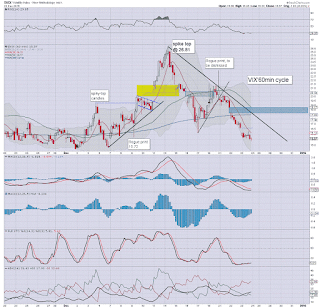

With equity indexes settling higher for a third consecutive day, the VIX was naturally still in cooling mode, settling -6.2% @ 15.57. Near term outlook offers the sp'2100s before year end, and that will likely equate to VIX 13/12s. The big 20 threshold looks out of range until at least the latter half of January.

VIX'60min

VIX'daily3

Summary

Not surprisingly, equities continue to push higher, and that is leading to the VIX continuing to cool.

VIX looks set to remain broadly subdued for at least another 2-3 weeks. The big 20 threshold looks out of range until late January.

--

more later... on the indexes

Wednesday, 23 December 2015

Closing Brief

US equity indexes closed broadly higher for the third consecutive day, sp +25pts @ 2064. The two leaders - Trans/R2K, settled higher by 1.1% and 1.3% respectively. Near term outlook is bullish to the 2075/80 zone, with the 2100 threshold just about in range by year end.

sp'60min

Summary

*closing hour action: minor chop... absolutely nothing for the equity bears to cling to.

--

A third day for the equity bulls, and the double floor of sp'2005 is now fading far below.. almost a full 3% ! The door is wide open to test resistance of 2075/80.

The sp'2100s look due.. the only issue is whether the year closes a little above.. or below. Difficult to say.

What is not difficult to say.. near term outlook is bullish.... and that should at least continue into mid January.

Have a good evening.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: minor chop... absolutely nothing for the equity bears to cling to.

--

A third day for the equity bulls, and the double floor of sp'2005 is now fading far below.. almost a full 3% ! The door is wide open to test resistance of 2075/80.

The sp'2100s look due.. the only issue is whether the year closes a little above.. or below. Difficult to say.

What is not difficult to say.. near term outlook is bullish.... and that should at least continue into mid January.

Have a good evening.

--

more later... on the VIX

3pm update - clearing the 200 and 50 day MAs

US equity indexes are seeing stronger than expected pre-Santa upside, with a clear push through the 200 and 50 day MAs. With the move to sp'2064, the door is now open to the resistance zone of 2075/80 tomorrow.. or at the latest, next Monday. The odds of a year end close in the 2100s just jumped.

sp'60min

Trans, daily

Summary

*even the battered Transports is set for a third daily gain. First target is the 200dma.. and is it notable that whilst the sp'500 is now above its 200dma, the Trans needs to climb another 670pts (around 9%).. just to test its 200dma in the 8200s.

--

So.. the market just wants to grind the equity bears to dust.. ahead of Santa.

There is a lot of other stuff to say on the bigger monthly cycles (hello AB), but I'll leave that for later.

--

back at the close

sp'60min

Trans, daily

Summary

*even the battered Transports is set for a third daily gain. First target is the 200dma.. and is it notable that whilst the sp'500 is now above its 200dma, the Trans needs to climb another 670pts (around 9%).. just to test its 200dma in the 8200s.

--

So.. the market just wants to grind the equity bears to dust.. ahead of Santa.

There is a lot of other stuff to say on the bigger monthly cycles (hello AB), but I'll leave that for later.

--

back at the close

2pm update - significant pre-Santa gains

With just 5.5 trading hours until the Christmas break, all US indexes have built pretty significant gains. A Thursday/weekly close in the sp'2060/65 zone looks probable. Oil is holding powerful gains of 3.2% in the $37s, and that continues to help prop up broader market mood.

sp'weekly7

USO, daily2

Summary

*note the green candle on the weekly sp'500 chart. Broader price structure could be argued is a giant bull flag.. and that would bode for a move well beyond the May historic high of 2134.

--

re: Oil - a move to the gap zone - where the 50dma will soon lurk, looks due for USO, equating to WTIC Oil around $40.

--

So... we're holding the sp'2060/55 zone.. and that is where we'll probably close today.

A daily close above the 200.. and 50 day MAs looks far more viable next Mon/Tuesday.

--

back at 3pm

sp'weekly7

USO, daily2

Summary

*note the green candle on the weekly sp'500 chart. Broader price structure could be argued is a giant bull flag.. and that would bode for a move well beyond the May historic high of 2134.

