With the main indexes closing with moderate gains, the VIX melted lower into the weekend, settling -0.8% @ 13.09. Across the week, the VIX gained 0.4%. It would seem the VIX will remain in the low/mid teens for the remainder of the year.

VIX'60min

VIX'daily3

VIX'weekly

Summary

A very quiet week for the VIX, remaining itself in a very narrow range, mostly in the 13s, with a brief spike into the low 14s.

VIX breaking back into the 20s looks very difficult in the remainder of the year.

--

more later..on the indexes

Friday, 25 October 2013

Closing Brief

The main indexes closed moderately higher, with the sp +7pts @ 1759. The two leaders - Trans/R2K, closed -0.2% and -0.1% respectively. Further upside looks very likely next week, with the 1800s most certainly viable in November.

sp'60min

Summary

*as I feared, a nasty little micro-spike higher into the close, although just shy of the 1760s.

--

Another week for the equity bulls, and for the few remaining bears out there, this remains a market to simple stay clear of.

Have a good weekend

-

*next main post, late Saturday, on the US weekly indexes

sp'60min

Summary

*as I feared, a nasty little micro-spike higher into the close, although just shy of the 1760s.

--

Another week for the equity bulls, and for the few remaining bears out there, this remains a market to simple stay clear of.

Have a good weekend

-

*next main post, late Saturday, on the US weekly indexes

3pm update - closing the week on a micro high?

The sp' is hovering just 3pts shy of breaking a new high. Will the market spite the bears into the weekly close, with a break into the 1760s? Regardless of whether we close in the 1760s, or 50s, this was the third consecutive weekly gain, and sp'1646 now looks a very long way down.

sp'weekly8

Summary

Unquestionably, the trend remains very much to the upside.

There is zero sign of a levelling/turn phase, and bulls look likely to claw into the 1760/70s next week..perhaps even higher if the market likes what the FOMC have to say.

-

There will certainly be opportunity for a turn on the weekly cycles by mid-November, but based on previous cycles, we look more likely to just keep crawling higher into mid December, before year end profit taking.

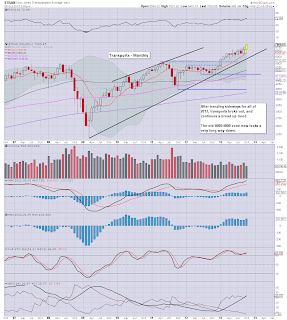

Transports is trying for a weekly close in the 7000s...

The monthly chart shows the most powerful bullish candle since January. Near term upside remains 7200/7300.

-

3.30pm....interesting chat on clown finance TV, even featuring Greenspan..urghh.

Every Friday afternoon, CNBC usually wheel out a doomer bear. I'm not sure what their game is here, but whatever it is..its laughable.

How is it no one is open to 1800s within the next week or two? We're only talking about another 3-4% higher, which is easily done across 2-3 weeks.

3.47pm..as I feared..Mr Market wants to spite the bears into the close...urghhh

3.58pm...well, almost the 1760s...nasty market!

sp'weekly8

Summary

Unquestionably, the trend remains very much to the upside.

There is zero sign of a levelling/turn phase, and bulls look likely to claw into the 1760/70s next week..perhaps even higher if the market likes what the FOMC have to say.

-

There will certainly be opportunity for a turn on the weekly cycles by mid-November, but based on previous cycles, we look more likely to just keep crawling higher into mid December, before year end profit taking.

Transports is trying for a weekly close in the 7000s...

The monthly chart shows the most powerful bullish candle since January. Near term upside remains 7200/7300.

-

3.30pm....interesting chat on clown finance TV, even featuring Greenspan..urghh.

Every Friday afternoon, CNBC usually wheel out a doomer bear. I'm not sure what their game is here, but whatever it is..its laughable.

How is it no one is open to 1800s within the next week or two? We're only talking about another 3-4% higher, which is easily done across 2-3 weeks.

3.47pm..as I feared..Mr Market wants to spite the bears into the close...urghhh

3.58pm...well, almost the 1760s...nasty market!

