It was a very mixed month for world equities, with net monthly changes ranging from +4.9% (Germany), +0.3% (USA - Dow), to -9.5% (Greece). Further upside into 2016 looks due... although the technical damage from the Aug' lows is yet to be fully negated.

Lets take our monthly look at ten of the world equity markets.

Greece

Greece remains a collapsed economy... only surviving due to the continuing (and relentlessly increasing) loans from the troika. The Athex fell almost 10% in November, and is already lower by another -4.3% in the first 4 trading days of December.

Until the debt is defaulted upon, the Euro dropped, and a return (for the first time since Plato?) to a balanced budget, Greece remains the economic gutter of Europe. Overly harsh? Maybe, but then... the Greek people have only themselves to blame for refusing to live within their means.

Brazil

The Bovespa lost -1.6% in November, as price action is increasingly tight. For now.. core support is holding. First upside target is the 10MA of 49212.. and that is around 9% higher.

France

The CAC managed a gain of 1.2% in Nov', with a notable close above the monthly 10MA. Current price action is a little shaky though, and it will be VERY important for the equity bulls to see the CAC end the year above the 5000 threshold.

Germany

The economic powerhouse of the EU - Germany, is leading the way higher, with a powerful net monthly gain of 4.9%, decisively above the 10MA. Equity bulls should be seeking (at minimum), a 2015 close >11500... preferably the 12000s. The 12500/13000 zone looks viable by late spring 2016.

UK

The FTSE saw a fractional Nov' decline of -0.1%, closing under the 10MA for the sixth consecutive month. Equity bulls need to see a break into the 6600s to give confidence that the Aug' lows are not going to be tested in early 2016.

Spain

The ugliest and most problematic (due to its size) of the EU-PIIGS - Spain, saw a minor net gain of 0.2%. Like most other EU indexes, the IBEX is consistently trading under the 10MA. Price structure could arguably be a giant H/S formation. If so.. the IBEX will get stuck around 11000 in early 2016. From there, downside target would be (12000-9500: 2500... 9500-2500) 7000. For now.. that extremely bearish target is on hold, as most other world markets look set to climb into early 2016.

USA - Dow

The mighty Dow saw a minor Nov' gain of 0.3%. With the Friday hyper-gain of 2.1% to 17847, first target is the 18K threshold. From there... a new historic high (>18351) before year end looks probable. Underlying MACD (green bar histogram) cycle remains negative for the tenth consecutive month, but is ticking upward. At the current rate of recovery, there will be a bullish cross in Feb/March.

Japan

The BoJ fuelled Nikkei climbed 3.5% in Nov', falling just fractionally short of the 20K threshold, but above the 10MA. There is viable upside to the 22000s in Q1 of 2016.

Russia

The Russian market saw a fractional gain of 0.6% in Nov', but remains broadly weak, pressured by weak oil/gas prices. Rising support is around 750.. if that is lost... there would be viable downside back to the 600/570 zone.

China

The China market saw some distinct upset into end month as the communist leadership launched another round of witch hunts against the 'malicious short sellers', this time.. those in the metals market. Even so, the Shanghai comp' saw a second consecutive net monthly gain of 1.9%.

The SSEC has traded under the 10MA since Aug'. Equity bulls should be seeking a year end close >3800. If achieved, that will open the door to not just 4K... but 6K by late 2016.

Summary

It was indeed a rather mixed month for world equities. Not surprisingly, the USA, Germany, and Japan continue to remain the stronger indexes, with China battling to resume 'normal service' after the summer collapse wave.

Price structure in a fair few indexes - (especially the European ones) is still very bearish, with a viable multi-month bear flag, as prices continue to trade under the 10MA.

For now... unless the US, German, and Japanese markets see a Dec' or Jan'2016 monthly close back under the 10MA... the other indexes should also be able to claw higher.

Best guess: further upside into early 2016.

--

Looking ahead

A much lighter week is ahead....

M - consumer credit

T -

W - wholesale trade, EIA report

T - weekly jobs, import/export prices, US T-budget

F - PPI, retail sales, bus' invent', consumer sent.

--

Back on Monday.

Saturday, 5 December 2015

A rough week for Oil

With OPEC unable to agree on anything, WTIC oil was unable to hold the $40 threshold, settling -$1.30 (3.1%) @ $39.97. The short/mid outlook is bearish, but from a pure cyclical perspective, a move to the $42-45 zone into early 2016 would not exactly be a bold upside target.

WTIC, weekly2

WTIC, monthly2

Summary

*note the blue monthly candle. Until we see a green candle, oil/energy bulls are fighting underlying bearish price momentum.

--

Suffice to say... as an organisation, OPEC appear extremely weak. Despite prices having collapsed from over $100 in summer 2014 to sub $40... the cartel are still not able to agree on restraining supply.

One thing is for sure, the US/world consumer are likely to benefit from low energy/fuel prices for the entirety of 2016.

.. by definition.. that is bullish for the broader economy.. and indeed... the market.

Goodnight from London

--

*the weekend post will be on the world monthly indexes.

WTIC, weekly2

WTIC, monthly2

Summary

*note the blue monthly candle. Until we see a green candle, oil/energy bulls are fighting underlying bearish price momentum.

--

Suffice to say... as an organisation, OPEC appear extremely weak. Despite prices having collapsed from over $100 in summer 2014 to sub $40... the cartel are still not able to agree on restraining supply.

One thing is for sure, the US/world consumer are likely to benefit from low energy/fuel prices for the entirety of 2016.

.. by definition.. that is bullish for the broader economy.. and indeed... the market.

Goodnight from London

--

*the weekend post will be on the world monthly indexes.

Daily Index Cycle update

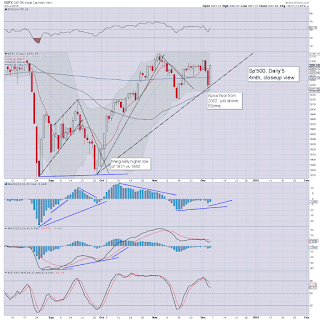

US equities closed with very powerful gains of 42pts (2.0%) @ 2091 (intra

high 2093). The two leaders - Trans/R2K, settled higher by 0.9% and

1.1% respectively. Near term outlook is for the sp'2115/20 zone... if

not a straight run to the 2150s by the FOMC of Dec 16th.

sp'daily5

Trans

Summary

*The Transports broke a new cycle low of 7831, but did close rather bullish, with a clear spike-floor. First target remains the 200dma in the 8300s.

--

The sp'500 saw a very powerful net daily gain of 2%... making for a fractional net weekly gain... pretty incredible.

--

a little more later...

sp'daily5

Trans

Summary

*The Transports broke a new cycle low of 7831, but did close rather bullish, with a clear spike-floor. First target remains the 200dma in the 8300s.

--

The sp'500 saw a very powerful net daily gain of 2%... making for a fractional net weekly gain... pretty incredible.

--

a little more later...

Subscribe to:

Comments (Atom)