With the main indexes falling under key support of sp'1675, the VIX has similarly broken out, settling +13% @ 14.73, with an earlier peak of 14.85. Volatility looks set to broadly climb into early September, although the VIX 20 threshold still looks very difficult to hit.

VIX'60min

VIX'daily3

Summary

Being the VIX, it is highly arguable whether moving averages are even relevant, but for what its worth.. the VIX did close around the 50/200 day MAs.

It is highly difficult to know if the VIX will merely see a brief pull back - to the 10MA..or just keep on rising into the upper teens early next week.

What is clear, the broader equity trend is to the downside (sp'1575/50), and thus much higher VIX levels look a given across the next 2-4 weeks.

more later..on those bearish indexes

Thursday, 15 August 2013

Closing Brief

The main indexes closed significantly lower, with the sp in the low 1660s.The break <1675 confirms the notion that 1709 was a mid-term high. Downside into September is the 1575/50 zone. The only issue now is whether the market can bounce into opex, or just continues lower.

sp'60min

Summary

For those on the long side, today was rough.

However, for those bears on the sidelines, today was a disastrous failure of nothing.

--

There is little else to add.

sp'60min

Summary

For those on the long side, today was rough.

However, for those bears on the sidelines, today was a disastrous failure of nothing.

--

There is little else to add.

3pm update - still due a ramp

The market broke marginally lower lows - best seen on the R2K, but hourly pressure remains to the upside. Upside into the Friday close, into the sp'1680s still looks very viable. The real action remains in the metals, with Gold +$29

sp'60min

sp'daily5

Summary

*an utterly tiresome and annoying day.

Frankly, I wish I was losing money today, at least I'd have achieved something.

-

Just where the hell is a decent re-short level? Looking at the daily index charts, why wouldn't we now see a giant wave'2/B to the upside, across the next 2 weeks?

Go stare at the hourly charts, ABC down...now a large B up into late August?

If that's the case, then it will be utter waste of time for anyone shorting until early Sept.

sp'60min

sp'daily5

Summary

*an utterly tiresome and annoying day.

Frankly, I wish I was losing money today, at least I'd have achieved something.

-

Just where the hell is a decent re-short level? Looking at the daily index charts, why wouldn't we now see a giant wave'2/B to the upside, across the next 2 weeks?

Go stare at the hourly charts, ABC down...now a large B up into late August?

If that's the case, then it will be utter waste of time for anyone shorting until early Sept.

2pm update - market due a snap upward

The market has tested the morning floor, and everything is set up for a late day ramp. A move into the 1670s is within easy reach, and that will open up the 1680/85 zone for tomorrow morning. Precious metals have snapped higher, with Gold clearing $1350.

sp'5min

GLD'daily

Summary

Baring a break of 1659, its a very reasonable entry level, not that I will get involved.

-

Gold following Silver..next target is the GLD 142/147 area.

-

*Interesting to see many people out there now touting the mid 1550s again.

For me, the issue is not whether <1600, but what the subsequent bounce will be.

Will it be a small 50/75pt bounce.....or a hyper-rally into spring 2014

--

2.19pm..oh well, there go the earlier lows.

Tiresome day.

sp'5min

GLD'daily

Summary

Baring a break of 1659, its a very reasonable entry level, not that I will get involved.

-

Gold following Silver..next target is the GLD 142/147 area.

-

*Interesting to see many people out there now touting the mid 1550s again.

For me, the issue is not whether <1600, but what the subsequent bounce will be.

Will it be a small 50/75pt bounce.....or a hyper-rally into spring 2014

--

2.19pm..oh well, there go the earlier lows.

Tiresome day.

1pm update - choppy, but pressure is up

The main indexes have seemingly formed a pre-opex floor of sp'1659. A gap fill of the opening drop - sp'1680 looks an easy target for the bulls into Friday. Precious metals are strong, with Gold +$15, on the edge of a breakout >$1350. Oil is similarly picking up.

sp'15min

sp'60min

Summary

A pretty straight forward gap to fill in the 1680 area..for late today/tomorrow.

An index re-short in the 1685/95 area is the target for late tomorrow.

--

VIX update from Mr T.

stay tuned

1.19pm.. market just testing the earlier floor of 1659.

I'd be somewhat surprised if we get another 5/10pts lower. Oh well, I won't be going long, not with the break of 1675. Default trade is short into mid Sept.

sp'15min

sp'60min

Summary

A pretty straight forward gap to fill in the 1680 area..for late today/tomorrow.

An index re-short in the 1685/95 area is the target for late tomorrow.

--

VIX update from Mr T.

stay tuned

1.19pm.. market just testing the earlier floor of 1659.

I'd be somewhat surprised if we get another 5/10pts lower. Oh well, I won't be going long, not with the break of 1675. Default trade is short into mid Sept.

12pm update - recovery underway

The market is seeing the usual recovery rally into the afternoon. With further QE tomorrow..and it being opex, bears should probably sit back..and see what the bull maniacs can manage. Metals are now positive, and Oil is showing significant strength. VIX is cooling down.

sp'60min

ViX'60min

Summary

Predictable.

