WIth equities closing broadly higher for a third day, the VIX continued to melt lower (intra low 13.55), settling -6.4% @ 13.63, the lowest close since Apr'27th. Near term outlook is borderline, as equity price action remains bullish in the near term, and that threatens VIX 12s.

VIX'60min

VIX'daily3

Summary

As equities have rallied from sp'2039 to 2084, the VIX has been ground down from the 16s to the 13s.

Considering a great many aspects of uncertainty, front month.. and 2nd/3rd month volatility remain at bizarrely low levels.

VIX should be sustainably above the key 20 threshold by end month, but for the moment.. its firmly stuck in the mid/low teens.

--

more later... on the indexes

Tuesday, 10 May 2016

Closing Brief

US equity indexes closed broadly higher for a third consecutive day, sp +25pts @ 2084. The two leaders - Trans/R2K, settled higher by 1.2% and 0.9% respectively. Near term outlook is extremely borderline, but clearly.. leaning bullish, as the 2100 threshold is within striking distance.

sp'60min

Summary

*closing hour action: a new intra high, and absolutely ZERO sign of a ceiling/turn.

Upper hourly bollinger will be 2090/92 at the Wed' open, with the key 2100 threshold easily within range.

--

So, a third day higher, and the Friday low of 2039 is now a clear 2% lower.

That sure doesn't exclude the possibility we still close net lower on the week, but it will be damn difficult. Where will the catalyst come from to kick the market significantly back lower?

Cyclically, we're due a down cycle tomorrow.. and one that should stretch into Thursday.

However, until we're back under the price cluster zone of 2050.. and more so.. the Friday low of 2039, equity bears should be seriously spooked right now.

I sure am.

--

Awaiting earnings from Disney (DIS)....

4.16pm... $1.36 vs. 1.40 exp

Rev. 12.97 vs 13.19 exp.

So.. its a marginal miss... but Mr Market is provisionally annoyed.. with DIS -6% in the $99s.... and that takes out a fair few aspects of support.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: a new intra high, and absolutely ZERO sign of a ceiling/turn.

Upper hourly bollinger will be 2090/92 at the Wed' open, with the key 2100 threshold easily within range.

--

So, a third day higher, and the Friday low of 2039 is now a clear 2% lower.

That sure doesn't exclude the possibility we still close net lower on the week, but it will be damn difficult. Where will the catalyst come from to kick the market significantly back lower?

Cyclically, we're due a down cycle tomorrow.. and one that should stretch into Thursday.

However, until we're back under the price cluster zone of 2050.. and more so.. the Friday low of 2039, equity bears should be seriously spooked right now.

I sure am.

--

Awaiting earnings from Disney (DIS)....

4.16pm... $1.36 vs. 1.40 exp

Rev. 12.97 vs 13.19 exp.

So.. its a marginal miss... but Mr Market is provisionally annoyed.. with DIS -6% in the $99s.... and that takes out a fair few aspects of support.

--

more later... on the VIX

3pm update - a musically hellish closing hour

US equities are set for a third consecutive net daily gain, with the sp' due to settle within the 2085/75 zone... along with VIX 13s. USD is set for a sixth daily gain, +0.1% in the DXY 94.20s. Metals have built moderate gains, Gold +$6, with Silver +1.1%. Oil is really helping the market mood, +2.9% in the $44s.

sp'daily5

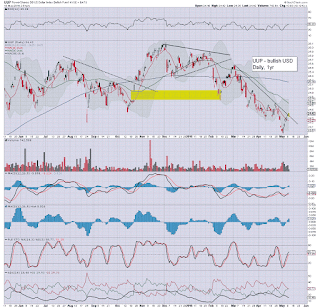

UUP daily

Summary

Well... 2081... the gap zone is fully filled, as Mr Market is either teasing the equity bulls (how many times is that since May 2015?)... or the bears are only just starting to feel the real pain.

For those short on margin... or time/stat' decay via options/leverage... it feels like the worse day in some months.

--

notable strength: DIS, +0.9% in the $106s... with earnings due at the close.

-

Meanwhile... for those utterly bored, or who just want a glimpse of the dying EU, you'll find no better example than.......

Ahh.. so it won't play via embedded video, instead....... just hit the YT link if you want to see some real horror.

