With the main indexes showing some rather impulsive downside action, the VIX jumped higher, hitting a peak of 18.71. With the break <sp'1675, the VIX door is now open to the key 20 threshold. Any daily close in the 20s would bode for deeply lower equity levels in the very near term.

VIX'60min

VIX'daily3

VIX'weekly

Summary

For the equity doomer bears out there, the bigger VIX weekly chart is really one to keep in mind. The first big primary target is the 200 weekly MA..around the key threshold of 20.

A daily/weekly VIX close in the low 20s would really open the door to much higher levels. Since the Oct'2011 low, we've never seen the VIX able to hold the 20s for more than a few days.

We are again about to see whether the VIX can spike into the 20s...but also hold the 20s.

Tomorrow...will be VERY interesting in terms of how the VIX ends the week.

--

more later..on the indexes

Thursday, 3 October 2013

Closing Brief

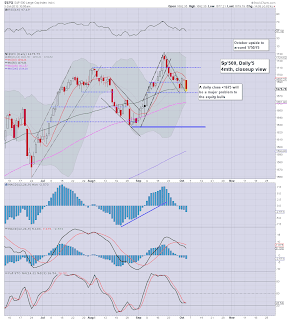

The main indexes closed lower, with the sp -15pts @ 1678. The two leaders - Trans/R2K, both closed lower by -1.1%. With the failure to hold the 50day MA of 1679, and the break <sp'1675, the near term downside trend is intensifying. Next primary target are the 1630/20s.

sp'60min

Summary

Today was important

We arguably saw the first real downside power on the bearish side in a few months. VIX especially supports this view, with the break into the upper 18s.

With the break under the 50day MA..and key support, the next target are the 1630/20s.

If the political maniacs can't agree on something real soon, this market will continue to increasingly unravel.

More than anything...sp'1627 is the CRITICAL level. If that breaks, then it'll break the two year ramp from sp'1074.

--

*I am short the indexes from sp'1681, seeking an exit into the Friday close...preferably in the 1650s with VIX 20/21

more later..on the VIX

sp'60min

Summary

Today was important

We arguably saw the first real downside power on the bearish side in a few months. VIX especially supports this view, with the break into the upper 18s.

With the break under the 50day MA..and key support, the next target are the 1630/20s.

If the political maniacs can't agree on something real soon, this market will continue to increasingly unravel.

More than anything...sp'1627 is the CRITICAL level. If that breaks, then it'll break the two year ramp from sp'1074.

--

*I am short the indexes from sp'1681, seeking an exit into the Friday close...preferably in the 1650s with VIX 20/21

more later..on the VIX

3pm update - closing action mini mayhem?

The main market is becoming increasingly unstable. Minute by minute price action is getting wilder, and despite a significant bounce from sp'1670 to '83, the momentum is with the bears. Daily/weekly charts are looking ugly, with the break <1675. VIX in the 20s...is now viable in the very near term.

sp'60min

VIX'60min

Summary

*with the break below 1675 support, I am resigned to much lower levels, and am now on the short side..will hold into late Friday.

--

Regardless of how we close.. the bears showed their first decent downside power since June. With the VIX in the upper 18s, I have to think market is in dire trouble.

Lets see if we see some renewed selling into the close!

*clown finance TV..with coverage of some incident. I guess not everyone likes Obamacare.

--

3.15pm..market stuck around 1680. Certainly, we look set to close below yesterday, and with the break <1675, the damage has been done.

Friday should, be a day for the bears to make a stronger push downward.

3.30pm.. Bears should be seeking a daily close under the 50 day MA of 1679 !

30mins to go...still looking for late day micro wave lower

3.51pm.. sp'1680.....well, I'm short the indexes (from an hour ago)..and will hold overnight...

back at the close!

sp'60min

VIX'60min

Summary

*with the break below 1675 support, I am resigned to much lower levels, and am now on the short side..will hold into late Friday.

--

Regardless of how we close.. the bears showed their first decent downside power since June. With the VIX in the upper 18s, I have to think market is in dire trouble.

Lets see if we see some renewed selling into the close!

*clown finance TV..with coverage of some incident. I guess not everyone likes Obamacare.

--

3.15pm..market stuck around 1680. Certainly, we look set to close below yesterday, and with the break <1675, the damage has been done.

Friday should, be a day for the bears to make a stronger push downward.

3.30pm.. Bears should be seeking a daily close under the 50 day MA of 1679 !

