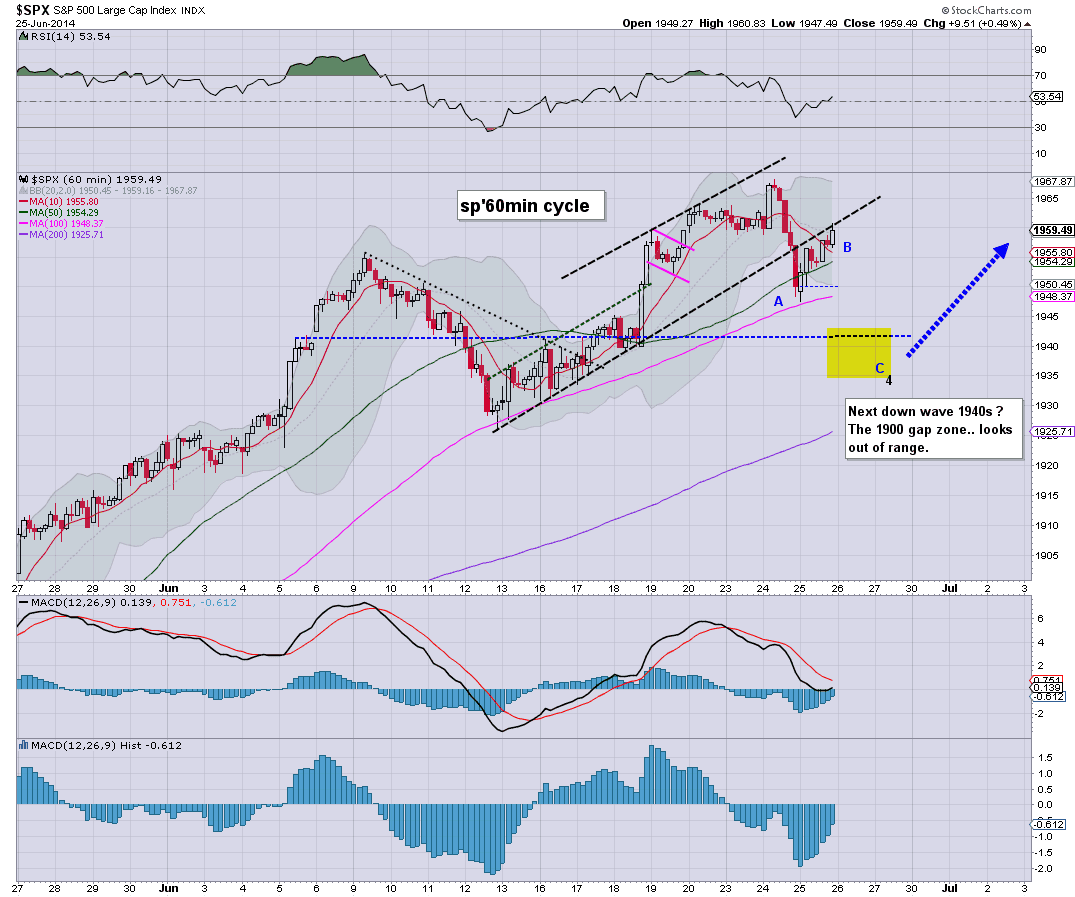

US equities closed moderately higher, sp +9pts @ 1959. The two leaders - Trans/R2K, settled higher by 0.9% and 0.8% respectively. Near term outlook is for moderate downside to 1940/35.. before renewed upside into July.

sp'60min

Summary

*Time for another pair of games... I'm going with the French game

--

Despite failing to roll lower into the close, it makes little difference.

Price structure is a very clear bear flag - call it a B wave if you like, and we're set for lower levels tomorrow. I'd not be surprised if we see sp'1940/35 tomorrow at some point, as part of a mini washout.

-

I'll post a full daily wrap at 8pm EST.

-

time for Ecuador vs France!

Wednesday, 25 June 2014

3pm update - weakness into the close

US equities are holding moderate gains, but look set for weakness into the close. Price structure is a near perfect bear flag, and equity bears should be seeking a break under 1955 to confirm a new way down is underway. Primary downside target remains 1940/35.

sp'60min

Summary

Well... 15/5min cycles are PRIME for breaking lower into the close.

