Despite most US equity indexes closing weak, the VIX was unable to hold minor gains, settling -0.5% @ 16.84. Near term outlook offers another equity push higher, and that threatens a brief VIX drop to the 15s.. even 14s. However, VIX looks set to begin a new multi-week up cycle... onward to the 30s and beyond.

VIX'60min

VIX'daily3

Summary

Suffice to add, VIX remains broadly subdued ahead of the latest FOMC announcement.

The daily lower bollinger is offering a brief foray into the 15s.. or even 14s.

--

more later... on the indexes

Tuesday, 15 March 2016

Closing Brief

US equity indexes closed broadly weak, sp -3pts @ 2015. The two leaders - Trans/R2K, settled lower by -0.6% and -1.6% respectively. Near term outlook offers another push higher.. but then maxing out, before cooling across the latter half of the month.

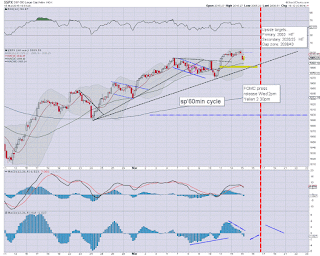

sp'60min

Summary

*closing hour action: as has been the case for the last month... a lot of micro chop, but leaning higher into the close.

--

Earlier today I noted I was hoping for a close in the sp'2010/15 zone, to help keep within range the upside gap of 2038/43.

... so I'm kinda very content with today's close.

Now its a case of waiting to see how the market reacts to the 2pm press release. Certainly, once the FOMC is out of the way, the window is wide open to the bears for the rest of the month.

--

Today's closing movie was...

.... Butch Casiddy and the Sundance Kid, what an incredible ending!

--

more later... on the VIX

sp'60min

Summary

*closing hour action: as has been the case for the last month... a lot of micro chop, but leaning higher into the close.

--

Earlier today I noted I was hoping for a close in the sp'2010/15 zone, to help keep within range the upside gap of 2038/43.

... so I'm kinda very content with today's close.

Now its a case of waiting to see how the market reacts to the 2pm press release. Certainly, once the FOMC is out of the way, the window is wide open to the bears for the rest of the month.

--

Today's closing movie was...

.... Butch Casiddy and the Sundance Kid, what an incredible ending!

--

more later... on the VIX

3pm update - sleeping into the close

US equities are set for the second consecutive net daily decline, but we remain well within range of the recent high of sp'2024. There is little reason why another spike higher to the gap zone of 2038/43 won't occur.. whether late tomorrow.. or Thursday. In any case.. a key top looks set to occur.

sp'60min

VIX'60min

Summary

*metals remain a little weak, Gold -$2, but the related mining stocks are holding up.. GDX +1.0%

---

.. this market has been too subdued for me to remain awake today.

Either that.. or its the lack of sunshine. urghh.

--

Today has indeed been subdued, tomorrow afternoon offers something different :)

back at the close.

sp'60min

VIX'60min

Summary

*metals remain a little weak, Gold -$2, but the related mining stocks are holding up.. GDX +1.0%

---

.. this market has been too subdued for me to remain awake today.

Either that.. or its the lack of sunshine. urghh.

--

Today has indeed been subdued, tomorrow afternoon offers something different :)

back at the close.

1pm update - declining junk

Whilst the broader market remains churning.. if moderately lower, there is notable weakness in the usual junk suspects. Freeport McMoran (FCX) and Seadrill (SDRL) are lower by -7% and -11% respectively.. mid term outlook remains dire.

FCX, daily

SDRL, daily

Summary

*a note on the metals.. with Gold -$2, although the mining stocks are holding up.. with GDX +0.4%.

Both the metals and miners still look set for further downside as part of a natural retrace.

--

As for FCX and SDRL... its notable than even when the market is down just a little, the 'junk' gets utterly smashed.. usually by at least 5-7%.

If you consider the sp'1600s as likely.. then do the math for FCX and SDRL. Neither look set to be around for the long term.

--

back at 2pm. maybe.

FCX, daily

SDRL, daily

Summary

*a note on the metals.. with Gold -$2, although the mining stocks are holding up.. with GDX +0.4%.

Both the metals and miners still look set for further downside as part of a natural retrace.

