Whilst the main equity indexes closed moderately higher, the VIX settled -3.4% @ 13.28. Across the week, the VIX gained 1.45%. Near term outlook is for a marginally higher VIX, perhaps into the 15/16s - with sp'1730s, before renewed equity upside into early December.

VIX'60min

VIX'daily3

VIX'weekly

Summary

The VIX hourly chart is effectively flat lining. We've seen the VIX remain in a super tight range of 14.50 to 13.0 for the past two weeks.

Even if sp' can decline to the 1730s next week - which itself will be difficult with heavy QE, I don't expect anything above 15/16. Certainly, the 20s look unlikely for the remainder of this year.

more later..on the indexes

Friday, 1 November 2013

Closing Brief

The main indexes closed moderately higher, with the sp +5pts @ 1761. The two leaders - Trans/R2K, closed +1.0% and -0.4% respectively. Near term trend remains somewhat weak, but there is huge underlying upside pressure into year end.

sp'60min

Summary

For the equity bears, even the closing hour of today was another disappointment.

I am certainly surprised that the market didn't at least close slightly lower. However, with the two leaders still somewhat weak (although Transports pulled a 1% gain in the late afternoon), I'd still expect some weakness next week, but it will be damn difficult - since next week is HEAVY Qe-pomo.

Have a good weekend

--

*next main post, late Saturday, on the World Monthly Indexes

-

closing video update from the PIT...

-

sp'60min

Summary

For the equity bears, even the closing hour of today was another disappointment.

I am certainly surprised that the market didn't at least close slightly lower. However, with the two leaders still somewhat weak (although Transports pulled a 1% gain in the late afternoon), I'd still expect some weakness next week, but it will be damn difficult - since next week is HEAVY Qe-pomo.

Have a good weekend

--

*next main post, late Saturday, on the World Monthly Indexes

-

closing video update from the PIT...

-

3pm update - weakness into the close

The main market has seen another micro cycle to the upside, but there is still an air of weakness in this market, especially seen in the Trans/R2K. A close in the 1755/45 zone looks..probable. Metals and Oil holding declines.

sp'60min

Summary

A tiresome..and somewhat sleepy end to the week.

There really isn't anything going on in market land,

At present, we are only fractionally lower on the week, but almost 1% lower from the 1775 high.

sp'weekly8

--

updates into the close, if I'm still awake. urghh

-

3.27pm...the micro 5/15min cycles are prone to a significant drop in the remaining 30mins.

sp'5min

A close in the 1740s..is just about possible.

-

3.37pm.. sp'1761...poor bears..getting short-stopped out. There is just a lack of downside power in the main indexes (Trans/R2K) still weak though.

A weekly close of 1760 would be about flat...a doji candle, and no doubt, some will tout that as a major top sign.

3.44pm.. Oil.. -1.7%. That is something not many are noticing today. Sure will help the general economy..and especially those transport and mining stocks - the latter are especially heavy dependent on fuel.

Main market, sp'1762, and the bears just not able to halt this afternoon micro rally.

For many..an annoying end to the week.

sp'60min

Summary

A tiresome..and somewhat sleepy end to the week.

There really isn't anything going on in market land,

At present, we are only fractionally lower on the week, but almost 1% lower from the 1775 high.

sp'weekly8

--

updates into the close, if I'm still awake. urghh

-

3.27pm...the micro 5/15min cycles are prone to a significant drop in the remaining 30mins.

sp'5min

A close in the 1740s..is just about possible.

-

3.37pm.. sp'1761...poor bears..getting short-stopped out. There is just a lack of downside power in the main indexes (Trans/R2K) still weak though.

A weekly close of 1760 would be about flat...a doji candle, and no doubt, some will tout that as a major top sign.

3.44pm.. Oil.. -1.7%. That is something not many are noticing today. Sure will help the general economy..and especially those transport and mining stocks - the latter are especially heavy dependent on fuel.

Main market, sp'1762, and the bears just not able to halt this afternoon micro rally.

For many..an annoying end to the week.

2pm update - quiet end to the week

The main indexes are somewhat mixed, with the sp' /dow, fractionally higher, whilst the two leaders - Trans/R2K are moderately lower . Precious metals and Oil are both weak.

sp'60min

Summary

Little to add, though I'd still look some selling to the closing hour, which should in theory has a reasonable chance of being stronger.

