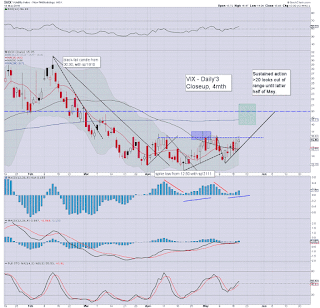

With US equity indexes closing moderately mixed, the VIX had to battle hard to hold minor gains, settling +2.4% @ 15.95. With the break of support (sp'2039), the door is open to another 2% lower, and that should offer VIX 18/19s. A bigger H/S scenario offers 1970/60, and that might briefly equate to VIX 24/27, but that really is 'very best case'.

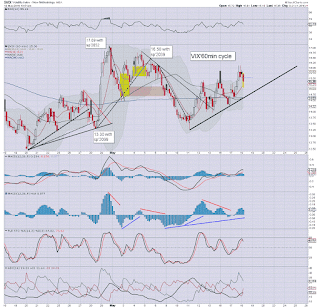

VIX'60min

VIX'daily3

Summary

Short term.. we're seeing a series of marginally higher highs.. and higher lows.

Clearly though, the VIX remains relatively subdued. A sustained break above the key 20 threshold looks difficult.

Even if the H/S scenario plays out to sp'1970/60s.. VIX will only very briefly spike to the 24/27 zone.. and that is out of range until next week.

--

more later... on the indexes

Wednesday, 18 May 2016

Closing Brief

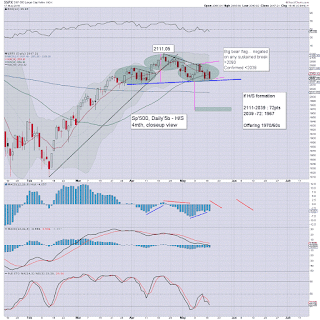

US equities closed moderately mixed, sp' u/c @ 2047 (intra range 2060/34). The two leaders - Trans/R2K, settled higher by 0.3% and 0.5% respectively. With the break of core support, near term outlook offers at least 2000/1990s, with a H/S scenario offering 1970/60s... certainly by end month.

sp'60min

Summary

*closing hour action: some pretty strong swings (relative to what we normally get)... but holding above the 2pm hour low of sp'2034.

--

So... opening weakness.. a ramp into the FOMC minutes.. but then upset at the overt threat of a June rate hike.

Yes.. we closed above the sp'2039 low.. but the floor IS broken.

The spike on the bigger daily candle is very bearish, and bodes for a near term decline of 2% (at min)... to 4%.

In the grand scheme of things.. its all still pretty small moves, but it won't be that way forever, as the summer proceeds.

--

more later... on the VIX

sp'60min

Summary

*closing hour action: some pretty strong swings (relative to what we normally get)... but holding above the 2pm hour low of sp'2034.

--

So... opening weakness.. a ramp into the FOMC minutes.. but then upset at the overt threat of a June rate hike.

Yes.. we closed above the sp'2039 low.. but the floor IS broken.

The spike on the bigger daily candle is very bearish, and bodes for a near term decline of 2% (at min)... to 4%.

In the grand scheme of things.. its all still pretty small moves, but it won't be that way forever, as the summer proceeds.

--

more later... on the VIX

3pm update - moody skies into the close

US equities have seen a very significant reversal, from the earlier high of sp'2060, with a break of core support. With the loss of 2039, the door is wide open to at least the 2000/1990s in the coming days. The H/S formation scenario offers 1970/60s.. as many recognise.

sp'daily5b

VIX'daily3

Summary

... just look at the big spike on the daily equity candle... that bodes VERY bearish for the next few days.

Notable strength in the USD, +0.5% in the DXY 95s.. and now talk of an attempt to break >100 will grow.

Oil is -1%... and that is no doubt partly a result of the rallying USD.. on latest rate hike threat.

--

--

Whilst the Fed were issuing a threatening press release.. I chose something better...

Somewhat appropriate, moody skies.. to sum up this afternoon's swing lower.

--

Regardless of the exact close... we have broken support... with the equity bulls seeing yet another bounce fail.

back at the close.

sp'daily5b

VIX'daily3

Summary

... just look at the big spike on the daily equity candle... that bodes VERY bearish for the next few days.

Notable strength in the USD, +0.5% in the DXY 95s.. and now talk of an attempt to break >100 will grow.

