With US equity indexes opening moderately lower on an adverse geo-pol' event in Belgium, the VIX opened higher to 14.76. Yet, the VIX then cooled, breaking an intra low of 13.75, but settling +2.8% @ 14.17. Near term outlook threatens further equity upside to the sp'2060/80 zone, and that might equate to VIX briefly in the 12s.

VIX'60min

VIX'daily3

Summary

Little to add.

The VIX remains broadly subdued, now firmly stuck in the low teens.. whilst equities continue to claw their way upward.

For the moment, there is little reason to expect the VIX to hit the key 20 threshold until the end of next week at the very earliest.

VIX 30s look out of range until the latter half of April.

--

more later... on the VIX

Tuesday, 22 March 2016

Closing Brief

US equity indexes closed moderately mixed, sp -1pt @ 2049. The two leaders - Trans/R2K, settled lower by -0.8% and -0.1% respectively. Near term outlook offers further upside to the sp'2060/80 zone, not least if WTIC Oil can see a brief surge to the $43/44s. In the next down wave, first soft target will be the 50dma.

sp'60min

Summary

Closing hour action: micro chop... offering no sign that the equity bears have any realistic hope of sustained downside until higher levels are first hit.

--

So.. aside from the 'news', it was a pretty subdued day, but then, with a 3 day holiday weekend ahead, that is to be expected.

Frankly, current price action remains very bullish, and for many.. it is arguably a case of 'turn ya screen off, come back next Monday'.

.. and I realise that is not what some of you want to hear.

--

more later... on the VIX

sp'60min

Summary

Closing hour action: micro chop... offering no sign that the equity bears have any realistic hope of sustained downside until higher levels are first hit.

--

So.. aside from the 'news', it was a pretty subdued day, but then, with a 3 day holiday weekend ahead, that is to be expected.

Frankly, current price action remains very bullish, and for many.. it is arguably a case of 'turn ya screen off, come back next Monday'.

.. and I realise that is not what some of you want to hear.

--

more later... on the VIX

3pm update - spring sunset

US equities are set to close marginally higher, having already broken a new cycle high of sp'2056, which is a monstrous 246pts (13.6%) above the Feb'11th low of 1810. Current price action continues to offer further upside, not least if Oil can see another surge (if unsustainable) to the $43/44s.

sp'daily5

Nasdaq comp', daily

Summary

*Nasdaq looks on track to at least test the 4900 threshold. I realise will then tout 5K.. and new historic highs, but considering 'everything'.. the latter looks extremely difficult.

--

Oil continues to be a primary driver for the equity market, and it should be clear that last week's break above the $40 threshold, offers further upside to the 43/44s.. which IS viable tomorrow.

Of course, the underlying issue of over-supply remains entirely unresolved, and I remain of the view that $26.05 was not a key multi-year low.

--

As for equities, daily upper bollinger is now in the 2070s, so.. the window is open to further upside.

--

Here in London city...

To the east.. an almost full moon, with a Lunar eclipse tomorrow.

Summer is coming, and it won't be dull.

--

back at the close

sp'daily5

Nasdaq comp', daily

Summary

*Nasdaq looks on track to at least test the 4900 threshold. I realise will then tout 5K.. and new historic highs, but considering 'everything'.. the latter looks extremely difficult.

--

Oil continues to be a primary driver for the equity market, and it should be clear that last week's break above the $40 threshold, offers further upside to the 43/44s.. which IS viable tomorrow.

Of course, the underlying issue of over-supply remains entirely unresolved, and I remain of the view that $26.05 was not a key multi-year low.

--

As for equities, daily upper bollinger is now in the 2070s, so.. the window is open to further upside.

--

Here in London city...

To the east.. an almost full moon, with a Lunar eclipse tomorrow.

Summer is coming, and it won't be dull.

--

back at the close

2pm update - the subdued VIX

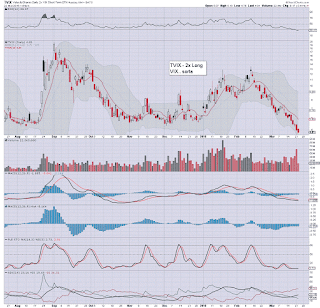

Despite this morning's geo-pol' event in Belgium, the VIX only opened moderately higher to 14.76.. and has already turned fractionally red to 13.75. Naturally, the related VIX instrument of TVIX continues to be ground lower, with effectively no floor.