2pm update - more nothing

The main indexes are flat lining into the weekend, with the sp' comfortably holding the 1750s. The daily, weekly, monthly cycles remain outright bullish, and there is literally nothing in the bears favour right now. Metals are building small gains after minor opening declines, Gold +$6

sp'60min

Summary

Simply...nothing...going....on.

--

I suppose some are having a rough day, especially those who were bravely (or stupidly) shorting AMZN ahead of earnings.

-

AAPL is doing broadly okay, $600 is viable by year end, if the main market holds together, and climbs into the mid sp'1800s.

Hey, at least it makes a profit, unlike AMZN.

sp'60min

Summary

Simply...nothing...going....on.

--

I suppose some are having a rough day, especially those who were bravely (or stupidly) shorting AMZN ahead of earnings.

-

AAPL is doing broadly okay, $600 is viable by year end, if the main market holds together, and climbs into the mid sp'1800s.

Hey, at least it makes a profit, unlike AMZN.

1pm update - falling asleep into the weekend

The market remains very quiet, and despite a lack of QE, the bears are still unable to even manage a moderate decline. The weekly charts look set to close the week positive for all indexes, not surprisingly, lead by the Transports, with gains of around 2.5%

sp'60min

sp'weekly

Summary

There is little to add, on what has turned out to be a very subdued day. Rather than see a minor down wave, the market is merely churning flat to fractionally higher.

Attention is already shifting to the FOMC of next Wednesday. I think I've seen all the bases covered this week. A few suggestive QE to be cut....whilst one even offered an increase. Consensus is most definitely one of QE to remain $85bn until March..if not next summer.

Effectively...QE without end....but hey, isn't that why we called it QE infinity to begin with? Duh!

--

AMZN is holding powerful gains of 8%..and the $400s look viable...which of course is a simply insane valuation. Annual sales of $70bn or so..and they still can't make a profit.

sp'60min

sp'weekly

Summary

There is little to add, on what has turned out to be a very subdued day. Rather than see a minor down wave, the market is merely churning flat to fractionally higher.

Attention is already shifting to the FOMC of next Wednesday. I think I've seen all the bases covered this week. A few suggestive QE to be cut....whilst one even offered an increase. Consensus is most definitely one of QE to remain $85bn until March..if not next summer.

Effectively...QE without end....but hey, isn't that why we called it QE infinity to begin with? Duh!

--

AMZN is holding powerful gains of 8%..and the $400s look viable...which of course is a simply insane valuation. Annual sales of $70bn or so..and they still can't make a profit.

12pm update - did we close yet?

Market is holding the low sp'1750s, and the bears are embarrassingly finding it tough just to break moderately lower. Metals are flat, Oil is a touch higher..and baring the indexes breaking <1750, VIX will melt lower into the late afternoon.

sp'60min

sp'daily5

Summary

There is little to add, on what is becoming a very quiet day.

Bears have no downside power, and right now, the 1730s look very difficult to hit. Price formation on the daily chart is a simple F' flag, very bullish, offering the 1770/80s next week.

time for lunch

sp'60min

sp'daily5

Summary

There is little to add, on what is becoming a very quiet day.

Bears have no downside power, and right now, the 1730s look very difficult to hit. Price formation on the daily chart is a simple F' flag, very bullish, offering the 1770/80s next week.

time for lunch

11am update - bears struggling to build downside momentum

The market is due a minor retracement on any basis, yet with underlying upside pressure so strong, equity bears are struggling just to muster a minor fall to soft support at the sp'1745 level. VIX is creeping slowly higher, +1.3%.

sp'60min

Summary

It seems utterly pointless to consider an index short position, even with 'moderate' risk of 10/20pts of downside into Monday. All main cycles are bullish, and as ever...QE continues. Monday in fact will see a very large QE of $5bn.

--

*regardless of the main market, AMZN is holding its opening gains, and even building upon them.

A few were looking for AMZN to 'do a NFLX', and see a reversal, but it just doesn't look likely, for what is the most hysteria-surrounded stock in the US market.

sp'60min

It seems utterly pointless to consider an index short position, even with 'moderate' risk of 10/20pts of downside into Monday. All main cycles are bullish, and as ever...QE continues. Monday in fact will see a very large QE of $5bn.

