It was a very mixed month for world equity indexes, with net changes ranging from +6.3% (Brazil), +0.8% (USA - Dow), to -16.2% (Greece). All markets remain highly vulnerable to renewed sharp downside of 20-25%. However, there is no doubt the central banks will be standing by to heavily intervene.

Lets take our monthly look at ten of the world equity markets

USA -Dow

It was a pretty dynamic month for the mighty Dow, swinging from a low of 17063, but settling +142pts (0.8%) to 17929. The 18k threshold remains powerful resistance, with 17K as core support. The monthly bollinger bands are relatively tight at 16372/18606.

As of the July 1st open, underlying MACD (green bar histogram) cycle has ticked higher for a fifth consecutive month, but remains negative. Equity bulls are likely going to need >18200 to attain a bullish cross.

A failure to keep pushing higher, will result in yet another rollover, with an eventual break <17k. From there, next target is the Aug'2015 low 15370. Any monthly close <15300, will open up capitulation within the 13500/12500 zone.

Best guess: considering repeated failures by the equity bull maniacs across the last year, renewed downside looks far more probable than an upside break. The 16000s should be seen in July, with 15-14k in Aug-Sept.

There is no question that the Fed would cut rates and spool up the printers if world capital markets are seriously upset at any point in the rest of this year. However, equity bears should have a realistic (if brief) opportunity to trade a broad market drop of 20-25%.

--

Germany - DAX

The economic powerhouse of the EU - Germany, struggled in June, with a net decline of -582pts (5.7%) to 9680, notably under the key 10MA. Upside resistance in July will be around 10500. A break <9200 will open up a swift drop to around 8K.

Japan - Nikkei

Despite continued support from the BoJ, the Nikkei had a rough month, settling -1659pts (9.6%) to 15575. Further downside to the 13-12k zone looks due, which if correct, bodes very bearish for other world markets.

China - Shanghai comp'

It was a third consecutive relatively muted month for the Chinese market, net higher by just 12pts (0.4%) at 2929. Equity bulls need a July close in the 3100s to become confident, whilst facing viable downside to the 2500/2300 zone.

Brazil - Bovespa

The Brazilian market saw a strong rebound in June, settling +3055pts (6.3%) at 51526. However, equity bulls can't get confident until the 55000s. There are continually building economic/societal problems in Brazil. Even if the Olympics proceed without any significant problems, once that event is over, the reality of an economy in deep recession will still need to be addressed.

Russia - RTSI

The Russian market remains firmly stuck under the giant psy' level of 1K, settling +24pts (2.7%) at 930. If energy prices cool across the summer - as seems probable, downside to the 700s will be due.

UK - FTSE

The BREXIT outcome shocked the UK market, with an intra low of 5788, but then rebounding, to settle with a net June gain of 273pts (4.4%) to 6504. The June close was the highest since Aug'2015. The monthly candle is arguably the most bullish seen since Oct'1998.

With a July 1st gain of 1.1%, underlying MACD (green bar histogram) cycle has turned positive for the first time since May'2015. Equity bears should be desperate for a July close <6200. First target for the inflationary bull maniacs should be a monthly close >7K, which looks at least 2-3 months away.

As for BREXIT implications (and there are many for the UK and wider EU), the vote has already spooked the Bank of England, with Carney threatening a rate cut and renewed QE to 'protect' the UK economy from what many see as an inevitable recession by early 2017.

France - CAC

The French market settled -268pts (5.9%) at 4237. Further downside to the 3500/200 zone looks probable. Equity bulls should be seeking a July/August close >4500, but that looks very difficult.

Spain - IBEX

A very rough month for the ugliest of the EU PIIGS - Spain, settling -870pts (9.6%) at 8163. The Spanish market has lost around a third of its value since summer 2015, having been unable to clear the 12k threshold. If world equity markets unravel, the IBEX will trade lower to at least 6k, and that is another 27% lower.

