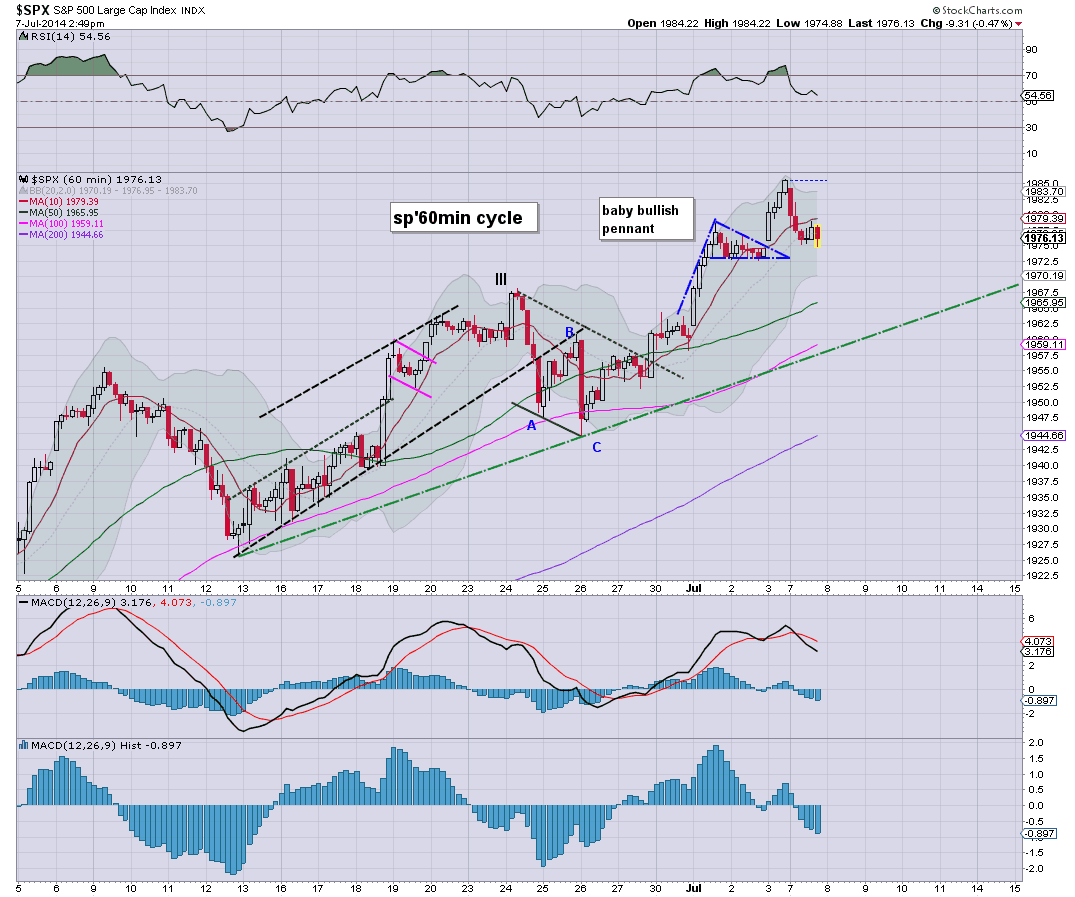

US equities closed moderately lower, sp -7pts @ 1977. The two leaders - Trans/R2K, settled lower by a more significant -1.0% and 1.7% respectively. Near term outlook offers the low sp'1960s, but the 2000s are... coming.

sp'60min

Summary

In many ways it remains a case of 'don't get lost in the minor noise'.

Sure, we could see a little more weakness across Tue/Wed, but the bigger picture is absolutely bullish.

I am keeping an open mind on things, but for now, unless the equity bears can break back below sp'1900, any talk of 'significant downside' should be dismissed as the same old crazy talk.

-

I'm kinda tired, so.. next posting will be a daily wrap.. 8pm EST.

*thanks to those who did say hello today, its good to know some of you are still out there.

Monday, 7 July 2014

3pm update - it remains.. minor chop

US equities remain moderately weak, on what is a pretty dull Monday. The sp' looks set for a close in the 1970s... with further viable downside to the low 1960s tomorrow/Wed'. Regardless of the minor noise, the sp'2000s look likely next week.

sp60min

Summary

A pretty tiresome day, and after installing another 150 or so updates for windows'7, I'm burnt out on anything else today.

The added issue of WFM getting another intraday smack down does not particularly help my mood either.

I suppose it could be worse, I could be short the indexes from the low sp'1800s.

--

time for a walk..before the vampires come out after sunset.

sp60min

Summary

A pretty tiresome day, and after installing another 150 or so updates for windows'7, I'm burnt out on anything else today.

The added issue of WFM getting another intraday smack down does not particularly help my mood either.

I suppose it could be worse, I could be short the indexes from the low sp'1800s.