--

back at the close

sp'daily5

UUP daily

Summary

Well... 2081... the gap zone is fully filled, as Mr Market is either teasing the equity bulls (how many times is that since May 2015?)... or the bears are only just starting to feel the real pain.

For those short on margin... or time/stat' decay via options/leverage... it feels like the worse day in some months.

--

notable strength: DIS, +0.9% in the $106s... with earnings due at the close.

-

Meanwhile... for those utterly bored, or who just want a glimpse of the dying EU, you'll find no better example than.......

Ahh.. so it won't play via embedded video, instead....... just hit the YT link if you want to see some real horror.

--

back at the close

2pm update - stuck at core resistance

US equities are holding significant gains, but are notably stuck at what is a pretty important resistance area of sp'2080. VIX remains extremely subdued, -5.5% in the 13.70s. Metals are leaning to the upside, Gold +$3, with Silver +0.8%. Oil +2.3% in the $44s.

sp'60min

Summary

Well... its clearly borderline.

Equity bulls have built a ramp from 2039 to 2079.. 40pts (2%)... either its just another bounce.. or 2039 was a key low.. and we're headed higher for rest of the week.

As things are, equity bears can't get remotely calm again until a break back <2050.. if not breaking an actual new low <2039.

--

notable movers... retail...

CROX, daily - post earnings ramp

GPS, daily - post earnings upset

--

stay tuned!

sp'60min

Summary

Well... its clearly borderline.

Equity bulls have built a ramp from 2039 to 2079.. 40pts (2%)... either its just another bounce.. or 2039 was a key low.. and we're headed higher for rest of the week.

As things are, equity bears can't get remotely calm again until a break back <2050.. if not breaking an actual new low <2039.

--

notable movers... retail...

CROX, daily - post earnings ramp

GPS, daily - post earnings upset

--

stay tuned!

1pm update - who wants to chase AMZN at $700 ?

Whilst US equity indexes are holding borderline significant gains of almost 1%, one of the remaining intact momo stocks - Amazon (AMZN), breaks a new historic high of $701.42. Not surprisingly, one of the infamous cheerleaders on clown finance TV felt compelled to chase it.

AMZN, monthly (linear scale)

Ms' link is a buyer

Summary

So.. Ms. S' Link on CNBC.. whom has always riled me up with her eyes straight to camera 'buy buy buy'.. is now chasing AMZN from the $700s.. with sp'2070/80s, and VIX 13s.

Go check a few of the basic stats for AMZN @ Yahoo! finance

How does a PE in the 70s sound?

There is no dividend of course.. and the net profit margin is under 1%.

Almost any of the Dow components would be infinately better.. but no.... she went for AMZN.

--

As for the main market...

sp'60min

Clearly.. there is a great deal of resistance around current levels. Considering current price action, it'd seem the bull maniacs will hold the rising trend (>2070) into the close.

AMZN, monthly (linear scale)

Ms' link is a buyer

Summary

So.. Ms. S' Link on CNBC.. whom has always riled me up with her eyes straight to camera 'buy buy buy'.. is now chasing AMZN from the $700s.. with sp'2070/80s, and VIX 13s.

Go check a few of the basic stats for AMZN @ Yahoo! finance

How does a PE in the 70s sound?

There is no dividend of course.. and the net profit margin is under 1%.

Almost any of the Dow components would be infinately better.. but no.... she went for AMZN.

--

As for the main market...

sp'60min

Clearly.. there is a great deal of resistance around current levels. Considering current price action, it'd seem the bull maniacs will hold the rising trend (>2070) into the close.

12pm update - chop in the gap

US equities are holding broad gains, with the sp'500 naturally seeing some distinct price chop in the gap zone of 2081/77. VIX is naturally under pressure, -5% in the 13s. Metals remain mixed, with Gold -$3, whilst Silver +0.6%. Oil is +2.2% in the $44s.

sp'60min

VIX'60min

Summary

For the moment... zero sign of a turn.

Cyclically.. we're clearly on the high side... with the VIX at bizarrely low levels.

Where is the catalyst for a turn this afternoon.. or even this week, going to come from?

--

notable weakness.... TSLA, daily

Despite the main market.. TSLA continues to struggle.. with next soft support in the 200/195 zone. After that... its empty air to the 150/140s.

