Whilst equities saw minor weak chop across the day, the VIX was also generally weak (intra low 15.81), but managed a minor rally into the close, settling +1.6% @ 16.66. The VIX saw a net weekly decline of a very significant -20.5%.

VIX'daily3

VIX'weekly

Summary

There is little to add.

VIX saw a major down swing... and the big 20 threshold has been lost.

Underlying MACD (blue bar histogram) cycle on the weekly chart will offer a bearish cross in two weeks time. If that is the case, it will bode for 3-4 weeks of further equity upside...taking us into late February.. with the sp'2100s.

-

more later.. on the indexes

Friday, 23 January 2015

Closing Brief

US equities settled moderately mixed, sp -11pts @ 2051 (intra high 2062). The two leaders - Trans/R2K, settled lower by -0.1% and -1.8% respectively. Near term outlook is bullish, with a straight up run into sp'2100s.

sp'60min

Summary

... and another week comes to a close.

A rather important week.. with the ECB deciding it now needs to resort to buying Govt' bonds with money it prints from nowhere. No doubt.. that will end well for all those in the EU.

Despite the weakness into the close, all indexes saw net weekly gains... and there looks to be further upside across next week.

Have a good weekend

-

*the usual bits and pieces across the evening... to wrap up the day.

sp'60min

Summary

... and another week comes to a close.

A rather important week.. with the ECB deciding it now needs to resort to buying Govt' bonds with money it prints from nowhere. No doubt.. that will end well for all those in the EU.

Despite the weakness into the close, all indexes saw net weekly gains... and there looks to be further upside across next week.

Have a good weekend

-

*the usual bits and pieces across the evening... to wrap up the day.

3pm update - a week for the bulls

US equities are set for the first net weekly gain of the year, with a gain of almost 2% for the sp'500. Metals are ending the week on a down note, Gold -$12. Energy remains mixed, with Nat' gas +3.1%, whilst Oil -2.0%.

sp'weekly7

sp'60min

Summary

Thank the gods... its almost the weekend!

Regardless of the exact close, equity bulls have held the market well today, and look set for 2070s next Monday.

Weekly cycles are offering the 2120s in the near term, although that will likely take at least two weeks.

-

back at the close... unless something 'interesting' happen before then.

sp'weekly7

sp'60min

Summary

Thank the gods... its almost the weekend!

Regardless of the exact close, equity bulls have held the market well today, and look set for 2070s next Monday.

Weekly cycles are offering the 2120s in the near term, although that will likely take at least two weeks.

-

back at the close... unless something 'interesting' happen before then.

2pm update - clawing upward

Equities are clawing slowly higher, battling for a weekly close above the Jan'9 high of sp'2064. In any case, the door looks wide open to a straight run into the low sp'2100s. VIX is reflecting a calmer market, -3% in the 15.80s. Gold remains weak, -$10, but still net higher on the week by around 1.5%.

sp'60min

Summary

Those still vainly touting the recent move from 1988 to 2062 as a B wave... are set for disappointment into the weekend.

I'm also well aware some are seeking a wave down to the 2030s before 2100s.. but even that seems out of range. Bears had their retrace this morning to 2052.. that looks to be it.

--

Notable weakness, copper miners, FCX and TCK both lower by around -3%

back at 3pm

sp'60min

Summary

Those still vainly touting the recent move from 1988 to 2062 as a B wave... are set for disappointment into the weekend.

I'm also well aware some are seeking a wave down to the 2030s before 2100s.. but even that seems out of range. Bears had their retrace this morning to 2052.. that looks to be it.

--

Notable weakness, copper miners, FCX and TCK both lower by around -3%

back at 3pm

12pm update - mixed minor chop

US equities are moderately mixed, with a viable retrace low of sp'2052. A weekly close in the 2065/75 zone is still viable... along with VIX 15s. Metals remain weak, Gold -$14, whilst Oil is -0.7%. USD has cooled a little, but is still higher by 0.5%

sp'60min

R2K, daily

Summary

*notable gains in the second market leader - the R2K

--

There really isn't much to add. Underlying pressure - seen better on the daily/weekly cycles, remains to the upside.. and market should be trading in the sp'2100s within a week or two.

Certainly, it seems utterly crazy for anyone trying to capture any minor down cycles along the way.

--

VIX update from Mr T

--

time for tea... back at 2pm

sp'60min

R2K, daily

Summary

*notable gains in the second market leader - the R2K

--

There really isn't much to add. Underlying pressure - seen better on the daily/weekly cycles, remains to the upside.. and market should be trading in the sp'2100s within a week or two.

Certainly, it seems utterly crazy for anyone trying to capture any minor down cycles along the way.

--

VIX update from Mr T

--

time for tea... back at 2pm

11am update - morning retrace... almost complete

US equities remain moderately lower, in what is almost certainlty just a partial retrace of the Thursday/ECB gains. Mr Market should level out somewhere in the 2050/45 zone... where the 50dma is lurking. Metals remain weak, Gold -$15. Oil is clawing back.. -0.4%

sp'60min

GLD, daily

Summary

Multiple aspects of support in the sp'2050/45 zone.. I sure don't see a weekly close under there.