--

*I remain on the sidelines, waiting to launch an index-short, later on Friday. With the break of 1675, the next short trade should be far less risky.

Downside target for September remains in the sp'1600/1550 range.

sp'60min

ViX'60min

Summary

Predictable.

--

*I remain on the sidelines, waiting to launch an index-short, later on Friday. With the break of 1675, the next short trade should be far less risky.

Downside target for September remains in the sp'1600/1550 range.

11am update - latter day recovery?

The bears have achieved a very significant victory. With the break of sp'1675, the 1709 mid-term top looks to be confirmed. Regardless of the usual 'latter day' recovery that seems likely today -and with QE to help, the bears should be increasingly confident into September.

sp'60min

vix'60min

Summary

The hourly index/VIX charts appear as though a floor is in.

With QE of 3-4bn today..and also tomorrow, lets see how high the maniacs will be able to bounce it into the late Friday.

-

On any basis, with the break of 1675, taking new index shorts in the coming days..a far safer trade.

-

Anyone still think 1740/60s viable this Sept?

-

CSCO, 5min

CSCO is failing to get a bounce, but neither are the bears able to hold it under the 10MA on the 5min

Its an interesting one to watch, and I won't be meddling in it.

sp'weekly7

A clear test of the 10MA. Bigger mid-term picture looks pretty clear now. Across the next few weeks..a return into the 1500s.

sp'60min

vix'60min

Summary

The hourly index/VIX charts appear as though a floor is in.

With QE of 3-4bn today..and also tomorrow, lets see how high the maniacs will be able to bounce it into the late Friday.

-

On any basis, with the break of 1675, taking new index shorts in the coming days..a far safer trade.

-

Anyone still think 1740/60s viable this Sept?

-

CSCO, 5min

CSCO is failing to get a bounce, but neither are the bears able to hold it under the 10MA on the 5min

Its an interesting one to watch, and I won't be meddling in it.

sp'weekly7

A clear test of the 10MA. Bigger mid-term picture looks pretty clear now. Across the next few weeks..a return into the 1500s.

10am update - sp'1709 a confirmed high

With the break of the five week trading range floor of sp'1675, it is now highly arguable that 1709 was indeed a key mid-term high. VIX is 10% higher in the low 14s. Gold is weak, with Oil losing earlier minor gains. Bears are on the rampage.. ahead of a large QE-pomo.

sp'60min

vix'daily3

Summary

Well...that is as clear a break as the bears could have hoped for.

CSCO is an interesting one...tempting to get involved (short-side) on any micro-bounce.

--

sp'daily'5

Pretty clear break...downside to the 1650s..where there is a very clear gap.

10.40am.. all the hourly cycles are strongly turning back to the bulls.

There is no real volume on the sell side...its largely technical..with the break of support.

Bears should be bailing here!

sp'60min

vix'daily3

Summary

Well...that is as clear a break as the bears could have hoped for.

CSCO is an interesting one...tempting to get involved (short-side) on any micro-bounce.

--

sp'daily'5

Pretty clear break...downside to the 1650s..where there is a very clear gap.

10.40am.. all the hourly cycles are strongly turning back to the bulls.

There is no real volume on the sell side...its largely technical..with the break of support.

Bears should be bailing here!

Pre-Market Brief

Good morning. Futures are moderately lower, sp -11pts, we're set to open at 1674, which is a marginal break of the key floor of 1675. The bears might actually be able to gap straight under support! Precious metals are lower, Gold -$8, Oil is a touch higher.

sp'60min

Summary

*jobless claims : 320k, better than expected

--

Well, its going to be a VERY marginal situation at the open. The bears just need a tiny bit of follow through, and the FIVE week support will be broken.

-

As ever..the QE remains a problem, and that will be kicking in after 10am.

Further, the hourly MACD cycle is already low, and it will be difficult for the bears to keep pushing lower.

-

Regardless, I'm holding off until both today and tomorrow QE are out of the way.

notable movers: CSCO, -8%

-

Mr Permabull-Carboni is looking for weakness...

Not sure what to make of his unusual call

--

8.44am... sp now set to -14pts, which will be 1671...a VERY clear break of support.

Well, the door will now open to 1660/55, where there is a multiple key support.

sp'60min

Summary

*jobless claims : 320k, better than expected

--

Well, its going to be a VERY marginal situation at the open. The bears just need a tiny bit of follow through, and the FIVE week support will be broken.

-

As ever..the QE remains a problem, and that will be kicking in after 10am.

Further, the hourly MACD cycle is already low, and it will be difficult for the bears to keep pushing lower.

-

Regardless, I'm holding off until both today and tomorrow QE are out of the way.

notable movers: CSCO, -8%

-

Mr Permabull-Carboni is looking for weakness...

Not sure what to make of his unusual call

--

8.44am... sp now set to -14pts, which will be 1671...a VERY clear break of support.

Well, the door will now open to 1660/55, where there is a multiple key support.

