With the indexes seeing some declines, the VIX saw a moderate opening jump, but was maxed out by late morning. The VIX closed +6.9% @ 13.58. Equity bears need to see the VIX back in the 16s before there is any evidence the current equity wave from November has concluded.

VIX'daily3

VIX'weekly

Summary

So, almost 7% to start the week, but considering the index hourly charts, the VIX could just as easily close Tue/Wednesday -10%.

There seems no point in picking up VIX calls...yet. We could easily see a test of the Oct'2007 high of sp'1576.

--

The weekly chart will be key this spring. Any weekly close above the 200MA - currently in the 21s, will be the last warning to the equity bulls of a 'problem'.

A little more later on the indexes

Monday, 1 April 2013

Closing Brief

The main indexes closed very mixed. The Dow almost closed flat, with the sp' -0.45% Yet the big two leaders - Trans and Rus'2000 slipped 1.5 and 1.3% respectively. Near term still offers one more jump to the upside, but there are increasingly signs of weakness.

sp'60min

Summary

Suffice to say, a bit of a choppy day.

Best guess remains, we'll max out Wednesday, in the sp'1575/80 area. From there, I'll be looking for a very sharp intra-day reversal, and first downside will be the 1540/30 area - at which level there is strong rising support..which itself should break by mid April.

The bears are going to need to be real patient in the days ahead.

Whilst the QE-POMO continues, its going to be real difficult just to claw back under sp'1500.

sp'60min

Summary

Suffice to say, a bit of a choppy day.

Best guess remains, we'll max out Wednesday, in the sp'1575/80 area. From there, I'll be looking for a very sharp intra-day reversal, and first downside will be the 1540/30 area - at which level there is strong rising support..which itself should break by mid April.

The bears are going to need to be real patient in the days ahead.

Whilst the QE-POMO continues, its going to be real difficult just to claw back under sp'1500.

3pm update - choppy mess

Another micro-cycle to the downside, but even now we're barely 0.5% lower. Hourly index cycles offer upside back into the 1570s across Tue/Wednesday. VIX is +8%, but is still below the important 15s from March'19. Gold holding slight gains, whilst Silver remains weak.

sp'60min

Summary

Hourly MACD cycle looks very low, and bears face a significant risk of seeing the indexes back in the 1570s tomorrow.

I suppose 1580s are viable Wed/Thursday, but that would merely make for an even better short level.

Still waiting.

back after the close

sp'60min

Summary

Hourly MACD cycle looks very low, and bears face a significant risk of seeing the indexes back in the 1570s tomorrow.

I suppose 1580s are viable Wed/Thursday, but that would merely make for an even better short level.

Still waiting.

back after the close

2pm update - more nonsense..as expected

The indexes are battling to claw back to flat. It won't be easy, but we'll surely see the market trading in the 1575/80 zone by late Wednesday. Oil is similarly trying to claw back to evens, whilst Gold is holding moderate gains of $4. Silver remains very weak, but is trying to rebound.

sp'60min

USO, daily2

Summary

Not exactly the most exciting of days, not least whilst many are still on an Easter break. Tuesday should see much more dynamic trading, not least in the metals.

--

*Oil will probably be a viable short once the market shows more sign of a solid ceiling later this week. USO could easily break into the low 35s

--

sp'60min

USO, daily2

Summary

Not exactly the most exciting of days, not least whilst many are still on an Easter break. Tuesday should see much more dynamic trading, not least in the metals.

--

*Oil will probably be a viable short once the market shows more sign of a solid ceiling later this week. USO could easily break into the low 35s

--

12pm update - waiting for a test of 1576

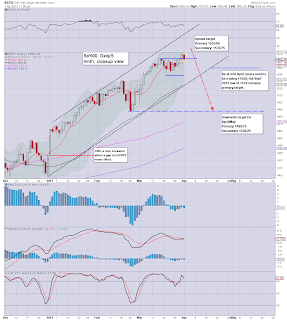

The morning wave lower is probably getting a few of the bears excited, but really, there remains no reason why we'd get stuck at 1570, and not make a challenge of the 2007 high of 1576. Daily charts look messy, but underlying upside is always going to be there with POMO.

sp'60min

sp'daily5

Summary

The hourly count is a very unreliable one, but I'm holding to it, and am guessing we'll see the indexes max out on Wednesday in the 1575/80 area.

Regardless, I ain't meddling in any indexes..yet.

--

Metals remain a real mix. Gold is a touch higher, whilst Silver - having got smacked lower at the open, is now beginning a rebound..the only issue is can it break over EXTREME resistance in the 27.70s Tue/Wednesday.

VIX update.. from Mr T

--

time for lunch.

sp'60min

sp'daily5

Summary

The hourly count is a very unreliable one, but I'm holding to it, and am guessing we'll see the indexes max out on Wednesday in the 1575/80 area.

Regardless, I ain't meddling in any indexes..yet.

--

Metals remain a real mix. Gold is a touch higher, whilst Silver - having got smacked lower at the open, is now beginning a rebound..the only issue is can it break over EXTREME resistance in the 27.70s Tue/Wednesday.

VIX update.. from Mr T

--

time for lunch.

10am update - a few more days

Market is opening with micro-chop, and is now fractionally higher. There is little reason why the bears are going to be able to push significantly lower until the latter part of this week. VIX jumps 5% at the open, but doesn't look like that will hold. Silver..is getting smacked lower.

sp'daily5

vix'daily3

Summary

I think bears are going to have to wait until at least Wednesday, if not early Thursday for a break of soft rising support, which is arguably now around 1555/60.

Daily MACD is ticking higher, and on any basis, is likely to do so until Wednesday..even if we see sideways chop in prices.

*As for metals...

Silver is smacked significantly lower again at the open, although Gold is flat. Lets see if Silver can again put in a reversal, yet the last one sure didn't work out well. Its not looking good though

sp'daily5

vix'daily3

Summary

I think bears are going to have to wait until at least Wednesday, if not early Thursday for a break of soft rising support, which is arguably now around 1555/60.

Daily MACD is ticking higher, and on any basis, is likely to do so until Wednesday..even if we see sideways chop in prices.

*As for metals...

Silver is smacked significantly lower again at the open, although Gold is flat. Lets see if Silver can again put in a reversal, yet the last one sure didn't work out well. Its not looking good though

Subscribe to:

Comments (Atom)