Whilst the equity market built gains across the day, the VIX appeared to be forming a double floor in the low 17s. Hourly VIX charts offer very significant upside potential across the next two days, and a weekly close in the low 20s looks very viable.

VIX'60min

VIX'daily3

Summary

The opening reversal candle was pretty much a classic, and we even saw the VIX break into the mid 18s by mid-morning, but with the indexes holding together, the VIX cooled back down.

Arguably, we closed the day with a double floor in the low 17s, and that surely 'fills the gap', and the VIX should now start a new climb - assuming the indexes have maxed @ sp'1606.

--

*I am Heavy LONG the VIX, from the 17.50s, seeking an exit in the 23/25s within 2-3 trading days.

Wednesday, 26 June 2013

Closing Brief

The market broadly continued its bounce from the sp'1560 low, although there remain plenty of a signs of weakness out there. Despite the break into the 1600s, VIX is holding the 17s, and looks primed to surge back into the 20s before the weekend.

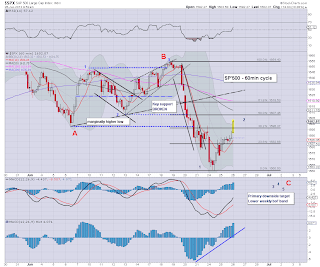

sp'60min

Summary

An interesting..but somewhat tiresome day. Seeing what appeared to be renewed QE-fuelled algo-bot melt was pretty troubling this afternoon.

Yet a bounce was expected, the only issue is where it will max out

--

*I hold heavy SHORT overnight, and probably into late Friday.

In the bigger picture..nothing has changed. Primary downside target is the lower weekly bollinger, currently @ sp'1497

sp'60min

Summary

An interesting..but somewhat tiresome day. Seeing what appeared to be renewed QE-fuelled algo-bot melt was pretty troubling this afternoon.

Yet a bounce was expected, the only issue is where it will max out

--

*I hold heavy SHORT overnight, and probably into late Friday.

In the bigger picture..nothing has changed. Primary downside target is the lower weekly bollinger, currently @ sp'1497

3pm update - melt into the close?

The market is broadly still climbing, bears need a close <sp'1595, and that doesn't look likely now. Indeed, with today's QE, the bulls might be able to quietly melt this into the close, 1608/10 would be the target. VIX so far showing no real power, and is close to the opening low.

sp'60min

vix'60min

Summary

A bit of a tiresome day for those on the short side. A hint of weakness in mid-morning, but then...back to slow motion melt.

Is it the QE ? Or merely the short term bounce?

--

Regardless, I'd be surprised if we close <1600.

--

*I will hold short overnight, and right now, probably into the Friday close..and across the weekend.

UPDATE 3.29pm.. well, we've effectively tested the 50% fib retrace from the 1654 high.

Only issue now is whether 1620s...before 1530s.

3.35pm.. Note the trans/R2K have NOT yet broken the morning high, equivilent to sp'1603. Kinda interesting.

3.45pm.. R2K looking like intra-day double top....and its weak right now - Transports is matching it.

sp'60min

vix'60min

Summary

A bit of a tiresome day for those on the short side. A hint of weakness in mid-morning, but then...back to slow motion melt.

Is it the QE ? Or merely the short term bounce?

--

Regardless, I'd be surprised if we close <1600.

--

*I will hold short overnight, and right now, probably into the Friday close..and across the weekend.

UPDATE 3.29pm.. well, we've effectively tested the 50% fib retrace from the 1654 high.

Only issue now is whether 1620s...before 1530s.

3.35pm.. Note the trans/R2K have NOT yet broken the morning high, equivilent to sp'1603. Kinda interesting.

3.45pm.. R2K looking like intra-day double top....and its weak right now - Transports is matching it.

2pm update - battle continues

Market has broken the early morning high, and the bulls are making a play for the 50% fib retrace in the sp'1607/08 area. The 1620s still look out of range, although VIX is so far unable to hold the 18s.

sp'60min

Summary

Well, certainly no clear break lower yet.

On any basis though, the bulls are a good 43pts above the Monday low, and considering the recent market mood, the general weakness should return at some point.

--

Regardless of how we close, I ain't exiting.

If the bull maniacs can manage 1620s..so be it.