30mins to go...still looking for late day micro wave lower

3.51pm.. sp'1680.....well, I'm short the indexes (from an hour ago)..and will hold overnight...

back at the close!

2pm update - just a bounce

From a technical perspective, the damage has been done, and the current jump should be arguably seen as a natural bounce to be shorted. With the market at the whim of the political maniacs, the days ahead look to be increasingly wild.

sp'15min

sp'60min

Summary

*looks like (how things are clearer in retrospect, urghh)...a mini H/S on the hourly chart.

--

Baring a daily close >1695...it is surely a case of short all bounces.

-

The problem bears AND bulls will face in the days ahead...increasing turbulence from sporadic news headlines from those on Capitol Hill.

--

2.06pm.. looking to exit a failed LONG index position..and throw into an index SHORT position....

2.10pm.. exited LONG.. .now SHORT the main market from sp'1681

Gods help the bears now, lol

2.13pm... 5/15min cycles look prone to a snap lower into the close.

What a day! ..and not over yet.

2.28pm... we have a VERY snappy market now..and the 5/15min cycles are breaking lower.

Equity bears should be seeking a close in the 1660s...with 1630/20s tomorrow.

sp'15min

sp'60min

Summary

*looks like (how things are clearer in retrospect, urghh)...a mini H/S on the hourly chart.

--

Baring a daily close >1695...it is surely a case of short all bounces.

-

The problem bears AND bulls will face in the days ahead...increasing turbulence from sporadic news headlines from those on Capitol Hill.

--

2.06pm.. looking to exit a failed LONG index position..and throw into an index SHORT position....

2.10pm.. exited LONG.. .now SHORT the main market from sp'1681

Gods help the bears now, lol

2.13pm... 5/15min cycles look prone to a snap lower into the close.

What a day! ..and not over yet.

2.28pm... we have a VERY snappy market now..and the 5/15min cycles are breaking lower.

Equity bears should be seeking a close in the 1660s...with 1630/20s tomorrow.

1pm update - bigger cycles turning nasty

Today is turning out to be a fiercely bearish day. Besides the nominal price falls, what is most notable..the style of price action/downside power...as especially seen in the VIX, hitting a high of 18.71. Any daily close in the 20s would be a severe warning of trouble

sp'weekly7 - bearish outlook

vix'weekly

Summary

*The sp'1660s were a target zone, quite a few have been looking for, but I personally, don't see why it would stop there.

--

As many recognise, regardless of how we close today..the damage HAS BEEN DONE, not least in the VIX. The bigger weekly charts are now breaking down, and if sp'1627 goes...it is OVER.

-

No doubt the political maniacs on Capitol Hill are getting some phone calls today from annoyed voters concerned about a possible autumnal market crash.

-

A VERY interesting afternoon is ahead. No doubt there will be one or two micro up waves..but..considering the break <1675.. the bulls look broken.

1.03pm.. clown finance TV headline 'Boehner willing to renegotiate'.

Regardless...a LOT of key technical breaks have occurred today.

--

1.15pm.. we're seeing a bounce..but with the damage done, default trade is to short the bounces.

Baring a break >1696 - and does anyone think thats viable before the Friday close?, the trends are now starkly downward.

sp'weekly7 - bearish outlook

vix'weekly

Summary

*The sp'1660s were a target zone, quite a few have been looking for, but I personally, don't see why it would stop there.

--

As many recognise, regardless of how we close today..the damage HAS BEEN DONE, not least in the VIX. The bigger weekly charts are now breaking down, and if sp'1627 goes...it is OVER.

-

No doubt the political maniacs on Capitol Hill are getting some phone calls today from annoyed voters concerned about a possible autumnal market crash.

-

A VERY interesting afternoon is ahead. No doubt there will be one or two micro up waves..but..considering the break <1675.. the bulls look broken.

1.03pm.. clown finance TV headline 'Boehner willing to renegotiate'.

Regardless...a LOT of key technical breaks have occurred today.

--

1.15pm.. we're seeing a bounce..but with the damage done, default trade is to short the bounces.

Baring a break >1696 - and does anyone think thats viable before the Friday close?, the trends are now starkly downward.

