With the main indexes rallying into the weekend, the VIX closed the week with rather significant declines of 14.75%, settling @ 14.97. Across the week, the VIX still managed gains of 24%. VIX looks set for further moderate weakness, before a renewed surge late next week into the 20s.

VIX'60min

VIX'daily3

VIX'weekly

Summary

As expected, the VIX slipped lower into the weekend - especially in the closing hour. Yet, the weekly gain of 24% was impressive, and it bodes well for the next six trading weeks.

Near term outlook is for VIX to slip a little lower. I suppose 13s are viable - which is frankly quite bizarre when you consider the recent surges into the 17/18s.

So,...the outlook is...

Mon/Tue...sp'1570, VIX 14/13s....

Wednesday - a turn lower, sub wave'1

By late Friday, I think there is the very real chance that VIX will break into the low 20s. Its hard to guess where the indexes might be, but sp' 1520/00 would be a very valid target by next Friday - or the following Monday of April'29.

more later..on the indexes

Friday, 19 April 2013

Closing Brief

The broader market closed with gains of around 1%. Today was probably day'1 of 2 or 3, of a wave'2 bounce. A pretty severe wave'3 looks set to begin in the latter half of next week. The VIX closed -15% in the 14s, next Friday VIX could easily be in the low 20s.

sp'60min

Summary

So, the market markers went for an April opex pin with the sp @ 1555.

Its been a very long and busy week, we've seen minor wave'1 complete, and now we're in a little'2 bounce.

This time next week we'll be in the middle of a 3, one that should take us to the sp'1480s within about 7-10 trading days - with VIX in the mid 20s.

Have a good weekend everyone!

--

The usual things to round up the week across the evening...

Next main post, late Saturday, on the weekly US indexes

sp'60min

Summary

So, the market markers went for an April opex pin with the sp @ 1555.

Its been a very long and busy week, we've seen minor wave'1 complete, and now we're in a little'2 bounce.

This time next week we'll be in the middle of a 3, one that should take us to the sp'1480s within about 7-10 trading days - with VIX in the mid 20s.

Have a good weekend everyone!

--

The usual things to round up the week across the evening...

Next main post, late Saturday, on the weekly US indexes

3pm update - closing hour chop to 1550

Market is flat lining into a quiet closing hour. Market makers look set to try to pin the market at sp'1550, although it will be tough for AAPL to hit the key $400 level. VIX is still -12%, and will probably melt lower into the close.

sp'60min

vix'60min

Summary

Just one hour left, of what has been a rather interesting week. Next week will be when the real excitement looks set to begin.

*as for the ABC waves on the current wave'2. Impossible to know where those should be placed. We'll only see it clearly - in retrospect by Tuesday.

Well...lets see if those marker makers can pin sp'1550...with AAPL $400

--

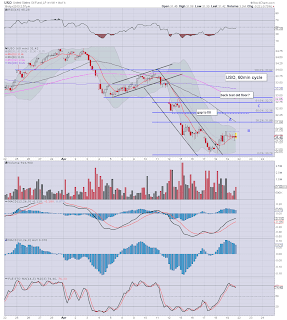

USO'60min

Forming a wide B' wave into Monday? The 32s still look likely.

--

3.20pm.. well, clearly AAPL is not going to $400, maybe the MMs want it at 390?

Anyway, sp' still looks set to close around the 1550s..so, that leaves just over 20pts across next Mon/Tuesday.

3.39pm...bulls manage a new daily high of 1555, urghh, that has to be annoying for those still short. VIX getting ground down..a close in the 14s would a major achievement, considering it was in the 18s just 7 trading hours ago!

sp'60min

vix'60min

Summary

Just one hour left, of what has been a rather interesting week. Next week will be when the real excitement looks set to begin.

*as for the ABC waves on the current wave'2. Impossible to know where those should be placed. We'll only see it clearly - in retrospect by Tuesday.

Well...lets see if those marker makers can pin sp'1550...with AAPL $400

--

USO'60min

Forming a wide B' wave into Monday? The 32s still look likely.

