lot of short-stops, and once again annoy a great many bears.

sp'daily5

VIX' daily3

Summary

There is easy upside into the 1570s in the immediate term.

There is seemingly no point shorting the indexes this week, not least when there is a rather large POMO this Thursday.

Even worse, even if we do open lower on Thursday (bad GDP, PMI data?), we'll likely see a significant rebound. It would seem its a case of 'come back next week' for those in bear land.

--

Oil is approaching the old broken neckline...

I'd be surprised if USO can put in a few daily closes >34.50. A few days trading sideways..and Oil will make for a good short next week, especially if equities are maxed out in the sp'1570s.

back at 2pm

sp'daily5

VIX' daily3

Summary

There is easy upside into the 1570s in the immediate term.

There is seemingly no point shorting the indexes this week, not least when there is a rather large POMO this Thursday.

Even worse, even if we do open lower on Thursday (bad GDP, PMI data?), we'll likely see a significant rebound. It would seem its a case of 'come back next week' for those in bear land.

--

Oil is approaching the old broken neckline...

I'd be surprised if USO can put in a few daily closes >34.50. A few days trading sideways..and Oil will make for a good short next week, especially if equities are maxed out in the sp'1570s.

back at 2pm

11am update - awaiting clearer direction

Mr Market is holding onto moderate gains. So long as no EU minister speaks today, the market should close in the 1560s..and that will keep the door open to the 1570s within a few days. Perhaps we're looking at a peak early next week? VIX is trying to rally, but its still -4%

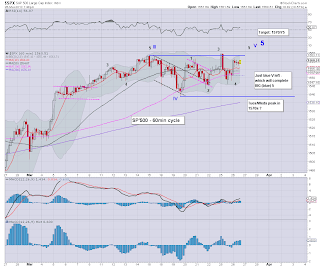

sp'60min

Summary

Suffice to say, we sure ain't down this morning.

Doesn't seem any point in meddling on the index-short side until after the long weekend.

--

Oil sure remains a tempting short at these levels for a day trade, but I'm keeping it simple, and will just watch it.

I've still to drop my somewhat frustrating SLV (long) trade, but that looks okay.

sp'60min

Summary

Suffice to say, we sure ain't down this morning.

Doesn't seem any point in meddling on the index-short side until after the long weekend.

--

Oil sure remains a tempting short at these levels for a day trade, but I'm keeping it simple, and will just watch it.

I've still to drop my somewhat frustrating SLV (long) trade, but that looks okay.

10am update - another tough open for the bears

The main indexes are moderately higher, but we're a fair way from taking out yesterdays new high of 1564. Notable mover of the day so far, Oil, which is 1% higher, and back in the $95s. Precious metals are weak, but could easily reverse across the morning.

sp'daily5

vix'daily3

Summary

Bears are having another difficult open, although just like yesterday we could rollover, but then, are we to expect another EU rumour mill day? I guess not.

So..on balance, we'll probably see melt to the upside.

VIX is down 7% already, that sure isn't bearish...the 11s seem viable again, if sp'1570s.

--

Oil is toppy on the 15min cycle...a tempting short, but it'd probably be better to wait until next week.

SLV, opening lower, but I'm seeking a reversal...imminently. the mid 28s remain first target..

sp'daily5

vix'daily3

Summary

Bears are having another difficult open, although just like yesterday we could rollover, but then, are we to expect another EU rumour mill day? I guess not.

So..on balance, we'll probably see melt to the upside.

VIX is down 7% already, that sure isn't bearish...the 11s seem viable again, if sp'1570s.

--

Oil is toppy on the 15min cycle...a tempting short, but it'd probably be better to wait until next week.

SLV, opening lower, but I'm seeking a reversal...imminently. the mid 28s remain first target..

Pre-Market Brief

Good morning. Futures are marginally higher, the sp +3pts or so, we're set to open around 1554/55. The dollar is fractionally higher, along with Oil. Gold is -$6, Silver is flat. The sp'1570s still seem viable in the very near term.

sp'60min

sp'daily5

Summary

There is lots of econ-data this morning, so Mr Market will have all the excuses it needs to pick a direction..and run with it.

*in the previous 3 cycle peaks, we've seen sideways chop usually for 3-6 weeks, and we're only at week 2/3, depending on how you look at it.

---

*I'm still long via SLV, but am looking to drop that today. Silver itself remains in an incredibly tight trading range. It could burst a little higher, only to get stuck at key resistance, and then collapse. A few daily closes >30/31 though, and 38/40 opens up...rather fast.

SLV, daily2

--

meanwhile, USO - which I've also been meddling in (long) lately is still battling higher. I don't expect it to be able to break/hold over the mid 34s.

USO, daily2

Indeed, next week, I will look to be shorting USO down into April/May.

sp'60min

sp'daily5

Summary

There is lots of econ-data this morning, so Mr Market will have all the excuses it needs to pick a direction..and run with it.

*in the previous 3 cycle peaks, we've seen sideways chop usually for 3-6 weeks, and we're only at week 2/3, depending on how you look at it.

---

*I'm still long via SLV, but am looking to drop that today. Silver itself remains in an incredibly tight trading range. It could burst a little higher, only to get stuck at key resistance, and then collapse. A few daily closes >30/31 though, and 38/40 opens up...rather fast.