Oil is -1%... and that is no doubt partly a result of the rallying USD.. on latest rate hike threat.

--

--

Whilst the Fed were issuing a threatening press release.. I chose something better...

Somewhat appropriate, moody skies.. to sum up this afternoon's swing lower.

--

Regardless of the exact close... we have broken support... with the equity bulls seeing yet another bounce fail.

back at the close.

2pm update - time for a press release from print central

US equities remain moderately higher, with the latest FOMC minutes due to be issued from Print central. With the market having seen a significant swing from 2039 to 2060, the threat will be of renewed weakness into the close. Eyes on the USD, metals/miners... and oil too!

sp'60min

sp'daily3

Summary

Seen on the bigger daily chart, current price action is nothing for the bull maniacs to be pleased about. We've been effectively stuck for two months.

Arguably, the only reason to buy/chase.. would be on a break >sp'2100, and that seems way out of range.

-

Interesting highlight on ZH of 'Northman trader'.. who has made it to clown finance TV. see HERE

Effectively, NT has an outlook identical to Oscar, yours truly... and a fair few others.

--

time for some air/sun... or I'll get twitchy... and I don't like that.

back at 3pm.

... BACK... at 2.28pm... and I see a BREAK of core support :)

sp'60min

sp'daily3

Summary

Seen on the bigger daily chart, current price action is nothing for the bull maniacs to be pleased about. We've been effectively stuck for two months.

Arguably, the only reason to buy/chase.. would be on a break >sp'2100, and that seems way out of range.

-

Interesting highlight on ZH of 'Northman trader'.. who has made it to clown finance TV. see HERE

Effectively, NT has an outlook identical to Oscar, yours truly... and a fair few others.

--

time for some air/sun... or I'll get twitchy... and I don't like that.

back at 3pm.

... BACK... at 2.28pm... and I see a BREAK of core support :)

1pm update - churn ahead of some fedspeak

US equities remain in chop mode.. ahead of the latest FOMC minutes (2pm). USD remains notably higher, +0.2% in the DXY 94.70s. An extra ramp into the late afternoon - to the DXY 95s, would likely spook the main market.. although financials would viably hold gains.

sp'60min

Summary

Little to add.... as we're set for another hour of churn.. before the algo-bots get to digest a press release from Print central.

Renewed weakness into the close looks probable (keeping in mind the bigger daily/weekly cycles) although breaking the earlier spike low from 2039.99 will not be easier. Far more viable tomorrow.

Best guess.. increasing renewed weakness in the closing 90mins of the day.

--

On CNBC, O'leary.. who is on the 'rate hike is back in play' train.

If sp'1970/60s.. I'd imagine he'll drop that outlook... much like the others will.

re: 'consumer data'... maybe he should go talk to the staff at TGT or WMT?

--

notably stuck.... BA, daily

A very fair representative for the broader market.. utterly stuck... with higher probability of sig' cooling, than a bullish breakout.

-

sp'60min

Summary

Little to add.... as we're set for another hour of churn.. before the algo-bots get to digest a press release from Print central.

Renewed weakness into the close looks probable (keeping in mind the bigger daily/weekly cycles) although breaking the earlier spike low from 2039.99 will not be easier. Far more viable tomorrow.

Best guess.. increasing renewed weakness in the closing 90mins of the day.

--

On CNBC, O'leary.. who is on the 'rate hike is back in play' train.

If sp'1970/60s.. I'd imagine he'll drop that outlook... much like the others will.

re: 'consumer data'... maybe he should go talk to the staff at TGT or WMT?

--

notably stuck.... BA, daily

A very fair representative for the broader market.. utterly stuck... with higher probability of sig' cooling, than a bullish breakout.

-

12pm update - moderate chop

US equities remain moderately choppy, leaning higher into the afternoon. The FOMC minutes (2pm), will offer an excuse for cooling into the close, as some are (wrongly) seeing a threat of a rate hike in June.. which of course will not happen due to the subsequent BREXIT vote a mere 8 days later.

sp'60min

VIX'60min

Summary

Not much to add.

Equities really shouldn't go much higher... and in the scheme of things.. price action is still pretty subdued. Things only get dynamic on a break <2039... or above the big 2100 threshold.

All bears need to do is contain things under short term declining trend.. which at the close of today will be 2063.

--

notable strength, financials... BAC, daily

.. as the bizarre talk of a rate hike inspires some upside... but is entirely unsustainable.

