The VIX actually managed a 0.25% increase by the close, even though the indexes still closed around 0.5% higher. Kinda interesting, but it could merely be noise as the VIX scraps along in the teens.

VIX'60min

VIX, daily

VIX, weekly

Summary

First, lets be clear, the index charts show ZERO sign of a turn, and worse still, some of the monthly index charts are arguably bullish now.

Yet, the bigger VIX weekly cycle is still battling to climb back higher on the MACD (blue bar histogram) cycle. At the current race of 'recovery', it now looks like the VIX might not explode higher until early September.

For the moment, until we clear the recent high of 21..and 27..the bigger targets remain mere 'crazy talk'.

A little more later.

Tuesday, 7 August 2012

Closing Brief

Again, a touch of weakness in the closing hour, but its still noise. The daily trend remains up.

The closing hourly index charts

IWM

Dow

Sp

Summary

From a MACD (blue bar histogram) cycle perspective, we are getting close to going negative cycle, but...its just as likely any pullback would only be 10-20pts anyway..before yet another new high is put in.

Today was yet more unrelenting pain and bemusement for the bears. With the monthly cycles as strong as they are, the big money bears will be sitting this out at least until any break under 1350.

A little more later.

The closing hourly index charts

IWM

Dow

Sp

Summary

From a MACD (blue bar histogram) cycle perspective, we are getting close to going negative cycle, but...its just as likely any pullback would only be 10-20pts anyway..before yet another new high is put in.

Today was yet more unrelenting pain and bemusement for the bears. With the monthly cycles as strong as they are, the big money bears will be sitting this out at least until any break under 1350.

A little more later.

3pm update - closing hour chop

Another quiet day. No rumours, no real news, no real volume.

*consumer credit data due out at 3pm.

sp'60min

Summary

A fair few people out have given up on any count since the June low of sp'1266 and I'm one of them.

For the moment, it remains a case of higher highs..and higher lows. Only with a break of 1354 can anything be said to be starting for the bears. Right now...the low 1350s look a long way down.

A little more after the close.

*consumer credit data due out at 3pm.

sp'60min

Summary

A fair few people out have given up on any count since the June low of sp'1266 and I'm one of them.

For the moment, it remains a case of higher highs..and higher lows. Only with a break of 1354 can anything be said to be starting for the bears. Right now...the low 1350s look a long way down.

A little more after the close.

2pm update - the bears are tired

The latest rally from 1354 to 1407 has to be exhausting for those few bears who remain. Only two groups remain. The first are those who will 'short and keep shorting' regardless of price. The second, are those who will only give up around 1422.

VIX remains very low, Mr Market is entirely fearless. There are endless stories about 'trouble in September/October', but for the moment...the algo-bots don't care.

sp'daily rainbow

vix'daily, rainbow

Summary

No sign of a turn on any of the daily charts, a close in the 1400s would obviously be a real victory to the bulls.

*consumer credit data at 3pm.

VIX remains very low, Mr Market is entirely fearless. There are endless stories about 'trouble in September/October', but for the moment...the algo-bots don't care.

sp'daily rainbow

vix'daily, rainbow

Summary

No sign of a turn on any of the daily charts, a close in the 1400s would obviously be a real victory to the bulls.

*consumer credit data at 3pm.

1pm update - why would it stop at 1422 ?

No sign of a turn...quite the opposite in fact.

In fact, it is laughable when you consider the bigger monthly cycle, which recently went back to outright bullish.

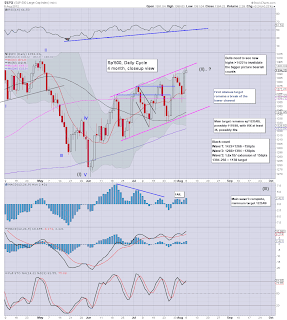

sp' weekly

sp'monthly, rainbow

Summary

Sure, we could form a double top at 1422, but why would it stop now? We know the central bank lunatics are going to do more.

Clearly, there shouldn't be any serious money bears in any positions now. They 'should' have got the kick somewhere between 1380/1405.

1400 has fallen, and 1422 will probably fall too. After that, first target is 1450.

In fact, it is laughable when you consider the bigger monthly cycle, which recently went back to outright bullish.

sp' weekly

sp'monthly, rainbow

Summary

Sure, we could form a double top at 1422, but why would it stop now? We know the central bank lunatics are going to do more.

Clearly, there shouldn't be any serious money bears in any positions now. They 'should' have got the kick somewhere between 1380/1405.

1400 has fallen, and 1422 will probably fall too. After that, first target is 1450.

12pm update - onward and upward

A mere 16pts from taking out the sp'1422 April peak.

sp'daily5

Summary

What can be said about this, really?

No sign of a turn. No sign of levelling out, with the sp monthly chart...outright bullish.

sp'daily5

Summary

What can be said about this, really?

No sign of a turn. No sign of levelling out, with the sp monthly chart...outright bullish.

11am update - a real mess

With the big 1400 level being hit, the clown networks are starting to get hyper again. They'll probably be bringing on the sp'1600 cheer leaders later today.

