Lets look at the usual six indexes I regularly highlight...

IWM (representing Rus'2000 small cap)

The Rus'2000 index had a very strong close to the week, but you can see it still put in a lower low for June..and even a lower high.

Only with a push over 82.50, and then 85.0 could I get bullish on the Rus'2000 this year. The 85.0 level has now been solid resistance since April 2011. It will be really difficult to break above there, not least since the underlying trend indicators are still showing clear weakness since the March peak.

Nasdaq Composite

Only with a move above the March peak of 3134 could I get bullish for the tech sector, and indeed the wider market. It is entirely possible we'll see a 2-3% upside in the early part of July, and then a major move lower - taking out the earlier June low.

From a cycle perspective, you can clearly see we are still very much declining, since the main market rolled over in April

Dow

With the very bullish close to the week and month, the Dow looks set for another move to 13k, and an attempt to take out the May'1st high of 13338.

Only with a break under 12k, can the bears start to get confident again. Until that level is taken out, there is the real threat of a renewed summer push to new highs.

NYSE Composite

The master index is still some 7% below its March peak. June certainly closed strongly, and there is at least some likely upside in early July. The monthly cycle trend indicators though are all bearish.

Only with a break over the 2011 high of 8700 could I get confident a major new uptrend is underway.

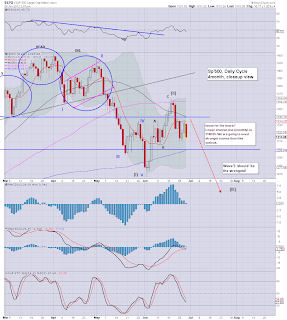

SP'500

The Sp' chart really highlights the difficult market conditions we've seen. Not only did we put in a lower low, but we closed with a bullish candle - closing at the top of the range...yet at the same time, we still closed with a lower high!

Bulls will need to take out the previous 1400 candle..and preferably >1422 for me to get bullish on the overall market.

Transports

The tranny has remained stuck in a tight range since the start of the year. However, one bearish aspect is that it did break below the range earlier this month. Yet again though, it closed right back in the centre of the range.

Only with a break over 5400, and preferably 5500 could I get bullish on the transports..and indeed the broader market.

---

A few key issues...

1. We put in new lows since the Spring peak

2. We put in a lower high, compared to May

3. We closed at the top of the candle for June, that is likely bullish at least for the opening week of July

4. All trend/momentum indicators are still showing weakness, since the Spring peaks

5. Buying volumn remains weaker than selling, although thats largely been the case since the 2009 lows!

Summary

Next week will be very important. However, it is complicated by the fact that its a holiday week. The US market will be closed Wednesday, and its likely many traders will take a few days either side of July'4th off, some even the whole week.

Yet, we have the monthly jobs data released Friday July'6. I believe that will probably show even fewer gains, and Mr Market will again have to wonder if the US can avoid recession* by the end of the year.

--

*Of course, even if the US economy slips into recession by Q4, we're not going to get official confirmation of that until GDP Q4 data is reported in late April 2013!

--

Looking into July

It would appear likely we'll see further upside this holiday week, at least until Thursday, where SP'1390/1400 seems very much within range (see daily charts).

If the market stalls at that level, and the econ-data does upset the market, what will then be paramount for the bears is to quickly take out the previous low of sp'1266. Only with a break below that level can the 'serious money' bears have confidence that the broader monthly cycle is still in a broad decline.

My original target of sp'1150/00 by end July is of course now looking seriously doubtful. If we are indeed around sp'1400 by the end of next week, then 1150 is 250pts lower. Yet we did see a near 250pt fall in the 12 day decline in July/August 2011..so it IS possible, if very unlikely.

The July/August 2011 collapse wave

Chasing it higher..or lower?

What is clear, is that if we break sp>1422, that would be a VERY major bullish sign, and traders could chase it higher. The contrary trade would be to merely wait for a break <1266, and then chase it lower. Of course, that is almost 100pts lower from where we are right now.

Arguably, the 'big money' bears, those playing non-leveraged short-ETFs can short all they like, with a simple stop no higher than 1423.

---

Thats all for today, more on Sunday