With equities continuing to break new historic highs, the VIX was naturally continuing to melt lower, settling -3.0% @ 14.80. Near term outlook is for VIX 12/11s by year end. The big 20 threshold looks out of range until at least late January.

VIX'daily3

Summary

Little to add.

VIX remains in melt mode, and looks set to go sub-teens before year end.

--

more later... on the indexes

Tuesday, 23 December 2014

Closing Brief

US equities closed broadly higher for the fifth consecutive day, sp +3pts @ 2082 (intra high 2086). The two leaders - Trans/R2K, settled higher by 0.8% and +0.1% respectively. Near term outlook is for continued moderate upside to the sp'2095/2105 zone by year end.. along with VIX in the 12/11s.

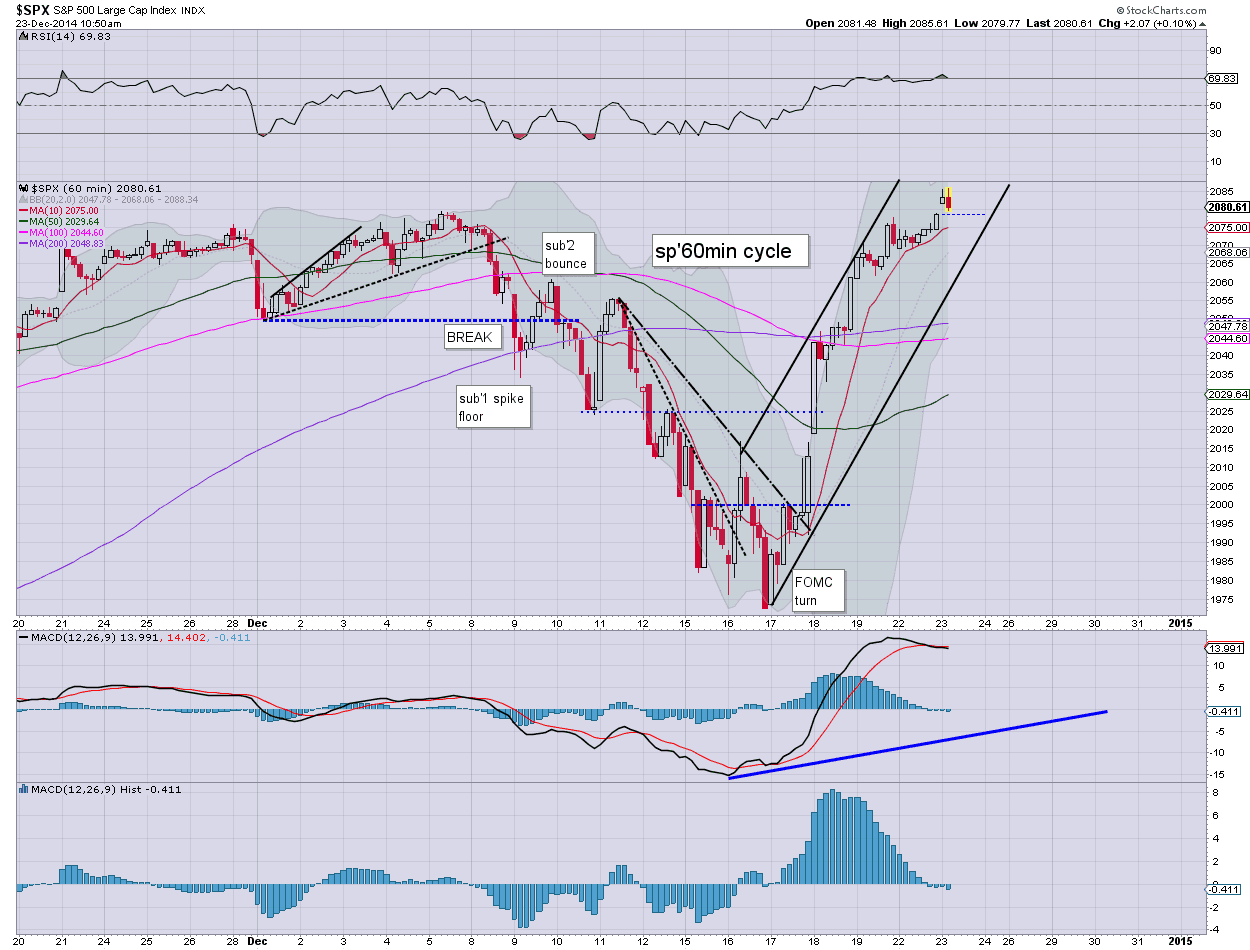

sp'60min

Summary

There is little to add, on what was a rather classic pre-holiday day of low vol' melt... not least in the more stable heavy industrials.

--

more later... on the VIX

sp'60min

Summary

There is little to add, on what was a rather classic pre-holiday day of low vol' melt... not least in the more stable heavy industrials.

