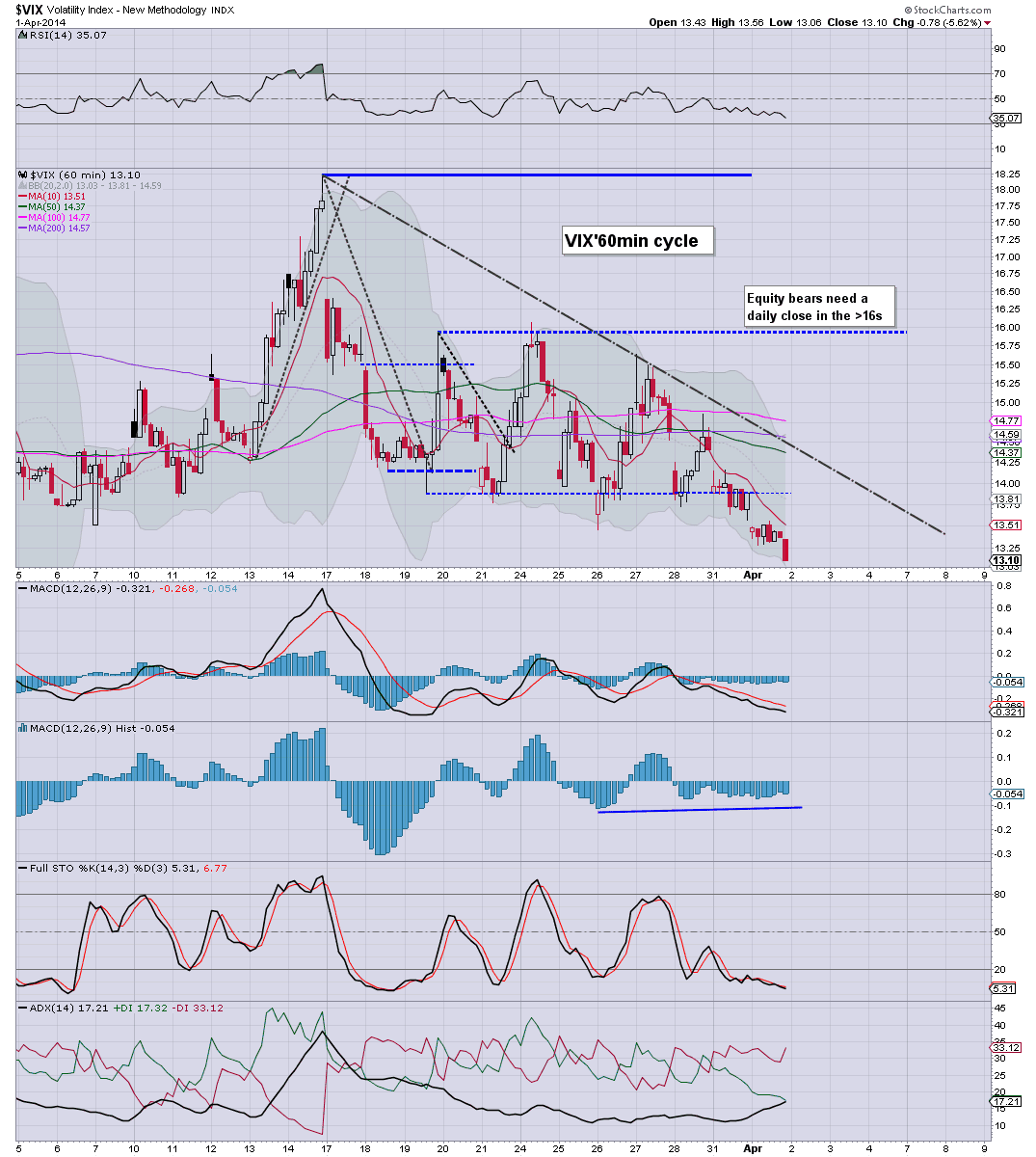

With equities rising for a third day, the VIX continued to melt lower, settling -5.6% @ 13.10. Hourly VIX cycle looks floored, but this was seemingly the case yesterday. VIX remains crushed, in a market that has little concern about anything.