VIX'daily3

TVIX, daily

Summary

Suffice to add, its one of those days when the opening VIX candle - a black fail no less, was an early warning that equity bears had no real chance today.

Tomorrow might offer a turn though.. from the sp'2060/70s... if Oil can max out in the $43/44s on 'better than expected inventories'.

yours... very sleepy.

VIX'daily3

TVIX, daily

Summary

Suffice to add, its one of those days when the opening VIX candle - a black fail no less, was an early warning that equity bears had no real chance today.

Tomorrow might offer a turn though.. from the sp'2060/70s... if Oil can max out in the $43/44s on 'better than expected inventories'.

yours... very sleepy.

1pm update - marginally positive

US equities are positive, if only marginally. It remains the case that regardless of whether today's close is marginally net higher.. or lower, the underlying price pressure is to the upside. Oil is -0.8% in the $41s.. but looks extremely vulnerable to snapping higher, to the $43/44s, as early as tomorrow on the next pair of inventory reports.

sp'daily5

VIX'daily3

Summary

Suffice to add.... VIX remains the tell, offering ZERO sign that the market is yet ready to rollover.

It'd seem Oil 43/44s will equate to sp'2070s or so.

--

notable weakness, TVIX -3.7% in the $4.70s.... true.... horror.

sp'daily5

VIX'daily3

Summary

Suffice to add.... VIX remains the tell, offering ZERO sign that the market is yet ready to rollover.

It'd seem Oil 43/44s will equate to sp'2070s or so.

--

notable weakness, TVIX -3.7% in the $4.70s.... true.... horror.

12pm update - underlying upward pressure

US equities remain leaning on the upward side. Regardless of whether moderate net daily gains.. or losses, further upside to the sp'2060/80 zone looks probable. There is notable resilience in tech, with the Nasdaq comp' within 2% of the very important 4900 threshold.

sp'60min

Nasdaq comp',daily

Summary

Little to add.

Oil looks set for the $43/44s... as early as tomorrow.. and that will certainly drag the equity market upward.

--

notable weakness, INFN, daily

There appears no real excuse for the drop. Technically, yesterday saw a hit of key resistance, now its a case of whether rising support holds. Broadly... the stock looks set for much lower levels.

--

time for lunch

sp'60min

Nasdaq comp',daily

Summary

Little to add.

Oil looks set for the $43/44s... as early as tomorrow.. and that will certainly drag the equity market upward.

--

notable weakness, INFN, daily

There appears no real excuse for the drop. Technically, yesterday saw a hit of key resistance, now its a case of whether rising support holds. Broadly... the stock looks set for much lower levels.

--

time for lunch

11am update - no downside power

US equity indexes are already in the process of turning positive, as the equity bears lack any power. With high threat of Oil battling to the $43/44s, the sp'500 still looks set to reach the 2060/70s.. before next realistic opportunity of a genuine turn lower.

sp'60min

VIX'60min

Summary

*opening hourly candle on the VIX.. a black-fail... and those rarely work out well for the equity bears.

--

Little to add.

Oil is -0.2% in the $41s.. and will probably close net higher.. and we know what that usually means for the broader equity market, yes?

-

Here in London city...

In the sunshine.. almost feels a little warm.

--

time to cook!

sp'60min

VIX'60min

Summary

*opening hourly candle on the VIX.. a black-fail... and those rarely work out well for the equity bears.

--

Little to add.

Oil is -0.2% in the $41s.. and will probably close net higher.. and we know what that usually means for the broader equity market, yes?

-

Here in London city...

In the sunshine.. almost feels a little warm.

--

time to cook!

10am update - moderate weakness

US equities open lower, but so far, there is ZERO sign that the equity bears are going to be able to muster any sustained/significant downside. VIX remains broadly subdued, only +6% in the 14s. Metals are catching a moderate fear bid, with Gold +$10 around $1250.

sp'60min

VIX'60min

Summary

*PMI manu': 51.4, a touch weak, but nothing dire either.

--

Current price action offers very little to the bears.

Even a break <2030 by the close looks unlikely.

Eyes on Oil, which still looks highly vulnerable to renewed upside to the $43/44s. If that is the case, the sp' will be in the 2060/70s.

--

notable weakness, oil/gas drillers, SDRL, daily

The recent delusional bullish hysteria has now almost entirely be negated. SDRL, along with RIG remain on the disappear list.