What I do know is that the upward channel from November is busted.

Downside target remains the lower weekly bol..currently sp'1495.

--

*could be worse, I could be long Gold/Silver

yours..

the patient bear :)

--

2.12pm.. market looking tired @ sp'1602. Hmm, can the bears whipsaw this lower by the close?

Key thing to look remains... VIX in the 18s. That'd set up tomorrow morning for VIX 20+

2.30pm.. .1604s, oh well, 1607/08 will surely be hit now.

For the bulls, a close of 1608/10, would open the door to 1620/25 tomorrow. That'd indeed be..annoying for those already short.

sp'60min

Summary

Well, certainly no clear break lower yet.

On any basis though, the bulls are a good 43pts above the Monday low, and considering the recent market mood, the general weakness should return at some point.

--

Regardless of how we close, I ain't exiting.

If the bull maniacs can manage 1620s..so be it.

What I do know is that the upward channel from November is busted.

Downside target remains the lower weekly bol..currently sp'1495.

--

*could be worse, I could be long Gold/Silver

yours..

the patient bear :)

--

2.12pm.. market looking tired @ sp'1602. Hmm, can the bears whipsaw this lower by the close?

Key thing to look remains... VIX in the 18s. That'd set up tomorrow morning for VIX 20+

2.30pm.. .1604s, oh well, 1607/08 will surely be hit now.

For the bulls, a close of 1608/10, would open the door to 1620/25 tomorrow. That'd indeed be..annoying for those already short.

1pm update - afternoon battle

The bulls are desperately trying to hold the 1600 level. Considering the VIX looks floored in the mid 17s, I do not think the market can hold a close >1600. With just a little push lower, the bears could achieve a moderately red close, and would set up some serious carnage into the Friday close.

sp'60min'3 - broad outlook

vix'60min

Summary

Its still looking okay for those who are taking/building new short positions.

Hourly MACD (blue bar histogram) cycle certainly looks on the high side, although no clear sell signals..yet.

--

I'm going with what I have been thinking about for the last few days.. a VIX gap fill..and then the next equity wave lower....sp'1530s would be the obvious target.

Certainly, that looks to be hit by mid July, but it could come within a few days.

-

*I am heavy short, and in no hurry to exit this until considerably lower levels.

sp'60min'3 - broad outlook

vix'60min

Summary

Its still looking okay for those who are taking/building new short positions.

Hourly MACD (blue bar histogram) cycle certainly looks on the high side, although no clear sell signals..yet.

--

I'm going with what I have been thinking about for the last few days.. a VIX gap fill..and then the next equity wave lower....sp'1530s would be the obvious target.

Certainly, that looks to be hit by mid July, but it could come within a few days.

-

*I am heavy short, and in no hurry to exit this until considerably lower levels.

12pm update - bulls need to break higher

Bulls need to keep pushing from here, or the bears are going to seize back control, and then whack this market to new lows, <sp'1560. VIX looks floored in the mid 17s. Precious metals are getting obliterated again, Gold -$40. Oil is weak, -0.5%

sp'60min

vix'60min

Summary

The levels are pretty clear for those seeking renewed downside.

Bears need a daily close of VIX 18s, with sp <1590. That doesn't necessarily have to occur today, but there is of course the risk that the bulls will manage 1620s on one final push.

-

I'm guessing no...and have indeed already launched a major short, from sp'1601 /VIX 17.50s.

Interestingly, MRO is perhaps showing todays failed rally better than anything out there...

--

VIX update from Mr T.

time for lunch

sp'60min

vix'60min

Summary

The levels are pretty clear for those seeking renewed downside.

Bears need a daily close of VIX 18s, with sp <1590. That doesn't necessarily have to occur today, but there is of course the risk that the bulls will manage 1620s on one final push.

-

I'm guessing no...and have indeed already launched a major short, from sp'1601 /VIX 17.50s.

Interestingly, MRO is perhaps showing todays failed rally better than anything out there...

--

VIX update from Mr T.

time for lunch

11am update - battling it out

The main market may have maxed out @ sp'1603. Bears should be seeking a daily close under the hourly10MA, currently (still rising) @ 1587. Bulls should be concerned that the VIX has put in an hourly reversal candle..in the gap-zone no less.

sp'60min

vix'60min

Summary

Well, its an interesting situation. We've bounced a good 43pts off the Monday morning low, and for me, that was a valid place to go short.