VIX'60min

VIX'daily3

Summary

Equity bears need to see a VIX daily close in the 16s, just to offer any hope of any major downside action, and with sp'1885, that no longer looks viable in the near term. With VIX closing in the 13s, the only issue is whether the VIX floors in the 12s, 11s...or even lower.

With new index highs in the sp'500 and the Transports, equity bears look utterly beaten.

-

more later..on the indexes

Tuesday, 1 April 2014

Closing Brief

US equities closed with borderline significant gains, sp +13pts @ 1885 - with a new intraday high of 1885.84. The two leaders - Trans/R2K, settled +0.9% and +1.3% respectively. Near term outlook offers opportunity for a minor down wave, but with a new high for the sp' & Trans, the bulls are in control.

sp'60min

Summary

*new historic highs for the sp'500, Transports.

---

A third consecutive day to the equity bulls, and for the remaining bears...it is white flag waving time.

Indeed, near the close, I was short-stopped on a secondary block....and I'm now back on the sidelines, with zero interest in getting involved for the rest of this week..or the month.

-

As for tomorrow....if Mr market likes the ADP jobs report, then the mainstream will be guns blazing bullish, and it'll be sp'1900s before most realise.

Oh well, I live to fight another day.

--

more later..on the VIX

sp'60min

Summary

*new historic highs for the sp'500, Transports.

---

A third consecutive day to the equity bulls, and for the remaining bears...it is white flag waving time.

Indeed, near the close, I was short-stopped on a secondary block....and I'm now back on the sidelines, with zero interest in getting involved for the rest of this week..or the month.

-

As for tomorrow....if Mr market likes the ADP jobs report, then the mainstream will be guns blazing bullish, and it'll be sp'1900s before most realise.

Oh well, I live to fight another day.

--

more later..on the VIX

3pm update - a tough close to call

US indexes continue to hold moderate gains, however the smaller 5/15min cycles will be inclined to fall into the close. Yet, a new high..is a new high..and equity bulls have come close to breaking most bears today. VIX remains crushed in the 13s, whilst precious metals remain weak.

sp'60min

Summary

*I remain holding a secondary short block, but will get the kick on any move >1884.

--

It was a day that has been 'testing' to put it mildly, with some mixed signals, but then, that's what trading stop are for..right?

-

Hourly 10MA, 1878/79, should be first target for those day-trading bears.

-

3.29pm... Hell, can't even break <1880..and we're back to 1883. What a lousy day.

3.48pm.. KICKED out of my secondary short-block.

...so...I'm back on the sidelines.

Have ZERO interest in getting involved for rest of the week, if not the month.

sp'60min

Summary

*I remain holding a secondary short block, but will get the kick on any move >1884.

--

It was a day that has been 'testing' to put it mildly, with some mixed signals, but then, that's what trading stop are for..right?

-

Hourly 10MA, 1878/79, should be first target for those day-trading bears.

-

3.29pm... Hell, can't even break <1880..and we're back to 1883. What a lousy day.

3.48pm.. KICKED out of my secondary short-block.

...so...I'm back on the sidelines.

Have ZERO interest in getting involved for rest of the week, if not the month.

2pm update - holding the gains

US equities continue to hold moderate gains, with the VIX crushed in the 13s. Hourly equity cycle is due a down cycle, but daily/weekly cycles are pushing upward. Barring a net daily decline on most indexes, it will be the third consecutive day of strength for the bulls.

sp'60min

Trans, daily

Summary

Trans - 'old leader' is just 0.5% from breaking a new high >7627.

-

With two hours to go, there is plenty of time to turn all this lower, but really, the price action very much favours the bulls.

Besides, if market decides it likes the ADP jobs data tomorrow, none of today will much matter anyway.

--

*I remain holding a secondary short block, but will get the boot if >1884, which I currently expect.

2.15pm... afternoon double top in the 1882/84 zone? Urghhh.