--

time for some sun

sp'60min

VIX'60min

Summary

*PMI manu': 51.4, a touch weak, but nothing dire either.

--

Current price action offers very little to the bears.

Even a break <2030 by the close looks unlikely.

Eyes on Oil, which still looks highly vulnerable to renewed upside to the $43/44s. If that is the case, the sp' will be in the 2060/70s.

--

notable weakness, oil/gas drillers, SDRL, daily

The recent delusional bullish hysteria has now almost entirely be negated. SDRL, along with RIG remain on the disappear list.

--

time for some sun

Pre-Market Brief

Good morning. US equity futures are moderately lower, sp - 8pts, we're set to open at 2043. USD is +0.2% in the DXY 95.40s. Metals are back on the rise, Gold +$9, with Silver +0.6%. Oil is starting to struggle, -1.3% in the $40s.

sp'60min

Summary

So, the market is weak, but certainly, its nothing significant yet.

Rising trend/channel is offering support - at the close it will be around 2030, with the lower hourly bollinger also in the 2030s.

A daily close <2030 would thus be somewhat important... but that does seem unlikely... not least if Oil can resume higher.

-

early movers..

FCX -2%

RIG -10%

DAL/UAL -3%

-

Overnight action

Japan: +1.9% @ 17048

China: moderately weak,0.6% @ 2999

Germany: currently -0.5% @ 9896

-

Have a good Tuesday

sp'60min

Summary

So, the market is weak, but certainly, its nothing significant yet.

Rising trend/channel is offering support - at the close it will be around 2030, with the lower hourly bollinger also in the 2030s.

A daily close <2030 would thus be somewhat important... but that does seem unlikely... not least if Oil can resume higher.

-

early movers..

FCX -2%

RIG -10%

DAL/UAL -3%

-

Overnight action

Japan: +1.9% @ 17048

China: moderately weak,0.6% @ 2999

Germany: currently -0.5% @ 9896

-

Have a good Tuesday

Just another day in market land

With the equity bears remaining powerless, it was just another day for the bulls, with the sp'500 breaking a new cycle high of 2053. The VIX remains bizarrely low, having imploded from the 30s to the 13s. As things are, another 1-1.5% equity upside looks probable.

sp'weekly1b

sp'monthly1b

Summary

Suffice to add, the monthly chart has a pretty powerful bullish candle. How we close the month will be important.

No doubt, a very large part of the ongoing equity rally is due to the recovery in oil.

WTIC oil, weekly2

Note the upper weekly bollinger has now cooled to $44.40. The 43/44s look viable in the near term. Sustained action >$45 looks difficult, as the over-supply issue remains ENTIRELY unresolved.

--

Macro-econ chatter - Mr Long and Mr Shedlock

--

Looking ahead

Tuesday will see the house price index, PMI manu', and Richmond Fed manu'.

*Fed official Evans is due to speak in the 12pm hour.

--

Goodnight from London

sp'weekly1b

sp'monthly1b

Summary

Suffice to add, the monthly chart has a pretty powerful bullish candle. How we close the month will be important.

No doubt, a very large part of the ongoing equity rally is due to the recovery in oil.

WTIC oil, weekly2

Note the upper weekly bollinger has now cooled to $44.40. The 43/44s look viable in the near term. Sustained action >$45 looks difficult, as the over-supply issue remains ENTIRELY unresolved.

--

Macro-econ chatter - Mr Long and Mr Shedlock

--

Looking ahead

Tuesday will see the house price index, PMI manu', and Richmond Fed manu'.

*Fed official Evans is due to speak in the 12pm hour.

--

Goodnight from London

Daily Index Cycle update

US equity indexes closed moderately mixed, sp +2pts @ 2051. The two

leaders - Trans/R2K, settled u/c and -0.3% respectively. Near term

outlook threatens the sp'2070/80 zone, along with Nasdaq comp' 4900.

sp'daily5

Nasdaq comp'

Summary

The fourth consecutive net daily gain for most indexes.

Ongoing price action offers zero sign of a turn. Next resistance for the Nasdaq comp' is clearly the 4900 threshold.

--

a little more later..

sp'daily5

Nasdaq comp'

Summary

The fourth consecutive net daily gain for most indexes.

Ongoing price action offers zero sign of a turn. Next resistance for the Nasdaq comp' is clearly the 4900 threshold.

--

a little more later..

Subscribe to:

Comments (Atom)