Mr Musk - who will clearly need a new capital injection to be able to ramp production, is going to struggle to raise new money from the equity market.

--

time for tea

sp'60min

VIX'60min

Summary

For the moment... zero sign of a turn.

Cyclically.. we're clearly on the high side... with the VIX at bizarrely low levels.

Where is the catalyst for a turn this afternoon.. or even this week, going to come from?

--

notable weakness.... TSLA, daily

Despite the main market.. TSLA continues to struggle.. with next soft support in the 200/195 zone. After that... its empty air to the 150/140s.

Mr Musk - who will clearly need a new capital injection to be able to ramp production, is going to struggle to raise new money from the equity market.

--

time for tea

11am update - in the gap zone

US equities continue to battle upward, with the sp'500 making it the gap zone of 2077/81. The equity bull maniacs will have reason to get confident on any daily close in the 2080s. Metals are mixed, Gold -$2, whilst Silver +0.8%, with the related miners catching a minor bounce, GDX +0.5%.

sp'60min

VIX'60min

Summary

No doubt (and understandably) many of the cheerleaders will now be especially bullish, and confident that the coming weeks and months are going to be just fine. After all, despite lousy earnings, and low growth... things are indeed just fine, yes?

I can only wonder how much of the 'big money' is hitting the sell button this morning.

-

notable strength.. DIS, daily

..with earnings due at the close. For the bears... need a trend break... <$102 by the Friday close.

-

time for an early lunch

sp'60min

VIX'60min

Summary

No doubt (and understandably) many of the cheerleaders will now be especially bullish, and confident that the coming weeks and months are going to be just fine. After all, despite lousy earnings, and low growth... things are indeed just fine, yes?

I can only wonder how much of the 'big money' is hitting the sell button this morning.

-

notable strength.. DIS, daily

..with earnings due at the close. For the bears... need a trend break... <$102 by the Friday close.

-

time for an early lunch

10am update - pushing for the gap zone

US equity indexes open broadly higher, with the sp'500 +15pts @ 2074. The gap zone of 2081/77 is seemingly due today. The issue will be whether the bulls can hold the gains. VIX has naturally imploded to the 13s, as Mr Market is utterly confident that everything is going to be just fine this summer.

sp'60min

VIX'60min

Summary

For the equity bears... this is clearly one of the worse opens in at least a month.

The May 2nd high of 2083 should be a key target for the bull maniacs this week. If that is cleared above.. its open air to 2111... and new historic highs.

-

Best guess.. .a failure to break/clear 2080. Equity bears need a Tuesday close <2070 to break short term rising trend.. which isn't exactly demanding.

However, if the bears can't restrain this.. then a push above 2111... in which case... you may as well put on that Dow 20k hat.

--

notable strength.. Oil, USO, daily

Net higher.. but still looks vulnerable until a break back >$11.00.... otherwise, downside to $10.20.. which is 6/7% lower.

sp'60min

VIX'60min

Summary

For the equity bears... this is clearly one of the worse opens in at least a month.

The May 2nd high of 2083 should be a key target for the bull maniacs this week. If that is cleared above.. its open air to 2111... and new historic highs.

-

Best guess.. .a failure to break/clear 2080. Equity bears need a Tuesday close <2070 to break short term rising trend.. which isn't exactly demanding.

However, if the bears can't restrain this.. then a push above 2111... in which case... you may as well put on that Dow 20k hat.

--

notable strength.. Oil, USO, daily

Net higher.. but still looks vulnerable until a break back >$11.00.... otherwise, downside to $10.20.. which is 6/7% lower.

Pre-Market Brief

Good morning. US equity futures are moderately higher, sp +7pts, we're set to open at 2065. USD continues to claw upward, +0.2% in the DXY 94.30s. Metals are fractionally higher, Gold +$2, with Silver +0.3%. Oil is -0.1% in the $43s.

sp'60min

sp'weekly6

Summary

With an overnight threat of intervention in Japan, world markets built some gains, although other than Japan, the gains haven't exactly been sustained.

re: sp'60min: break levels 2080.... which looks overly difficult. <2039... very viable.. even by the close of today.

re: weekly'6: a notable third blue candle. A sustained break <2K should have occurred by mid June.