12pm update - bulls are losing it

The market has battled hard to hold together, but with no end in sight to the US shutdown..and increasing concern over the debt ceiling, the market is breaking new lows. With the VIX in the 18s - first time since late June, this market is now in real trouble. Last line in the sand is the 1627 low.

sp'daily5

vix'daily3

Summary

Bear are finally showing the first decent downside power since late June, as confirmed with a VIX in the 18s..and now the 20s are viable..as early as later today.

Bulls should be fleeing for the hills now, weekly charts offer downside in the immediate term to 1600, although bears first have the key low of 1627 to break.

-

For those who are on the bear train, the obvious first major target is 1627...

sp'weekly7 - bearish outlook

If 1627 is taken out, it'll be the first lower low since last year, and that would really be a massive warning of trouble for Oct/Nov.

VIX update from Mr T.

Fear is indeed back.

-

12.22pm... VIX 20 is indeed the next key level.

In my view..if we see 23s...its all over for equity bulls this year. Upside target range 35/45 by early Nov.

-

...as noted...this is first significant downside power for the bears since June.

12.43pm...weak weak WEAK. Bears showing near relentless power today..and with the weekly charts now rolling over...bulls are busted.

All those touting autumnal doom...now have the door open to their deeply lower targets.

The only thing that can stop it is a rushed agreement...on the shutdown...but more importantly..the debt ceiling.

sp'daily5

vix'daily3

Summary

Bear are finally showing the first decent downside power since late June, as confirmed with a VIX in the 18s..and now the 20s are viable..as early as later today.

Bulls should be fleeing for the hills now, weekly charts offer downside in the immediate term to 1600, although bears first have the key low of 1627 to break.

-

For those who are on the bear train, the obvious first major target is 1627...

sp'weekly7 - bearish outlook

If 1627 is taken out, it'll be the first lower low since last year, and that would really be a massive warning of trouble for Oct/Nov.

VIX update from Mr T.

Fear is indeed back.

-

12.22pm... VIX 20 is indeed the next key level.

In my view..if we see 23s...its all over for equity bulls this year. Upside target range 35/45 by early Nov.

-

...as noted...this is first significant downside power for the bears since June.

12.43pm...weak weak WEAK. Bears showing near relentless power today..and with the weekly charts now rolling over...bulls are busted.

All those touting autumnal doom...now have the door open to their deeply lower targets.

The only thing that can stop it is a rushed agreement...on the shutdown...but more importantly..the debt ceiling.

11am update - typical turning time

The main indexes are weak, with the sp' failing to hold the key 50 day MA of 1679. The VIX has broken the Monday spike high of 17.49, so far peaking at 17.70. Metals are a touch lower, but perhaps benefiting from the fear-trade aspect.

sp'15min

sp'daily5

Summary

*another sign of a turn on the smaller 5/15 min charts.

--

We're at the typical turning point of the trading day..11am is often where a ceiling..or floor is put in.

Bears have certainly caused some damage this morning..but its nothing critical yet.

-

With the market as shaky as it is, it won't take much of a news headline to break the 1675 floor, with a daily close in the 1660s.

..and that is when things start to get interesting.

--

We're turning...at what I sometimes call 'that magical time of day' (actually, there are arguably two..the second being 2.30pm)

11.07am.. we have a confirmed floor.

Now..lets see what the bull maniacs can manage into the afternoon!

11.40am..urghh..floor fails to hold..and 1675s, with VIX trying to break the 18s.

....FAIL. 1674s....with VIX 18s.

sp'15min

sp'daily5

Summary

*another sign of a turn on the smaller 5/15 min charts.

--

We're at the typical turning point of the trading day..11am is often where a ceiling..or floor is put in.

Bears have certainly caused some damage this morning..but its nothing critical yet.

-

With the market as shaky as it is, it won't take much of a news headline to break the 1675 floor, with a daily close in the 1660s.

..and that is when things start to get interesting.

--

We're turning...at what I sometimes call 'that magical time of day' (actually, there are arguably two..the second being 2.30pm)

11.07am.. we have a confirmed floor.

Now..lets see what the bull maniacs can manage into the afternoon!

11.40am..urghh..floor fails to hold..and 1675s, with VIX trying to break the 18s.

....FAIL. 1674s....with VIX 18s.

10am update - another replay

The main indexes are moderately lower, and we're seemingly seeing a replay of the past few days. The 50 day MA of 1680/79 is even more likely to hold that yesterday, and from there, we should see a recovery into the afternoon.

sp'60min

Summary

Maybe I should just cut/paste the postings from yesterday?

