US equities closed weak, with the sp'500 -14pts @ 2053 (intra low 2049). The two leaders - Trans/R2K, settled lower by -2.7% and -1.6% respectively. Near term outlook offers a retrace to the sp'2020/00 zone. Sustained price action <2000 looks highly unlikely.

sp'60min

Summary

An interesting day to start the week, and we should certainly see some increased price action... rather than the recent few weeks of algo-bot tedium.

For now... I'll leave it that... but I will publish an update on the metals and highlight BTU, RIG, and SDRL on my 'fair value' page.

--

A fully daily wrap at 8pm EST.

Monday, 1 December 2014

3pm update - weakness into the close

US equities look set for increasing weakness into the close, with a viable daily close in the sp'2040s, with VIX 15s. Precious metals are set to hold the biggest gains of the year, with Gold +$44, and Silver +6.5%. Oil has build 'bounce gains' of 1.7%

sp'60min

Summary

Interesting day... having soared from sp'1820 to 2075, perhaps finally we'll see a retrace to around the sp'2000 level by mid month.

--

So.. a break to sp'2049.... arguably confirming the bear flag, but still. the broader market is only moderately lower.

Aside from the more significant declines in the Trans/R2K, today is only notable for moves in the energy and momo stocks.

BTU -8%... truly dire..

TWTR -6.4%

--

updates into the close...

3.28pm .. sp' 2058.. VIX +4%.... just no real concern in the broader market.

The real action remains in commodities...

Oil +2.8%....

Nat 'gas -3.3%...but a fair way above the earlier low

Metals are cooling a little, Gold +$44, but still there is roughly a full $70 above the overnight low.

-

back at the close

sp'60min

Summary

Interesting day... having soared from sp'1820 to 2075, perhaps finally we'll see a retrace to around the sp'2000 level by mid month.

--

So.. a break to sp'2049.... arguably confirming the bear flag, but still. the broader market is only moderately lower.

Aside from the more significant declines in the Trans/R2K, today is only notable for moves in the energy and momo stocks.

BTU -8%... truly dire..

TWTR -6.4%

--

updates into the close...

3.28pm .. sp' 2058.. VIX +4%.... just no real concern in the broader market.

The real action remains in commodities...

Oil +2.8%....

Nat 'gas -3.3%...but a fair way above the earlier low

Metals are cooling a little, Gold +$44, but still there is roughly a full $70 above the overnight low.

-

back at the close

2pm update - baby bear flag

US equities remain broadly weak, with the two leaders - Trans/R2K, lower by a significant -2.4% and -1.1% respectively. Price structure on the hourly cycle is offering a small bear flag, with viable downside to sp'2020/00.. by mid month.

sp'60min

Trans, daily

Summary

*precious metals remain powerfully higher, Gold +$51, with Silver +7%. Biggest gains of the year.. after significant overnight declines.

--

Interesting day.. not least in the energy sector...

BTU -6.7%... coal miners getting destroyed...

RIG -5.2%.. having lost the 20s

SDRL -8.0%... now in the 13s.... close to first target of $12.

*more on those three companies after the close on my 'fair value' page.

--

Notable weakness in the momo stocks.. inc. TWTR -5%..in the $39s.

sp'60min

Trans, daily

Summary

*precious metals remain powerfully higher, Gold +$51, with Silver +7%. Biggest gains of the year.. after significant overnight declines.

--

Interesting day.. not least in the energy sector...

BTU -6.7%... coal miners getting destroyed...

RIG -5.2%.. having lost the 20s

SDRL -8.0%... now in the 13s.... close to first target of $12.

*more on those three companies after the close on my 'fair value' page.

--

Notable weakness in the momo stocks.. inc. TWTR -5%..in the $39s.

12pm update - no buyers today

Mr Market is not starting the month in the best of moods, and a daily close in the sp'2040s looks viable.. along with VIX 15s. Metals are building gains, Gold +$34, with Silver +6%.. the lower USD is no doubt helping. Oil has turned higher, +1.2%, but Nat' gas is not following, -5%

sp'60min

GLD, daily

Summary

*considering the overnight declines, the current Gold gain is a huge swing. A daily close above the 50dma would be significant. However, unless GLD >120, this is almost surely just another crazy bounce... as has been the case for over THREE years.

--

A lot of individual strong movers today.... hard to decide what to highlight...

TWTR, -4%... having lost the key $40 threshold

DRYS -9%.. seemingly set to lose the $1 level (reverse split coming?)

Oil/gas drillers continue to be smashed... SDRL -8.8% in the $13s. RIG -6%, $19s

--

VIX update from Mr P.

--

time for lunch, back at 2pm

sp'60min

GLD, daily

Summary

*considering the overnight declines, the current Gold gain is a huge swing. A daily close above the 50dma would be significant. However, unless GLD >120, this is almost surely just another crazy bounce... as has been the case for over THREE years.

