With equities failing to hold sp'1815, the VIX saw its first big jump of the year, battling consistently higher across the day, settling +31.7% @ 18.14. Near term outlook is for the VIX to get stuck in the 19/20 zone. Across the week, the VIX saw net gains of 45.8%

VIX'60min

VIX'daily3

VIX'weekly

Summary

Indeed, one of the most notable aspects of today was the extremely strong..and importantly - consistent, climb in the VIX.

Yesterday certainly didn't show the consistency..but today sure did. With the break <sp'1815, VIX looks set for 19/20. The only issue is whether we keep on going..into the mid 20s.

Baring a break <sp'1760, I find it hard to believe the VIX will break..AND hold the low 20s.

--

more later..on the indexes

Friday, 24 January 2014

Closing Brief

US indexes saw the biggest two day decline since May 2012, with the sp -38pts @ 1790. The two leaders - Trans/R2K, fell a very significant -4.1% and -2.4% respectively. With the break <sp'1815, upside targets are negated, and there is further downside to 1780/60.

sp'60min

Summary

*with a little drama via the google Blogger server dropping offline this afternoon, I'm tired..so..I'm keeping this short.

---

It was the biggest weekly decline for the sp' since May'2012...when we closed @ 1295..which sure seems a disturbingly long way down. With the break <sp'1815...near term downside ...1780/60..with VIX 19/20

-

I will endeavour to add all the usual bits and pieces to wrap up the day..across the evening.

Have a good weekend.

--

*the weekend post - late Saturday, will be on the US weekly indexes

sp'60min

*with a little drama via the google Blogger server dropping offline this afternoon, I'm tired..so..I'm keeping this short.

---

It was the biggest weekly decline for the sp' since May'2012...when we closed @ 1295..which sure seems a disturbingly long way down. With the break <sp'1815...near term downside ...1780/60..with VIX 19/20

-

I will endeavour to add all the usual bits and pieces to wrap up the day..across the evening.

Have a good weekend.

--

*the weekend post - late Saturday, will be on the US weekly indexes

3pm update - bullish server reboots

Whilst the GOOG kick the Blogger web server, equities remain very weak. Most notable.. we have the first red candle on the rainbow weekly index charts since last August. The only issue now is whether we have a final lunge higher into the late spring..or....if the top is already in.

sp'weekly8

Summary

*sorry for the offline earlier, but hey..its not my server...

--

So..a red candle..and we're sub sp'1800...headed for 1780/60.

See 2pm post (if you've not already seen it)....on the bigger issue.

updates into the close...server permitting ;)

3.02pm....VIX breaking higher....relentless

Surely the 20s not viable on an equity snap into the 1780s..by the close?

3.14pm...we're a mere 30pts from the FOMC taper-low, and now 53pts from the recent high.

Certainly..trend is with the bears...downside to 1780/60..with VIX 19/20.

3.27pm.. Trans -4%...biggest drop since summer 2011 (I think)..next support is 7000, around 3/4% lower.. equating to sp'1770/60.

3.31pm.. VIX +30% @ 18.00.... so..err...I guess taper'2 is off the table next Wednesday.

3.48pm... according to Cashin on CNBC, sell side 1.4bn to process....

could be looking at dow -325/350

3.51pm...despite the big selling...VIX is not going hyper...yet.

It's been one hell of a week....back at the close..to wrap things up.

sp'weekly8

Summary

*sorry for the offline earlier, but hey..its not my server...

--

So..a red candle..and we're sub sp'1800...headed for 1780/60.

See 2pm post (if you've not already seen it)....on the bigger issue.

updates into the close...server permitting ;)

3.02pm....VIX breaking higher....relentless

Surely the 20s not viable on an equity snap into the 1780s..by the close?

3.14pm...we're a mere 30pts from the FOMC taper-low, and now 53pts from the recent high.

Certainly..trend is with the bears...downside to 1780/60..with VIX 19/20.

3.27pm.. Trans -4%...biggest drop since summer 2011 (I think)..next support is 7000, around 3/4% lower.. equating to sp'1770/60.

3.31pm.. VIX +30% @ 18.00.... so..err...I guess taper'2 is off the table next Wednesday.

3.48pm... according to Cashin on CNBC, sell side 1.4bn to process....

could be looking at dow -325/350

3.51pm...despite the big selling...VIX is not going hyper...yet.

It's been one hell of a week....back at the close..to wrap things up.

2pm update - has the October 2011 wave completed?