--

re: Oil - a move to the gap zone - where the 50dma will soon lurk, looks due for USO, equating to WTIC Oil around $40.

--

So... we're holding the sp'2060/55 zone.. and that is where we'll probably close today.

A daily close above the 200.. and 50 day MAs looks far more viable next Mon/Tuesday.

--

back at 3pm

1pm update - testing the 200 day MA

US equities continue to claw upward, making the first attempt to re-take the 200dma (sp'2061). Underlying price momentum on the bigger daily/weekly/monthly cycles continues to swing back toward the equity bulls. In no way does the current near term setup favour the bears.

sp'daily5

Summary

At the current rate, the daily MACD (blue bar histogram) will turn positive cycle tomorrow.. or next Monday. In either case.. it bodes for an attempt to break above the FOMC high of sp'2076.

A Mon/Tuesday close in the 2080s will be necessary to have any chance of a year end/Thursday close >2100. Right now, that still looks a little out of range.

--

notable strength...

Copper miners... FCX, daily

A very powerful gain of 13% in the $7.30s, but with the stock having started 2015 in the $22s..the stock is still lower by a horrific -67.8%.

--

back at 2pm

sp'daily5

Summary

At the current rate, the daily MACD (blue bar histogram) will turn positive cycle tomorrow.. or next Monday. In either case.. it bodes for an attempt to break above the FOMC high of sp'2076.

A Mon/Tuesday close in the 2080s will be necessary to have any chance of a year end/Thursday close >2100. Right now, that still looks a little out of range.

--

notable strength...

Copper miners... FCX, daily

A very powerful gain of 13% in the $7.30s, but with the stock having started 2015 in the $22s..the stock is still lower by a horrific -67.8%.

--

back at 2pm

12pm update - holding gains

US equities are holding gains for a third consecutive day, and the double floor of sp'2005 is fading far below. A year end close in the 2070/90 zone looks increasingly probable. Oil is helping broader market sentiment, currently +3.4% in the $37s. Metals remain subdued, Gold -$3.

sp'60min

GLD, daily

Summary

*With Gartman now bullish, Gold looks vulnerable to $1000 at any time (and that would equate to GLD 95 or so).

--

Oil is clearly helping drag the broader market higher. Considering there is a rather clear 8-10% viable upside by mid/late January, that'll give the equity bulls a fair chance of break >sp'2134.

Whether the market can hold that level, or sees a strong reversal... that is the real issue for early 2016.

--

VIX update from Mr T

--

time for lunch

sp'60min

GLD, daily

Summary

*With Gartman now bullish, Gold looks vulnerable to $1000 at any time (and that would equate to GLD 95 or so).

--

Oil is clearly helping drag the broader market higher. Considering there is a rather clear 8-10% viable upside by mid/late January, that'll give the equity bulls a fair chance of break >sp'2134.

Whether the market can hold that level, or sees a strong reversal... that is the real issue for early 2016.

--

VIX update from Mr T

--

time for lunch

11am update - sunshine for the equity bulls

US equities are comfortably holding broad gains, with the sp' set for a third net daily gain, probably settling within the 2055/60 zone. A daily close above the 50/200 day MA's looks far more viable next Monday. VIX is naturally in cooling mode, having already broken into the 15s.

sp'60min

USO' daily2

Summary

*the latest EIA report showed a net draw of -5.9 million barrels, and that is really helping the case for a short term bounce to $40.

--

So...a third day for the bulls, and again, I gotta ask.. where are all those maniacs who were touting crash/collapse last week? Where are they? Are they all on radio silent mode now?

No doubt, those same posters will re-appear in mid/late January.. whether the market is trading a little above.. or below sp'2134.

--

notable weakness...

DIS -2.2% in the $104s.. as comms stocks continue to unwind

NKE -1.8%.. a rather strong swing from opening gains.

TLT -1.0%... appropriately relative to equities

--

Here in London city...

.. and that is the first decent bit of sunshine in what feels like a long... long time.

--

time to cook

sp'60min

USO' daily2

Summary

*the latest EIA report showed a net draw of -5.9 million barrels, and that is really helping the case for a short term bounce to $40.

--

So...a third day for the bulls, and again, I gotta ask.. where are all those maniacs who were touting crash/collapse last week? Where are they? Are they all on radio silent mode now?