--

3.20pm.. well, clearly AAPL is not going to $400, maybe the MMs want it at 390?

Anyway, sp' still looks set to close around the 1550s..so, that leaves just over 20pts across next Mon/Tuesday.

3.39pm...bulls manage a new daily high of 1555, urghh, that has to be annoying for those still short. VIX getting ground down..a close in the 14s would a major achievement, considering it was in the 18s just 7 trading hours ago!

2pm update - chop chop

Market is holding around the low 1550s, and it seems we'll likely close around current levels. Precious metals have lost much of their opening gains, and Silver is red again. Oil is a touch weak, but looks set for moderate gains across Mon/Tuesday.

--

*with the hourly charts largely the same, here are the daily ones...

sp'daily5

VIX'daily3

Summary

The H/S formation idea is just that...an idea..but its something I will be watching carefully next week.

Bears need a clear RS around the 1570s..and then a major push down to 1490/80s by early May.

-

Its nice to be on the sidelines ahead of the weekend..and besides, no point being short with the current immediate trend.

--

*with the hourly charts largely the same, here are the daily ones...

sp'daily5

VIX'daily3

Summary

The H/S formation idea is just that...an idea..but its something I will be watching carefully next week.

Bears need a clear RS around the 1570s..and then a major push down to 1490/80s by early May.

-

Its nice to be on the sidelines ahead of the weekend..and besides, no point being short with the current immediate trend.

1pm update - choppy afternoon

Market is seeing a micro pull back, and the VIX is trying to crawl up a little. I still think we'll close at sp'1550, although VIX might well slip lower into the close - as its often 'mysteriously' whacked 3-5% lower in the closing 1-3 minutes.

sp'60min

vix'60min

Summary

Its turning into a rather quiet day.

My targets of sp'1550..and AAPL $400 for April opex...look very probable.

--

A poster asked '....One thing I cant figure out is with Europe in a recession How are many countries stock markets at multi year highs. It makes no sense. I have not heard anybody comment on the subject either' - Reece, Phoenix

- I can only say as someone in Europe, that even calling it a 'basket case' would be overly positive. The southern Med' states all have chronic unemployment, and there are some very disturbing stories of the poverty in Greece. Its almost borderline third world now.

Why are markets holding together? Largely mainstream denial/delusion, money printing, and partly this was the natural up cycle from 2009. As many recognise though, we're now due a recession, they occur every 4-6 yrs, and of course, the EU is already in recession.

Look to US GDP data next Friday. A negative number would have to get more people to question the mid-term outlook.

--

*Always good to hear from anyone, I highly suggest a disque account, since comments won't appear otherwise (the disque comments over-rides the normal blogger comments).

--

sp'60min

vix'60min

Summary

Its turning into a rather quiet day.

My targets of sp'1550..and AAPL $400 for April opex...look very probable.

--

A poster asked '....One thing I cant figure out is with Europe in a recession How are many countries stock markets at multi year highs. It makes no sense. I have not heard anybody comment on the subject either' - Reece, Phoenix

- I can only say as someone in Europe, that even calling it a 'basket case' would be overly positive. The southern Med' states all have chronic unemployment, and there are some very disturbing stories of the poverty in Greece. Its almost borderline third world now.

Why are markets holding together? Largely mainstream denial/delusion, money printing, and partly this was the natural up cycle from 2009. As many recognise though, we're now due a recession, they occur every 4-6 yrs, and of course, the EU is already in recession.

Look to US GDP data next Friday. A negative number would have to get more people to question the mid-term outlook.

--

*Always good to hear from anyone, I highly suggest a disque account, since comments won't appear otherwise (the disque comments over-rides the normal blogger comments).

--

12pm update - as expected

Market is comfortably still holding moderate gains, even the Dow - weighed down by IBM, is almost green. VIX is -13%, and a close in the 15s now looks a given. Market makers will likely be seeking to close the day @ sp'1550.

sp'60min

Summary

Market battling higher....which will broadly continue into Tuesday.