Lets see how many of the rats want to exit into the close.

-

3.05pm... early warning sign... rolling over.... 1956

3.19pm.. micro chop...but the setup is there... we're due to fall from here...although downside is a mere 1%...not much more than that.

-

3.25pm.. a micro double top at 1958 ?

Regardless, we are due to fall....

-

notable strength: FB +2.5%

3.30pm... I see a double top....... invalid if 1959 ..

come on bears..where are you?

3.34pm.. they are selling the 1958s

.. 1959... fail. oh well.

-

3.39pm... and the short stops are getting hit... 1960..... VIX -5.9%...

3.46pm sp'1960... and just no downside pressure, but price structure remains a VERY clear bear flag.

3.52pm... so...still a bear flag.. and I'll be seeking sp'500 to lose 20/25pts in the near term.. by the Friday close.

sp'60min

Summary

Well... 15/5min cycles are PRIME for breaking lower into the close.

Lets see how many of the rats want to exit into the close.

-

3.05pm... early warning sign... rolling over.... 1956

3.19pm.. micro chop...but the setup is there... we're due to fall from here...although downside is a mere 1%...not much more than that.

-

3.25pm.. a micro double top at 1958 ?

Regardless, we are due to fall....

-

notable strength: FB +2.5%

3.30pm... I see a double top....... invalid if 1959 ..

come on bears..where are you?

3.34pm.. they are selling the 1958s

.. 1959... fail. oh well.

-

3.39pm... and the short stops are getting hit... 1960..... VIX -5.9%...

3.46pm sp'1960... and just no downside pressure, but price structure remains a VERY clear bear flag.

3.52pm... so...still a bear flag.. and I'll be seeking sp'500 to lose 20/25pts in the near term.. by the Friday close.

2pm update - churning before the next wave lower

US equities are holding moderate gains, but another down wave is likely in the near term.. possibly beginning before the close of today. Primary downside remains 1940/35 zone.. from where the market should rally into July.

sp'60min

Summary

A lightly labelled chart, and I am guessing we'll see a C wave begin late today...or tomorrow...it really makes little difference.

--

So...two hours to go...lets see if we roll over again.

sp'60min

Summary

A lightly labelled chart, and I am guessing we'll see a C wave begin late today...or tomorrow...it really makes little difference.

--

So...two hours to go...lets see if we roll over again.

1pm update - it is a B wave

US indexes are in churn mode...probably close to completing a B wave. The market will likely see renewed weakness in the late afternoon. Primary downside target zone remains sp'1940/35, before renewed strength into July.

sp'60min

Summary

From a chart perspective, a rather classic B wave.. back testing the old broken mini trend/channel.

We'll likely see some weakness into the close, with follow through tomorrow.

-

back to the game... I'm watching Nigeria/Argentina

sp'60min

Summary

From a chart perspective, a rather classic B wave.. back testing the old broken mini trend/channel.

We'll likely see some weakness into the close, with follow through tomorrow.

-

back to the game... I'm watching Nigeria/Argentina

12pm update - London flyng the Iranian flag

Whilst the indexes churn out a B, 2, or whatever you wanna call it up wave, we have another two big games in the World cup. London city is filled with flags.. not least those supporting Iran - who face Bosnia and Herzo' this lunch time.

sp'60min

Summary

Well, its time for kick off, and frankly...I'm going to focus mostly on that.

*I'm just home from a minor venture.. and there are indeed a fair few Iranian flags being flown from the passing traffic..

-

VIX update from Mr T.

--

WFM is higher by 0.9% in the $39.30s, but I'm concerned at how much it will fall in the next index down wave. If I'm lucky, it'll at least be able to remain flat...before the market rallies into July.

back at 1pm

sp'60min

Summary

Well, its time for kick off, and frankly...I'm going to focus mostly on that.

*I'm just home from a minor venture.. and there are indeed a fair few Iranian flags being flown from the passing traffic..

-

VIX update from Mr T.

--

WFM is higher by 0.9% in the $39.30s, but I'm concerned at how much it will fall in the next index down wave. If I'm lucky, it'll at least be able to remain flat...before the market rallies into July.

back at 1pm

11am update - minor upward melt

US indexes continue to push higher..if slowly, from the opening minor declines. The sp'500 looks set to climb for a few more hours..before another roll over.. late today.... or Thursday. In the scheme of things.. it makes no difference. Downside target zone remains 1940/35.

sp'60min

Summary

Little to add.