A break above the recent high of $15.30 (where the 200dma is lurking) seems highly unlikely, and instead.. the psy' level of $10.00 remains a basic target for the summer.

--

time for tea.

sp'60min

VIX'60min

Summary

Not much to add.

Equities really shouldn't go much higher... and in the scheme of things.. price action is still pretty subdued. Things only get dynamic on a break <2039... or above the big 2100 threshold.

All bears need to do is contain things under short term declining trend.. which at the close of today will be 2063.

--

notable strength, financials... BAC, daily

.. as the bizarre talk of a rate hike inspires some upside... but is entirely unsustainable.

A break above the recent high of $15.30 (where the 200dma is lurking) seems highly unlikely, and instead.. the psy' level of $10.00 remains a basic target for the summer.

--

time for tea.

11am update - watch the swings

US equities have swung from an opening low of sp'2039 to 2054. Clearly, there are still many out there who are holding to the view that the market is set for a major bullish breakout. Even more amusing though is the upward swing in mainstream chatter that rates can be hiked at the next FOMC of June 15th.

sp'60min

VIX'60min

Summary

*opening reversal candle for equities, with an opening black-fail for the VIX.

--

No doubt a morning bounce has spooked some of the bears.. and given renewed confidence to the bulls that 'everything is just fine'.

Yet.. any look at the bigger daily/weekly cycles makes it crystal clear... we're firmly stuck... with price momentum swinging back to the bears.

A break lower remains due.

--

Meanwhile, on clown finance TV, head cheerleader Sara Eisen...

It is utterly bizarre how the clowns are now touting a viable rate hike in June. When the market swings a mere 2-4% lower in the near term.. these same maniacs will be talking about how a rate hike is now 'off the table'.

Now that IS data dependency.

--

time for an early lunch

sp'60min

VIX'60min

Summary

*opening reversal candle for equities, with an opening black-fail for the VIX.

--

No doubt a morning bounce has spooked some of the bears.. and given renewed confidence to the bulls that 'everything is just fine'.

Yet.. any look at the bigger daily/weekly cycles makes it crystal clear... we're firmly stuck... with price momentum swinging back to the bears.

A break lower remains due.

--

Meanwhile, on clown finance TV, head cheerleader Sara Eisen...

It is utterly bizarre how the clowns are now touting a viable rate hike in June. When the market swings a mere 2-4% lower in the near term.. these same maniacs will be talking about how a rate hike is now 'off the table'.

Now that IS data dependency.

--

time for an early lunch

10am update - opening weakness

US equities open a little lower, but notably holding above the key low of sp'2039. Despite the initial chop, a break <2039 remains imminent, and that should then spiral to 2000/1990s within days. The only issue is whether a valid H/S scenario plays out.. which would instead offer a more dynamic decline to 1970/60s.

sp'daily5b

VIX, daily3

Summary

A fair bit of minor chop... but we're clearly still leaning weak.

Daily MACD (blue bar histogram) equity cycle is ticking lower, and we should see increasing downside pressure for the rest of this week.

Similarly, VIX - which has been broadly stuck in the mid/low teens since early March.. is close to starting an upside surge.

-

notable strength, TSLA, daily

As GS tout $250.. but that seems ludicrous, even more so, as Goldman themselves tout stocks to be broadly weak for the next 12mths.

--

*awaiting the oil report at 10.30am....

10.32am.. Net inventory gain, 1.3 million barrels....

Oil remains a little weak, -0.5%.. but still at the bizarrely high level of the $48/49s.

sp'daily5b

VIX, daily3

Summary

A fair bit of minor chop... but we're clearly still leaning weak.

Daily MACD (blue bar histogram) equity cycle is ticking lower, and we should see increasing downside pressure for the rest of this week.

Similarly, VIX - which has been broadly stuck in the mid/low teens since early March.. is close to starting an upside surge.

-

notable strength, TSLA, daily

As GS tout $250.. but that seems ludicrous, even more so, as Goldman themselves tout stocks to be broadly weak for the next 12mths.

--

*awaiting the oil report at 10.30am....

10.32am.. Net inventory gain, 1.3 million barrels....

Oil remains a little weak, -0.5%.. but still at the bizarrely high level of the $48/49s.

Pre-Market Brief

Good morning. US equity futures are a little lower, sp -3pts, we're set to open around 2044. USD is +0.2% in the DXY 94.70s. Metals are under pressure, Gold -$6, with Silver -1.3%. Oil is -0.6% in the $48s, ahead of the EIA report.

sp'60min

Summary

So.... Monday saw sig' gains, largely negated yesterday.