-

Notable weakness, coal miners, BTU -6% in the $6.30s, still headed for ultimate target of $5

time for an early lunch... back at 12pm

sp'60min

GLD, daily

Summary

Multiple aspects of support in the sp'2050/45 zone.. I sure don't see a weekly close under there.

-

Notable weakness, coal miners, BTU -6% in the $6.30s, still headed for ultimate target of $5

time for an early lunch... back at 12pm

10am update - opening weak chop

US equities open with some weak chop... into the mid sp'2050s. There is strong support in the 2050/45 zone... a weekly close looks likely above that area. Metals are increasingly weak, Gold -$8. Oil remains weak, -1.2%. King Dollar remains strong, +0.7%, a mere 6% from the giant DXY 100 threshold.

sp'60min

R2K, daily

Summary

*notable minor strength in the R2K, a weekly close in the low 1200s is viable.

--

Not much to add... on what will mainly be a day of consolidation and reflection after the ECB announcement.

Notable weakness, AA, -2.7%...

sp'60min

R2K, daily

Summary

*notable minor strength in the R2K, a weekly close in the low 1200s is viable.

--

Not much to add... on what will mainly be a day of consolidation and reflection after the ECB announcement.

Notable weakness, AA, -2.7%...

Pre-Market Brief

Good morning. Futures are a touch lower, sp -3pts, we're set to open at 2060. Metals are lower, Gold -$6, whilst Oil is -.0.7%. Equity bulls should be content with any weekly close above the 50dma of sp'2046.

sp'daily5

Summary

It has been just a 4 day week, but it has felt like six.

I realise some are looking for a test of the 50dma in the sp'2040s.. but frankly, we might not even do that. As things are... a weekly close in the 2070s is possible. In either case.. we look headed for the 2100s, which will merely make for yet another higher high.

--

Yet another update from Mr C.

--

Have a good Friday!

sp'daily5

Summary

It has been just a 4 day week, but it has felt like six.

I realise some are looking for a test of the 50dma in the sp'2040s.. but frankly, we might not even do that. As things are... a weekly close in the 2070s is possible. In either case.. we look headed for the 2100s, which will merely make for yet another higher high.

--

Yet another update from Mr C.

--

Have a good Friday!