--

early movers...

VIX -2.9% in the 14.10s.

CHK +3.7%

FCX +2.0%

SDRL +0.5%.... dead cat bounces in the junk/trash stocks.

-

Overnight action

China: micro chop, settling effectively u/c @ 2832

Japan: +2.1% @ 16565

Germany; currently +0.5% @ 10031... battling for a daily close >10K.

--

Have a good Tuesday

sp'60min

sp'weekly6

Summary

With an overnight threat of intervention in Japan, world markets built some gains, although other than Japan, the gains haven't exactly been sustained.

re: sp'60min: break levels 2080.... which looks overly difficult. <2039... very viable.. even by the close of today.

re: weekly'6: a notable third blue candle. A sustained break <2K should have occurred by mid June.

--

early movers...

VIX -2.9% in the 14.10s.

CHK +3.7%

FCX +2.0%

SDRL +0.5%.... dead cat bounces in the junk/trash stocks.

-

Overnight action

China: micro chop, settling effectively u/c @ 2832

Japan: +2.1% @ 16565

Germany; currently +0.5% @ 10031... battling for a daily close >10K.

--

Have a good Tuesday

The communists should be concerned

The Chinese equity market continues to struggle, with the Shanghai comp' starting the week with a rather powerful Monday decline of -2.8% @ 2832. Unless the communists leadership can 'inspire' a break back above the 3K threshold, the 2300/200s are seemingly due this summer.

China, monthly

China, daily

Summary

The Monday chatter in Asia was that some high level Chinese official was touting no more easing. That sure didn't help sentiment, resulting in a second consecutive powerful daily decline. The 3000 threshold is increasingly solidifying as core resistance, with the Shanghai comp' unable to break/hold above the key 10MA (3082).

It would seem another multi-month wave lower is already well underway. First target is the Jan' low of 2638, from there.. the psy' level of 2500, then 2300/200s.

There is no doubt the Chinese communists leadership will increasingly target anyone who dares question the veracity of economic data, or who forecast a lower equity/commodity market.

Anyone who knows their history of course, should recognise that such persecution and scapegoating will do nothing to change the reality. The reality being one of an overly leveraged financial system... one which is many times worse than the US property bubble of 2005-08.

It won't end well.. but then.. it never does.

--

Looking ahead

Tuesday will see Wholesale trade data.... but that is it.

--

Goodnight from London

China, monthly

China, daily

Summary

The Monday chatter in Asia was that some high level Chinese official was touting no more easing. That sure didn't help sentiment, resulting in a second consecutive powerful daily decline. The 3000 threshold is increasingly solidifying as core resistance, with the Shanghai comp' unable to break/hold above the key 10MA (3082).

It would seem another multi-month wave lower is already well underway. First target is the Jan' low of 2638, from there.. the psy' level of 2500, then 2300/200s.

There is no doubt the Chinese communists leadership will increasingly target anyone who dares question the veracity of economic data, or who forecast a lower equity/commodity market.

Anyone who knows their history of course, should recognise that such persecution and scapegoating will do nothing to change the reality. The reality being one of an overly leveraged financial system... one which is many times worse than the US property bubble of 2005-08.

It won't end well.. but then.. it never does.

--

Looking ahead

Tuesday will see Wholesale trade data.... but that is it.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed moderately mixed, sp +1pt @ 2058. The two

leaders - Trans/R2K, settled u/c and +0.3% respectively. Near term

outlook offers a further push to around 2080, but a bullish breakout

looks unlikely. Instead, equity bears should get opportunity to break

the Friday low of 2039.

sp'daily5

Nasdaq comp'

Summary

sp'500: a day of minor chop, with a mere 10pt (0.5%) trading range. Break levels are 2080 on the upside... and <2039 on the downside.

Nasdaq: a second day higher for the tech', but remaining within a short term downward trend, under the 10/50/200 day MAs.

--

a little more later...

sp'daily5

Nasdaq comp'

Summary

sp'500: a day of minor chop, with a mere 10pt (0.5%) trading range. Break levels are 2080 on the upside... and <2039 on the downside.

Nasdaq: a second day higher for the tech', but remaining within a short term downward trend, under the 10/50/200 day MAs.

--

a little more later...

Subscribe to:

Comments (Atom)