--

sp'60min

Summary

Little to add, though I'd still look some selling to the closing hour, which should in theory has a reasonable chance of being stronger.

--

1pm update - afternoon weakness

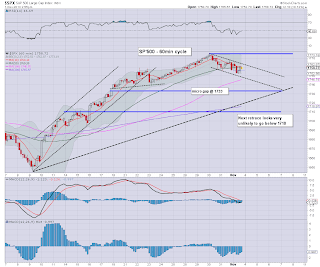

The market is trundling in the mid sp'1750s. Downside to the gap zone in the low 1730s looks pretty likely. and that should be enough to flush out the weaker bull hands. Metals and Oil both remain especially weak, pressured by the stronger USD.

sp'60min

Summary

Mr Market continues to generally track as expected. Should see increased weakness this afternoon, with a break into the 1740s.

I see other people posting about sub'1700s within the near term, but I just find that unlikely.

--

VIX update from Mr T.

VIX volume remains very low, and even the 15/16s look as high as we'll go, if sp'1730s.

sp'60min

Summary

Mr Market continues to generally track as expected. Should see increased weakness this afternoon, with a break into the 1740s.

I see other people posting about sub'1700s within the near term, but I just find that unlikely.

--

VIX update from Mr T.

VIX volume remains very low, and even the 15/16s look as high as we'll go, if sp'1730s.

12pm update - market leaders... leading lower

The main indexes are showing increasing weakness, with the two leaders - Trans/R2K, clearly leading the way lower. Metals and Oil are both weak, no doubt under added pressure via the stronger USD. VIX will likely break into the 14s this afternoon.

Trans, daily

R2K, daily

Summary

Like yesterday, market looks increasingly prone to late day selling. Right now, a close in the 1645/40 zone looks very viable.

--

time for lunch

Trans, daily

R2K, daily

Summary

Like yesterday, market looks increasingly prone to late day selling. Right now, a close in the 1645/40 zone looks very viable.

--

time for lunch

11am update - market behaving itself

The early bounce is failing..as expected. General weakness into the weekly close seems very likely, with a close in the 1740s now viable. No doubt some bears will get overly excited about 3 consecutive down days, despite a near certainty that the 1800s loom later in the month.

sp'60min

Summary

Will be interesting to see how many of the rats will start selling into the weekend. We saw a fair bit in yesterday closing hour, but should see much more today.

-

*metals remain very weak, and the miners under severe pressure....

GDX, daily

Its starting to look real ugly for the gold bugs again.

sp'60min

Summary

Will be interesting to see how many of the rats will start selling into the weekend. We saw a fair bit in yesterday closing hour, but should see much more today.

-

*metals remain very weak, and the miners under severe pressure....

GDX, daily

Its starting to look real ugly for the gold bugs again.

10am update - opening minor bounce

The main indexes are holding very minor gains to start the month, with the sp' in the low 1760s. Considering the previous two days, the 1775 high looks unlikely to be breached, and renewed weakness down to the 1740/30s is highly probable within the next few days.

sp'60min

sp'monthly

Summary

*I want to note the new monthly charts, where the upper bol' has jumped to the 1790s. Clearly, by late November, the low 1800s will be viable. Perhaps we'll get to the 1830/50s in early/mid December, before some HEAVY profit taking to conclude the year.

-

Anyway...I don't expect the current minor gains to hold today...seeking weakness as the day develops. Equity bears should seek a weekly close in the 1755/45 zone, which will easily allow 1735/30 next week.

-

TSLA, minor bounce..back testing the old broken channel?

Earnings at the Tuesday close, I still think that is a $110/100 stock in the near term. One to watch!

-

10.18am. This market stinks of weakness, hourly charts offering an opening failed bounce..as expected.

Best guess, we close somewhere in the 1740s. I'm not sure if that will turn the weekly charts back to marginally bearish.

sp'60min

sp'monthly

Summary

*I want to note the new monthly charts, where the upper bol' has jumped to the 1790s. Clearly, by late November, the low 1800s will be viable. Perhaps we'll get to the 1830/50s in early/mid December, before some HEAVY profit taking to conclude the year.

-

Anyway...I don't expect the current minor gains to hold today...seeking weakness as the day develops. Equity bears should seek a weekly close in the 1755/45 zone, which will easily allow 1735/30 next week.

-

TSLA, minor bounce..back testing the old broken channel?

Earnings at the Tuesday close, I still think that is a $110/100 stock in the near term. One to watch!