--

As for FCX and SDRL... its notable than even when the market is down just a little, the 'junk' gets utterly smashed.. usually by at least 5-7%.

If you consider the sp'1600s as likely.. then do the math for FCX and SDRL. Neither look set to be around for the long term.

--

back at 2pm. maybe.

12pm update - naturally churning

With the econ-data out of the way, the market is naturally churning as the board of directors meet at print central. There is notable further weakness in the precious metals, with Gold -$1, and Silver -0.2%. Oil remains broadly weak, -2.5% in the $36s.. as the $40 threshold is fading away.

sp'60min

GLD, daily2

Summary

Little to add.

The hourly cycle will most certainly favour the equity bulls tomorrow afternoon.

--

re: VRX. I checked the options chain... where there are gains of 5-10,000% for front month Puts. I'd guess at least a few smaller time traders are having the best day ever.

--

time for lunch

sp'60min

GLD, daily2

Summary

Little to add.

The hourly cycle will most certainly favour the equity bulls tomorrow afternoon.

--

re: VRX. I checked the options chain... where there are gains of 5-10,000% for front month Puts. I'd guess at least a few smaller time traders are having the best day ever.

--

time for lunch

11am update - moderate weakness

US equities remain moderately weak, and we already have an early floor for today of sp'2005, with VIX only managing to hit 17.85. The rest of today offers a great deal of chop, with high threat of a post FOMC spike to the gap zone of sp'2038/43... before another key lower high is put in.

sp'60min

VIX'60min

Summary

*I didn't notice the opening black-fail candle in the VIX. It doesn't bode well for the equity bears.. this side of the FOMC.

---

Well, there really isn't much to add.

Pre-FOMC chop.. a little weakness, but it still appears we'll push somewhat higher tomorrow afternoon.. if briefly.

--

Meanwhile.. in bio-tech land....

VRX, daily (linear chart)

Another dire day for the much beloved Valient. A lot of big money has been vapourised in this one!

sp'60min

VIX'60min

Summary

*I didn't notice the opening black-fail candle in the VIX. It doesn't bode well for the equity bears.. this side of the FOMC.

---

Well, there really isn't much to add.

Pre-FOMC chop.. a little weakness, but it still appears we'll push somewhat higher tomorrow afternoon.. if briefly.

--

Meanwhile.. in bio-tech land....

VRX, daily (linear chart)

Another dire day for the much beloved Valient. A lot of big money has been vapourised in this one!

10am update - opening weakness

US equities open moderately lower, but there still seems no realistic chance of sustained downside until after the FOMC. VIX remains subdued, +1% in the 17.20s. Metals are choppy, but leaning on the downside, Gold -$3. Oil is not helping the market mood, -1.9% in the $37s.

sp'60min

GLD, daily2

Summary

*amusing to see the Cramer get rather rattled at how negative Morgan Stanley are. Any talk of recession is already starting to upset the mainstream.

--

So... we're a little lower, but until the FOMC is out of the way, it still seems a case of the market quietly churning.

Indeed, there still seems serious threat of an initial spike higher on tomorrow's press release at 2pm. before what could be a major reversal.

I'll hope for a daily close in the sp'2015/10 zone today... which keeps within range the 2038/43 gap zone tomorrow.

--

notable weakness... FCX, daily

Much like SDRL, RIG.. and many other pieces of corporate junk, FCX is stuck around the 200dma, and still looks set to disappear. Oh how 'surprised' they will be.

sp'60min

GLD, daily2

Summary

*amusing to see the Cramer get rather rattled at how negative Morgan Stanley are. Any talk of recession is already starting to upset the mainstream.

--

So... we're a little lower, but until the FOMC is out of the way, it still seems a case of the market quietly churning.

Indeed, there still seems serious threat of an initial spike higher on tomorrow's press release at 2pm. before what could be a major reversal.

I'll hope for a daily close in the sp'2015/10 zone today... which keeps within range the 2038/43 gap zone tomorrow.

--

notable weakness... FCX, daily

Much like SDRL, RIG.. and many other pieces of corporate junk, FCX is stuck around the 200dma, and still looks set to disappear. Oh how 'surprised' they will be.

Pre-Market Brief

US equity futures are moderately lower, sp -10pts, we're set to open at 2009. USD is u/c in the DXY 96.60s. Metals continue to retrace, Gold -$3. Oil is -2.3% in the $36s.. as the $40 threshold is starting to fade out of range.

sp'60min

Summary

*awaiting econ-data..