Regardless of how we close, I'm real tired of this week already, and its only Tuesday.

-

2.30pm.. 5/15 min cycles favour the bears in the remaining 90mins....

However, barring a close <1870...bears can't call today anything other than a key failure, with fractional new sp'500 high.

sp'60min

Trans, daily

Summary

Trans - 'old leader' is just 0.5% from breaking a new high >7627.

-

With two hours to go, there is plenty of time to turn all this lower, but really, the price action very much favours the bulls.

Besides, if market decides it likes the ADP jobs data tomorrow, none of today will much matter anyway.

--

*I remain holding a secondary short block, but will get the boot if >1884, which I currently expect.

2.15pm... afternoon double top in the 1882/84 zone? Urghhh.

Regardless of how we close, I'm real tired of this week already, and its only Tuesday.

-

2.30pm.. 5/15 min cycles favour the bears in the remaining 90mins....

However, barring a close <1870...bears can't call today anything other than a key failure, with fractional new sp'500 high.

1pm update - minor chop

A minor down wave to tease the bears from sp'1884 to 1877, but with the daily/weekly cycles pushing upward, the broader direction remains bullish. Metals remain weak, Gold -$2. VIX appears stuck in the 13s, and if sp'1890/1900s, then VIX 12/11s.

sp'60min

Summary

Bull maniacs should be content with any positive daily close.

Whilst bears have to break <1870, and that looks difficult. I just can't see any downside power, price action is pretty strong.

Yes..the waves are over-lapping, but does it matter? We just broke a new historic sp'500 high, and other indexes are real close to breaking new highs.

-

Notable strength: FB, +3%, although sister hysteria stock, the TWTR, remains only +0.5%.

*I hold a remaining secondary short-block, but will get the kick >1885, and I'd guess that will occur.

sp'60min

Summary

Bull maniacs should be content with any positive daily close.

Whilst bears have to break <1870, and that looks difficult. I just can't see any downside power, price action is pretty strong.

Yes..the waves are over-lapping, but does it matter? We just broke a new historic sp'500 high, and other indexes are real close to breaking new highs.

-

Notable strength: FB, +3%, although sister hysteria stock, the TWTR, remains only +0.5%.

*I hold a remaining secondary short-block, but will get the kick >1885, and I'd guess that will occur.

12pm update - so, what now?

US indexes are holding minor gains, with the sp'500 so far being the first index to break a new historic high. The rest of the market looks likely to follow. Metals remain broadly weak, Gold -$3, after a very clear March bearish reversal.

sp'60min

GLD, daily

Summary

*I was kicked from a core-short block earlier, have no plan to re-enter, regardless of near term action. Holding a secondary block..will get kicked if >1884.

--

First, let me be clear, the notion of a 'triple top'..looks highly unlikely. Certainly, any daily close >1883, and that idea gets dropped.

Further, bears need to break <1870 to have ANY hope, along with VIX 15s, and that sure looks difficult in the near term. Hourly index/VIX cycles are due to turn, but ...that was the case yesterday afternoon, and we saw how that worked out.

--

VIX update from Mr C.........or T.

--

time for tea... (or should that be tranquilisers and wine?)

12.15pm.. Daily candle on the trans..turns black..... set to turn red this afternoon.

Again though..unless sp <1870...this is NOTHING for the bears to get excited about.

12.42pm.. market probably just teasing the bears.....back to the sp'1880s.

The only thing the bulls need is a new high in the Transports.. >7627,

sp'60min

GLD, daily

Summary

*I was kicked from a core-short block earlier, have no plan to re-enter, regardless of near term action. Holding a secondary block..will get kicked if >1884.

--

First, let me be clear, the notion of a 'triple top'..looks highly unlikely. Certainly, any daily close >1883, and that idea gets dropped.

Further, bears need to break <1870 to have ANY hope, along with VIX 15s, and that sure looks difficult in the near term. Hourly index/VIX cycles are due to turn, but ...that was the case yesterday afternoon, and we saw how that worked out.

--

VIX update from Mr C.........or T.