--

*regardless of the main market, AMZN is holding its opening gains, and even building upon them.

A few were looking for AMZN to 'do a NFLX', and see a reversal, but it just doesn't look likely, for what is the most hysteria-surrounded stock in the US market.

10am update - market wants an excuse to retrace

Underlying price pressure remains strongly to the upside, but the market still feels tired, and some weakness across today looks viable. Metals are a touch weak, Gold -$3. Oil is moderately higher,+0.4%. VIX is generally flat lining in the 13s, +0.4%

sp'60min

Summary

*consumer sentiment: 73.2

--

It is unquestionably a tired market, and a retrace would be very natural right now.

Overly risky for a short-index trade, not least with ALL bigger cycles outright bullish.

As it is, the price action is highly suggestive that no one wants to buy >1759 into the weekend.

--

Meanwhile, in crazy land...

AMZN, daily

A loss making company...naturally ramping to the moon...and then Mars.

-

10.20am.. market WANTS to retrace. Even 1745 will be difficult though.

Everything is set up though for the bears across today.

sp'60min

Summary

*consumer sentiment: 73.2

--

It is unquestionably a tired market, and a retrace would be very natural right now.

Overly risky for a short-index trade, not least with ALL bigger cycles outright bullish.

As it is, the price action is highly suggestive that no one wants to buy >1759 into the weekend.

--

Meanwhile, in crazy land...

AMZN, daily

A loss making company...naturally ramping to the moon...and then Mars.

-

10.20am.. market WANTS to retrace. Even 1745 will be difficult though.

Everything is set up though for the bears across today.

Pre-Market Brief

Good morning. Futures are a touch higher, sp +2pts, we're set to open around 1754. Metals are weak, with Gold -$6. Oil is flat, whilst the USD is moderately higher, +0.2% @ 79.32. Equity bulls should be very content with any weekly close in the 1750s.

sp'60min

Summary

*we have econ-data to be mindful of, and there is no QE until next Monday.

--

So far this week, the sp is +7pts, a mere 0.4%. Clearly, the bulls should be looking for a Friday/weekly close in the 1750s, that will at least keep all the trends outright bullish.

-

Notable early movers

AMZN, $358 + 26 (8%)...and still a loss making company that pays no dividend.

MSFT, +$2 @ $35.70, on very good earnings.

ZNGA +11% in the $3.90s, but still losing money.

The 'new economy' huh?

sp'60min

Summary

*we have econ-data to be mindful of, and there is no QE until next Monday.

--

So far this week, the sp is +7pts, a mere 0.4%. Clearly, the bulls should be looking for a Friday/weekly close in the 1750s, that will at least keep all the trends outright bullish.

-

Notable early movers

AMZN, $358 + 26 (8%)...and still a loss making company that pays no dividend.

MSFT, +$2 @ $35.70, on very good earnings.

ZNGA +11% in the $3.90s, but still losing money.

The 'new economy' huh?

Equity bulls need Dow 15800s

Whilst most other indexes all continue to break new historic highs - not least with the Transports in the 7000s, the Dow continues to lag. Those equity bulls seeking broad upside into spring 2014, should have a simple target for the near term - a weekly close in the 15800s..or higher!

sp'weekly8

Dow, weekly

Trans, weekly2, rainbow

Summary

More than anything today, it was the Transports finally breaking into the 7000s that was especially impressive. Mr Carboni was the first to tout tranny @ 7k in the early spring, I followed within a month, and for you regular readers out there, you know my 'hyper-bullish' outlook has indeed included Trans' @ 7k.

Upside across November for the tranny looks to be 7200/7300, which would equate to sp' in the low 1800s. Certainly, sp'1900s do not look viable until at least December - if briefly, before some very understandable year end profit taking.

Dow 15800s, then 16k...and 20k-moonshot?

I have to think that if we see the Dow get a weekly close in the 15800s - which certainly looks viable this November, 16k will be quickly hit, and then the door is wide open to 20,000..as soon as late spring 2014. That would shock the equity bulls, even the cheer leading deluded maniacs on clown finance TV.