--

Bears had a good opportunity on Monday to push lower.... failed

Bears had a bonus chance yesterday......failed at the 50 day MA.

There is arguably even less downside power today....so surely 1680 will hold?

--

*VIX is higher, but only 2%...so..if the market can rally from here...VIX will be in the red by late morning.

10.04... sp'1682... 2pts to go. If Mr Market wants to spook the bulls, it'll break 1680s..briefly...before the turn back upward.

Despite the declines.. VIX only 4% higher.

10.25am..well, there goes the 1680s...just a 5pts buffer zone now, and then the 1660s will hit.

The problem for the equity bulls remains a weekly close in the 1660s (or lower) would really be a problem for the bigger upward trends.

10.36am... Equties still holding above the Monday low of sp'1674.99, but VIX has broken a new high.

A little concern finally appearing!

Spike-floor candles appearing on the 5/15min index charts...it looks like the Monday low will indeed hold...at least for this morning.

The bulls should now be desperate to break back into the 1690s on the bounce.

sp'60min

Summary

Maybe I should just cut/paste the postings from yesterday?

--

Bears had a good opportunity on Monday to push lower.... failed

Bears had a bonus chance yesterday......failed at the 50 day MA.

There is arguably even less downside power today....so surely 1680 will hold?

--

*VIX is higher, but only 2%...so..if the market can rally from here...VIX will be in the red by late morning.

10.04... sp'1682... 2pts to go. If Mr Market wants to spook the bulls, it'll break 1680s..briefly...before the turn back upward.

Despite the declines.. VIX only 4% higher.

10.25am..well, there goes the 1680s...just a 5pts buffer zone now, and then the 1660s will hit.

The problem for the equity bulls remains a weekly close in the 1660s (or lower) would really be a problem for the bigger upward trends.

10.36am... Equties still holding above the Monday low of sp'1674.99, but VIX has broken a new high.

A little concern finally appearing!

Spike-floor candles appearing on the 5/15min index charts...it looks like the Monday low will indeed hold...at least for this morning.

The bulls should now be desperate to break back into the 1690s on the bounce.

Pre-Market Brief

Good morning. Futures are moderately lower, sp -6pts, we're set to open at 1687. Precious metals are weak, Gold -$9. Oil is flat. Equity bulls should be battling for a positive close today, into the low sp'1700s.

sp'60min

Summary

Once again we're set to open somewhat lower..and again...the declines are not significant.

I certainly don't expect a break below the key low of 1675, baring some spurious news report from either the Obama/Boehner camp that there is 'little hope of a resolution'.

Market could just remain stuck in the 1680/90s until next week.

--

Update from Mr C.

--

sp'60min

Summary

Once again we're set to open somewhat lower..and again...the declines are not significant.

I certainly don't expect a break below the key low of 1675, baring some spurious news report from either the Obama/Boehner camp that there is 'little hope of a resolution'.

Market could just remain stuck in the 1680/90s until next week.

--

Update from Mr C.

--

Market holding together

Despite another day where the US Govt' is partly shut, the US capital markets remain relatively calm. The sp' weekly charts remain within a starkly strong upward trend from the Oct'2011 low of 1074. Near term upside target remains sp'1750/75, so long as 1675 is not broken below.

sp'weekly8 - mid term bullish outlook/count

sp'weekly3 - Bol/Keltner bands

Summary

There isn't much to say about today, which was almost a carbon copy replay of Tuesday. We even saw another little micro-ramp into the close..as I expected.

--

Are the political maniacs really that stupid?

Without getting into all the dirty, petty, and outright dumb ass stupidity of the US politicians, having noted the latest Obama/Boehner developments this evening, I'm even more disgusted with them than usual.

It would seem even Obama was subtly referencing the July/August market cliff fall of 2011 in the CNBC interview this afternoon. Further, it is always bizarre to see some leader claim credit for a higher stock market, as if that is 1. a good thing. 2. actually reflective of the economy.

Many out there (not least on Zerohedge) are again highlighting the price action of summer 2011. Yet, from a technical point of view, the recent price action is NOT the same. In summer 2011 the market had already put in a significant multi-week down wave, and QE had ended earlier in May.

sp'2011, weekly H/S pattern..and collapse wave

As I regularly note, in the last two down cycles of June and August, bears were weak, and couldn't even knock the market down to the lower weekly bollinger - which in both cases wasn't that far down anyway.

