Whilst US equities closed moderately mixed, the VIX remained broadly subdued (intra high 16.44), and settling -1.3% @ 14.74. Across the week, the VIX gained 5.1%. The key 20 threshold looks viable late next week/early April.

VIX'60min

VIX'daily3

VIX'weekly

Summary

*note the opening black-fail candle on the hourly chart. Those are often warnings of equity downside exhaustion.

--

It was not surprising to see early VIX gains evaporate into the close, not least because of the long 3 day holiday weekend.

A retrace to the low 14s.. even 13s, seems due next Mon/Tuesday, before the next surge, back to around the key 20 threshold.

*it is highly notable, that the weekly MACD (blue bar histogram) cycle is now on the extremely low side. At the current rate, a bullish cross is not viable for at least 4-5 weeks.

By default, 'hyper VIX upside' to the 40s.. or 50s, appears possible no earlier than May.

--

more later.. on the indexes

Thursday, 24 March 2016

Closing Brief

US equity indexes closed moderately mixed, sp -0.8pts @ 2035 (intra low 2022). The two leaders - Trans/R2K, settled -0.4% and +0.3% respectively. Near term outlook threatens a bounce to the 2045/55 zone, but a break above the recent high of 2056 looks overly difficult. First soft downside target is the 1960/50 zone.

sp'60min

Summary

*closing hour action: micro chop, but leaning to the upside.

--

... and another (if short) week comes to a close.

Pretty subdued overall, and its been a fair while since we've seen any dynamic price action.

All US indexes look stuck at what are multiple aspects of resistance.

--

Best guess... regardless of any Mon/Tuesday upside, the market looks to have maxed out at sp'2056.

If correct, its just a matter of how many days it takes to test the 50dma/lower daily bollinger.. whether next week.. or early April.

--

Have a good holiday/Easter weekend!

--

*the usual bits and pieces across the evening.. to wrap up the week.

sp'60min

Summary

*closing hour action: micro chop, but leaning to the upside.

--

... and another (if short) week comes to a close.

Pretty subdued overall, and its been a fair while since we've seen any dynamic price action.

All US indexes look stuck at what are multiple aspects of resistance.

--

Best guess... regardless of any Mon/Tuesday upside, the market looks to have maxed out at sp'2056.

If correct, its just a matter of how many days it takes to test the 50dma/lower daily bollinger.. whether next week.. or early April.

--

Have a good holiday/Easter weekend!

--

*the usual bits and pieces across the evening.. to wrap up the week.

3pm update - melting into the Easter holiday

US equities remain in micro chop mode, with the hourly cycle swinging back toward the equity bulls. Indeed, the sp'2040s look very viable next Mon/Tuesday. Regardless of the exact close, all US indexes are set for the first net weekly decline in six weeks.

sp'60min

sp'weekly1b

Summary

Little to add.

Interesting week... congrats to those who managed to stay awake for much of it!

-

notable weakness, Seagate (STX), 5.4%.. and I've no idea why.

-

back at the close

sp'60min

sp'weekly1b

Summary

Little to add.

Interesting week... congrats to those who managed to stay awake for much of it!

-

notable weakness, Seagate (STX), 5.4%.. and I've no idea why.

-

back at the close

2pm update - battling to push upward

US equities remain weak, but the hourly MACD cycle is highly suggestive of a short term floor of sp'2022, along with VIX 16.44. Upside across next Monday/Tuesday morning looks probable, back to the 2040s, with VIX 14s, before next rollover.

sp'60min

VIX'60min

Summary

It sure is pretty quiet out there... but then, that is as it should be.

There is little to add... other than its notable that Oil is clawing upward from the earlier low of $38.33, currently -0.8%.

-

back at 3pm

sp'60min

VIX'60min

Summary

It sure is pretty quiet out there... but then, that is as it should be.

There is little to add... other than its notable that Oil is clawing upward from the earlier low of $38.33, currently -0.8%.

-

back at 3pm

1pm update - moderate weak chop

US equities remain moderately choppy in the sp'2020s, with VIX 15s. USD is +0.1% in the DXY 96.10s. Metals are mixed, Gold +$1, with Silver -0.2%. Oil remains broadly weak, -1.5% in the $38s.

sp'60min

UUP, weekly

Summary

*a notable strong week for the USD, with the Euro looking very vulnerable to imploding this summer, but more on that later.

