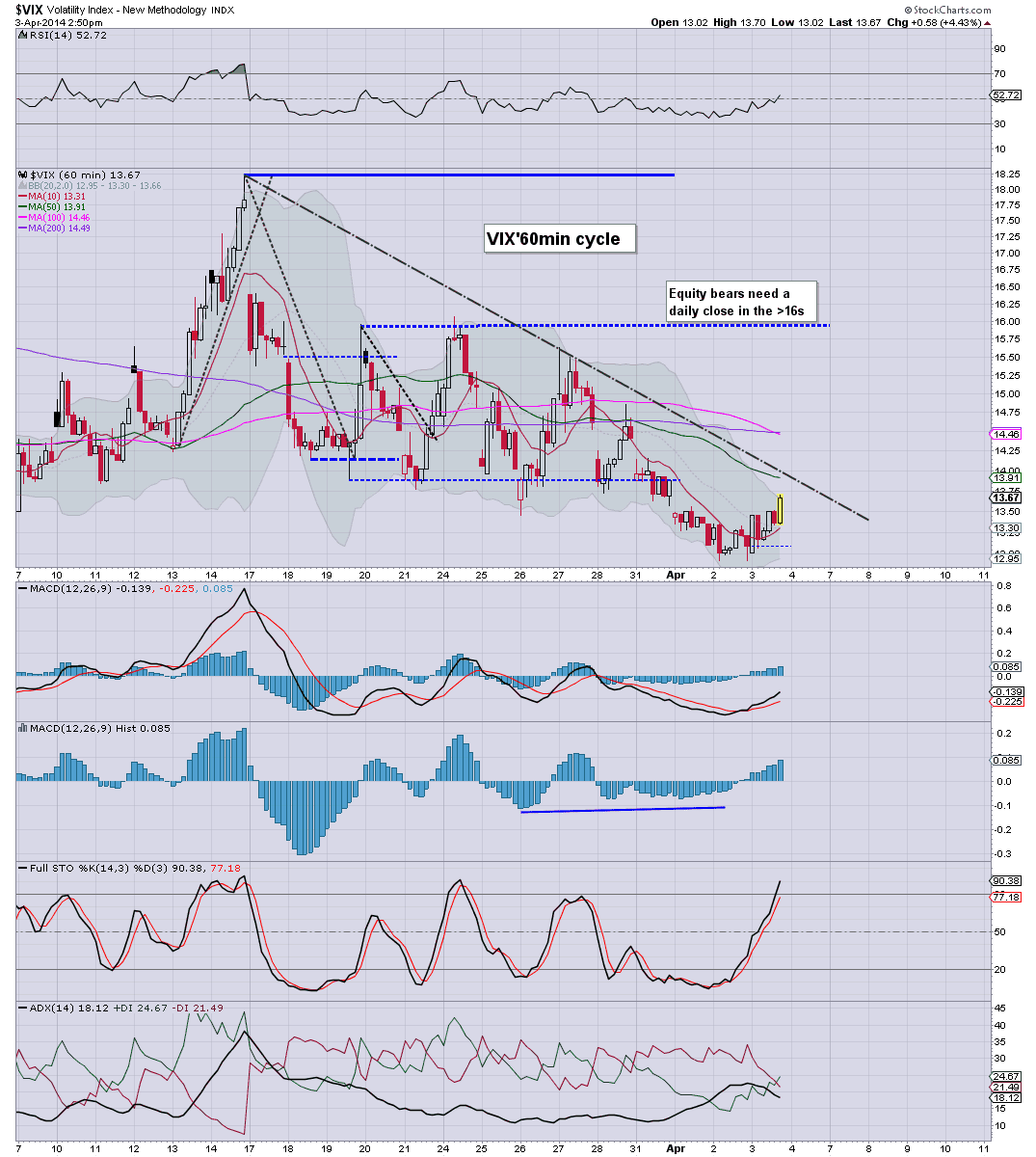

With US indexes turning moderately lower into the afternoon, the VIX turned positive, and achieved its first daily gain in six trading days. The VIX settled +2.1% @ 13.37. Near term outlook offers a VIX in the 14s, before remaining low across much of April/early May.

VIX'60min

VIX'daily3

Summary

Little to add.

VIX remains low, and the big 20 threshold looks unlikely to be hit for at least 6-8 weeks.

It remains the case that the VIX spikes are just getting generally lower and lower, since the giant equity wave began Oct'2011.

The notion of the VIX 30s right now..looks almost inconceivable. After all, neither Syrian or Ukrainian 'issues' never rattled the market enough to break and hold the 20s for more than a day or so.

