It was a very bearish week for US equity indexes,

with net weekly declines ranging from -4.4%

(Dow), -4.3% (Nasdaq comp'), -3.8% (sp'500), -2.9% (NYSE comp'), -2.5% (R2K), to

-2.0% (Trans).

Lets take our regular look at six of the main US indexes

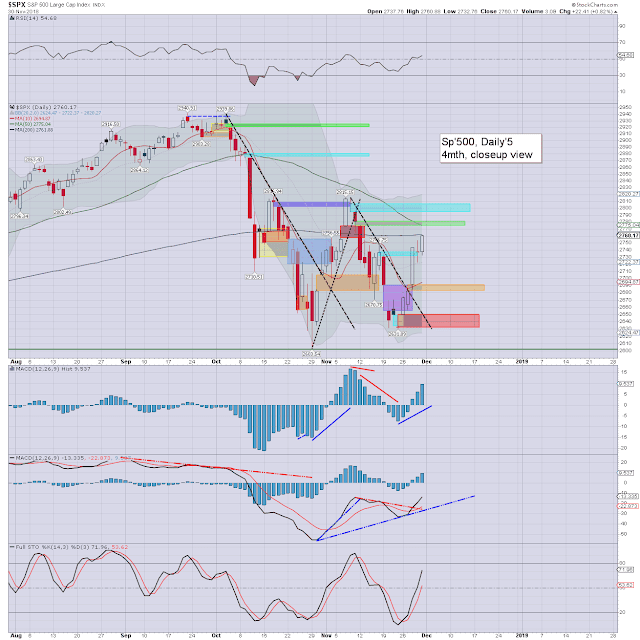

sp'500

The sp'500 fell for the 6th week of 9, settling -3.8% to 2632. The Oct' low of 2603 will likely fail to hold, and that will offer a challenge of the Feb' low of 2532... another 3.8% lower.

Nasdaq comp'

The Nasdaq declined for the 6th week of 8, settling -4.3% to 6938. Next support is the Feb' low of 6630, which is clearly viable within the immediate term. The bulls can't get confident again until >7600, and that does not look probable in the remainder of this year.

Dow

The mighty Dow is leading the broader market lower, settling -1127pts (4.4%) to 24285. The weekly candle is ugly, and leans to further weakness into end month/early December. Support at the April low of 23344, and then its technically empty air to giant psy' 20K.

NYSE comp'

The master index settled -2.9% to 12036... notably just below key price threshold. Next support (via monthly charts) are the 11400s.

R2K

The R2k fell for the 9th week of 12, settling -2.5% to 1488. Whilst it could be argued the weekly candle is a little spiky on the lower side, there really isn't much support until the Feb' low of 1436, a mere 52pts (3.5%) lower.

Trans

The 'old leader' - Transports was once again resilient against the main market (due to ongoing WTIC/fuel downside), but still settling sig' lower, -2.0% to 10369. Its notable that this index/sector has already broken below the Feb' lows.

–

Summary

All six of the main US equity indexes settled significantly lower.

The Dow and Nasdaq are leading the way downward, whilst the Transports remain relatively resilient.

YTD price performance:

Only the Nasdaq remains net higher for the year, and by just 0.5%. The spx -1.5%, with the Dow -1.7%. The Transports are -2.3%, the R2K -3.0%, with the NYSE comp' -6.0%.

--

Looking ahead

The weekend of Nov'24/25 will see all manner of BREXIT related discussions and votes, which will have significant bearing on how the week opens.

More broadly, the market will be focused on the G20, which is being hosted in Argentina. The event begins Nov'26th, with the 'Leaders summit' spanning Nov'30th>Dec'1st.

For details:

https://www.g20.org/en/calendar

M -

T - Case-Shiller HPI, consumer con'.

W - GDP Q3 (2nd' print), intl' trade, new home sales, EIA Pet' report, FOMC mins. Powell is speaking at the economic club in NYC. That might garner live coverage.

T - Weekly jobs, pers' income/outlays, pending home sales

F - Chicago PMI

--

If you value my work on Blogger and Twitter, subscribe to me.

For details:

https://permabeardoomster.blogspot.co.uk/p/subscriptions.html

Have a good weekend

--

*the next post on this page will likely appear 5pm EST on Monday.