So..from a purely chart perspective, the cycles of 2013/11 are not especially comparable. The news/events are somewhat similar, but then...unlike summer 2011...we have ongoing monthly QE of $85bn.

All things considered, I'm still guessing some political compromise will be reached. However..lets be clear..if not..and the debt ceiling is failed to be raised in time...this market is going to cliff fall. Lets just say, I think its important to keep in mind the circuit breakers kick in on a daily drop of 7%, 13%, and the market is shut for the day on any 20% drop. See NYSE for details.

Looking ahead

The usual weekly jobs data will probably not appear due to the govt' shutdown. There are factory orders/ISM non-manu' data, which I guess will be released.

*the next sig' QE-pomo is not until next Monday.

--

More than anything, the clearest aspect of the current market is that the bears simply lack downside power. This morning was yet another classic example, with opening moderate declines of around 0.75-1% on the indexes, only to be largely recovered by the close.

As ever..one day at a time, but so long as the market does not break the Monday low of 1674.99, those on the long side can remain quietly confident.

-

Video update from Gordon T Long, on the Fed decision to not taper QE.

Goodnight from London

sp'weekly8 - mid term bullish outlook/count

sp'weekly3 - Bol/Keltner bands

Summary

There isn't much to say about today, which was almost a carbon copy replay of Tuesday. We even saw another little micro-ramp into the close..as I expected.

--

Are the political maniacs really that stupid?

Without getting into all the dirty, petty, and outright dumb ass stupidity of the US politicians, having noted the latest Obama/Boehner developments this evening, I'm even more disgusted with them than usual.

It would seem even Obama was subtly referencing the July/August market cliff fall of 2011 in the CNBC interview this afternoon. Further, it is always bizarre to see some leader claim credit for a higher stock market, as if that is 1. a good thing. 2. actually reflective of the economy.

Many out there (not least on Zerohedge) are again highlighting the price action of summer 2011. Yet, from a technical point of view, the recent price action is NOT the same. In summer 2011 the market had already put in a significant multi-week down wave, and QE had ended earlier in May.

sp'2011, weekly H/S pattern..and collapse wave

As I regularly note, in the last two down cycles of June and August, bears were weak, and couldn't even knock the market down to the lower weekly bollinger - which in both cases wasn't that far down anyway.

So..from a purely chart perspective, the cycles of 2013/11 are not especially comparable. The news/events are somewhat similar, but then...unlike summer 2011...we have ongoing monthly QE of $85bn.

All things considered, I'm still guessing some political compromise will be reached. However..lets be clear..if not..and the debt ceiling is failed to be raised in time...this market is going to cliff fall. Lets just say, I think its important to keep in mind the circuit breakers kick in on a daily drop of 7%, 13%, and the market is shut for the day on any 20% drop. See NYSE for details.

Looking ahead

The usual weekly jobs data will probably not appear due to the govt' shutdown. There are factory orders/ISM non-manu' data, which I guess will be released.

*the next sig' QE-pomo is not until next Monday.

--

More than anything, the clearest aspect of the current market is that the bears simply lack downside power. This morning was yet another classic example, with opening moderate declines of around 0.75-1% on the indexes, only to be largely recovered by the close.

As ever..one day at a time, but so long as the market does not break the Monday low of 1674.99, those on the long side can remain quietly confident.

-

Video update from Gordon T Long, on the Fed decision to not taper QE.

Goodnight from London

Daily Index Cycle update

The main indexes closed moderately lower, with the sp -1pt @ 1693. The two leaders - Trans/R2K, closed -0.4%. The US capital markets remain largely not concerned about the US Govt. shutdown with a VIX that remains relatively low in the 16s.

sp'daily5

R2K

Trans

Summary

Suffice to say, the reversal candle on the sp' daily chart is probably important to keep in mind.

We certainly opened lower , but the 50 day MA did hold..and the market appears to just be building a secure floor before the first real upside.

Obviously, that upside is likely to violently begin the moment the politicians on capitol hill appear to have reached an agreement.

--

a little more later...

sp'daily5

R2K

Trans

Summary

Suffice to say, the reversal candle on the sp' daily chart is probably important to keep in mind.

We certainly opened lower , but the 50 day MA did hold..and the market appears to just be building a secure floor before the first real upside.

Obviously, that upside is likely to violently begin the moment the politicians on capitol hill appear to have reached an agreement.

--

a little more later...

Subscribe to:

Comments (Atom)