Seeking a major re-short in the sp'1570s, with VIX 14s.

--

VIX update

back later

sp'60min

Summary

Market battling higher....which will broadly continue into Tuesday.

Seeking a major re-short in the sp'1570s, with VIX 14s.

--

VIX update

back later

11am update - cruising higher

Mr Market is comfortably a little higher. Considering its opex, market makers will likely try to close this nonsense @ sp'1550. VIX is currently -9%, and it'd not be a surprise to see further declines into the close - down in the low 15s. Metals are higher, but Oil is a little lower.

sp'60min

vix'60min

Summary

We have a pretty clear break of trend, and on any basis, the VIX looks set to fall into Monday, if not also Tuesday. We're already in the 15s..and all things considered..14s again look viable.

Right now, it would seem the patient bears need to just sit back until Tuesday afternoon.

sp'60min

vix'60min

Summary

We have a pretty clear break of trend, and on any basis, the VIX looks set to fall into Monday, if not also Tuesday. We're already in the 15s..and all things considered..14s again look viable.

Right now, it would seem the patient bears need to just sit back until Tuesday afternoon.

10am update - messy open

The indexes open weird, with a micro flash lower - although the index ETFs opened higher. Clearly, not everything is working okay this morning. After that initial drop, most indexes are now moderately higher. Hourly charts are highly suggestive of upside into next Tuesday. VIX is lower.

sp'60min

vix'60min

Summary

So...a 'broken' open for the indexes..see this 1min chart...

The SPY ETF was suggesting +3pts...and you can see the sp' index itself finally corrected itself after a few minutes. I wonder if anyone got stopped out on what was an incorrect open.

*seeking a Friday close, sp'1550, with AAPL @ $400

Lets see those market makers do what they do best...FIX the opex price levels.

sp'60min

vix'60min

Summary

So...a 'broken' open for the indexes..see this 1min chart...

The SPY ETF was suggesting +3pts...and you can see the sp' index itself finally corrected itself after a few minutes. I wonder if anyone got stopped out on what was an incorrect open.

*seeking a Friday close, sp'1550, with AAPL @ $400

Lets see those market makers do what they do best...FIX the opex price levels.

Pre-Market Brief

Good morning. Futures are moderately higher, sp +7, we're set to open @ 1548. The USD is a touch lower, which is probably going to help give the precious metals and Oil a kick higher into the weekend. Its opex today, so things could be a bit choppy, especially late afternoon.

sp'60min

sp'daily5

Summary

First, if you've not checked last nights post, have a look!

It does look like we have a very strong chance of closing today around sp'1550, making day'1 of 2 (or 3) of a sub wave'2 bounce.

Next major downside action likely begins in the latter part of next week, with a key target of sp'1480s.

Best guess for today remains a close of sp'1550, with AAPL $400. Never under estimate the power of the market makers in pinning a price to maximise their profits.

---

Oil - I am particularly seeking a re-short of USO next week, in the 32s, downside target is 28/27 by mid May.

USO'60min

USO, daily2

--

*I will sit on the sidelines until late Mon/Tuesday.

9.34am..Did you notice the weirdness just now?

The indexes see a micro-flash crash, yet the ETFs were opening fine.

We had SPY +3pts...yet market was -3pts.

Hourly charts remain VERY bullish into Mon/Tuesday

sp'60min

sp'daily5

Summary

First, if you've not checked last nights post, have a look!

It does look like we have a very strong chance of closing today around sp'1550, making day'1 of 2 (or 3) of a sub wave'2 bounce.

Next major downside action likely begins in the latter part of next week, with a key target of sp'1480s.

Best guess for today remains a close of sp'1550, with AAPL $400. Never under estimate the power of the market makers in pinning a price to maximise their profits.

---

Oil - I am particularly seeking a re-short of USO next week, in the 32s, downside target is 28/27 by mid May.

USO'60min

USO, daily2

--

*I will sit on the sidelines until late Mon/Tuesday.