There IS risk of upside to 1620s - as many realise, but I think the risk/reward is very reasonable.

*I am HEAVY short the main market from sp'1601, and via VIX 17.50s.

Seeking an exit in the sp'1550s, with VIX 23/25..within 3-5 trading days.

11.23am... still battling it out..just under 1600. This could easily last all day..even much of tomorrow.

What is clear though, we have a few pretty clear trends.

Bears need a VIX close >18.., 18.50s would be decisive, along with sp <1590.

--

sp'60min

vix'60min

Summary

Well, its an interesting situation. We've bounced a good 43pts off the Monday morning low, and for me, that was a valid place to go short.

There IS risk of upside to 1620s - as many realise, but I think the risk/reward is very reasonable.

*I am HEAVY short the main market from sp'1601, and via VIX 17.50s.

Seeking an exit in the sp'1550s, with VIX 23/25..within 3-5 trading days.

11.23am... still battling it out..just under 1600. This could easily last all day..even much of tomorrow.

What is clear though, we have a few pretty clear trends.

Bears need a VIX close >18.., 18.50s would be decisive, along with sp <1590.

--

10am update - bounce complete?

The market has managed to hit some short-stops in pre-market, and we've opened above sp'1600. Next level is 1607/08, where a 50% fib retrace and an old low reside. The VIX has possible completed a gap-fill in the mid 17s, and is offering a reversal candle!

sp'60min

vix'60min

Summary

*I am HEAVY short the market from VIX 17.50s, and sp'1601.

--

This was actually the open I was hoping for, its knocked another 10/15% off the 'bearish' side in options land, and I'm considering it as a bonus discount.

Lets be clear, there IS risk of continued rally to the 1620s - as many recognise, but that is only another 1% higher, and downside is arguably all the way to sp'1510/00, about 6% lower.

So...1% risk of upside... 6% downside, thats pretty good in my view.

-

Now...its back to the waiting game.

-

Here is the thing..if you believe this is merely the bounce, then on any basis, this is the place to be taking a new short, at the top of the hourly bol/Keltner bands.

We're seen a good 40pt bounce since the Monday low, I think the bounce is at least 'largely' complete, if not fully.

10.10am.. first soft downside target is the rising hourly 10MA @ 1587. A daily close under that..and the bounce will indeed be confirmed as complete.

10.17am...sp'1598...hmm...interesting...but a long day ahead. I will be holding short overnight anyway, I ain't in this for a 5/10pt down move, I want 50pts down.

sp'60min

vix'60min

Summary

*I am HEAVY short the market from VIX 17.50s, and sp'1601.

--

This was actually the open I was hoping for, its knocked another 10/15% off the 'bearish' side in options land, and I'm considering it as a bonus discount.

Lets be clear, there IS risk of continued rally to the 1620s - as many recognise, but that is only another 1% higher, and downside is arguably all the way to sp'1510/00, about 6% lower.

So...1% risk of upside... 6% downside, thats pretty good in my view.

-

Now...its back to the waiting game.

-

Here is the thing..if you believe this is merely the bounce, then on any basis, this is the place to be taking a new short, at the top of the hourly bol/Keltner bands.

We're seen a good 40pt bounce since the Monday low, I think the bounce is at least 'largely' complete, if not fully.

10.10am.. first soft downside target is the rising hourly 10MA @ 1587. A daily close under that..and the bounce will indeed be confirmed as complete.

10.17am...sp'1598...hmm...interesting...but a long day ahead. I will be holding short overnight anyway, I ain't in this for a 5/10pt down move, I want 50pts down.

Pre-Market Brief

Good morning. Futures have turned strongly around overnight, and we're now looking at sp +9pts @ 1597. Precious metals are seeing severe falls, Gold -$40, Silver -80 cents (4%). USD is moderately higher. Oil is actually a touch lower again.

sp'60min

vix'60min

Summary

With the turn in the futures (from Dow -60), everything remains on track.

--

The one issue we have this morning are comments from two Fed' people at 10am.

Considering futures are higher, I'm wondering if that will be the excuse the market wants for a full reversal to RED indexes. Or...if the gains will intensify, and that we'll be making a play for 1600/10 later in the day.