No doubt, those same posters will re-appear in mid/late January.. whether the market is trading a little above.. or below sp'2134.

--

notable weakness...

DIS -2.2% in the $104s.. as comms stocks continue to unwind

NKE -1.8%.. a rather strong swing from opening gains.

TLT -1.0%... appropriately relative to equities

--

Here in London city...

.. and that is the first decent bit of sunshine in what feels like a long... long time.

--

time to cook

10am update - opening gains

US equities open broadly higher, with the sp' in the 2050s, within 0.5% of the 50/200 day MAs. Indeed, a year end close in the 2070/90 zone looks probable. The 2100 threshold appears out of range. Oil is helping give the market an extra kick, +2.3%, ahead of the latest EIA report.

sp'60min

USO'daily2

Summary

*note the daily MACD (blue bar histogram) on Oil - USO, set to turn positive cycle for the first time since early November. There looks to be upside of around 8-10% in the near term.

The 50dma and gap zone will likely halt the rally in mid/late January.

--

Equity bulls are getting some extra luck as Oil is set for a third consecutive gain.. and seemingly headed for the $40 threshold into early 2016.

-

time for a little sun... back soon

-

10.31am. Oil inventories -5.9 million barrels... and that sure is helping oil, +3.1%.

sp'60min

USO'daily2

Summary

*note the daily MACD (blue bar histogram) on Oil - USO, set to turn positive cycle for the first time since early November. There looks to be upside of around 8-10% in the near term.

The 50dma and gap zone will likely halt the rally in mid/late January.

--

Equity bulls are getting some extra luck as Oil is set for a third consecutive gain.. and seemingly headed for the $40 threshold into early 2016.

-

time for a little sun... back soon

-

10.31am. Oil inventories -5.9 million barrels... and that sure is helping oil, +3.1%.

Pre-Market Brief

Good morning. US equity futures are broadly higher, sp +13pts, we're set to open at 2051. With Oil set to push for a third consecutive daily gain, it would seem the market wants to test the 50/200 day MAs ahead of the Christmas break.

sp'60min

Summary

*Oil is +1.6% in early trading, as the API report suggested a net weekly draw for the EIA report (due 10.30am).

--

Santa is just two days away, and Mr Market is behaving itself rather well. We're seeing things continue to claw higher... even a little faster than I expected.

So, now its a case of whether we can break >2061 before the Thursday close (1pm). If Oil can build more momentum... then its very possible.

More than anything though, it remains a case of, do you really want to be short ahead of Santa?

-

early movers...

NKE: +2.7%, post earnings joy

MU -7.3%, post earnings depression

SDRL +7.2%.. as Oil looks set for a third daily gain

--

Econ chatter, Mr Long with Rubino

-

Doomer chat, Hunter with Mannerino

As ever.. make of that.. what you will. I sure don't agree with a fair amount of what Mr Man' says.

--

The sun is shining in London city for what seems like the first time in months, and that is something to be very bullish about.

Have a good Wednesday

-

8.31am Durable goods orders: m/m, 0.0%. Not great. The last few months of data sure doesn't bode well for Q4 GDP data... due late Jan'

Equities holding gains, sp +12pts... 2050

sp'60min

Summary

*Oil is +1.6% in early trading, as the API report suggested a net weekly draw for the EIA report (due 10.30am).

--

Santa is just two days away, and Mr Market is behaving itself rather well. We're seeing things continue to claw higher... even a little faster than I expected.

So, now its a case of whether we can break >2061 before the Thursday close (1pm). If Oil can build more momentum... then its very possible.

More than anything though, it remains a case of, do you really want to be short ahead of Santa?

-

early movers...

NKE: +2.7%, post earnings joy

MU -7.3%, post earnings depression

SDRL +7.2%.. as Oil looks set for a third daily gain

--

Econ chatter, Mr Long with Rubino

-

Doomer chat, Hunter with Mannerino

As ever.. make of that.. what you will. I sure don't agree with a fair amount of what Mr Man' says.

--

The sun is shining in London city for what seems like the first time in months, and that is something to be very bullish about.