-

10.18am. This market stinks of weakness, hourly charts offering an opening failed bounce..as expected.

Best guess, we close somewhere in the 1740s. I'm not sure if that will turn the weekly charts back to marginally bearish.

Pre-Market Brief

Good morning, futures are a touch higher, sp +1pt, we're set to open around 1757. Metals are weak, Gold -$10. Equity bears have a fair opportunity to knock the market somewhat lower into the weekend, the low sp'1740s look viable today.

sp'60min

Summary

Welcome to November. :)

Considering the last two days, I have to think the 1775 high will not be broken for some while now, perhaps a week or two at least.

Today should see some further selling, not least as price momentum swings increasingly to the bears. This really is the first decent opportunity of a major down close in over four weeks.

With no significant QE-pomo today, lets see what the bears can manage today!

Notable movers..

NFLX +$8 to 331

FB +80 cents to 51.00

--

sp'60min

Summary

Welcome to November. :)

Considering the last two days, I have to think the 1775 high will not be broken for some while now, perhaps a week or two at least.

Today should see some further selling, not least as price momentum swings increasingly to the bears. This really is the first decent opportunity of a major down close in over four weeks.

With no significant QE-pomo today, lets see what the bears can manage today!

Notable movers..

NFLX +$8 to 331

FB +80 cents to 51.00

--

Twenty five months... and counting

The US equity indexes closed October with net monthly gains of around 4%. It has now been over two years since the bears saw any significant downside price action. It would appear likely, there are a further 4-6 months of upside, before some degree of intermediate multi-month down wave.

sp'monthly'6b - hyper-bullish outlook

dow, monthly2, rainbow

Summary

What is there to say? Yet another bullish month, and an especially strong one.

Even the laggy Dow is starting to suggest that the last six trading months are merely a giant bull flag, and the monthly Dow chart is now offering 17500 by late spring.

Looking ahead

The week concludes with vehicle sales and ISM non-manu'' data. However, I don't think the market is going to pay much attention to either of those.

Perhaps more importantly, there is a trio of Fed printing maniacs on the loose tomorrow, whose comments might be enough to spook the market lower into the 1740s..even 30s.

*there is no sig' QE until next Monday.

--

So..another month comes to a close. I can only add, I refer anyone out there to go stare at the world equity monthly charts. I will be doing a full update on those this weekend. A further 10/15% upside into spring 2014 looks likely before the current wave concludes.

Goodnight from London

sp'monthly'6b - hyper-bullish outlook

dow, monthly2, rainbow

Summary

What is there to say? Yet another bullish month, and an especially strong one.

Even the laggy Dow is starting to suggest that the last six trading months are merely a giant bull flag, and the monthly Dow chart is now offering 17500 by late spring.

Looking ahead

The week concludes with vehicle sales and ISM non-manu'' data. However, I don't think the market is going to pay much attention to either of those.

Perhaps more importantly, there is a trio of Fed printing maniacs on the loose tomorrow, whose comments might be enough to spook the market lower into the 1740s..even 30s.

*there is no sig' QE until next Monday.

--

So..another month comes to a close. I can only add, I refer anyone out there to go stare at the world equity monthly charts. I will be doing a full update on those this weekend. A further 10/15% upside into spring 2014 looks likely before the current wave concludes.

Goodnight from London

Daily Index Cycle update

The main indexes closed moderately lower, with the sp -6pts @ 1756. The two leaders - Trans/R2K, both closed -0.5%. Equity bears look set for minor downside into early November, before much higher levels by late November, when the 1800s will be easily viable.

sp'daily5

Dow

R2K

Trans

Summary

The initial sign of an equity rollover we saw yesterday has been confirmed with today's closing daily candles.

Further downside to the sp'1730s appears a very valid target, before a renewed push higher into the 1800s.

I just can't see sub'1700 in the remainder of this year. Underlying pressure remains strongly to the upside, not least helped by continued QE of $85bn a month.

--

a little more later...

sp'daily5

Dow

R2K

Trans

Summary

The initial sign of an equity rollover we saw yesterday has been confirmed with today's closing daily candles.

Further downside to the sp'1730s appears a very valid target, before a renewed push higher into the 1800s.

I just can't see sub'1700 in the remainder of this year. Underlying pressure remains strongly to the upside, not least helped by continued QE of $85bn a month.

--

a little more later...

Subscribe to:

Comments (Atom)