--

time for tea... (or should that be tranquilisers and wine?)

12.15pm.. Daily candle on the trans..turns black..... set to turn red this afternoon.

Again though..unless sp <1870...this is NOTHING for the bears to get excited about.

12.42pm.. market probably just teasing the bears.....back to the sp'1880s.

The only thing the bulls need is a new high in the Transports.. >7627,

11am update - one index new high, so far

The sp'500 breaks a fractional new high of 1884.60. Despite a touch of weakness, the rest of the market will surely follow. VIX is crushed, and can barely hold the 13s. It remains the most bizarre of markets, and for the bears... just another failed move.

sp'daily5

Trans

Summary

*I was kicked out of my core short-block of SDS around sp'1883/84.

I am holding a small secondary short Put block, but will get kicked out of that on any further move >1884.

-

Dare I cite Carboni, with his 'stops are in, emotions are out!' mantra.

For me, it has always been 'stop are in...emotions are...IN'. I'll sure get emotionally involved in this nonsense, but I won't trade without at least some degree of trading stop.

--

Well, its the typical turn time of 11am....if we're going to get a magical reversal..now would be the time.

I find it hard to envision a red close today....I just don't see where the downside power is going to come from.

11.10am... sp'1879... 5 whole pts from the new high, but really, unless <1870, with VIX 15s...this is nothing.

VIX looks abysmally weak in the 13.30s

11.16am.. Look at the transports..still stuck...breaks into the 7600s..but just can't hold it.

Surely we're not going to reverse lower from here?

11.23am.. Eyes on the two leaders - Trans/R2K. If we're going to get another reversal.. if'll likely be seen there..first.

Trans is only higher by 0.18%...so..it could easily turned red.

VIX showing NO power to rally back.

sp'daily5

Trans

Summary

*I was kicked out of my core short-block of SDS around sp'1883/84.

I am holding a small secondary short Put block, but will get kicked out of that on any further move >1884.

-

Dare I cite Carboni, with his 'stops are in, emotions are out!' mantra.

For me, it has always been 'stop are in...emotions are...IN'. I'll sure get emotionally involved in this nonsense, but I won't trade without at least some degree of trading stop.

--

Well, its the typical turn time of 11am....if we're going to get a magical reversal..now would be the time.

I find it hard to envision a red close today....I just don't see where the downside power is going to come from.

11.10am... sp'1879... 5 whole pts from the new high, but really, unless <1870, with VIX 15s...this is nothing.

VIX looks abysmally weak in the 13.30s

11.16am.. Look at the transports..still stuck...breaks into the 7600s..but just can't hold it.

Surely we're not going to reverse lower from here?

11.23am.. Eyes on the two leaders - Trans/R2K. If we're going to get another reversal.. if'll likely be seen there..first.

Trans is only higher by 0.18%...so..it could easily turned red.

VIX showing NO power to rally back.

10am update - awaiting new highs

US equities open moderately higher (why wouldn't they?) for the 8th consecutive day, and it seems just a matter of when we break new historic highs. VIX remains crushed in the 13s, but is offering an opening reversal candle. Metals are vainly trying to build small gains, Gold +$1

sp'daily5

vix'daily3

Summary

*I remain short, but I'll get the boot, if >1883/85 or so. There sure won't be any point holding beyond there.

--

sp'1882...with Transports similarly close to breaking a new high >7627.

Dow just 40pts shy of breaking a new high...

-

I just don't see where the downside is going to come from here. Bears look toast, and I'm about to be short-stopped.

10.06am... sp'1884... new highs....rest of the market will surely follow.

VIX -4% in the 13.30s...the 12s look due.

-

10.13am.. Well, my core block of SDS has come within 1 cent of being hit....I don't see it holding.

Barring a complete reversal back to 1870....with a red close...this is just another failure.

Oh well...

10.28am.. Looks like the momo chasers are appearing, the R2K is really on the move, +0.8%..playing catchup after last weeks 3.5% drop.

More than anything right now, I just don't see how the bears can turn this around now. We have jobs data across rest of the week, and market will likely take that as a positive either way.