--

more later... on the VIX

3pm update - just another day of gains

US equities look set to broadly close higher for the fifth consecutive day, having broken the psy' level of Dow 18k, along with a new high of sp'2086. There is probably another 0.5-1.0% of upside in the remainder of the year.

sp'60min

Summary

Another day for the bull maniacs, and it remains a case of broader melt to the upside.

--

Notable weakness: TWTR -2.1%

sp'60min

Summary

Another day for the bull maniacs, and it remains a case of broader melt to the upside.

--

Notable weakness: TWTR -2.1%

2pm update - holiday melt

The broader US equity market remains higher for a fifth day, although there is some notable weakness in the momo stocks. VIX remains cooling, -3% in the upper 14s... the 12/11s are coming before year end. Metals have managed a minor bounce, Gold +$4... but look broadly bearish.

sp'60min

GLD, daily

Summary

Not much to add.

Oil is holding gains of around 2%.... remains broadly choppy... still no definitive sign of a floor yet, although I'm content with calling a floor from last week of $53.60.

Notable weakness, TWTR -1.7%

--

back at 3pm

sp'60min

GLD, daily

Summary

Not much to add.

Oil is holding gains of around 2%.... remains broadly choppy... still no definitive sign of a floor yet, although I'm content with calling a floor from last week of $53.60.

Notable weakness, TWTR -1.7%

--

back at 3pm

12pm update - 984pts in 5 days for the mighty Dow

Today is day'5 of the latest hyper-ramp, with the mighty Dow having climbed almost a full thousand points since the Tuesday close of 17067. There looks to be another 125/150pts before year end, equating to sp'2095/2105... along with VIX 12/11s.

Dow, monthly

Summary

*I thought a brief reminder on the bigger monthly cycle would be useful for this lunch.

--

In terms of the Dow, for the equity bears.. it most pretty bad to see only 3 negative monthly closings... and only January even rated as significant.

December certainly looks set for another positive close... somewhere in the 18100s.

-

Oil is still building a floor...

USO, daily2, rainbow

The sixth blue candle.... awaiting the first green... which seems highly likely within the next few days.

--

VIX update from Mr T.

--

time for a long lunch..... back at 2pm

Dow, monthly

Summary

*I thought a brief reminder on the bigger monthly cycle would be useful for this lunch.

--

In terms of the Dow, for the equity bears.. it most pretty bad to see only 3 negative monthly closings... and only January even rated as significant.

December certainly looks set for another positive close... somewhere in the 18100s.

-

Oil is still building a floor...

USO, daily2, rainbow

The sixth blue candle.... awaiting the first green... which seems highly likely within the next few days.

--

VIX update from Mr T.

--

time for a long lunch..... back at 2pm

11am update - micro cooling

US equities are cooling a touch from the earlier highs... with the R2K set to slip under 1200. Metals are holding minor gains, Gold +$5, but looks vulnerable to closing red. Oil is holding sig' gains, +1.6%.

sp'60min

Summary

With the econ-data out of the way... market is back into micro holiday chop mode.

--

Notable strength: TCK +4.5%

Although both FCX and TCK look highly vulnerable, with Copper prices still <$3... with low $2s viable next yr.

sp'60min

Summary

With the econ-data out of the way... market is back into micro holiday chop mode.

--

Notable strength: TCK +4.5%

Although both FCX and TCK look highly vulnerable, with Copper prices still <$3... with low $2s viable next yr.

10am update - new day... new highs

US equities break new historic highs of sp'2085, along with Dow in the 18000s. VIX remains in melt mode, -4% in the mid 14s... 12/11s are due before year end. Metals are seeing minor gains, Gold +$4... but looks vulnerable to turning red this morning. Energy is mixed, Nat' gas -1.5%, whilst Oil +0.6%

R2K, daily

GLD, daily

Summary

*R2K... 1205... getting very close to breaking a new historic high.. and that will be the ultimate signal for next year.

--

re: econ-data. The revised Q3 GDP of 5.0% is clearly a much better than expected number, the best since 2003. On any basis, the US economy is doing far better than the rest of the world, which is why King $ is still King

--

Regardless of today's close.... its already been one hell of a crazy 5 day ramp from sp'1972 to 2085... 113pts...

--

Notable strength: CHK +7%... on an announced $1bn buyback... yeah... buying back stock will solve ALL their problems.

R2K, daily

GLD, daily

Summary

*R2K... 1205... getting very close to breaking a new historic high.. and that will be the ultimate signal for next year.

--

re: econ-data. The revised Q3 GDP of 5.0% is clearly a much better than expected number, the best since 2003. On any basis, the US economy is doing far better than the rest of the world, which is why King $ is still King

--

Regardless of today's close.... its already been one hell of a crazy 5 day ramp from sp'1972 to 2085... 113pts...

--

Notable strength: CHK +7%... on an announced $1bn buyback... yeah... buying back stock will solve ALL their problems.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +5pts, we're set to open at a new historic high of sp'2083, along with Dow 18000. Metals are seeing a minor bounce, Gold +$5. Energy is mixed, Nat' gas -0.4%, whilst Oil has jumped 2.0%

sp'daily4

Summary

So.. today is day'5 of this latest up cycle, and new historic highs are set to be hit.