Whilst the bulls vainly battle to hold sp'1800 (not that it matters now), it has to be asked, was sp'1850 the high of this grand wave from Oct'2011 ? Metals are moderately mixed, whilst Oil is -0.5%. VIX is most notable, with strong gains of 18% in the low 16s.

sp'weekly4

sp'weekly - poster 'delubicz'

Summary

For the normally choppy hour of 2-3pm, I wanted to raise the ultimate issue...is the market maxed out already for this grand wave?

I often get 'lost in the minor waves', and frankly, it'd not surprise me if the slightly different count by poster 'delubicz' is actually more correct.

Key issue: if the latter is correct, then equity bears should look for a hit of the lower weekly bollinger. By end February, that will be around sp'1760/50.

So..we'll know within 4-6 weeks, if the market has already completed the giant wave from Oct'2011.

*I'll cover this issue in more detail later this evening.

---

I should add, I do appreciate all counter views, and I most certainly always seek to learn from others.

sp'weekly4

sp'weekly - poster 'delubicz'

Summary

For the normally choppy hour of 2-3pm, I wanted to raise the ultimate issue...is the market maxed out already for this grand wave?

I often get 'lost in the minor waves', and frankly, it'd not surprise me if the slightly different count by poster 'delubicz' is actually more correct.

Key issue: if the latter is correct, then equity bears should look for a hit of the lower weekly bollinger. By end February, that will be around sp'1760/50.

So..we'll know within 4-6 weeks, if the market has already completed the giant wave from Oct'2011.

*I'll cover this issue in more detail later this evening.

---

I should add, I do appreciate all counter views, and I most certainly always seek to learn from others.

1pm update - maximum VIX upside?

With equities now clearly in a down trend, another key issue is how high can the VIX go. Many recognise that the 200MA on the weekly cycle will be primary resistance - currently in the 19s. Despite the current equity weakness, VIX looks unlikely to break and hold above 20.

VIX'weekly

sp'60min

Summary

*To be clear, I'm not saying VIX 20 won't be briefly broken..but I can't see it holding for more than a few days..if not mere hours.

--

With the hourly MACD index cycle so low, equity bears are vulnerable to a bounce, but...any such bounces are to be shorted....now that key support is broken.

Downside target zone is 1780/60...which I realise..is one hell of a flip from original target upside of 1860/80.

With the break of support, I can change my mind..yes?

--

*Do you think Yellen is watching the markets today? If so...is taper'2 off the table next Wednesday, or will the Fed do it anyway?

1.11pm.. CNBC rolls out the Cramer in a bonus appearence to help 'guide us'. I feel calmer now... don't you?

1.34pm.. Bulls battling to hold sp'1800 this hour..not that it matters..with the earlier break of 1815

VIX'weekly

sp'60min

Summary

*To be clear, I'm not saying VIX 20 won't be briefly broken..but I can't see it holding for more than a few days..if not mere hours.

--

With the hourly MACD index cycle so low, equity bears are vulnerable to a bounce, but...any such bounces are to be shorted....now that key support is broken.

Downside target zone is 1780/60...which I realise..is one hell of a flip from original target upside of 1860/80.

With the break of support, I can change my mind..yes?

--

*Do you think Yellen is watching the markets today? If so...is taper'2 off the table next Wednesday, or will the Fed do it anyway?

1.11pm.. CNBC rolls out the Cramer in a bonus appearence to help 'guide us'. I feel calmer now... don't you?

1.34pm.. Bulls battling to hold sp'1800 this hour..not that it matters..with the earlier break of 1815

12pm update - how low can we go?

With a decisive failure to hold the 50 MA on both the SP' and the Dow, the question is how low will the current wave go? There is a natural attraction down to the 1780/60 zone - within the next few weeks. Metals have turned negative, Gold -$1, with Oil -0.6%.

sp'daily3 - fib levels

sp'weekly8

Summary

Two major down days in a row....yeah...its something of a surprise, but then..its been many months since we've seen this kind of weakness.

--

re: daily'3 chart. It relates to weekly'8, and considering the past two days, I'm resigned that we're now in sub'4 - which in theory, should be no stronger than the August wave.

--

So..best guess for the current wave...1780/60...where the old FOMC-taper low of 1767 is lurking.

No doubt the doomers will be guns blazing bearish tonight, but hey, they've been at it for over two years...and yet..they'll have the audacity to claim they were right all along. Yeah...sure. Enjoy it whilst it lasts.

time for tea.

sp'daily3 - fib levels

sp'weekly8

Summary

Two major down days in a row....yeah...its something of a surprise, but then..its been many months since we've seen this kind of weakness.