It is notable that whilst the SP has made a clear break above the channel, other indexes are still holding within.

sp'daily5

NYSE, comp, daily

Summary

Very little to add, this could merely be a capitulation day, but arguably any 'big money' bears are out of this, and back to spectating. After all, the immediate trend remains UP.

19pts to go, and then the 'wave'1 theory' has to get trashed.

It is notable that whilst the SP has made a clear break above the channel, other indexes are still holding within.

sp'daily5

NYSE, comp, daily

Summary

Very little to add, this could merely be a capitulation day, but arguably any 'big money' bears are out of this, and back to spectating. After all, the immediate trend remains UP.

19pts to go, and then the 'wave'1 theory' has to get trashed.

10am update - there go the 1400 stops

We're a mere 20 pts from the April peak.

This is the thing that gets me about the chartists - especially the elliot wavers, if we do hit 1423, that invalidates EVERYTHING they've said since April. All that talk of 'ohh, its a wave'1' etc, it will all have to be thrown into the trash bin

But no, they won't admit that, they can't.

There remain only a few who are suggesting a marginally lower high <1422 in the near term, before a major move lower. As it is, with the monthly cycle now outright bullish, its hard to argue that 1422 won't be broken.

sp'60min

VIX'60min

VIX is putting in a reversal candle, but they've not been particularly reliable lately.

Summary

Bulls are very close to removing the last set of bear stops at the 1422 peak. Just one more big up day, and we're back into a massively strong market (volume has been irrelevant since summer 2009) with QE yet to come.

Its all so bizarre!

This is the thing that gets me about the chartists - especially the elliot wavers, if we do hit 1423, that invalidates EVERYTHING they've said since April. All that talk of 'ohh, its a wave'1' etc, it will all have to be thrown into the trash bin

But no, they won't admit that, they can't.

There remain only a few who are suggesting a marginally lower high <1422 in the near term, before a major move lower. As it is, with the monthly cycle now outright bullish, its hard to argue that 1422 won't be broken.

sp'60min

VIX'60min

VIX is putting in a reversal candle, but they've not been particularly reliable lately.

Summary

Bulls are very close to removing the last set of bear stops at the 1422 peak. Just one more big up day, and we're back into a massively strong market (volume has been irrelevant since summer 2009) with QE yet to come.

Its all so bizarre!

Pre-Market Brief

Good morning. Futures (for whatever reason) are sp+5pts..we're set to open around the 1400 level.

sp'60min

sp'daily5

Summary

Looks like the bulls will get a moderate opening gap higher, and stop out all those bears in the 1400/05 level.

I would be very surprised if we can close higher today.

*we have consumer credit data late today at 3pm.

More across the day.

sp'60min

sp'daily5

Summary

Looks like the bulls will get a moderate opening gap higher, and stop out all those bears in the 1400/05 level.

I would be very surprised if we can close higher today.

*we have consumer credit data late today at 3pm.

More across the day.

Daily Index Cycle update

A very dull day, and even the last 30 minutes can't really be counted as anything other than 'marginal dullness'. I realise its the sleepy summer season, and the market can't often be expected to be trading briskly, but today must be both embarrassing and disturbing for the exchange managers.

There are just so few 'real people' left, and with Knight capital causing havoc last Thursday morning, no one should have any confidence in what is a very sick, nasty, and near bid less equity market.

--

A few of the daily indexes...

sp,daily5

Dow

Transports

Summary

So..once again the bears will be asking themselves 'is that it?' Sp'1399...just missing the big 1400 again, last seen at the start of May - when the original rollover began. Its not a bad spike for a near-term top, but there is no turn on the MACD (blue bar histogram) cycle, in fact, its pretty bullish for the next few days.

---

A reminder on the doomer count.... - which a few notable others also are seeking in the weeks/months ahead.

sp'daily4 - the doomer count

As I've noted a few times lately, if any such outcome is going to happen, there needs to be a catalyst, something to really spook the market. Right now, there is no sign of anything in the immediate term.

So, even if do get down to sp'1350 this week, we'll very likely just bounce up again..and put in yet another higher high. Things only get interesting if we break into the 1320s..and close <1325. Only then can the doomer bears start to claim 'something' might be underway.

A quiet day, I'll leave it at that. Goodnight

There are just so few 'real people' left, and with Knight capital causing havoc last Thursday morning, no one should have any confidence in what is a very sick, nasty, and near bid less equity market.

--

A few of the daily indexes...

sp,daily5

Dow

Transports

Summary

So..once again the bears will be asking themselves 'is that it?' Sp'1399...just missing the big 1400 again, last seen at the start of May - when the original rollover began. Its not a bad spike for a near-term top, but there is no turn on the MACD (blue bar histogram) cycle, in fact, its pretty bullish for the next few days.

---

A reminder on the doomer count.... - which a few notable others also are seeking in the weeks/months ahead.

sp'daily4 - the doomer count

As I've noted a few times lately, if any such outcome is going to happen, there needs to be a catalyst, something to really spook the market. Right now, there is no sign of anything in the immediate term.

So, even if do get down to sp'1350 this week, we'll very likely just bounce up again..and put in yet another higher high. Things only get interesting if we break into the 1320s..and close <1325. Only then can the doomer bears start to claim 'something' might be underway.

A quiet day, I'll leave it at that. Goodnight

Subscribe to:

Comments (Atom)