Minor wave up... call it a 2, B..or whatever...we're set to drop some more.

-

Arguably, anyone looking to go long..should get a chance in the 1940/35 zone this week.

-

*WFM is even more annoying that yesterday.... until it is back in the $40s.. I'm not going to be in the best of moods.

sp'60min

Summary

Little to add.

Minor wave up... call it a 2, B..or whatever...we're set to drop some more.

-

Arguably, anyone looking to go long..should get a chance in the 1940/35 zone this week.

-

*WFM is even more annoying that yesterday.... until it is back in the $40s.. I'm not going to be in the best of moods.

10am update - opening reversal

With the lousy GDP data, indexes open a little lower, but we're already seeing a pretty clear opening reversal. Indexes look set to battle higher across much of today, with the sp'1955/60 viable. From there... a further wave lower into Thursday seems very probable... 1940/35.

sp'60min

Summary

So...Q1 was a deep contraction for the US economy.. and that was when QE was still running at a rate of 900bn a year.

Subtrack the Fed money printing... and Q1 was -4.5% or so.

DIRE. Simple....dire

--

Meanwhile...we have green indexes...and the $3bn of QE fuel hasn't even been distributed yet.

Bears....should have bailed at the open....a re-short (for the swift day traders) in the 1957/63 zone seems a viable level.

--

*naturally, not only have WFM failed to hold the opening gains, but it has turned red.. and the US market recovers. Utter... fail.

sp'60min

Summary

So...Q1 was a deep contraction for the US economy.. and that was when QE was still running at a rate of 900bn a year.

Subtrack the Fed money printing... and Q1 was -4.5% or so.

DIRE. Simple....dire

--

Meanwhile...we have green indexes...and the $3bn of QE fuel hasn't even been distributed yet.

Bears....should have bailed at the open....a re-short (for the swift day traders) in the 1957/63 zone seems a viable level.

--

*naturally, not only have WFM failed to hold the opening gains, but it has turned red.. and the US market recovers. Utter... fail.

Pre-Market Brief

Good morning. Futures are a touch higher, sp +1pt, we're set to open at 1950. Precious metals are weak, Gold -$5. With sig' QE-pomo this morning, equity bears are going to find it difficult to push lower. A minor bounce seems likely, before a further wave lower late today.. or Thursday.

sp'60min

Summary

*awaiting revised GDP Q1 data

---

We have a clear break of short term trend on the hourly.

A bounce wave seems very viable..before a secondary (C wave?) lower late today..or early Thursday.

--

Notable strength: WFM +1.2%, but still below the $40 threshold.

Good wishes for Wednesday trading :)

8.30am.. GDP Q1 revised... -2.9%... err.........thats rather severe....

Indexes slip a touch lower, but really...-2.9%...ugly

9.04am... sp -3pts... so that is 1946.....

Equity bears getting an opportunity to exit at the open...before a latter day ramp...probably back to 1955/60 zone.

The QE today will most certainly help.

9.34am.. opening reversal likely underway...

Bears beware... sig' QE coming at 10am

sp'60min

Summary

*awaiting revised GDP Q1 data

---

We have a clear break of short term trend on the hourly.

A bounce wave seems very viable..before a secondary (C wave?) lower late today..or early Thursday.

--

Notable strength: WFM +1.2%, but still below the $40 threshold.

Good wishes for Wednesday trading :)

8.30am.. GDP Q1 revised... -2.9%... err.........thats rather severe....

Indexes slip a touch lower, but really...-2.9%...ugly

9.04am... sp -3pts... so that is 1946.....

Equity bears getting an opportunity to exit at the open...before a latter day ramp...probably back to 1955/60 zone.

The QE today will most certainly help.

9.34am.. opening reversal likely underway...

Bears beware... sig' QE coming at 10am

Beware of the bearish hysteria

This afternoons equity reversal was a pretty significant one, but it does nothing to the primary trend. Barring a break under sp'1930, the market still looks set for broad upside into mid July.

sp'weekly8b

Summary

So, with the afternoon reversal, the 11th weekly green candle has turned blue. Certainly, it could easily turn back to green by the Friday close, but even if it stays blue... it doesn't mean the broader trend is due to change.