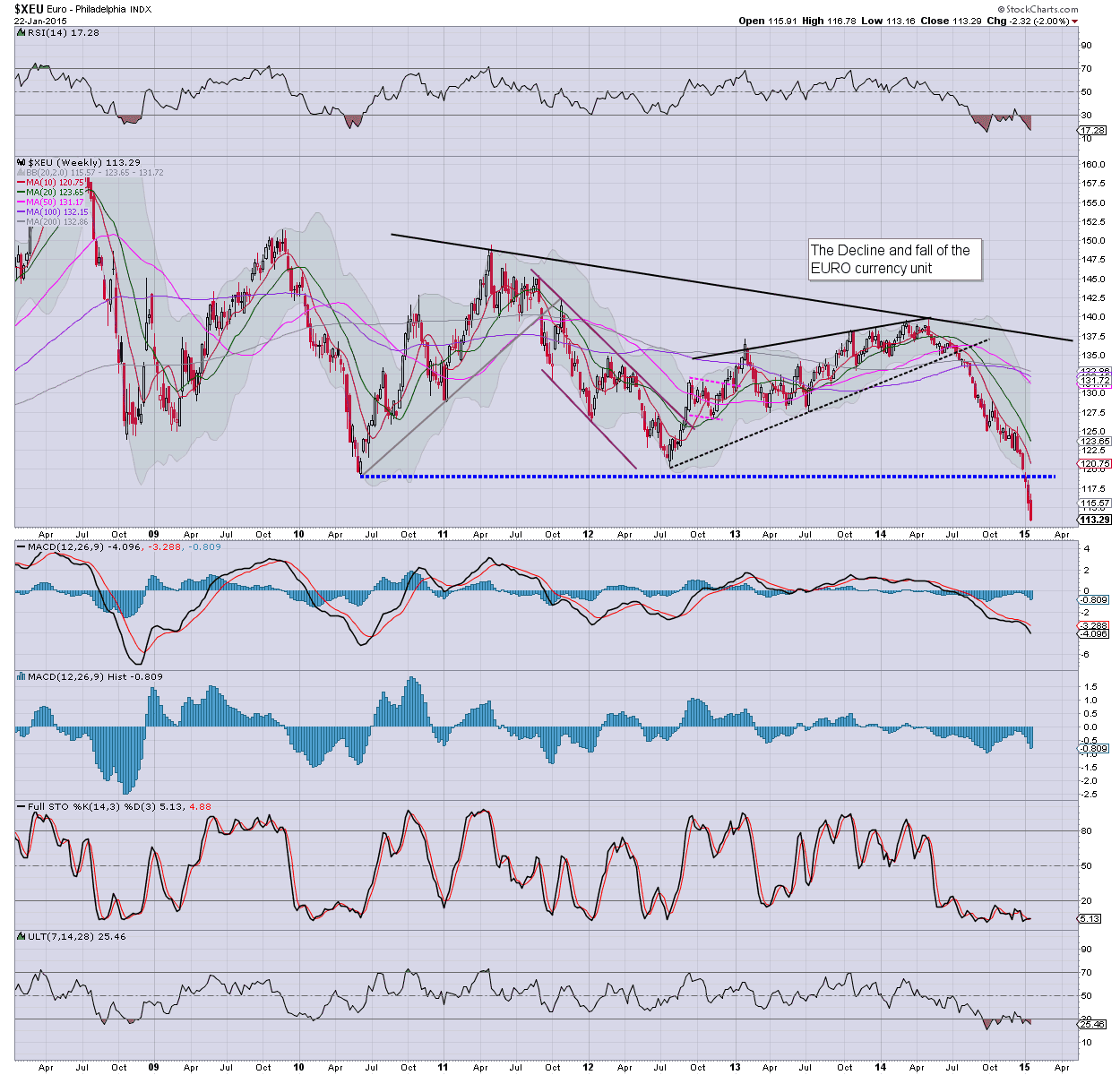

King Dollar continues to strengthen

With the ECB announcing what is effectively QE-pomo for the EU equity markets, the USD continued to climb, settling higher by a very significant 164bps (1.8%) @ 94.72. The giant 100 threshold looks a given in the first half of this year.

USD, monthly

Euro, weekly

Summary

So.. the ECB has finally cracked, and is now planning to start buying Govt. bonds in March, and at least continue until Sept' 2016. The whole program should be seen as equivalent to the US Fed's QE-pomo.

Not surprisingly, the Euro continues to implode... parity is coming. Even then... the bigger issue is what happens across the next few years?

Scenario'1 - One (if not 2-3) of the weaker EU members, namely Greece, Spain, Portugal, abruptly leave

2 - an agreement is made for a two tier euro, although that is hard to believe as viable.

3 - complete disintegration of the euro.. with ALL member states going back to their original currency.

The third scenario would be a horror story for the European Union, and right now.. it remains a VERY valid outcome, considering the underlying structural problems.. few of which are being addressed.

--

As for the US equity market...

sp'weekly7

The first green candle of the year... and a weekly close in the sp'2070s is now viable.. as the daily charts would suggest. First key target are the sp'2120/30s by mid February.

--

Looking ahead

Friday will see a trio of data - PMI manu', existing home sales, leading indicators. If those all come in 'reasonable' that will be enough to kick the market into the sp'2070s.. a mere 1% from breaking a new historic high.

-

Update from Mr C

--

Goodnight from London

USD, monthly

Euro, weekly

Summary

So.. the ECB has finally cracked, and is now planning to start buying Govt. bonds in March, and at least continue until Sept' 2016. The whole program should be seen as equivalent to the US Fed's QE-pomo.

Not surprisingly, the Euro continues to implode... parity is coming. Even then... the bigger issue is what happens across the next few years?

Scenario'1 - One (if not 2-3) of the weaker EU members, namely Greece, Spain, Portugal, abruptly leave

2 - an agreement is made for a two tier euro, although that is hard to believe as viable.

3 - complete disintegration of the euro.. with ALL member states going back to their original currency.

The third scenario would be a horror story for the European Union, and right now.. it remains a VERY valid outcome, considering the underlying structural problems.. few of which are being addressed.

--

As for the US equity market...

sp'weekly7

The first green candle of the year... and a weekly close in the sp'2070s is now viable.. as the daily charts would suggest. First key target are the sp'2120/30s by mid February.

--

Looking ahead

Friday will see a trio of data - PMI manu', existing home sales, leading indicators. If those all come in 'reasonable' that will be enough to kick the market into the sp'2070s.. a mere 1% from breaking a new historic high.

-

Update from Mr C

--

Goodnight from London

Daily Index Cycle update

After an early morning washout, US equities built significant gains across the day, with the sp'500 settling +31pts @ 2063. The two leaders - Trans/R2K, settled higher by a very significant 2.9% and 2.1% respectively. Near term outlook is for a straight run to the sp'2100s.

Sp'daily5

R2K

Trans

Summary

The 50dma has been cleared on most indexes.... bulls have a clear break to the upside... with a fourth consecutive daily gain.

We're headed for the sp'2100s...and new historic highs on most indexes.

--

Closing update from Riley

--

a little more later...

Sp'daily5

R2K

Trans

Summary

The 50dma has been cleared on most indexes.... bulls have a clear break to the upside... with a fourth consecutive daily gain.

We're headed for the sp'2100s...and new historic highs on most indexes.

--

Closing update from Riley

--

a little more later...

Subscribe to:

Comments (Atom)