SLV, daily2

--

meanwhile, USO - which I've also been meddling in (long) lately is still battling higher. I don't expect it to be able to break/hold over the mid 34s.

USO, daily2

Indeed, next week, I will look to be shorting USO down into April/May.

Near term chop

A choppy day to begin a shortened week, with the main indexes closing moderately lower. Yet, the daily charts still threaten of further upside into the sp'1570s, not least whilst the more important weekly/monthly cycles are still very much on the bullish side.

sp'daily7 - fib levels

sp'weekly2, rainbow

sp'monthly3, rainbow

Summary

So, today was a bit of a choppy mess, and I'm sure many are already longing for the extended Easter weekend. I am one of them.

As someone who is seeking to re-short the indexes and start picking up VIX call blocks, I'm resigned to waiting until next week. As has been the case in the past three years, April/May is often a good place to pick up short positions for a multi-week down cycle.

Bigger picture outlook

In terms of the next few months, I'm still seeking a multi-week down cycle, primary target is somewhere in the 1490/70 area. That's not exactly the most exciting scale (5-7%) of drop, but its possible we might fall to the lower bollinger band (weekly cycle)...which by early May will probably be in the 1425/50 area.

I will note that the MACD (green bar histogram) on the weekly charts is now looking very good for the bears. We have a lower secondary tower/wave, and we ARE rolling over. We should see a close below the important 10MA by mid April.

Looking ahead

We have plenty of econ-data tomorrow morning, not least the Durable Goods Orders data. Keep in mind that Thursday will be key with GDP and PMI data.

Certainly, there is potential for further index declines this week, but I would be somewhat surprised if we go below the recent 1538 low. There remains very strong rising support on the sp in the 1520/25 area. I just can't see that being broken this side of the Easter break, even if some of the econ-data comes in way below market expectations.

In my view...the bears would be better to just sit this week out..and see where we're at next Monday..April 1'st.

Goodnight from London

--

Bonus video, from Biderman. He has some interesting ideas on how April might play out, in relation to money flow and tax year issues.

sp'daily7 - fib levels

sp'weekly2, rainbow

sp'monthly3, rainbow

Summary

So, today was a bit of a choppy mess, and I'm sure many are already longing for the extended Easter weekend. I am one of them.

As someone who is seeking to re-short the indexes and start picking up VIX call blocks, I'm resigned to waiting until next week. As has been the case in the past three years, April/May is often a good place to pick up short positions for a multi-week down cycle.

Bigger picture outlook

In terms of the next few months, I'm still seeking a multi-week down cycle, primary target is somewhere in the 1490/70 area. That's not exactly the most exciting scale (5-7%) of drop, but its possible we might fall to the lower bollinger band (weekly cycle)...which by early May will probably be in the 1425/50 area.

I will note that the MACD (green bar histogram) on the weekly charts is now looking very good for the bears. We have a lower secondary tower/wave, and we ARE rolling over. We should see a close below the important 10MA by mid April.

Looking ahead

We have plenty of econ-data tomorrow morning, not least the Durable Goods Orders data. Keep in mind that Thursday will be key with GDP and PMI data.

Certainly, there is potential for further index declines this week, but I would be somewhat surprised if we go below the recent 1538 low. There remains very strong rising support on the sp in the 1520/25 area. I just can't see that being broken this side of the Easter break, even if some of the econ-data comes in way below market expectations.

In my view...the bears would be better to just sit this week out..and see where we're at next Monday..April 1'st.

Goodnight from London

--

Bonus video, from Biderman. He has some interesting ideas on how April might play out, in relation to money flow and tax year issues.

Daily Index Cycle update

The US indexes saw a choppy Monday. Opening minor gains - which saw the SP' fractionally break the recent 1563 high failed to hold, after some EU minister said something (or not)..and the market slipped, closing off the lows. Near term trend looks messy, sp'1570s..still viable.

IWM

SP'daily5

Trans

Summary

Well, that's one day complete in this short four day week. I think today was a real mind-frak for many traders.

With opening gains, Mr Market no doubt short-stopped a lot of bears out in the 1560/64 zone, only for the market to reverse.

Yet, with the Dow -100pts or so, then we saw a re-statement of what the EU minister had supposedly said, and the market ramps back, kicking out those bears who were shorting into the declines.

--

It remains a nasty market for those on the bearish side, one where the primary trend - weekly/monthly cycles, is still UP.

I don't see any point in shorting this market ahead of the 3 day Easter weekend, and besides, I still think there is a very significant chance of the market breaking into the 1570s before this November-March wave completes.

a little more later

IWM

SP'daily5

Trans

Summary

Well, that's one day complete in this short four day week. I think today was a real mind-frak for many traders.

With opening gains, Mr Market no doubt short-stopped a lot of bears out in the 1560/64 zone, only for the market to reverse.

Yet, with the Dow -100pts or so, then we saw a re-statement of what the EU minister had supposedly said, and the market ramps back, kicking out those bears who were shorting into the declines.

--

It remains a nasty market for those on the bearish side, one where the primary trend - weekly/monthly cycles, is still UP.

I don't see any point in shorting this market ahead of the 3 day Easter weekend, and besides, I still think there is a very significant chance of the market breaking into the 1570s before this November-March wave completes.

a little more later

Subscribe to:

Comments (Atom)