My wave count - the vain attempt that it is, is still suggestive of higher levels into mid July. From there, I would be seeking a multi-week down cycle. The big issue is whether that amounts to a decline of just 4-6%...or something more.

No doubt, there will be many touting today's reversal as a potential key top, but really..I just can't see it. A down wave/reversal was expected this week, and I've little doubt we'll rally into end month.. and probably at least the first half of July - as Q2 earnings start to appear.

Cashing out?

The following video by Don Harrold is pretty provocative, and I wanted to highlight it here.

Without question, 99% of the mainstream will not be selling into rising prices. Only the 'insiders' tend to have the inclination to do that. The next major wave lower.. whether this year..next.. or whenever, will be just another occasion when the average retail investor will ask themselves 'why did I not at least cash some/all of my stocks out after such huge multi-year gains?'

Looking ahead

Tomorrow has durable goods orders and Q1 GDP (final reading), market is expecting a downward revision to -1.5/-2.0%.. As ever though, market will be more concerned on what the Q2 number might be, but that is not due for another 5 trading weeks.

*there is sig' QE-pomo of $3bn... bears.. beware!

--

Crawling along the floor

I remain only holding a single long position, WFM, which today continued to churn out a floor. So long as it doesn't go any lower, the upside/recovery potential remains.

WFM' 60min

It would seem the stock jumped into the close on news of some legal settlement. As it is, I'm content to hold all the way into next Thursday - which is when the market will close early (1pm) for the July'4 holiday weekend.

Goodnight from London

sp'weekly8b

Summary

So, with the afternoon reversal, the 11th weekly green candle has turned blue. Certainly, it could easily turn back to green by the Friday close, but even if it stays blue... it doesn't mean the broader trend is due to change.

My wave count - the vain attempt that it is, is still suggestive of higher levels into mid July. From there, I would be seeking a multi-week down cycle. The big issue is whether that amounts to a decline of just 4-6%...or something more.

No doubt, there will be many touting today's reversal as a potential key top, but really..I just can't see it. A down wave/reversal was expected this week, and I've little doubt we'll rally into end month.. and probably at least the first half of July - as Q2 earnings start to appear.

Cashing out?

The following video by Don Harrold is pretty provocative, and I wanted to highlight it here.

Without question, 99% of the mainstream will not be selling into rising prices. Only the 'insiders' tend to have the inclination to do that. The next major wave lower.. whether this year..next.. or whenever, will be just another occasion when the average retail investor will ask themselves 'why did I not at least cash some/all of my stocks out after such huge multi-year gains?'

Looking ahead

Tomorrow has durable goods orders and Q1 GDP (final reading), market is expecting a downward revision to -1.5/-2.0%.. As ever though, market will be more concerned on what the Q2 number might be, but that is not due for another 5 trading weeks.

*there is sig' QE-pomo of $3bn... bears.. beware!

--

Crawling along the floor

I remain only holding a single long position, WFM, which today continued to churn out a floor. So long as it doesn't go any lower, the upside/recovery potential remains.

WFM' 60min

Goodnight from London

Daily Index Cycle update

US indexes saw a rather significant late afternoon reversal, with the sp' swinging from a new historic high of 1968 to 1948, and settling -12pts @ 1950. The two leaders - Trans/R2K, settled lower by -0.8% and -1.0% respectively. Further downside to 1940/35 appears likely.

sp'daily5

R2K

Trans

Summary

So..we have very clear bearish reversals on all the main indexes.

I can understand if some are going to get really bearish for the rest of this week, but I can't.

This kind of wave/reversal was expected...and we are VERY likely going to floor in the sp'1940/35 zone..whether tomorrow..or Thursday.

-

Closing update from Riley

--

a little more later...

sp'daily5

R2K

Trans

Summary

So..we have very clear bearish reversals on all the main indexes.

I can understand if some are going to get really bearish for the rest of this week, but I can't.

This kind of wave/reversal was expected...and we are VERY likely going to floor in the sp'1940/35 zone..whether tomorrow..or Thursday.

-

Closing update from Riley

--

a little more later...

Subscribe to:

Comments (Atom)