Side stepping the QE

The main indexes closed moderately lower, with the market remaining stuck within a tight trading range of 2-3%. The rest of the week looks set to see continued minor price chop. The two significant QEs - totalling $6-7bn, will no doubt help hold things together into the weekend.

sp'weekly4b - hyper-bullish with fib levels

sp'daily3 - fib levels

Summary

I want to start by noting that even without it being highlighted on the daily'3 chart, you can quite clearly see a possible H/S formation - spanning the past few 4-5 weeks.

Of course, if we break >1709, then the formation/idea gets thrown out.

--

RE: weekly chart 4b.

The interesting thing is the fib' levels might suggest a move as low as 1540..although I find that VERY difficult to envision this side of the next FOMC (Sept'18).

Regardless, its something to keep in mind if we break below the weekly 10MA (currently rising @ 1660) next week.

Looking ahead

There is actually a very wide array of econ-data tomorrow. Besides the usual weekly jobless, there is the CPI, empire state, housing, indust' prod' and the Phil' Fed' survey.

*there is a sig' QE of $3-4bn, bears..beware!

--

With QE-pomo both tomorrow and Friday, I am simply going to sit back..and wait. The fact there is also an opex this Friday, along with the current tight trading range, is more than enough to make me sit on the sidelines.

However, baring a break >sp'1700, I will be seeking an index re-short later this Friday, in the sp'1695/1700 zone.

--

*CSCO earnings were inline, but the stock looks set to open around 10% lower. Naturally, futures (as at 11pm EST) are already almost back to flat.

--

Something to end the night with....

It just makes me wonder when the bears will again have 'their time'. I see many out there touting a key multi-year top is about in, but for the moment, that is arguably too bold a thing for anyone to call, least of all, yours truly.

Goodnight from London

sp'weekly4b - hyper-bullish with fib levels

sp'daily3 - fib levels

Summary

I want to start by noting that even without it being highlighted on the daily'3 chart, you can quite clearly see a possible H/S formation - spanning the past few 4-5 weeks.

Of course, if we break >1709, then the formation/idea gets thrown out.

--

RE: weekly chart 4b.

The interesting thing is the fib' levels might suggest a move as low as 1540..although I find that VERY difficult to envision this side of the next FOMC (Sept'18).

Regardless, its something to keep in mind if we break below the weekly 10MA (currently rising @ 1660) next week.

Looking ahead

There is actually a very wide array of econ-data tomorrow. Besides the usual weekly jobless, there is the CPI, empire state, housing, indust' prod' and the Phil' Fed' survey.

*there is a sig' QE of $3-4bn, bears..beware!

--

With QE-pomo both tomorrow and Friday, I am simply going to sit back..and wait. The fact there is also an opex this Friday, along with the current tight trading range, is more than enough to make me sit on the sidelines.

However, baring a break >sp'1700, I will be seeking an index re-short later this Friday, in the sp'1695/1700 zone.

--

*CSCO earnings were inline, but the stock looks set to open around 10% lower. Naturally, futures (as at 11pm EST) are already almost back to flat.

--

Something to end the night with....

It just makes me wonder when the bears will again have 'their time'. I see many out there touting a key multi-year top is about in, but for the moment, that is arguably too bold a thing for anyone to call, least of all, yours truly.

Goodnight from London

Daily Index Cycle update

The main indexes were weak for the entire day, with the sp'500 closing -8pts at 1685. The two market leaders - Trans/R2K, saw more significant declines of 0.8% and 0.4% respectively. The market remains stuck between resistance of 1700 and support of 1675.

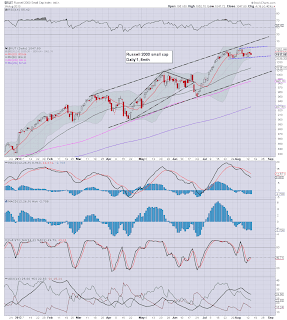

sp'daily5

R2K

Trans

Summary

A pretty dull day in the main market, even though we did close somewhat lower.

Until we get a clear break either above 1700 (and more importantly 1709), or below 1675, this market is simply adrift. Indeed, this is week'5 of a very narrow 2-3% trading range. Dull dull...dull!

--

With two QEs to end the week, and opex on Friday, it'd be surprising if the bears or bulls break the current trading range.

However, weekly charts continue to suggest the bears will achieve a downside break early next week..opening up a target of 1660/50s.

a little more later...

sp'daily5

R2K

Trans

Summary

A pretty dull day in the main market, even though we did close somewhat lower.

Until we get a clear break either above 1700 (and more importantly 1709), or below 1675, this market is simply adrift. Indeed, this is week'5 of a very narrow 2-3% trading range. Dull dull...dull!

--

With two QEs to end the week, and opex on Friday, it'd be surprising if the bears or bulls break the current trading range.

However, weekly charts continue to suggest the bears will achieve a downside break early next week..opening up a target of 1660/50s.

a little more later...

Subscribe to:

Comments (Atom)