--

With 3 hours left of the trading week.. price action remains highly inclined to be increasingly subdued, and that will favour the bulls.

There seems fair chance of a bounce to the 2040s next Mon/Tuesday, and would appear to be a very good short level indeed.

--

notable weakness, BA, daily

The big issue is whether the low of $102 will be taken out, if so... next level is not until 75/74.

Do the math for the Dow/sp'500... Hmmmm

--

back at 2pm :)

sp'60min

UUP, weekly

Summary

*a notable strong week for the USD, with the Euro looking very vulnerable to imploding this summer, but more on that later.

--

With 3 hours left of the trading week.. price action remains highly inclined to be increasingly subdued, and that will favour the bulls.

There seems fair chance of a bounce to the 2040s next Mon/Tuesday, and would appear to be a very good short level indeed.

--

notable weakness, BA, daily

The big issue is whether the low of $102 will be taken out, if so... next level is not until 75/74.

Do the math for the Dow/sp'500... Hmmmm

--

back at 2pm :)

12pm update - grey skies to end the week

US equities remain moderately weak, sp -9pts @ 2026. Cyclically, we're still due a bounce, but with each passing hour, the recent high of 2056 is more likely a key mid term high. VIX remains 'relatively' subdued, +4% in the 15s. The key 20 threshold looks viable next week.

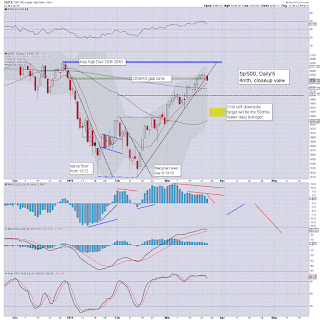

sp'daily5

VIX'daily3

Summary

*note the upper daily bollinger for the VIX, across next week, that will be around the key 20 threshold.

--

So.. we're still weak, and with a 3 day holiday ahead, price action will be increasingly subdued this afternoon.

Q. How spooked will the cheerleaders on clown finance TV be, with a third consecutive net daily decline?

-

Here in London city

Not an inspiring way to lead into 'Good Friday', rainy, and zero sunshine.

--

time for lunch :)

sp'daily5

VIX'daily3

Summary

*note the upper daily bollinger for the VIX, across next week, that will be around the key 20 threshold.

--

So.. we're still weak, and with a 3 day holiday ahead, price action will be increasingly subdued this afternoon.

Q. How spooked will the cheerleaders on clown finance TV be, with a third consecutive net daily decline?

-

Here in London city

|

| Bear market remains under construction |

Not an inspiring way to lead into 'Good Friday', rainy, and zero sunshine.

--

time for lunch :)

11am update - cyclically set to bounce

US equities remain moderately weak, but the smaller hourly cycle is on the very low side, and we're set to recover (if choppy) into the weekly close, and probably across Monday/early Tuesday. What is now rather exciting is if the next up cycle merely puts in a marginally lower high <2056.

sp'60min

VIX'60min

Summary

*again, note the opening black-fail candle in the VIX. Considering the holiday, and the hourly MACD cycle, we're set to see the VIX cool back to the 14s.

--

Suffice to add.. its been a somewhat interesting few days. Now its a case of where we close the month. The monthly 10MA stands at 2016, and I'd prefer a close under that.

Even if we're 2040s next Tuesday lunch time (when the Yellen will appear), it won't take much to get to 2015/2005 by the Thursday/March close.

--

time to shop...back soon

sp'60min

VIX'60min

Summary

*again, note the opening black-fail candle in the VIX. Considering the holiday, and the hourly MACD cycle, we're set to see the VIX cool back to the 14s.

--

Suffice to add.. its been a somewhat interesting few days. Now its a case of where we close the month. The monthly 10MA stands at 2016, and I'd prefer a close under that.

Even if we're 2040s next Tuesday lunch time (when the Yellen will appear), it won't take much to get to 2015/2005 by the Thursday/March close.

