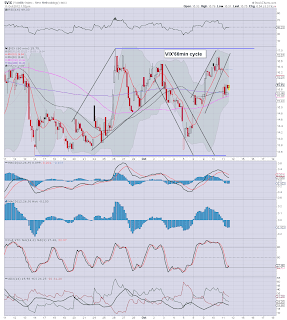

With the main indexes rallying in the morning the VIX dropped around 6%. Despite the indexes closing largely flat, the VIX still failed to rally back to evens, closing 4% lower into the mid 15s.

The VIX remains completely bizarre, showing zero concern in the wider market.

VIX'60min

VIX'daily

Summary

Bears have a real problem for Friday. We have a clear bear flag on the hourly chart, and unless we can battle into the 16s, this bear flag will more than likely play out.

The daily cycle is still showing underlying positive momentum for volatility, but..its only moderate. It won't take much to start this ticking lower.

So, its a real mixed bag in VIX land. Once again, I'll note that whilst the VIX is <20..it is pretty unreliable.

More later

Thursday, 11 October 2012

Closing Brief

With the weekly jobless claims the best in a few years, we saw an excuse for morning gains, but they sure did not hold. It took the bears most of the day, but we managed to close broadly flat.

iwm'60min

dow'60min

sp'60min

Summary

I think many bears will be glad today is over with.

As for tomorrow, really tough to guess. I suppose bears can tout the short term trend is still somewhat down - and the Dow, R2k, tranny, are already below their sp'1430 equivalent lows.

Yet..as I keep noting, the VIX shows zero sign of market concern.

As ever, the bigger trends are what I'm trying to focus on. We have had a few major warnings lately, but the bears must stay in control..and push this market below sp'1430..and close below the 50 day MA @ 1427

More later

iwm'60min

dow'60min

sp'60min

Summary

I think many bears will be glad today is over with.

As for tomorrow, really tough to guess. I suppose bears can tout the short term trend is still somewhat down - and the Dow, R2k, tranny, are already below their sp'1430 equivalent lows.

Yet..as I keep noting, the VIX shows zero sign of market concern.

As ever, the bigger trends are what I'm trying to focus on. We have had a few major warnings lately, but the bears must stay in control..and push this market below sp'1430..and close below the 50 day MA @ 1427

More later

3pm update - a very important closing hour

The earlier gains have largely been eroded, but even a marginally higher close would be a real victory to the bulls.

Bears must close this market at least flat. A close <1430 would be a major reversal victory for the bears, but that seems unlikely.

sp'60min

sp'daily5

Summary

I've frankly no idea what to make of this mornings nonsense. Was it a wave'2 of 3, or what? Pointless to guess it seems.

It remains surprising that so many out there don't think we'll go any lower..for the rest of the year! Surely we're going to break 1430 at some point?

I remain short, back on the 'hope it falls' train.

More after the close.

Bears must close this market at least flat. A close <1430 would be a major reversal victory for the bears, but that seems unlikely.

sp'60min

sp'daily5

Summary

I've frankly no idea what to make of this mornings nonsense. Was it a wave'2 of 3, or what? Pointless to guess it seems.

It remains surprising that so many out there don't think we'll go any lower..for the rest of the year! Surely we're going to break 1430 at some point?

I remain short, back on the 'hope it falls' train.

More after the close.

2pm update - bulls failing to hold together

Urgh. today is not a pleasent one to be part of. Bulls failing badly this past hour, indexes poised to go red again. What a damn mess.

VIX is still red though.

sp'60min

vix'60min

Summary

With two hours to go, what now? The turn around is pretty good so far for the bears, but even a flat close is a major threat to what was a reasonable 3 day down trend.

Bears should be seeking at least a moderately red close....preferably <1430. Right now, that still feels like a very long way down.

I'm still short, but this sure ain't a good day so far.

VIX is still red though.

sp'60min

vix'60min

Summary

With two hours to go, what now? The turn around is pretty good so far for the bears, but even a flat close is a major threat to what was a reasonable 3 day down trend.

Bears should be seeking at least a moderately red close....preferably <1430. Right now, that still feels like a very long way down.

I'm still short, but this sure ain't a good day so far.

10am update - bear massacre coming?

Urghh, it is not a good morning so far in bear land. Here we go again, with a significant opening gap higher, right back into the low sp'1440s.

The failure to break below 1430 should probably be seen as very significant, and now the bull maniacs are already starting to tout new index highs again.

sp'60min

vix'60min

Summary

Its a real confusing mess. With this mornings opening gap, its a reminder that this market just can't find much downside momentum - the move from 1474 to 1430 is barely 3%..a very lame move in the scheme of things.

So, is that it? Now we rally into opex and the US election, sp'1500s?

Unless bears can get back below the hourly 10MA, currently 1437, its looking really bad for the bears.