--

What will I be looking for ?

VIX, a reversal candle in the lower gap zone, 17.25/16.75....best seen on the hourly chart.

Sp' getting stuck just under the old key low of 1598

I'm seeking to pick up a HEAVY index-short, and also long VIX. I've not been long volatility since January, so this is an 'old school' trade for me. Its sure been a while!

-

Arguably, the 'don't trade in the first 30mins rule', is good, but if I see black candles on the R2K/Trans hourly (where they usually appear first), and a reversal candle on the VIX early on...I'll be sorely tempted.

--

Good wishes for what will be an important day !

Just noticed an update from Oscar

Naturally..he is bullish, ;)

--

UPDATE 8.42am.. GDP revised down from 2.4 to 1.8%....which is somewhat of a surprise to Mr Market.

sp +6pts, we're now looking at 1594.

8.59am... Oil sure is weak, -0.5% now, sp +8pts, which is impressive considering the lousy GDP data.

9.21am..there go some stops..and we're sp +12... @ 1600.

Next level is the old 1608 'moderately higher low'.

There is also the 50% fib retrace around 1607.

I am in NO hurry to hit buttons right now. Good bears..need patience ;)

9.37am.. sp'1603.. hmm..... VIX is near the lower gap level

Eyes..sharp

9.42am LONG VIX... from 17.54

9.45am.. SHORT the main market, from sp'1601

Thats it...I've made my move.. am HEAVY short this market, now ....I wait.

I can sustain a move to sp'1620s...if I'm wrong, but the smaller cycles look pretty maxed out already.

Long day ahead....

As it is, I will look to hold short..overnight..and across all of Thursday, possibly all the way into the Friday close.

First downside target is the 1560 low, then 1550..and the mid-april low of 1536.

sp'60min

vix'60min

Summary

With the turn in the futures (from Dow -60), everything remains on track.

--

The one issue we have this morning are comments from two Fed' people at 10am.

Considering futures are higher, I'm wondering if that will be the excuse the market wants for a full reversal to RED indexes. Or...if the gains will intensify, and that we'll be making a play for 1600/10 later in the day.

--

What will I be looking for ?

VIX, a reversal candle in the lower gap zone, 17.25/16.75....best seen on the hourly chart.

Sp' getting stuck just under the old key low of 1598

I'm seeking to pick up a HEAVY index-short, and also long VIX. I've not been long volatility since January, so this is an 'old school' trade for me. Its sure been a while!

-

Arguably, the 'don't trade in the first 30mins rule', is good, but if I see black candles on the R2K/Trans hourly (where they usually appear first), and a reversal candle on the VIX early on...I'll be sorely tempted.

--

Good wishes for what will be an important day !

Just noticed an update from Oscar

Naturally..he is bullish, ;)

--

UPDATE 8.42am.. GDP revised down from 2.4 to 1.8%....which is somewhat of a surprise to Mr Market.

sp +6pts, we're now looking at 1594.

8.59am... Oil sure is weak, -0.5% now, sp +8pts, which is impressive considering the lousy GDP data.

9.21am..there go some stops..and we're sp +12... @ 1600.

Next level is the old 1608 'moderately higher low'.

There is also the 50% fib retrace around 1607.

I am in NO hurry to hit buttons right now. Good bears..need patience ;)

9.37am.. sp'1603.. hmm..... VIX is near the lower gap level

Eyes..sharp

9.42am LONG VIX... from 17.54

9.45am.. SHORT the main market, from sp'1601

Thats it...I've made my move.. am HEAVY short this market, now ....I wait.

I can sustain a move to sp'1620s...if I'm wrong, but the smaller cycles look pretty maxed out already.

Long day ahead....

As it is, I will look to hold short..overnight..and across all of Thursday, possibly all the way into the Friday close.

First downside target is the 1560 low, then 1550..and the mid-april low of 1536.

Still on schedule for lower levels

Despite the rally from sp'1560 to 1588, this is probably just a bounce, and primary outlook remains unchanged. The sp'1550/30 zone looks very viable within the next few days, although the bigger weekly cycle target remains the lower bollinger, currently @ 1495.

sp'weekly7 - near term count'1

sp'60min'3 - near term hourly outlook

Summary

An interesting day to watch, although more so, for individual stocks - like BKS, CNX, and MRO.

