With the main indexes seeing minor price chop, the VIX was similarly largely unmoved, settling 0.9% higher @ 13.16. The VIX looks set to remain in the 15-11 range for some weeks. A move back above the key 20 threshold now looks very much in doubt for the rest of 2013.

VIX'60min

VIX'daily3

Summary

There is little to note on the VIX.

With the shutdown over, and the debt ceiling kicked into Feb'2014, the VIX will likely remain low for the remainder of the year. The 2012 high of VIX 27 looks VERY unlikely to be surpassed this year. Even a brief foray into the low 20s looks very difficult, on any end year profit taking.

-

more later..on the indexes

Monday, 21 October 2013

Closing Brief

The main indexes closed largely unchanged, with the sp flat @ 1744. The two leaders - Trans/R2K closed +0.4% and -0.2% respectively. Near term trend is somewhat over-stretched, but a further rally to the sp'1750/60s looks viable before end month. VIX continues to reflect a market that is now back in total complacency mode.

sp'60min

Summary

*NFLX explodes on earnings...$396...I've seen so far..and the $400s look viable.

Anyone doubt $500s not likely in the current up wave?

--

A quiet day, aside from a few moves in the momo stocks.

Primary trend remains to the upside.

-

more later..on the VIX

sp'60min

Summary

*NFLX explodes on earnings...$396...I've seen so far..and the $400s look viable.

Anyone doubt $500s not likely in the current up wave?

--

A quiet day, aside from a few moves in the momo stocks.

Primary trend remains to the upside.

-

more later..on the VIX

3pm update - closing hour chop

The main indexes continue to see micro-chop. Mr Market could see a minor drop into the sp'1730s tomorrow - using the jobs data as an excuse. Regardless of any such reaction, broad trend remains higher.and the 1750s look an easy target at some point this week.

sp'60min

Summary

Very quiet day. Anyone who has managed to stay awake deserves a prize of 1 GOOG share.

--

*NFLX earnings at the close.

How about a hyper-ramp to the low $400s in AH ? Not that I would ever trade one of the hysteria stocks though. They remain purely for 'entertainment viewing' only...at least to me.

Certainly from a trend point of view, its at the top end, yet we've seen some clearly accelerating breakouts lately, not least in the broader Nasdaq Comp' index itself.

-

Much more interesting, that I just noticed...

DRYS, daily

Testing the 50 day MA, and right on my target line of $3. The whole price structure looks like a simple giant bull flag.

-

3.19pm.. Major warning to the bears..

ALL micro index cycles look floored, especially the 5/15min cycles.

VERY high risk of upside into early Tuesday..as high the sp'1760s - if Mr Market likes earnings/jobs data.

--

Absolutely zero point being short anything right now. Anyone short NFLX on margin..could see their accounts blown up in AH.

sp'60min

Summary

Very quiet day. Anyone who has managed to stay awake deserves a prize of 1 GOOG share.

--

*NFLX earnings at the close.

How about a hyper-ramp to the low $400s in AH ? Not that I would ever trade one of the hysteria stocks though. They remain purely for 'entertainment viewing' only...at least to me.

Certainly from a trend point of view, its at the top end, yet we've seen some clearly accelerating breakouts lately, not least in the broader Nasdaq Comp' index itself.

-

Much more interesting, that I just noticed...

DRYS, daily

Testing the 50 day MA, and right on my target line of $3. The whole price structure looks like a simple giant bull flag.

-

3.19pm.. Major warning to the bears..

ALL micro index cycles look floored, especially the 5/15min cycles.

VERY high risk of upside into early Tuesday..as high the sp'1760s - if Mr Market likes earnings/jobs data.

--

Absolutely zero point being short anything right now. Anyone short NFLX on margin..could see their accounts blown up in AH.

2pm update - transports pushing to new highs

Whilst the headline indexes see minor chop, the old leader -Transports, is pushing to new highs, +19pts @ 6849. Could anyone doubt the 7000s won't be hit in the near term? Meanwhile, Oil remains weak, and with the break <$100 WTIC, a further 2% downside looks viable across Tue/Wednesday.

Trans, daily

USO, daily2

Summary

Quiet day...and no doubt the QE fuel of $3bn is helping to take the edge off what selling there is - after the ramp from 1646 to 1747.

--

*NFLX earnings at the close of today..so that is something to stay awake for.

Trans, daily

USO, daily2

Summary

Quiet day...and no doubt the QE fuel of $3bn is helping to take the edge off what selling there is - after the ramp from 1646 to 1747.

--

*NFLX earnings at the close of today..so that is something to stay awake for.

1pm update - underlying upward pressure

The main indexes are likely going to see minor chop for the rest of the day, with underlying pressure to the upside. With Sept' jobs data tomorrow, if Mr Market likes it, the sp'1760s are very viable on a hysteria spike. APPL and NFLX continue to power higher.

sp'60min

Summary

A slow start to the week, and indeed, these are prime conditions for the bulls to put in a marginally higher close. There is simply NO hope for the bears under these trading conditions, which could easily last months.

-

The action in the momo stocks of AAPL and NFLX is particularly telling, and should really concern those who believe the wall will be hit around sp'1750/60.

WHY would it stop there?

sp'60min

Summary

A slow start to the week, and indeed, these are prime conditions for the bulls to put in a marginally higher close. There is simply NO hope for the bears under these trading conditions, which could easily last months.

-

The action in the momo stocks of AAPL and NFLX is particularly telling, and should really concern those who believe the wall will be hit around sp'1750/60.

WHY would it stop there?