--

time for a walk..before the vampires come out after sunset.

1pm update - tedous Monday

US equities remain moderately lower, sp -10pts @ 1975. Metals and Oil are similarly weak, on what is relatively quiet start to the week. What is clear... despite the declines, there is no sig' power on the bearish side.

sp'60min

Summary

...consumed with other things today.

--

back at 3pm

*1.59pm... If I have to reconfigure my email client again this year. urghhhhhhhhhhhhh

Great new computer, but omg, too many things to set up. I need a secretary/admin (if only).

...back to the tech...

sp'60min

Summary

...consumed with other things today.

--

back at 3pm

*1.59pm... If I have to reconfigure my email client again this year. urghhhhhhhhhhhhh

Great new computer, but omg, too many things to set up. I need a secretary/admin (if only).

...back to the tech...

12pm update - moderate weakness

US equities remain moderately weak, with the sp' -9pts in the mid 1970s. Price action remains relatively strong though, and at best.. the equity bears might manage a gap fill in the low 1960s.

sp'daily5

Summary

There is little to add. Hourly cycles would allow minor downside into Tuesday, but there remains no real power on the downside.

The R2K is a much more significant -1.5% lower, but then.. it was up 12% in past 2 months.

--

VIX update from Mr T

--

time for a cool drink

sp'daily5

Summary

There is little to add. Hourly cycles would allow minor downside into Tuesday, but there remains no real power on the downside.

The R2K is a much more significant -1.5% lower, but then.. it was up 12% in past 2 months.

--

VIX update from Mr T

--

time for a cool drink

11am update - running on half power

US indexes are moderately lower, but today's sig' QE-pomo of around $3bn will no doubt help negate what little sell side volume there is. Metals and Oil are both moderately lower. VIX is +7%, but 7% of a small number.. still makes for a very low VIX.

sp'60min

Summary

Well, I'm tired, Too much 'computer' stuff still to do today, and its really slowing me down here.

The fact I have a blazing headache the size of Nebraska is not helping.

time for a marginally early lunch

-

*not sure what is going on with WFM, some kind of mini hyper jump this past hour. I need to see a daily close in the $40s to have any real hope on that one.

sp'60min

Summary

Well, I'm tired, Too much 'computer' stuff still to do today, and its really slowing me down here.

The fact I have a blazing headache the size of Nebraska is not helping.

time for a marginally early lunch

-

*not sure what is going on with WFM, some kind of mini hyper jump this past hour. I need to see a daily close in the $40s to have any real hope on that one.

10am update - morning weakness

Equities open moderately lower, but with sig' QE this morning, equity bears will be lucky to get a daily close in the 1970s. Metals are a little weak, Gold -$6. VIX is 9% higher, but still...only in the 11s.

sp'weekly8b

Summary

It is notable that the upper bol' on the weekly is now the 1990s. Certainly, 1990/95 is viable in the immediate term. I'd still guess 2000 won't be hit until at least next week.

-

As noted at the weekend, there really isn't much of significance this week. The 1900 threshold is a relatively long way down, and I sure don't see that being violated for a few months, if not the rest of the year.

*naturally, WFM is lower by almost -1% to start the week. Great. Just.. great.

--

time to shop...

sp'weekly8b

Summary

It is notable that the upper bol' on the weekly is now the 1990s. Certainly, 1990/95 is viable in the immediate term. I'd still guess 2000 won't be hit until at least next week.

-

As noted at the weekend, there really isn't much of significance this week. The 1900 threshold is a relatively long way down, and I sure don't see that being violated for a few months, if not the rest of the year.

*naturally, WFM is lower by almost -1% to start the week. Great. Just.. great.

--

time to shop...

Pre-Market Brief

Good morning. Futures are moderately lower, sp -4pts, we're set to open at 1981. Metals are weak, Gold -$6, with Silver -0.8%. Equity bulls still have everything on their side, not least helped by a sig' QE-pomo of $3bn today.

sp'weekly8b

Summary

*I spent most of yesterday building a new computer, I'm kinda tired, so...bear with me today! The good thing, I now have enough processing capability to do videos... at some point.

--

No doubt will be looking for some sig' downside this week..and into end July. Yet the trend remains strongly higher - as also reflected on most of the other world indexes.

*I will have my eyes on WFM this week, I really could do with the $41s by Friday, but that is a good 5% higher, and is pretty unlikely.

sp'weekly8b

Summary

*I spent most of yesterday building a new computer, I'm kinda tired, so...bear with me today! The good thing, I now have enough processing capability to do videos... at some point.

--

No doubt will be looking for some sig' downside this week..and into end July. Yet the trend remains strongly higher - as also reflected on most of the other world indexes.

*I will have my eyes on WFM this week, I really could do with the $41s by Friday, but that is a good 5% higher, and is pretty unlikely.

Subscribe to:

Comments (Atom)