A pretty bearish end to the week. Lets take a look

at the two outlooks which I noted just a few days ago. There are

infinite possibilities of course in this crazy market, but I think

the following two broad outlooks are still useful to consider, and

can help provoke a few thoughts from both a bearish and bullish

viewpoint.

Sp' - bullish outlook

From a cycle point of view, we've already floored,

but of course we can remain low for days or even weeks. A break under

1340 arguably wrecks ALL bullish outlooks in the near and mid term.

Bulls really need to see a new high sp'1422> preferably before the

month ends - that would flip the weekly and monthly cycles back to a

bullish trend.

VIX - bullish (market) outlook

My original VIX target of 24 (which seems to have

often been a VIX cycle peak in the last few years), is still some 4%

pts away, but that could be attained within just 2 or 3 days.

Right now, the bulls will not want to see VIX

break a new high on Monday...a move over 21.00 would open the door to

an almost immediate jump to 24- which would certainly equate to

Sp'1340.

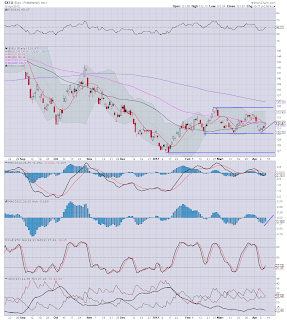

The Bearish market outlook

SP' bearish scenario

This is arguably a

'doomer' chart, it targets 1270/50 sometime this May, although the

possibility - especially if European Bond spreads start to spike,

would be a move to 1150, but that would probably take a bit

longer..maybe June/July (much like the action in summer 2010).

VIX, daily, bearish market

Perhaps the most scary thing for the bulls right

now was to see the VIX hold the 10MA on the daily yesterday. With

today's significant up move, there is now the real threat of putting

in a new VIX high on Mon/Tuesday.

I would still guess that if VIX hits the 24 zone,

we'd see some kind of brief pullback, before the VIX explodes into

the 40s.

Time for the weekend

That's probably it from me for today. We've seen

some pretty dynamic market days this week, I think many will need

this weekend to recover. However, there will be more from me over the

weekend, especially highlighting the weekly/monthly cycles.

Goodnight