Greece - Athex

The economic/societal basket case that is Greece, saw a massive June decline, settling -104pts (16.2%) at 542, negating much of the previous three months of gains. Further downside seems probable, with the Feb' low of 420 very vulnerable to being taken out. As most should recognise by now, the Greek economy remains in a depression. A return to the Drachma is a given.. the only issue is when.

--

Summary

A very mixed month for world equity markets.

Despite a significant recovery across the last three days of June, many equity markets still closed June significantly net lower.

All world markets remain at least somewhat below historic highs. Some, notably - Russia, Japan, Spain and Greece, remain immensely lower.

Most world markets are holding within broader downward trends from spring/summer 2015, even the relatively strong economy/market of Germany.

---

Looking ahead

A short trading week, but a very important one...

M - CLOSED

T - Factory orders

W - intl' trade, PMI/ISM serv', FOMC mins (2pm)

T - ADP jobs, weekly jobs, EIA report

F - monthly jobs, consumer credit

Market is expecting monthly job gains of around 180k, after last month's abysmal 38k. That does seem overly optimistic, and I'd expect a number around 90-110k. Even if the number is indeed lousy again, how the market reacts to it... very hard to foresee.

There is always the twisted scenario that 'bad news is good news', in that rates would be seen as not rising any time soon. Of course, that is not good for the financials.

*the week is light on fed officials, and nothing of significance is expected.

--

If you have valued my posts across the last four years, you can support me via a subscription, which will give you access to my relentless intraday postings.

Enjoy the long holiday weekend.

Happy birthday America, 240 years young, and only 19.3 trillion in debt !

--

*the next post on this page will be Tuesday @ 7pm EST

Saturday, 2 July 2016

Seventeen arguable failures

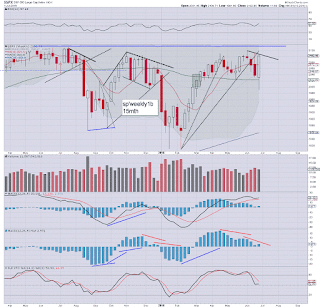

Despite a net weekly gain for the sp'500 of 65pts (3.2%) to 2102, a look across the last year should make it clear... the bull maniacs are still unable to break up and away. There have arguably been seventeen failures since the May 2015 high of sp'2134.

sp'daily1b - failures

sp'weekly1b

Summary

I can understand if you'd dismiss some of the cycle peaks, but we've had at least a clear dozen failures.

Those bull maniacs who still believe we are in a bull market.... err... no.

However, equity bears can't claim we're in a bear market either, as a fair number of the main US indexes remain close to historic highs.

--

re: weekly1b: consider the underlying MACD (blue bar histogram) cycle. The pattern is similar to mid December 2015. If it repeats, next week should close at least moderately net lower, with more powerful downside the week of July 11-15. It is notable that the lower bollinger will be in the 1970/60s next week.

--

Market/Gold chatter from Schiff

--

Thanks for the many comments/emails this week, it is always good to hear from you.

Goodnight from London

--

*the weekend post will appear Sat' at 12pm EST, and will detail the world monthly indexes.

sp'daily1b - failures

sp'weekly1b

Summary

I can understand if you'd dismiss some of the cycle peaks, but we've had at least a clear dozen failures.

Those bull maniacs who still believe we are in a bull market.... err... no.

However, equity bears can't claim we're in a bear market either, as a fair number of the main US indexes remain close to historic highs.

--

re: weekly1b: consider the underlying MACD (blue bar histogram) cycle. The pattern is similar to mid December 2015. If it repeats, next week should close at least moderately net lower, with more powerful downside the week of July 11-15. It is notable that the lower bollinger will be in the 1970/60s next week.

--

Market/Gold chatter from Schiff

--

Thanks for the many comments/emails this week, it is always good to hear from you.

Goodnight from London

--

*the weekend post will appear Sat' at 12pm EST, and will detail the world monthly indexes.

Subscribe to:

Comments (Atom)