*VIX is presenting a opening red reversal candle..suggestive the opening index gains will NOT last. However, with the VIX <20, its just not very reliable at these levels.

back at 12pm...perhaps.

The failure to break below 1430 should probably be seen as very significant, and now the bull maniacs are already starting to tout new index highs again.

sp'60min

vix'60min

Summary

Its a real confusing mess. With this mornings opening gap, its a reminder that this market just can't find much downside momentum - the move from 1474 to 1430 is barely 3%..a very lame move in the scheme of things.

So, is that it? Now we rally into opex and the US election, sp'1500s?

Unless bears can get back below the hourly 10MA, currently 1437, its looking really bad for the bears.

*VIX is presenting a opening red reversal candle..suggestive the opening index gains will NOT last. However, with the VIX <20, its just not very reliable at these levels.

back at 12pm...perhaps.

Main indexes also giving provisional warnings

With a third day of declines in the Sp'500 and the Dow'30, we are starting to see some provisional warnings appear on the monthly rainbow charts.

Sp' monthly, 6yr, rainbow

dow' monthly, 6yr, rainbow

Summary

Today was the first time we've seen a blue candle on the SP and the Dow monthly charts since July and August respectively. These blue candles might even change to red if we can break the 10MA - sp'1381, although right now, that sure looks a tough (and unlikely in October) target to hit.

As ever, what matters is where we close at the end of the month.

The bears should arguably merely be seeking blue candles for October on the bigger SP/Dow indexes, which will add to the 'early warning system', that is the Transportation index.

So, lets see if we can close October with the tranny sporting a third red candle, and ALL other main indexes with at least a blue candle. If that is the case, then it would indeed be a warning of trouble this Autumn.

My three red flags remain...

Transports, monthly close <5000 - achieved end September

WTIC Oil weekly <$90, which was achieved last week

VIX weekly close >20, this seems unlikely for at least a few more weeks.

--

Today was...interesting, lets hope Thursday will be even more dynamic, especially in regards to the VIX.

Goodnight from London

Sp' monthly, 6yr, rainbow

dow' monthly, 6yr, rainbow

Summary

Today was the first time we've seen a blue candle on the SP and the Dow monthly charts since July and August respectively. These blue candles might even change to red if we can break the 10MA - sp'1381, although right now, that sure looks a tough (and unlikely in October) target to hit.

As ever, what matters is where we close at the end of the month.

The bears should arguably merely be seeking blue candles for October on the bigger SP/Dow indexes, which will add to the 'early warning system', that is the Transportation index.

So, lets see if we can close October with the tranny sporting a third red candle, and ALL other main indexes with at least a blue candle. If that is the case, then it would indeed be a warning of trouble this Autumn.

My three red flags remain...

Transports, monthly close <5000 - achieved end September

WTIC Oil weekly <$90, which was achieved last week

VIX weekly close >20, this seems unlikely for at least a few more weeks.

--

Today was...interesting, lets hope Thursday will be even more dynamic, especially in regards to the VIX.

Goodnight from London

Daily Index Cycle update

The two main indexes - SP/Dow closed moderately lower, but it is notable that the transports managed to close green, and the Rus'2000 small cap only closed fractionally lower.

With the VIX closing flat, todays index moves are not entirely bearish for Thursday.

IWM

Dow

SP'daily5

Transports

Summary

So, its something of a mixed bag. I suppose the transports and IWM are maybe just doing their usual random/volatile nonsense, but its not exactly the sort of thing I wish to see on what should have been a stronger down move.

*most notable to note though, the Dow, SP, are breaking below their June trend/support channels. The transprots is already well below it of course. The R2K is still 2/3% away.

Thursday outlook

Bears should look for an overnight break below the important sp' 1430 level, that will offer a test of the 1425 level - which is important in many respects.

A gap straight under 1425 would make things a lot easier for those bears seeking an exit in the next day or two.

Lets keep in mind that we're only 41pts from the QE spike high, thats not even 3% ! A move down to sp'1400 would be a very natural level to hit by the Friday close.

A little more later.

With the VIX closing flat, todays index moves are not entirely bearish for Thursday.

IWM

Dow

SP'daily5

Transports

Summary

So, its something of a mixed bag. I suppose the transports and IWM are maybe just doing their usual random/volatile nonsense, but its not exactly the sort of thing I wish to see on what should have been a stronger down move.

*most notable to note though, the Dow, SP, are breaking below their June trend/support channels. The transprots is already well below it of course. The R2K is still 2/3% away.

Thursday outlook

Bears should look for an overnight break below the important sp' 1430 level, that will offer a test of the 1425 level - which is important in many respects.

A gap straight under 1425 would make things a lot easier for those bears seeking an exit in the next day or two.

Lets keep in mind that we're only 41pts from the QE spike high, thats not even 3% ! A move down to sp'1400 would be a very natural level to hit by the Friday close.

A little more later.

Subscribe to:

Comments (Atom)