After all, if jobs <150k...the Yellen monster might even delay taper, right?

-

**I was kicked out of my core short block.. with SDS breaking <28.00.

10.41am.. sp'1882.. I wish the market would break new highs for the Dow, Trans, etc..and get this over with!

sp'daily5

vix'daily3

Summary

*I remain short, but I'll get the boot, if >1883/85 or so. There sure won't be any point holding beyond there.

--

sp'1882...with Transports similarly close to breaking a new high >7627.

Dow just 40pts shy of breaking a new high...

-

I just don't see where the downside is going to come from here. Bears look toast, and I'm about to be short-stopped.

10.06am... sp'1884... new highs....rest of the market will surely follow.

VIX -4% in the 13.30s...the 12s look due.

-

10.13am.. Well, my core block of SDS has come within 1 cent of being hit....I don't see it holding.

Barring a complete reversal back to 1870....with a red close...this is just another failure.

Oh well...

10.28am.. Looks like the momo chasers are appearing, the R2K is really on the move, +0.8%..playing catchup after last weeks 3.5% drop.

More than anything right now, I just don't see how the bears can turn this around now. We have jobs data across rest of the week, and market will likely take that as a positive either way.

After all, if jobs <150k...the Yellen monster might even delay taper, right?

-

**I was kicked out of my core short block.. with SDS breaking <28.00.

10.41am.. sp'1882.. I wish the market would break new highs for the Dow, Trans, etc..and get this over with!

Pre-Market Brief

Good morning. Futures are set to open higher again (8'th day running), sp +5pts, taking the market to 1877. Metals are a touch higher, Gold +$2. Equity bulls just need a daily close >1875, which should confirm that 1883 will be broken this week..opening up much higher levels into May.

sp'daily5

Summary

Well, either this market is going to put in an epic fail, or we're going to break new highs..and keep pushing.

For those on the short side, we're fast approaching total white flag territory.

Frankly, it looks lousy for those in bear land, and it makes the last few weeks a complete waste of time.

I expect to get hit on a short-stop today, in the low 1880s.

9.38am... no new index highs..yet... but we're damn close..not least in the Trans.

awaiting a trio of econ-data..across the next 20mins.

--

9.43am.. opening reversal candle on the VIX, although yes..they sure haven't been reliable lately

VIX remains crushed..in the 13.40s.

Laughably, even the 14s now look difficult.

Is this capitulation?

sp'daily5

Summary

Well, either this market is going to put in an epic fail, or we're going to break new highs..and keep pushing.

For those on the short side, we're fast approaching total white flag territory.

Frankly, it looks lousy for those in bear land, and it makes the last few weeks a complete waste of time.

I expect to get hit on a short-stop today, in the low 1880s.

9.38am... no new index highs..yet... but we're damn close..not least in the Trans.

awaiting a trio of econ-data..across the next 20mins.

--

9.43am.. opening reversal candle on the VIX, although yes..they sure haven't been reliable lately

VIX remains crushed..in the 13.40s.

Laughably, even the 14s now look difficult.

Is this capitulation?

One quarter complete

A new week began with broad gains for the US equity market. Across the month, most indexes saw moderate gains, sp'500, +0.7%, (notable exception, R2K, -0.8%). Considering the somewhat reduced QE fuel, the US capital markets are holding together rather well.

sp'monthly

R2K, monthly

Summary

So, we now have one quarter of 2014 complete. More notable than anything, equity bulls can now count 30 full months of upside since the giant wave began in Oct'2011, when the sp' was a mere 1074 - around 800pts lower.

Equity bears are still fighting for a turn month, never mind an actual 'significant' monthly decline. A monthly close below the rising 10MA (currently 1753, and likely the 1770s across April), should remain the first objective for those seeking a multi-month down wave.

Right now, an April close <1770 looks exceedingly difficult, even with reduced QE.

A few other notable aspects for March...

Copper, monthly

The break below the big $3 threshold was very important, and even though we closed March in the $3s, some serious technical damage has been done.