--

A lot of individual strong movers today.... hard to decide what to highlight...

TWTR, -4%... having lost the key $40 threshold

DRYS -9%.. seemingly set to lose the $1 level (reverse split coming?)

Oil/gas drillers continue to be smashed... SDRL -8.8% in the $13s. RIG -6%, $19s

--

VIX update from Mr P.

--

time for lunch, back at 2pm

11am update - remaining weak

US equities remain weak, with the sp -0.7% @ 2052. VIX is +8% in the mid 14s. There remains threat of continued weakness to the sp'2020/00 zone.. before the next push into the low 2100s. Precious metals are holding strong gains, Gold +$30.

sp'60min

Summary

Well, at least we're not trading flat today.

*two fed officials are speaking today... any hint of 'rate rises coming in 2015'.. and Mr Market will see increased weakness.

--

Far more interesting...

Notable weakness

RIG -4%, set to lose the $20s... next support are the $17s.

SDRL, -6.5% in the $13s

Coal miners are similarly still being destroyed.. BTU -5% in the mid $9s..

... seemingly headed for $5, by the spring.

sp'60min

Summary

Well, at least we're not trading flat today.

*two fed officials are speaking today... any hint of 'rate rises coming in 2015'.. and Mr Market will see increased weakness.

--

Far more interesting...

Notable weakness

RIG -4%, set to lose the $20s... next support are the $17s.

SDRL, -6.5% in the $13s

Coal miners are similarly still being destroyed.. BTU -5% in the mid $9s..

... seemingly headed for $5, by the spring.

10am update - opening weakness

The US equity market begins the last month of the year with some moderate weakness. The real dynamic action though remains in commodities. Precious metals are soaring, Gold +$27, with Silver +4%. Energy prices remain weak, Oil -0.4%, Nat' gas -4.3%