R2K will be a mere 4/5pts shy of 1213 at the open... and that is what really matters.

--

Have a good Tuesday

sp'daily4

Summary

So.. today is day'5 of this latest up cycle, and new historic highs are set to be hit.

R2K will be a mere 4/5pts shy of 1213 at the open... and that is what really matters.

--

Have a good Tuesday

Submit your target for end 2015

US equities look set to close the year at new historic highs, with the sp'2100s and Dow 18000s. Even the R2K is set to break out after a year long of pain. Yet.. what about 2015? Its time to submit YOUR outlook for end 2015.

sp'monthly6 - scenarios for 2015

sp'weekly7, rainbow

Summary

Suffice to say... day'4 up for the US equity market. Second green candle on the weekly 'rainbow' chart... nothing bearish here!

--

Submit your outlook

I had been meaning to do this last year, but I never got around to it. With just over a full week left of the year... I'm open to taking your predictions!

Two aspects to submit (latter is optional)

Primary - 2015 year end target for sp'500. Submit a specific number, rather than a range.

Secondary - anything else you want to note, whether Dow, a commodity, individual stock, or even an economic trend. No more than a few sentences/brief notes only please!

How to submit...

The best way to submit a target (and any related notes)... is via the DISQUS comments system. If you don't yet have a DISQUS account... go get one! See HERE

You are free to email me (see CONTACT).. left column... but if you do... please let me know what 'display name' I should use, to go with your target/notes, for publishing on Jan1'st.

You could also post via Twitter.. to any of my most recent tweets.

--

Notes

1. Prize? The only prize is the prize of being more right than any of the other maniacs out there, not least yours truly!

2. I will publicly post your sp'500 target, along with your DISQUS name, Twitter handle, the website that you represent, OR any other name of your choice.

*I strongly suggest you submit via Disqus... it makes things somewhat easier for me.

--

3. You are welcome to adjust/re-submit an entry up to midnight (UK) Dec'31st 2014.

4. I aim to post the full list of entries on Thursday Jan'1st 2015, and will likely occasionally refer back to them across next year.

--

What is my target for end 2015?

Actually, I've not yet settled on a number yet, but it'll likely be higher than sp'2500. On that speculative note.....

Goodnight from London

sp'monthly6 - scenarios for 2015

sp'weekly7, rainbow

Summary

Suffice to say... day'4 up for the US equity market. Second green candle on the weekly 'rainbow' chart... nothing bearish here!

--

Submit your outlook

I had been meaning to do this last year, but I never got around to it. With just over a full week left of the year... I'm open to taking your predictions!

Two aspects to submit (latter is optional)

Primary - 2015 year end target for sp'500. Submit a specific number, rather than a range.

Secondary - anything else you want to note, whether Dow, a commodity, individual stock, or even an economic trend. No more than a few sentences/brief notes only please!

How to submit...

The best way to submit a target (and any related notes)... is via the DISQUS comments system. If you don't yet have a DISQUS account... go get one! See HERE

You are free to email me (see CONTACT).. left column... but if you do... please let me know what 'display name' I should use, to go with your target/notes, for publishing on Jan1'st.

You could also post via Twitter.. to any of my most recent tweets.

--

Notes

1. Prize? The only prize is the prize of being more right than any of the other maniacs out there, not least yours truly!

2. I will publicly post your sp'500 target, along with your DISQUS name, Twitter handle, the website that you represent, OR any other name of your choice.

*I strongly suggest you submit via Disqus... it makes things somewhat easier for me.

--

3. You are welcome to adjust/re-submit an entry up to midnight (UK) Dec'31st 2014.

4. I aim to post the full list of entries on Thursday Jan'1st 2015, and will likely occasionally refer back to them across next year.

--

What is my target for end 2015?

Actually, I've not yet settled on a number yet, but it'll likely be higher than sp'2500. On that speculative note.....

Goodnight from London

Daily Index Cycle update

US equities saw a little chop, but still closed broadly higher for the fourth consecutive day, sp +7pts @ 2078. The two leaders - Trans/R2K, settled higher by 1.0% and 0.5% respectively. Near term outlook offers a year end close in the sp'2100s.. with much higher levels (2300s) by late spring.

sp'daily5

R2K

Summary

*the R2K remains something a great many seriously need to keep in mind. Once above the July high of 1213, the R2K will just keep on pushing... and bring the rest of the market with it.

-

Not much to add. Sp'2100s are due... along with Dow 18000s....

--

a little more later...

sp'daily5

R2K

Summary

*the R2K remains something a great many seriously need to keep in mind. Once above the July high of 1213, the R2K will just keep on pushing... and bring the rest of the market with it.

-

Not much to add. Sp'2100s are due... along with Dow 18000s....

--

a little more later...

Subscribe to:

Comments (Atom)