WTIC Oil, monthly'2

Oil prices remain stuck in an increasingly tight 110/90 range. Until we break out of that, the price action is arguably all minor noise.

Finally, a look at the USD, which managed a minor, but important monthly gain of just over 0.5%.

USD, monthly'2

Importantly, the USD held a monthly close above the key 80 threshold. Note the monthly bollinger bands, they are super tight, which bodes for a big move sometime this year, and I'm guessing it will be to the upside. That will put significant downside pressure on equities, but especially on commodities, not least the precious metals.

--

Looking ahead

We have a little array of econ-data tomorrow, PMI manu', ISM manu', and construction.

*next sig' QE-pomo is not until Wednesday, and even then, it will only be $2.5bn or so.

--

Equity bulls can't get confident.. quite yet

Despite today's gains, the market remains stuck within a very tight range of 1834/1883. Until we break above..or below this range..neither bulls..nor bears have anything much to get excited about.

Yours truly remains short, with a 'sand line' of 1884/85 or so. If I get the short-stop boot tomorrow, I can live with that, but hey..maybe I won't get the boot.

Goodnight from London

sp'monthly

R2K, monthly

Summary

So, we now have one quarter of 2014 complete. More notable than anything, equity bulls can now count 30 full months of upside since the giant wave began in Oct'2011, when the sp' was a mere 1074 - around 800pts lower.

Equity bears are still fighting for a turn month, never mind an actual 'significant' monthly decline. A monthly close below the rising 10MA (currently 1753, and likely the 1770s across April), should remain the first objective for those seeking a multi-month down wave.

Right now, an April close <1770 looks exceedingly difficult, even with reduced QE.

A few other notable aspects for March...

Copper, monthly

The break below the big $3 threshold was very important, and even though we closed March in the $3s, some serious technical damage has been done.

WTIC Oil, monthly'2

Oil prices remain stuck in an increasingly tight 110/90 range. Until we break out of that, the price action is arguably all minor noise.

Finally, a look at the USD, which managed a minor, but important monthly gain of just over 0.5%.

USD, monthly'2

Importantly, the USD held a monthly close above the key 80 threshold. Note the monthly bollinger bands, they are super tight, which bodes for a big move sometime this year, and I'm guessing it will be to the upside. That will put significant downside pressure on equities, but especially on commodities, not least the precious metals.

--

Looking ahead

We have a little array of econ-data tomorrow, PMI manu', ISM manu', and construction.

*next sig' QE-pomo is not until Wednesday, and even then, it will only be $2.5bn or so.

--

Equity bulls can't get confident.. quite yet

Despite today's gains, the market remains stuck within a very tight range of 1834/1883. Until we break above..or below this range..neither bulls..nor bears have anything much to get excited about.

Yours truly remains short, with a 'sand line' of 1884/85 or so. If I get the short-stop boot tomorrow, I can live with that, but hey..maybe I won't get the boot.

Goodnight from London

Daily Index Cycle update

US indexes closed the month on a positive note, sp +14pts @ 1872. The two leaders - Trans/R2K, settled higher by a very significant 1.7% and 1.8% respectively. Near term outlook remains entirely dependent on whether the bulls can break >1883.

sp'daily5

R2K

Trans

Summary

So. a second day higher for sp'500, and the Thursday low of 1842 is now a clear 30pts lower. Although, in the grand scheme of things, that is barely 1.5%

Most notable today, the gains in the two leaders, with the Transports just 0.6% away from breaking a new historic high.

Despite the gains though, we do remain within the same range of the past four weeks.

--

a little more later...on some end-month issues.

sp'daily5

R2K

Trans

Summary

So. a second day higher for sp'500, and the Thursday low of 1842 is now a clear 30pts lower. Although, in the grand scheme of things, that is barely 1.5%

Most notable today, the gains in the two leaders, with the Transports just 0.6% away from breaking a new historic high.

Despite the gains though, we do remain within the same range of the past four weeks.

--

a little more later...on some end-month issues.

Subscribe to:

Comments (Atom)