--

re: daily'3 chart. It relates to weekly'8, and considering the past two days, I'm resigned that we're now in sub'4 - which in theory, should be no stronger than the August wave.

--

So..best guess for the current wave...1780/60...where the old FOMC-taper low of 1767 is lurking.

No doubt the doomers will be guns blazing bearish tonight, but hey, they've been at it for over two years...and yet..they'll have the audacity to claim they were right all along. Yeah...sure. Enjoy it whilst it lasts.

time for tea.

11am update - key support busted

With a decisive break below the 50 day MA, the market is seeing a second day of significant declines. Next soft support is around sp'1780. VIX +16% into the low 16s...highest level since mid December. Gold is holding slight gains of $4.

sp'daily

vix'daily3

Summary

Well, with the 50 day failing...we're clearly on the way...

The only issue now is whether the FOMC spike low of 1767 will be taken out on the current cycle.

Equity bears should be content with any weekly close <1815

--

sp'daily

vix'daily3

Summary

Well, with the 50 day failing...we're clearly on the way...

The only issue now is whether the FOMC spike low of 1767 will be taken out on the current cycle.

Equity bears should be content with any weekly close <1815

--

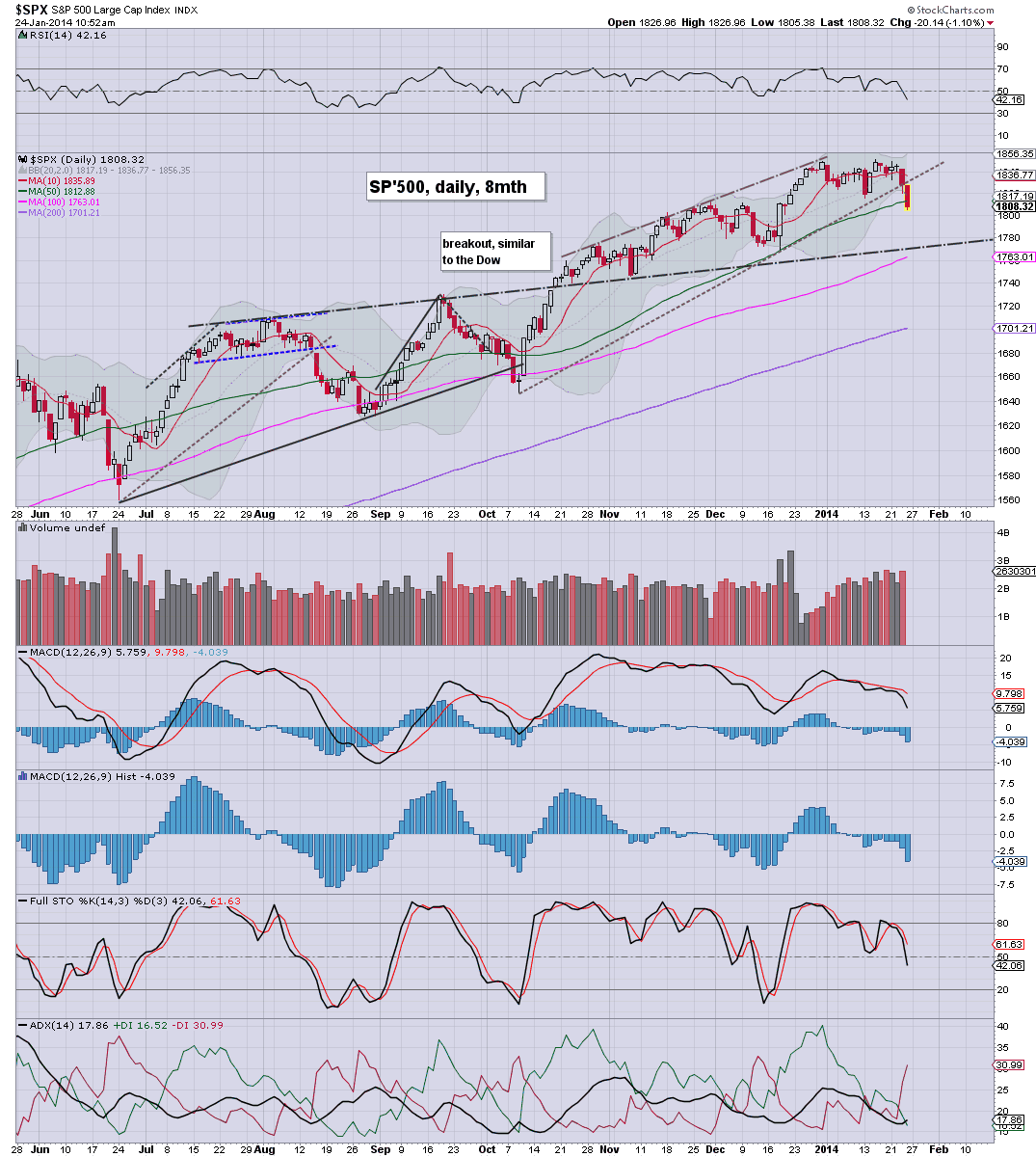

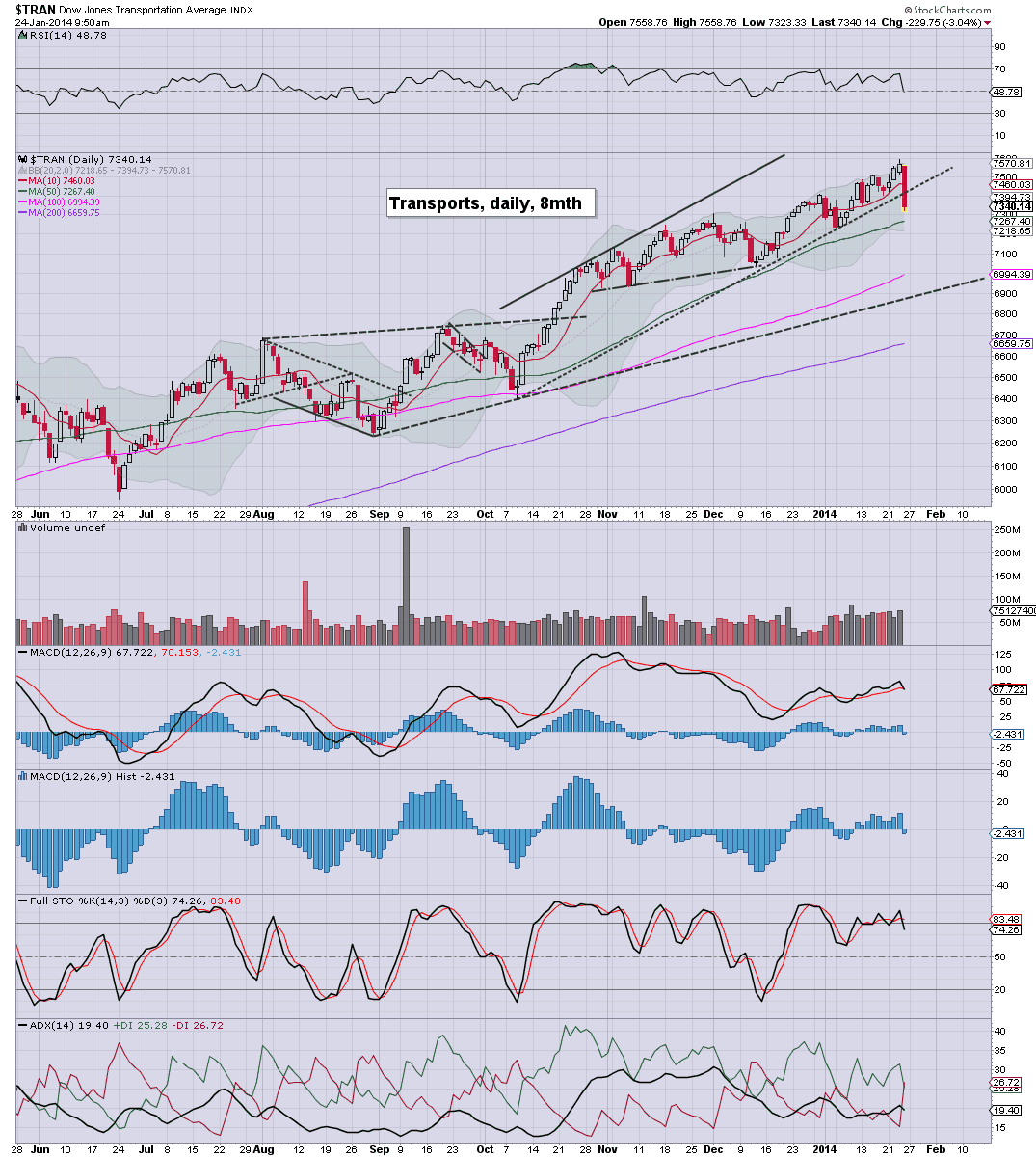

10am update - follow through weakness

For the first time since last October, equity bears are seeing two days of sig' downside in a row. How we close today will be critical. Metals are higher, with Gold breaking back above old support for first time since mid November. VIX is +12% in the mid 15s.

sp'60min

Trans'daily

Summary

*there is a lot to cover, but I think the above two charts cover the bigger issues right now.