--

time to shop...back soon

10am update - opening weakness

US equity indexes open broadly lower, with the sp' having now cooled from 2056 to the 2020s. The bigger daily/weekly cycles are looking maxed out. Metals are somewhat struggling, Gold +$1, with Silver +0.3%. Oil remains under increasing pressure, -3% in the mid $38s.

sp'weekly1b

VIX'60min

Summary

*note the VIX hourly candle.... a black-fail... considering we have a 3 day break ahead... its a probable opening exhaustion high. Equity bears... beware.

--

PMI serv' sector: 51.0 (prev' 49.8), arguably 'okay', but neither is it anything for the econ' bulls to get excited about.

--

Even if there is a latter day recovery, its still looking like we'll get our first net weekly decline in six weeks.

Any bounce next Mon/Tuesday will likely result in a marginally lower high <2056.... one to short into.

--

notable weakness... FCX, daily

Again, its a case where any moderately lower open in the broader market leads to the 'junk' getting smashed.

sp'weekly1b

VIX'60min

Summary

*note the VIX hourly candle.... a black-fail... considering we have a 3 day break ahead... its a probable opening exhaustion high. Equity bears... beware.

--

PMI serv' sector: 51.0 (prev' 49.8), arguably 'okay', but neither is it anything for the econ' bulls to get excited about.

--

Even if there is a latter day recovery, its still looking like we'll get our first net weekly decline in six weeks.

Any bounce next Mon/Tuesday will likely result in a marginally lower high <2056.... one to short into.

--

notable weakness... FCX, daily

Again, its a case where any moderately lower open in the broader market leads to the 'junk' getting smashed.

Pre-Market Brief

Good morning. US equity futures are moderately lower, sp -9pts, we're set to open at 2027. USD is +0.2% in the DXY 96.20s. Metals are bouncing, Gold +$1, with Silver +0.5%. Oil is -1.8% in the $39s.

sp'60min

Summary

With further weakness, we'll break rising trend on the sp' hourly chart... and that does greatly increase the probability that 2056 was a key mid term high.

In any case... a long weekend is almost here.

*I see a post from Armstrong that the NYSE 'closes early Friday at 1pm. That is incorrect. The US and almost all markets are closed tomorrow for 'Good Friday'.

Further, most of the EU markets are closed on Monday too, but US will be open.

--

Cyclically, we're on the very low side of the MACD cycle, and will still be due for a bounce into this afternoon, and early next week.

-

Update from Mr C.

Failed head test? Certainly sp'2056 is within the zone where such a formation would be expected to max out.

sp'weekly8e - H/S

... and that is indeed effectively what Mr C' is suggesting. A simple extrapolation would give sp'1600 or so within 2 months or so.

--

Overnight action

Japan: -0.6% @ 16892

China: very weak into the close, -1.6% @ 2960

Germany: currently -1.4% @ 9885

--

Have a good Thursday

-

8.52am.. Durable goods orders, m/m, -2.8%... not good at all.

sp -12pts. 2024.

Oil -2.8%... the $38s are looming, and that really makes the 43s difficult next week.

sp'60min

Summary

With further weakness, we'll break rising trend on the sp' hourly chart... and that does greatly increase the probability that 2056 was a key mid term high.

In any case... a long weekend is almost here.

*I see a post from Armstrong that the NYSE 'closes early Friday at 1pm. That is incorrect. The US and almost all markets are closed tomorrow for 'Good Friday'.

Further, most of the EU markets are closed on Monday too, but US will be open.

--

Cyclically, we're on the very low side of the MACD cycle, and will still be due for a bounce into this afternoon, and early next week.

-

Update from Mr C.

Failed head test? Certainly sp'2056 is within the zone where such a formation would be expected to max out.

sp'weekly8e - H/S

... and that is indeed effectively what Mr C' is suggesting. A simple extrapolation would give sp'1600 or so within 2 months or so.

--

Overnight action

Japan: -0.6% @ 16892

China: very weak into the close, -1.6% @ 2960

Germany: currently -1.4% @ 9885

--

Have a good Thursday

-

8.52am.. Durable goods orders, m/m, -2.8%... not good at all.

sp -12pts. 2024.