9.34am..Did you notice the weirdness just now?

The indexes see a micro-flash crash, yet the ETFs were opening fine.

We had SPY +3pts...yet market was -3pts.

Hourly charts remain VERY bullish into Mon/Tuesday

Market is increasingly weak and twitchy

Another down day for the market, and with the break of the sp'1538 March low, the bulls are now clearly in real trouble. With the weekly charts looking imminently prone to a major snap lower, there is a chance of very significant downside across the next six weeks.

spdaily5b - best guess

sp'weekly2, rainbow

vix,weekly

Summary

Today was a real mind-frak..to be honest.

I took the simple decision to merely exit a USO (long) trade at the open, and sit the rest of the day out. I still think we have a VERY clear 5 waves lower, from what I now am calling a top @ sp'1597. There are many other issues that support weakness in the main US and world markets into May, and I won't be changing my mid-term bearish outlook any time soon.

I do of course seek a 2-3 day bounce - forming a sub'2 wave (see daily5b), which - since we closed lower today, now seems likely not to complete until next Mon/Tuesday.

There are certainly days when I simply can't stomach the instability, and today was one of them.

Small H/S, within big H/S ?

I had this idea recently, but ditched it when we broke above the sp'1576 high. I think it probably deserves being highlighted again though.

sp'daily5

One major key issue is extrapolating viable downside - see pink lines, first set is from 1597/1536 - which gives 1485. Second set is 1597/1485...which gives 1380. I have to say the latter number would make for a pretty exciting May. It would take the market to marginally negative on the year, and I can only imagine the near terror on the faces of those cheer leading maniacs on clown finance TV.

US, GDP Q1 - weak, weak, WEAK!

I thought I'd end today with a few thoughts on the big economic picture. We have Q1 GDP data out next Friday Apr'26. The Q4 GDP data - to the surprise of many, originally came in a little negative, but (I think) the second revision was +0.4%. Well below 'stall speed', and clearly, borderline recession on any basis.

My guess for next Fridays data point is for -0.5 to -1.0%. I think that would make for a real wake up call to the mainstream, and be a clear warning that Q4s weakness was not a one off. The EU is a basket case, and that has to have been affecting the US for some considerable time now. I would be stunned if GDP came in over +2%, and even 1% looks like a stretch.

There are possible implications for Gold/Silver, in that if the main market sells down on a lousy economic outlook, perhaps the metals will use it as an excuse to ramp 'flight to safety'?, after their recent extreme drops? Its just an idea, and I will add, I sure won't be trading them.

Looking ahead

There is no econ-data to end the week, and of course, its option expiration for April. It could certainly be a bit choppy across the day, and especially in the closing hour.

I will throw out a vague guess that the market makers might want to nail/pin the SPY and SP'500 @ 155/1550, that is just over 8pts higher. Similarly, for AAPL, I'd guess they will try to pin it @ $400, to nuke all the call and put holders - at what is a very obvious key strike level.

So, lets see if we close the week @ sp'1550, with AAPL @ $400.

--

*I do not intend to trade tomorrow, and indeed, look to wait for a full re-short in the sp'1570s, with VIX back in the 15s. As ever, I will try to keep an open mind to things, but broadly speaking, I will be looking to trade the daily5b chart outlook.

Finally, it was good to see some more comments today, always good to hear from some of you!

Goodnight from London

spdaily5b - best guess

sp'weekly2, rainbow

vix,weekly

Summary

Today was a real mind-frak..to be honest.

I took the simple decision to merely exit a USO (long) trade at the open, and sit the rest of the day out. I still think we have a VERY clear 5 waves lower, from what I now am calling a top @ sp'1597. There are many other issues that support weakness in the main US and world markets into May, and I won't be changing my mid-term bearish outlook any time soon.

I do of course seek a 2-3 day bounce - forming a sub'2 wave (see daily5b), which - since we closed lower today, now seems likely not to complete until next Mon/Tuesday.

There are certainly days when I simply can't stomach the instability, and today was one of them.

Small H/S, within big H/S ?