12pm update - continuing chop

The main indexes are mixed, with very minor chop that looks set to continue across the afternoon. The market is just cooling down a bit, before the next push into the sp'1750s. Metals are holding gains, whilst Oil remains weak, -1%. VIX is higher, but remains in the insignificant mid 13s.

sp'60min

Summary

Tis a quiet start to the week, there really isn't much to note. The bulls have managed - early this morning, a gain of 101pts across 9 trading days, which is very impressive on any basis.

I realise many are again trying to pinpoint a top, but really, why will the market not just keep on going? After all, the QE fuel continues, and even fear of a slight reduction to $70bn is now off the table until next year.

stock of the day...

NFLX, daily

Anyone doubt NFLX won't be in the $400s..and then 500s before the next grand multi-year equity top is in?

VIX update from Mr T.

time for tea.

sp'60min

Summary

Tis a quiet start to the week, there really isn't much to note. The bulls have managed - early this morning, a gain of 101pts across 9 trading days, which is very impressive on any basis.

I realise many are again trying to pinpoint a top, but really, why will the market not just keep on going? After all, the QE fuel continues, and even fear of a slight reduction to $70bn is now off the table until next year.

stock of the day...

NFLX, daily

Anyone doubt NFLX won't be in the $400s..and then 500s before the next grand multi-year equity top is in?

VIX update from Mr T.

time for tea.

11am update - minor down cycle

The indexes are cooling down a touch after breaking new highs. Equity bears should not get lost in any mild hysteria that 'we're done for the week'. Metals are holding gains, Oil remains weak, -0.8%. The momo stocks are all generally continuing their relentless gains.

sp'60min

Summary

Again, it really is a case of 'don't get lost in the bearish hysteria'.

A minor down cycle....nothing more. Obviously..we could in theory trundle lower for the rest of the day, but with daily/weekly cycles pushing upward....any declines will likely be very slight.

--

Monthly jobs data tomorrow, a move into the sp'1750s is very likely this week.

Notable movers: AAPL, +2% @ 520, NFLX, +3% @ 344.

sp'60min

Summary

Again, it really is a case of 'don't get lost in the bearish hysteria'.

A minor down cycle....nothing more. Obviously..we could in theory trundle lower for the rest of the day, but with daily/weekly cycles pushing upward....any declines will likely be very slight.

--

Monthly jobs data tomorrow, a move into the sp'1750s is very likely this week.

Notable movers: AAPL, +2% @ 520, NFLX, +3% @ 344.

10am update - minor chop

The main indexes open with very minor chop. Underlying pressure remains very much to the upside, and regardless of any minor down cycle today, the bulls are unquestionably in full control. A weekly close in the 1750s looks likely. Metals building gains, Oil trying to recover, -0.6%

sp'60min

Summary

Certainly, the hourly charts look over-stretched, but shorting would be madness. Even a fall to 1730 would merely be another buying opportunity.

The bigger weekly chart...

sp'weekly8

Note the upper bol' has jumped to 1755, and that is a very reasonable target to close this Friday.

*by the end of next week/month-end, we're probably looking at 1760 - which is in the zone that many are now calling for a top (good morning deflationland!).

-

Momo stocks are ripping...

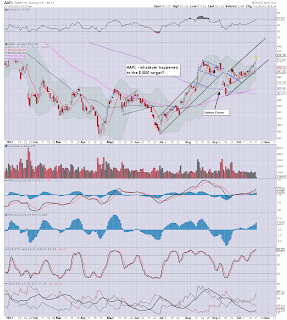

AAPL, daily

August high taken out...next level is 580/600..by year end?

sp'60min

Summary

Certainly, the hourly charts look over-stretched, but shorting would be madness. Even a fall to 1730 would merely be another buying opportunity.

The bigger weekly chart...

sp'weekly8

Note the upper bol' has jumped to 1755, and that is a very reasonable target to close this Friday.

*by the end of next week/month-end, we're probably looking at 1760 - which is in the zone that many are now calling for a top (good morning deflationland!).

-

Momo stocks are ripping...

AAPL, daily

August high taken out...next level is 580/600..by year end?

Pre-Market Brief

Good morning. Futures are flat, we're set to start the week around sp'1744. Metals are mixed, Gold is flat, but Silver +1%. Oil has broken below the big $100 threshold, -1%.With the weekly charts looking especially strong, equity bulls should remain comfortably in control into November.

sp'60min

Summary

It looks like a quiet start to the week. Underlying pressure remains to the upside, and a daily close in the 1750s is likely.

ALL index cycles are primed for further upside, especially the weekly cycle, which will be turning positive for many of the indexes/sectors today.

It looks like the momo stocks are doing especially well in pre-market, NFLX, FB..all the usual suspects are breaking new historic highs. GOOG is +$7 @ $1018, when will someone be brave enough to suggest $2000 'within a few years' ?

--

*Bears should be mindful of a QE of $3bn today (and also Wednesday), that will no doubt make things...difficult.

-

sp'60min

Summary

It looks like a quiet start to the week. Underlying pressure remains to the upside, and a daily close in the 1750s is likely.

ALL index cycles are primed for further upside, especially the weekly cycle, which will be turning positive for many of the indexes/sectors today.

It looks like the momo stocks are doing especially well in pre-market, NFLX, FB..all the usual suspects are breaking new historic highs. GOOG is +$7 @ $1018, when will someone be brave enough to suggest $2000 'within a few years' ?

--

*Bears should be mindful of a QE of $3bn today (and also Wednesday), that will no doubt make things...difficult.

-

Subscribe to:

Comments (Atom)