Have a good Wednesday

-

8.31am Durable goods orders: m/m, 0.0%. Not great. The last few months of data sure doesn't bode well for Q4 GDP data... due late Jan'

Equities holding gains, sp +12pts... 2050

The ultimate contrarian indicator - Gartman

Its been a tough year for most traders, as the sp'500 has largely traded within the 2100/2000 zone. For many, it has felt like being stuck inside a washing machine on spin cycle. Someone who continues to rotate at 1400rpm is the infamous Gartman, who remains one of the ultimate contrarian indicators.

sp'weekly1b

sp'monthly1b

Summary

Re' weekly1b: aside from the Aug/Sept' upset, the sp'500 has been stuck with a relatively narrow 5% range.

Re' monthly1b: without question, the most important issue is whether the market can hold above the 10MA, which was decisively re-taken in Oct'.

A Dec' or Jan' monthly close under the 10MA should signal alarm bells. For now... lets see how the year wraps up.

--

Looking ahead

Wed' will see a small wheel barrow of data... Durable Goods orders, Pers' income/outlays, new home sales, consumer sent', and the latest EIA report.

--

As for Gartman

First.. see HERE

Frankly, the gold bugs should be utterly terrified at Gartman's new bullish call for Gold.

Why would anyone think the recent low of $1045 was a core multi-floor for Gold? It makes no more sense than those who called $1321 a floor, 1179, 1130, or 1051.

What will happen to Gold (or for that matter Oil) if the USD starts consistently trading above the DXY 100 threshold next year? It sure won't help, right?

I kinda feel sorry for Gartman. I have certainly had my times when I've been on the wrong side of almost every cycle for some weeks, or even a few months. I've found the only solution is to quit hitting the BUY or SELL button for at least a month or two.

Of course, Gartman won't do that. No mainstream commentator or analyst would ever announce they are sitting it out for a few months.

I will be looking for Gartman - and some others, to turn bearish Gold, somewhere in the $900/875 zone. If that is the case in late spring/summer 2016, well, it'd likely be the key floor many have been seeking since the commodity peak in 2011.

Goodnight from London

sp'weekly1b

sp'monthly1b

Summary

Re' weekly1b: aside from the Aug/Sept' upset, the sp'500 has been stuck with a relatively narrow 5% range.

Re' monthly1b: without question, the most important issue is whether the market can hold above the 10MA, which was decisively re-taken in Oct'.

A Dec' or Jan' monthly close under the 10MA should signal alarm bells. For now... lets see how the year wraps up.

--

Looking ahead

Wed' will see a small wheel barrow of data... Durable Goods orders, Pers' income/outlays, new home sales, consumer sent', and the latest EIA report.

--

As for Gartman

First.. see HERE

Frankly, the gold bugs should be utterly terrified at Gartman's new bullish call for Gold.

Why would anyone think the recent low of $1045 was a core multi-floor for Gold? It makes no more sense than those who called $1321 a floor, 1179, 1130, or 1051.

|

| Books always suggest intelligence, yes? |

What will happen to Gold (or for that matter Oil) if the USD starts consistently trading above the DXY 100 threshold next year? It sure won't help, right?

I kinda feel sorry for Gartman. I have certainly had my times when I've been on the wrong side of almost every cycle for some weeks, or even a few months. I've found the only solution is to quit hitting the BUY or SELL button for at least a month or two.

Of course, Gartman won't do that. No mainstream commentator or analyst would ever announce they are sitting it out for a few months.

I will be looking for Gartman - and some others, to turn bearish Gold, somewhere in the $900/875 zone. If that is the case in late spring/summer 2016, well, it'd likely be the key floor many have been seeking since the commodity peak in 2011.

Goodnight from London

Daily Index Cycle update

US equity indexes closed broadly higher for the second consecutive

day, sp +17pts @ 2038. The two leaders - Trans/R2K, settled higher by

1.5% and 0.9% respectively. Near term outlook offers a lot of chop, but

with underlying seasonal upward pressure. Right now, a year end close

>2065 looks probable.

sp'daily5

Trans

Summary

*first upside target on the 'old leader' - Transports, remains the 200dma.. currently in 8200s.

--

As for the sp'500, a year end close above the 50/200 day MA's looks probable. It is difficult to say if the market will manage a Dec'31st settlement >2100.

--

a little more later...

sp'daily5

Trans

Summary

*first upside target on the 'old leader' - Transports, remains the 200dma.. currently in 8200s.

--

As for the sp'500, a year end close above the 50/200 day MA's looks probable. It is difficult to say if the market will manage a Dec'31st settlement >2100.

--

a little more later...

Subscribe to:

Comments (Atom)