Oil -2.8%... the $38s are looming, and that really makes the 43s difficult next week.

WTIC oil - unable to hold $40

Most notable today, price action in WTIC oil, which battled hard to hold the $40 threshold, but fell apart in the afternoon, settling -$1.43 (3.5%) at $39.79. On any fair outlook, Oil is close to a key mid term top, and looks set for renewed broad downside into the summer, as the over-supply issue remains entirely unresolved.

WTIC, weekly2

WTIC, daily

Summary

Note the current green candle on the weekly cycle, still indicative of broader upside. Weekly upper' bol is in the $44s... but will cool to the $43s next week.

The daily cycle offers clear resistance at the 200dma in the mid $42s

Regardless of near term price action, the bigger issue is one of over-supply. That has not in any way been resolved.. and thus I am seeking new multi-year lows in the months ahead.

I'd argue its not whether we'll see WTIC Oil in the teens, but for how many days, weeks.. or even months, will it trade there?

--

As for equities...

sp'weekly6

The equity bears can start getting mildly excited once we see the first blue candle. As was the case from Nov-Dec', before <1810, price action will likely see a fair few swings (across 3-5 weeks) before a break of the Feb'11 low of 1810.

In any case, first downside target (via daily charts) is the 50dma/lower daily bollinger. In early April, that will be in the sp'1950/60s.

--

Looking ahead

Thursday will see the weekly jobs, and Durable goods orders.

With Friday CLOSED, expect increasingly minor chop into the late afternoon, and such light action generally favours the equity bulls.

*Fed official Bullard will be speaking, and Mr Market will be listening, as chatter of a 'Yellen revolt' increases.

--

Goodnight from London

WTIC, weekly2

WTIC, daily

Summary

Note the current green candle on the weekly cycle, still indicative of broader upside. Weekly upper' bol is in the $44s... but will cool to the $43s next week.

The daily cycle offers clear resistance at the 200dma in the mid $42s

Regardless of near term price action, the bigger issue is one of over-supply. That has not in any way been resolved.. and thus I am seeking new multi-year lows in the months ahead.

I'd argue its not whether we'll see WTIC Oil in the teens, but for how many days, weeks.. or even months, will it trade there?

--

As for equities...

sp'weekly6

The equity bears can start getting mildly excited once we see the first blue candle. As was the case from Nov-Dec', before <1810, price action will likely see a fair few swings (across 3-5 weeks) before a break of the Feb'11 low of 1810.

In any case, first downside target (via daily charts) is the 50dma/lower daily bollinger. In early April, that will be in the sp'1950/60s.

--

Looking ahead

Thursday will see the weekly jobs, and Durable goods orders.

With Friday CLOSED, expect increasingly minor chop into the late afternoon, and such light action generally favours the equity bulls.

*Fed official Bullard will be speaking, and Mr Market will be listening, as chatter of a 'Yellen revolt' increases.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed broadly weak, sp -13pts @ 2036. The two leaders

- Trans/R2K, settled lower by -0.7% and -2.0% respectively. Considering

the 3 day holiday weekend ahead, and the smaller hourly MACD cycle,

there is significant threat of renewed upside into early next week.

sp'daily5

NYSE comp'

R2K

Summary

sp'500 - break of rising trend... a viable key top of 2056. Underlying MACD (blue bar histogram) cycle set to turn negative no later than next Mon/Tuesday.

NYSE comp' - stuck at the 200dma....highly representative of the main market, which still looks set for renewed broad downside into the summer.

R2K, maxed out from 1103.. just a trio of points above the key 1100 threshold.... with a very sig' daily decline of around -2.0%.

--

a little more later...

sp'daily5

NYSE comp'

R2K

Summary

sp'500 - break of rising trend... a viable key top of 2056. Underlying MACD (blue bar histogram) cycle set to turn negative no later than next Mon/Tuesday.

NYSE comp' - stuck at the 200dma....highly representative of the main market, which still looks set for renewed broad downside into the summer.

R2K, maxed out from 1103.. just a trio of points above the key 1100 threshold.... with a very sig' daily decline of around -2.0%.

--

a little more later...

Subscribe to:

Comments (Atom)