The bulls have now had almost two full days of bounce, and I'm still guessing we'll cycle to much lower levels within the next few days.

--

Keep those bond yields in mind.

Just a brief reminder on the 10yr US treasury note..

Despite the market rallying, the 10yr yield is still 2.60..a mere 15bps from breaking the next critical level of 2.75. If we see 2.80s at ANY point, then a further 40/60bps look viable within days..if not 'hours'.

Looking ahead

There are a few econ-data points tomorrow, the main one being the final reading 'attempt' for Q1 GDP, market is expecting an unchanged number of +2.4%. There is a mid-sized QE this Wednesday..and Thursday, so equity bears will be fighting the Fed to some extent.

*perhaps most notable, there are three Fed' reserve people talking tomorrow, and no doubt those comments will be listened to by Mr Market.

-

Seeking a major re-short

I am looking to launch a major short of this market early tomorrow, somewhere in the sp'1595/1605 area. I no longer think the gap in the mid sp'1620s is going to be hit/filled in the current bounce.

Goodnight from London

--

Bonus video...

In my somewhat random youtube viewing just earlier, I noticed the following, and I think its worth highlighting.

There are times when I wonder if my econ/market/stock postings are actually 'entertaining' enough. Since I started doing this, some 15 months ago, I have tried my best, I really have.

Am I doing enough? Anyone......anyone? ;)

sp'weekly7 - near term count'1

sp'60min'3 - near term hourly outlook

Summary

An interesting day to watch, although more so, for individual stocks - like BKS, CNX, and MRO.

The bulls have now had almost two full days of bounce, and I'm still guessing we'll cycle to much lower levels within the next few days.

--

Keep those bond yields in mind.

Just a brief reminder on the 10yr US treasury note..

Despite the market rallying, the 10yr yield is still 2.60..a mere 15bps from breaking the next critical level of 2.75. If we see 2.80s at ANY point, then a further 40/60bps look viable within days..if not 'hours'.

Looking ahead

There are a few econ-data points tomorrow, the main one being the final reading 'attempt' for Q1 GDP, market is expecting an unchanged number of +2.4%. There is a mid-sized QE this Wednesday..and Thursday, so equity bears will be fighting the Fed to some extent.

*perhaps most notable, there are three Fed' reserve people talking tomorrow, and no doubt those comments will be listened to by Mr Market.

-

Seeking a major re-short

I am looking to launch a major short of this market early tomorrow, somewhere in the sp'1595/1605 area. I no longer think the gap in the mid sp'1620s is going to be hit/filled in the current bounce.

Goodnight from London

--

Bonus video...

In my somewhat random youtube viewing just earlier, I noticed the following, and I think its worth highlighting.

There are times when I wonder if my econ/market/stock postings are actually 'entertaining' enough. Since I started doing this, some 15 months ago, I have tried my best, I really have.

Am I doing enough? Anyone......anyone? ;)

Daily Index Cycle update

The main indexes battled higher across the day. The sp' closed +0.95% @ 1588, having hit 1593. The transports saw a far more significant 1.9%, with the R2K +1.1%. Near term is broadly weak, and further downside to the 1530s looks likely, if not even 1510/00.

sp'daily5

R2K

Trans

Summary

An interesting day to watch from the sidelines. A day where the market was desperately trying to claw away from the recent low of 1560. We're now 28pts above that, and it would seem the bulls will get at least one opportunity to make a play to break through 1600 early tomorrow.

However, considering the near term trend, renewed underlying weakness looks set to reappear, with significantly lower levels across Thursday and Friday.

*equity bears however will face significant QEs on both Wed/Thursday.

--

a little more later...

sp'daily5

R2K

Trans

Summary

An interesting day to watch from the sidelines. A day where the market was desperately trying to claw away from the recent low of 1560. We're now 28pts above that, and it would seem the bulls will get at least one opportunity to make a play to break through 1600 early tomorrow.

However, considering the near term trend, renewed underlying weakness looks set to reappear, with significantly lower levels across Thursday and Friday.

*equity bears however will face significant QEs on both Wed/Thursday.

--

a little more later...

Subscribe to:

Comments (Atom)