I had this idea recently, but ditched it when we broke above the sp'1576 high. I think it probably deserves being highlighted again though.

sp'daily5

One major key issue is extrapolating viable downside - see pink lines, first set is from 1597/1536 - which gives 1485. Second set is 1597/1485...which gives 1380. I have to say the latter number would make for a pretty exciting May. It would take the market to marginally negative on the year, and I can only imagine the near terror on the faces of those cheer leading maniacs on clown finance TV.

US, GDP Q1 - weak, weak, WEAK!

I thought I'd end today with a few thoughts on the big economic picture. We have Q1 GDP data out next Friday Apr'26. The Q4 GDP data - to the surprise of many, originally came in a little negative, but (I think) the second revision was +0.4%. Well below 'stall speed', and clearly, borderline recession on any basis.

My guess for next Fridays data point is for -0.5 to -1.0%. I think that would make for a real wake up call to the mainstream, and be a clear warning that Q4s weakness was not a one off. The EU is a basket case, and that has to have been affecting the US for some considerable time now. I would be stunned if GDP came in over +2%, and even 1% looks like a stretch.

There are possible implications for Gold/Silver, in that if the main market sells down on a lousy economic outlook, perhaps the metals will use it as an excuse to ramp 'flight to safety'?, after their recent extreme drops? Its just an idea, and I will add, I sure won't be trading them.

Looking ahead

There is no econ-data to end the week, and of course, its option expiration for April. It could certainly be a bit choppy across the day, and especially in the closing hour.

I will throw out a vague guess that the market makers might want to nail/pin the SPY and SP'500 @ 155/1550, that is just over 8pts higher. Similarly, for AAPL, I'd guess they will try to pin it @ $400, to nuke all the call and put holders - at what is a very obvious key strike level.

So, lets see if we close the week @ sp'1550, with AAPL @ $400.

--

*I do not intend to trade tomorrow, and indeed, look to wait for a full re-short in the sp'1570s, with VIX back in the 15s. As ever, I will try to keep an open mind to things, but broadly speaking, I will be looking to trade the daily5b chart outlook.

Finally, it was good to see some more comments today, always good to hear from some of you!

Goodnight from London

Daily Index Cycle update

The market opened moderately higher with the sp @ 1554, but it quickly failed, and there were some consistent little waves lower across the day. The critical 1538 low from March was briefly breached, although the Dow and Transports still held above their equivalent levels.

IWM

SP'daily5

Trans

Summary

So..issue of the day was clearly the breach of the March'19 low of sp'1538.57.

I have to say I was very surprised by the break under yesterdays low of 1543, but still, I wasn't going to chase it lower. The hourly charts were simply NOT looking good for the bears today, and I am very much a more cautious trader lately.

The close back above 1538 level was important to the bulls, and I will hold to the original count/outlook. I am seeking another break into the low sp'1570s, which probably equates to VIX back in the 16/15s.

However, with today's further weakness, any such bounce - which is likely to take at least two trading days, will mean there is no point shorting tomorrow.

Right now, it would seem bears will need to be patient for the sp'1570s, which might not come until Tuesday.

--

a little more later..covering the outlook for next week - when things look set to get exciting.

IWM

SP'daily5

Trans

Summary

So..issue of the day was clearly the breach of the March'19 low of sp'1538.57.

I have to say I was very surprised by the break under yesterdays low of 1543, but still, I wasn't going to chase it lower. The hourly charts were simply NOT looking good for the bears today, and I am very much a more cautious trader lately.

The close back above 1538 level was important to the bulls, and I will hold to the original count/outlook. I am seeking another break into the low sp'1570s, which probably equates to VIX back in the 16/15s.

However, with today's further weakness, any such bounce - which is likely to take at least two trading days, will mean there is no point shorting tomorrow.

Right now, it would seem bears will need to be patient for the sp'1570s, which might not come until Tuesday.

--

a little more later..covering the outlook for next week - when things look set to get exciting.

Subscribe to:

Comments (Atom)