Cyclically, a minor bounce this morning would not exactly be that surprising.

Broadly though, we're due to break <2039.. .and that will open up a move to 2000/1990... or the H/S target of 1967.

Daily/weekly cycles are both suggestive of increasing weakness for the rest of the week, although the fact opex is this Friday complicates things.

--

Doomer chat, Hunter with Kirby

I sure don't agree with all of it... but its still kinda interesting.

--

Overnight action

Japan: mild chop, settling -0.1% @ 16644

China: broad weakness, -1.3% @ 2807

Germany; currently a little weak, -0.3% @ 9861

Have a good Wednesday

-

8.45am.... sp -6pts... 2041.... things are indeed borderline.

As ever.... metals will be liable for a rebound... if market upset.

sp'60min

Summary

So.... Monday saw sig' gains, largely negated yesterday.

Cyclically, a minor bounce this morning would not exactly be that surprising.

Broadly though, we're due to break <2039.. .and that will open up a move to 2000/1990... or the H/S target of 1967.

Daily/weekly cycles are both suggestive of increasing weakness for the rest of the week, although the fact opex is this Friday complicates things.

--

Doomer chat, Hunter with Kirby

I sure don't agree with all of it... but its still kinda interesting.

--

Overnight action

Japan: mild chop, settling -0.1% @ 16644

China: broad weakness, -1.3% @ 2807

Germany; currently a little weak, -0.3% @ 9861

Have a good Wednesday

-

8.45am.... sp -6pts... 2041.... things are indeed borderline.

As ever.... metals will be liable for a rebound... if market upset.

Eyes on the bigger weekly cycles

Equity price action has been broadly messy for the better part of two months. Price structure in the bigger weekly cycles is looking much the same as last Nov/December. An eventual big break lower remains due... with a viable monthly close under sp'2K.

sp'weekly1b

sp'weekly1c - time fibs

Summary

A fourth consecutive net weekly decline is now on the menu. In theory.. a weekly close around the giant psy' level of 2K would be a rather appropriate target for this Friday's opex close.

re: weekly1c. Time fibs are semi-kooky stuff, and its something I occasionally look at.

For those that have never used them.. you just start from a given date - in this case, the May'2015 high of sp'2134, and the various key fibs (see numbers at base of chart, 1, 2, 3, 5, 8, 13.. etc) offer potential key turns/moves.

The next time-fib turn lines up well with a VIX weekly MACD cycle that is set for a bullish cross by end May.

--

Market chatter from the Schiff

--

Looking ahead

Wed' will see the latest EIA report, and the FOMC minutes (2pm).

--

Goodnight from London

sp'weekly1b

sp'weekly1c - time fibs

Summary

A fourth consecutive net weekly decline is now on the menu. In theory.. a weekly close around the giant psy' level of 2K would be a rather appropriate target for this Friday's opex close.

re: weekly1c. Time fibs are semi-kooky stuff, and its something I occasionally look at.

For those that have never used them.. you just start from a given date - in this case, the May'2015 high of sp'2134, and the various key fibs (see numbers at base of chart, 1, 2, 3, 5, 8, 13.. etc) offer potential key turns/moves.

The next time-fib turn lines up well with a VIX weekly MACD cycle that is set for a bullish cross by end May.

--

Market chatter from the Schiff

--

Looking ahead

Wed' will see the latest EIA report, and the FOMC minutes (2pm).

--

Goodnight from London

Daily Index Cycle update

US equities closed broadly lower, sp -19pts @ 2047. The two leaders -

Trans/R2K, settled +0.6% and -1.6% respectively. Near term outlook

offers a primary target of 2000/1990s.. with an equally valid H/S

scenario target of the 1970/60s.

sp'daily5b

Dow

Summary

Suffice to add... the Monday gains were largely negated by today's net daily declines.

Many indexes are offering a valid H/S scenario. By default, that offers a further 4% or so lower.. and that could be achieved within just 3-5 trading days.

--

a little more later...

sp'daily5b

Dow

Summary

Suffice to add... the Monday gains were largely negated by today's net daily declines.

Many indexes are offering a valid H/S scenario. By default, that offers a further 4% or so lower.. and that could be achieved within just 3-5 trading days.

--

a little more later...

Subscribe to:

Comments (Atom)