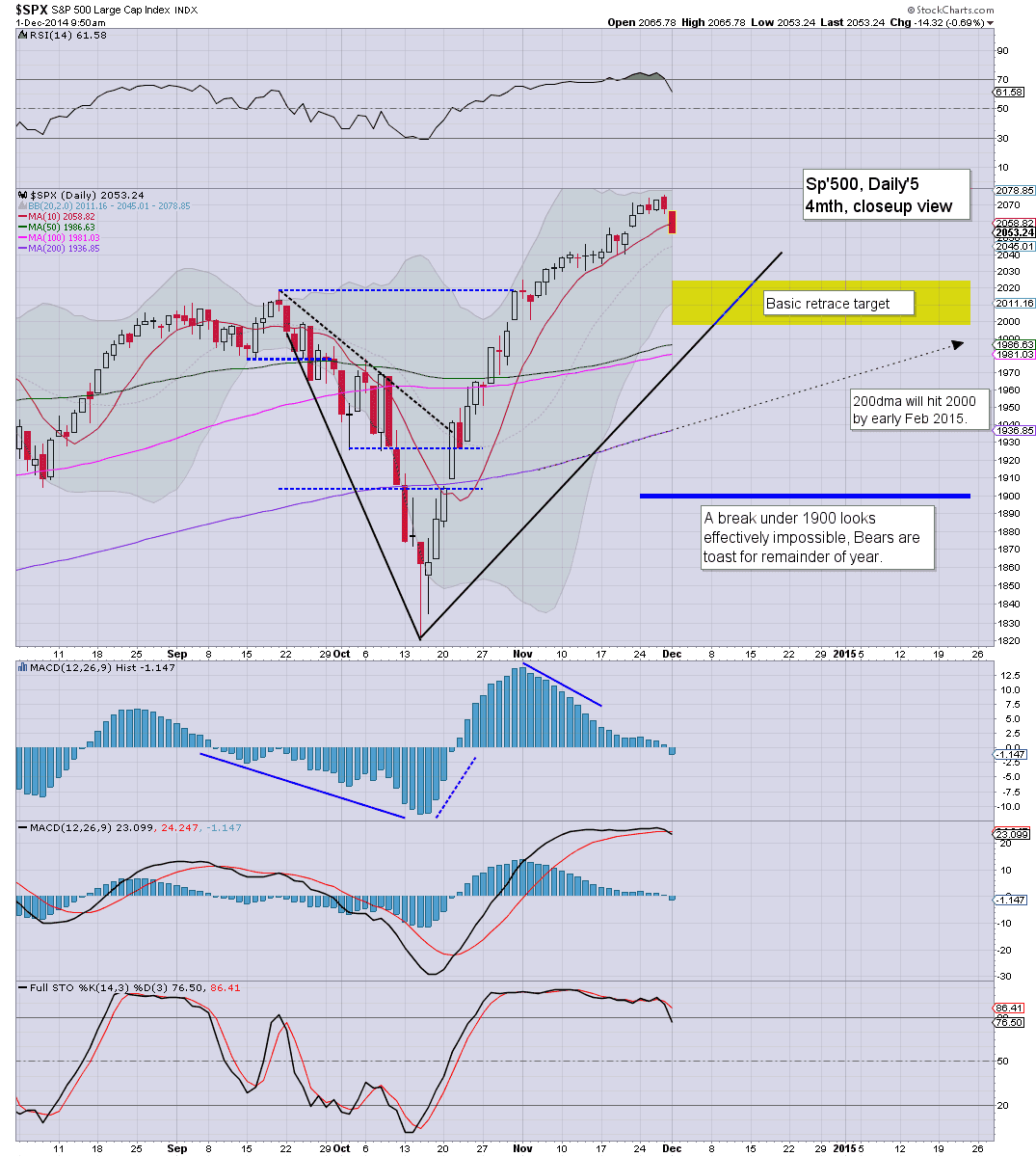

sp'daily5

GLD, daily

Summary

*USD is -0.55%, and that is no doubt helping the metals get an extra kick higher.

---

So, we're a little lower. At best.. perhaps sp'2020/00 zone.. but in the scheme of things, is that really anything to get excited about?

-

The move in the metals is pretty bizarre, not least after overnight action. No doubt right now, most of those short across the weekend have been stopped out.

-

notable weakness...

FCX -2%.. testing the low from summer 2013

DRYS -3%... sub $1 looks viable... ugly.

Coal miners.. BTU -2%.. with BTU breaking new multi-year lows.

-

VIX is +9%, but still.. only in the mid 14s. Even a brief test of the key 20 threshold looks damn tough.. even if the market can manage to go sub sp'2000 for a few days.

-

10.01am.. ISM/PMI manufacturing.. come in 'reasonable'...

sp -12pts @ 2054... still...just 'moderate' declines.

-

10.11am.. Oil/gas drillers seeing major declines...

SDRL.. -4%... in the 13s.

RIG -3%.. set to lose the $20s.

sp'daily5

GLD, daily

Summary

*USD is -0.55%, and that is no doubt helping the metals get an extra kick higher.

---

So, we're a little lower. At best.. perhaps sp'2020/00 zone.. but in the scheme of things, is that really anything to get excited about?

-

The move in the metals is pretty bizarre, not least after overnight action. No doubt right now, most of those short across the weekend have been stopped out.

-

notable weakness...

FCX -2%.. testing the low from summer 2013

DRYS -3%... sub $1 looks viable... ugly.

Coal miners.. BTU -2%.. with BTU breaking new multi-year lows.

-

VIX is +9%, but still.. only in the mid 14s. Even a brief test of the key 20 threshold looks damn tough.. even if the market can manage to go sub sp'2000 for a few days.

-

10.01am.. ISM/PMI manufacturing.. come in 'reasonable'...

sp -12pts @ 2054... still...just 'moderate' declines.

-

10.11am.. Oil/gas drillers seeing major declines...

SDRL.. -4%... in the 13s.

RIG -3%.. set to lose the $20s.

Pre-Market Brief

Good morning. Futures are moderately lower, sp -9pts, we're set to start the last month of the year at 2058. Metals have swung strongly upward from overnight lows, Gold +$15. Oil remains weak, -0.4%

sp'daily5

Summary

*awaiting ISM/PMI manu' data around 10am.

---

Welcome to December... just 22 trading days left of what has been another bizarre and twisted year.

So, we're set to open a little lower, but its clearly nothing significant. A retrace.. best case sp'2000 or so. Maybe a brief foray under.. but really.... anyone still touting sub 1900 is just crazy.

-

re: metals... strong overnight drop.... but turning to sig' gains in early morning

The opening gain still only retraces just half of the Friday fall. The gold bugs should still be concerned at what is a giant bear flag on the daily chart.

The weaker USD, -0.4% is no doubt partly helping.

--

Notable early mover: CHK, -1.3%.. as energy prices remain weak.

sp'daily5

Summary

*awaiting ISM/PMI manu' data around 10am.

---

Welcome to December... just 22 trading days left of what has been another bizarre and twisted year.

So, we're set to open a little lower, but its clearly nothing significant. A retrace.. best case sp'2000 or so. Maybe a brief foray under.. but really.... anyone still touting sub 1900 is just crazy.

-

re: metals... strong overnight drop.... but turning to sig' gains in early morning

The opening gain still only retraces just half of the Friday fall. The gold bugs should still be concerned at what is a giant bear flag on the daily chart.

The weaker USD, -0.4% is no doubt partly helping.

--

Notable early mover: CHK, -1.3%.. as energy prices remain weak.

Subscribe to:

Comments (Atom)