--

Clearly, the break <1815 confirms the dow break <16174...bulls are in trouble.

The old leader - Trans, which even managed to close yesterday higher, is getting smashed this morning, biggest fall since last August.

-

*I should note, there is sig' QE of $2-3bn this hour...bears should at least be tightening short-stops right now.

-

To the doomer bears out there...

All those still looking for a mid size collapse wave, should be clawing for a end Jan close <1767 - the FOMC low. If that 'miracle' occurred, it'd break the weekly up trend..and make things real interesting for March/April.

As it is, I don't expect that, but then..I didn't expect this morning's follow through either.

-

10.11am.. minor bounce underway, but really...bulls need to clear 1830 before out of the problem zone.

Hey, at least its not a boring end to the week, right?

10.20am..battling it out at the 50 day of sp'1813/12. Although yes...the Dow is already well below.

The real issue here is how big a bounce will the bulls get.

10.36am Consider this....

It taken the bears FOUR weeks to knock the market down from 1850 to 1809....

2.5% over FOUR weeks. That is truly lousy

sp'60min

Trans'daily

Summary

*there is a lot to cover, but I think the above two charts cover the bigger issues right now.

--

Clearly, the break <1815 confirms the dow break <16174...bulls are in trouble.

The old leader - Trans, which even managed to close yesterday higher, is getting smashed this morning, biggest fall since last August.

-

*I should note, there is sig' QE of $2-3bn this hour...bears should at least be tightening short-stops right now.

-

To the doomer bears out there...

All those still looking for a mid size collapse wave, should be clawing for a end Jan close <1767 - the FOMC low. If that 'miracle' occurred, it'd break the weekly up trend..and make things real interesting for March/April.

As it is, I don't expect that, but then..I didn't expect this morning's follow through either.

-

10.11am.. minor bounce underway, but really...bulls need to clear 1830 before out of the problem zone.

Hey, at least its not a boring end to the week, right?

10.20am..battling it out at the 50 day of sp'1813/12. Although yes...the Dow is already well below.

The real issue here is how big a bounce will the bulls get.

10.36am Consider this....

It taken the bears FOUR weeks to knock the market down from 1850 to 1809....

2.5% over FOUR weeks. That is truly lousy

Pre-Market Brief

Good morning. Futures are lower, sp -11pts, we're set to open at sp'1817 - a mere 2pts above the key low of 1815. Metals are a little higher, Gold +$4. Equity bulls are looking increasingly vulnerable. A weekly close <1815 would be a real problem to the mid-term trend.

sp'60min

Summary

Hmm...it looks like the week is going to end with some drama...one way or another.

Underlying MACD cycle is very low, so the bears will be vulnerable to a whipsaw higher for the entire day.

Equity bulls should be increasingly desperate to break back above the hourly 10MA, which will be around 1825 by late morning.

It remains notable that the bears haven't strung together two decent down days since last October, and even then, we were only talking about 32pts across 2 days.

---

Video update from Oscar

Even Mr Permabull has had a rough week, with the last 5 calls being wrong.

--

Post earnings movers: MSFT, +3.5%, SBUX +1%

--

9.31am... okay..key issue..the 50 day MA is sp'1813. The last it was tested was the FOMC-taper day..where we soared from it.

Clearly, ANY break under..and it will confirm yesterdays break in the Dow <16174

9.43am... Transports..-2.6%, the biggest drop since last August. Now the bears..finally have something worthy of note.

sp'60min

Summary

Hmm...it looks like the week is going to end with some drama...one way or another.

Underlying MACD cycle is very low, so the bears will be vulnerable to a whipsaw higher for the entire day.

Equity bulls should be increasingly desperate to break back above the hourly 10MA, which will be around 1825 by late morning.

It remains notable that the bears haven't strung together two decent down days since last October, and even then, we were only talking about 32pts across 2 days.

---

Video update from Oscar

Even Mr Permabull has had a rough week, with the last 5 calls being wrong.

--

Post earnings movers: MSFT, +3.5%, SBUX +1%

--

9.31am... okay..key issue..the 50 day MA is sp'1813. The last it was tested was the FOMC-taper day..where we soared from it.