Looking ahead

There is a little trio of econ-data to conclude the week. Most importantly, we have Durable Goods Orders. There is also consumer sentiment and wholesale trade. If either of those come in a touch disappointing, it will give Mr Market the excuse it probably wants to sell lower.

*next sig' QE-pomo is next Monday.

--

There remains a moderate chance of a further minor down wave to the sp'1735/30 zone tomorrow. No doubt, that will merely be seen as a buying opportunity, and the market will quickly rebound, and climb across next week.

Goodnight from London

--

Video update from Oscar

--

Video update from Walker

--

*tech help of the day*

I use Mozilla Thunderbird email client. Lately, I don't get notifications of new mail, which is VERY annoying. I can't keep checking my inbox manually every 5-10mins.

Solution. Search add-ons for 'new mail attention 1.2.1'. Install it. When you next get new email, that will light up the taskbar icon for Thunderbird. I just thought a few of you out there might find that useful.

--

sp'weekly8

Dow, weekly

Trans, weekly2, rainbow

Summary

More than anything today, it was the Transports finally breaking into the 7000s that was especially impressive. Mr Carboni was the first to tout tranny @ 7k in the early spring, I followed within a month, and for you regular readers out there, you know my 'hyper-bullish' outlook has indeed included Trans' @ 7k.

Upside across November for the tranny looks to be 7200/7300, which would equate to sp' in the low 1800s. Certainly, sp'1900s do not look viable until at least December - if briefly, before some very understandable year end profit taking.

Dow 15800s, then 16k...and 20k-moonshot?

I have to think that if we see the Dow get a weekly close in the 15800s - which certainly looks viable this November, 16k will be quickly hit, and then the door is wide open to 20,000..as soon as late spring 2014. That would shock the equity bulls, even the cheer leading deluded maniacs on clown finance TV.

Looking ahead

There is a little trio of econ-data to conclude the week. Most importantly, we have Durable Goods Orders. There is also consumer sentiment and wholesale trade. If either of those come in a touch disappointing, it will give Mr Market the excuse it probably wants to sell lower.

*next sig' QE-pomo is next Monday.

--

There remains a moderate chance of a further minor down wave to the sp'1735/30 zone tomorrow. No doubt, that will merely be seen as a buying opportunity, and the market will quickly rebound, and climb across next week.

Goodnight from London

--

Video update from Oscar

--

Video update from Walker

--

*tech help of the day*

I use Mozilla Thunderbird email client. Lately, I don't get notifications of new mail, which is VERY annoying. I can't keep checking my inbox manually every 5-10mins.

Solution. Search add-ons for 'new mail attention 1.2.1'. Install it. When you next get new email, that will light up the taskbar icon for Thunderbird. I just thought a few of you out there might find that useful.

--

Daily Index Cycle update

The main indexes closed with moderate gains, with the sp +5pts to 1752. The two leaders - Trans/R2K, managed gains of 0.9% and 0.7% respectively. Near term trend remains very much to the upside, with the sp'1800s comfortably viable in November.

sp'daily5

R2K

Trans

Summary

Most notable today, the Transports breaking into the 7000s.

Again, I'd have to note that it was Mr Permabull, who was the first in the mainstream (that I know of) to tout the 7000s. Oscar was suggesting that target very early this year. Good call Mr Carboni!

--

Primary trend remains bullish on the daily, weekly, and monthly index cycles. There is simply nothing for the bears to get excited about. I realise many are looking at 1759 as a top, but frankly, those same people were calling the same thing at sp'1576, 1600, 1650....etc.

With QE continuing, the broad upward trend looks set to continue into spring 2014.

a little more later..

sp'daily5

R2K

Trans

Summary

Most notable today, the Transports breaking into the 7000s.

Again, I'd have to note that it was Mr Permabull, who was the first in the mainstream (that I know of) to tout the 7000s. Oscar was suggesting that target very early this year. Good call Mr Carboni!

--

Primary trend remains bullish on the daily, weekly, and monthly index cycles. There is simply nothing for the bears to get excited about. I realise many are looking at 1759 as a top, but frankly, those same people were calling the same thing at sp'1576, 1600, 1650....etc.

With QE continuing, the broad upward trend looks set to continue into spring 2014.

a little more later..

Subscribe to:

Comments (Atom)