--

The BoJ do nothing, aside from a veiled hint they might soon reverse NIRP, but then.. they said NIRP would not happen mere days before they began it. Anything being spouted from Kuroda is not to be trusted.

-

As for the likely opening declines... marginally interesting, but again... its NOT significant. The lower hourly bollinger is rising, and by end of today should keep the market well above 1990.

A spike higher on Wed' afternoon still seems probable.

--

Overnight action....

Japan: -0.7% @ 17117

China: late day recovery, +0.2% @ 2864

Germany: currently -0.6% @ 9933... 10K remains powerful resistance

-

8.31am..

Retail sales: m/m -0.1%, with a lousy revision to -0.4% for previous month

PPI:m/m -0.2%....

Empire state manu': 0.62... much recovered from recent months.

-

Equities not pleased... sp -13pts... 2006.

sp'60min

Summary

*awaiting econ-data..

--

The BoJ do nothing, aside from a veiled hint they might soon reverse NIRP, but then.. they said NIRP would not happen mere days before they began it. Anything being spouted from Kuroda is not to be trusted.

-

As for the likely opening declines... marginally interesting, but again... its NOT significant. The lower hourly bollinger is rising, and by end of today should keep the market well above 1990.

A spike higher on Wed' afternoon still seems probable.

--

Overnight action....

Japan: -0.7% @ 17117

China: late day recovery, +0.2% @ 2864

Germany: currently -0.6% @ 9933... 10K remains powerful resistance

-

8.31am..

Retail sales: m/m -0.1%, with a lousy revision to -0.4% for previous month

PPI:m/m -0.2%....

Empire state manu': 0.62... much recovered from recent months.

-

Equities not pleased... sp -13pts... 2006.

Close to max bullishness

Having climbed from the Feb'11th low of sp'1810 to 2024, the mainstream are very close to hitting max bullishness. It is pretty amusing to see some of the once 'broadly bearish' now getting moderately bullish.. mere days ahead of the next FOMC.

sp'weekly1b

sp'monthly1b

Summary

Suffice to add, a new cycle high of sp'2024, although VIX did not confirm, having remained positive across the day.

The bigger issue remains whether the equity bulls can turn the bigger weekly/monthly cycles.

From a bearish perspective, I'd like to see a close at least under the monthly 10MA, and really under the sp'2K threshold.

The daily cycles are somewhat suggestive that we should see the 50dma tested before end month.. and that is currently in the 1950s.

--

Looking ahead

Tuesday will see PPI, retail sales, empire state, bus' invent', housing market index

--

Goodnight from London

sp'weekly1b

sp'monthly1b

Summary

Suffice to add, a new cycle high of sp'2024, although VIX did not confirm, having remained positive across the day.

The bigger issue remains whether the equity bulls can turn the bigger weekly/monthly cycles.

From a bearish perspective, I'd like to see a close at least under the monthly 10MA, and really under the sp'2K threshold.

The daily cycles are somewhat suggestive that we should see the 50dma tested before end month.. and that is currently in the 1950s.

--

Looking ahead

Tuesday will see PPI, retail sales, empire state, bus' invent', housing market index

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed moderately mixed, sp -2pts @ 2019 (intra low

2012). The two leaders - Trans/R2K, settled u/c and -0.3% respectively.

Near term outlook offers further upside to the gap zone of sp'2038/43,

with Dow 17405/425. Sustained action >2050 and Dow 17500 looks

extremely unlikely.

sp'daily5

Trans

Summary

Suffice to add, a second consecutive close above the 200dma for the sp'500/Dow.

Certainly, it is something for the equity bulls to tout, but the bigger weekly/monthly cycles are still suggestive the past 5 weeks of upside are nothing more than a standard 'bear market rally'.

--

a little more later..

sp'daily5

Trans

Summary

Suffice to add, a second consecutive close above the 200dma for the sp'500/Dow.

Certainly, it is something for the equity bulls to tout, but the bigger weekly/monthly cycles are still suggestive the past 5 weeks of upside are nothing more than a standard 'bear market rally'.

--

a little more later..

Subscribe to:

Comments (Atom)