Clearly, ANY break under..and it will confirm yesterdays break in the Dow <16174

9.43am... Transports..-2.6%, the biggest drop since last August. Now the bears..finally have something worthy of note.

The weekly close will be important

Despite today's declines, the market remains in what is the fourth week of sideways chop. Baring a break <sp'1815, the recent month is mere 'consolidation across time', whilst the daily/weekly cycles cool down. The near term target zone remains 1860/80.

sp'weekly8

Summary

So..the fourth blue consecutive candle, but in price terms..market is effectively flat. For the equity bears out there, this should be real concerning. Every day of chop is another missed opportunity.

Best guess remains..upside into the 1860/80 zone...then a 3% down wave..which now seems unlikely to start until early February, after the next FOMC.

WTIC Oil..creeping upward

weekly, 3yr

First target is $100/101, and then $105, where we have upper bol' resistance. Underlying MACD (blue bar histogram) cycle is set to turn positive within the next 1-2 weeks.

Things don't get interesting unless we break the May'2011 high of $114.83. That is certainly a fair way up, and looks unlikely this year. I'd guess there is no real chance of Oil breaking the 2008 high of $147 until late summer 2015 at the very earliest

Looking ahead

There is no data due tomorrow, aside from various corporate earnings.

*there is sig' QE-pomo of $2-3bn.

---

The weekend is almost here

Equity bulls should merely seek a weekly close >sp'1815/20. Anything in the 1830/40s is a bonus - considering the recent weakness. Equity bears look weak, and frankly, I just can't see the sp'1700s until the summer, and that still assumes my broader 'intermediate top in the late spring' is correct. There remains the threat..a VERY real one, that we'll just keep going broadly higher - in the style of 2012/13. I sure hope that is not the case.

Goodnight from London

sp'weekly8

Summary

So..the fourth blue consecutive candle, but in price terms..market is effectively flat. For the equity bears out there, this should be real concerning. Every day of chop is another missed opportunity.

Best guess remains..upside into the 1860/80 zone...then a 3% down wave..which now seems unlikely to start until early February, after the next FOMC.

WTIC Oil..creeping upward

weekly, 3yr

First target is $100/101, and then $105, where we have upper bol' resistance. Underlying MACD (blue bar histogram) cycle is set to turn positive within the next 1-2 weeks.

Things don't get interesting unless we break the May'2011 high of $114.83. That is certainly a fair way up, and looks unlikely this year. I'd guess there is no real chance of Oil breaking the 2008 high of $147 until late summer 2015 at the very earliest

Looking ahead

There is no data due tomorrow, aside from various corporate earnings.

*there is sig' QE-pomo of $2-3bn.

---

The weekend is almost here

Equity bulls should merely seek a weekly close >sp'1815/20. Anything in the 1830/40s is a bonus - considering the recent weakness. Equity bears look weak, and frankly, I just can't see the sp'1700s until the summer, and that still assumes my broader 'intermediate top in the late spring' is correct. There remains the threat..a VERY real one, that we'll just keep going broadly higher - in the style of 2012/13. I sure hope that is not the case.

Goodnight from London

Daily Index Cycle update

The main indexes saw somewhat significant declines, with the sp -16pts @ 1828. The two leaders - Trans/R2K, settled +0.3% and -0.8% respectively. Near term outlook remains broadly bullish, whilst the sp' holds >1815.

sp'daily5

Dow

Trans

Summary

*again, its notable, the underlying power in the Transports. They don't call it 'old leader' for nothing, and the Tranny is still comfortably holding within a very strong up trend.

--

The only real weakness for the bears to get moderately excited about was the break < Dow 16174. Baring a break <sp'1815, I don't think the current price action is anything for the bulls to be concerned about.

The past month has been one of mere consolidation across time..rather than price. With the two market leaders still very strong, there is no justification for anyone to short the primary trend..which most certainly remains to the upside.

a little more later...

sp'daily5

Dow

Trans

Summary

*again, its notable, the underlying power in the Transports. They don't call it 'old leader' for nothing, and the Tranny is still comfortably holding within a very strong up trend.

--

The only real weakness for the bears to get moderately excited about was the break < Dow 16174. Baring a break <sp'1815, I don't think the current price action is anything for the bulls to be concerned about.

The past month has been one of mere consolidation across time..rather than price. With the two market leaders still very strong, there is no justification for anyone to short the primary trend..which most certainly remains to the upside.

a little more later...

Subscribe to:

Comments (Atom)