--

more later, on the indexes

Thursday, 3 April 2014

Closing Brief

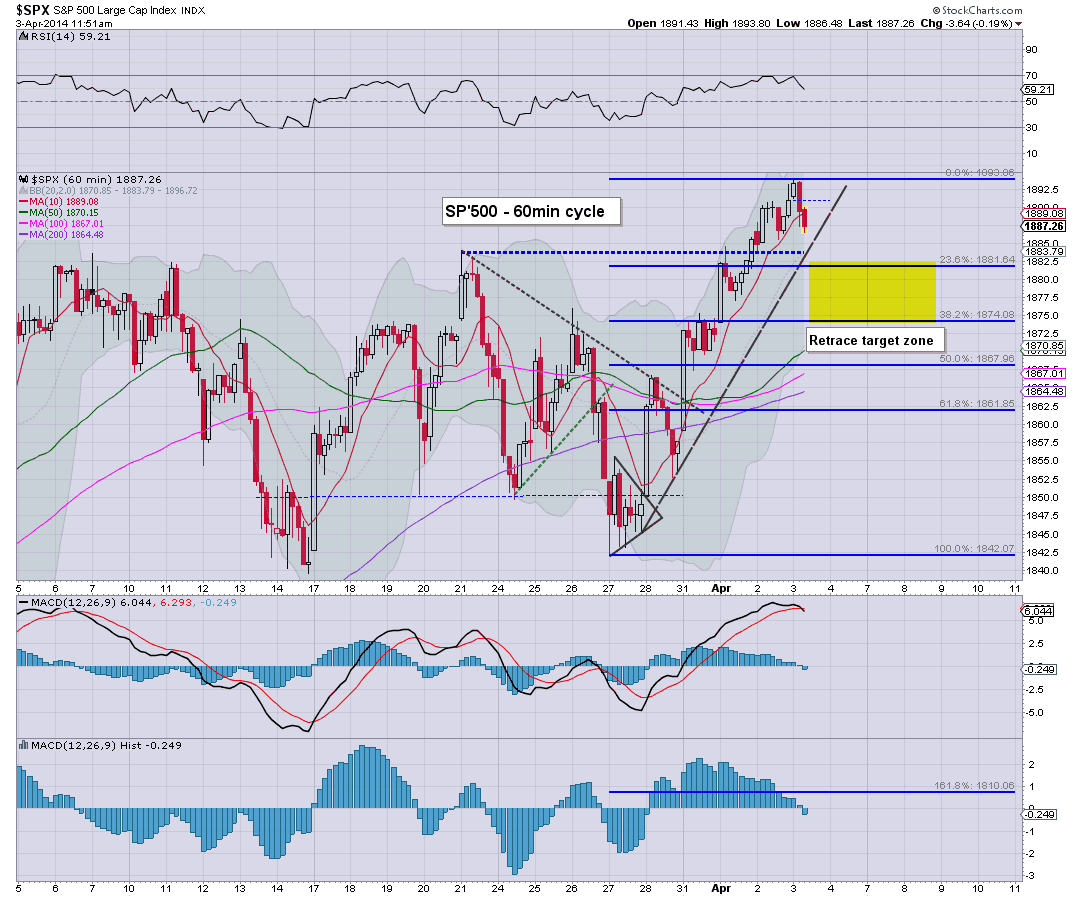

US indexes closed moderately lower, having broken another set of new historic highs in early morning, sp -2pts @ 1888. The two leaders - Trans/R2K, settled -0.2% and -1.0% respectively. Near term outlook offers minor weakness for Friday morning, before a latter day rally into the weekend.

sp'60min

Summary

*a closing hour of minor chop, but this is surely just a part of a little retracement.

--

The weakness in the R2K is...curious, and it remains a fair way from breaking a new high. However, the R2K/Nasdaq were very bearish last week, and we saw how that turned out.

VIX settling higher by 2-3%, not much, but it is the first daily gain in six days.

-

more later..on the VIX

sp'60min

Summary

*a closing hour of minor chop, but this is surely just a part of a little retracement.

--

The weakness in the R2K is...curious, and it remains a fair way from breaking a new high. However, the R2K/Nasdaq were very bearish last week, and we saw how that turned out.

VIX settling higher by 2-3%, not much, but it is the first daily gain in six days.

-

more later..on the VIX

3pm update - retracing into the close

Equities have seen a moderate swing to the downside from the morning peak of sp'1893, so far to 1882. There is downside to 1880/75 in the immediate term, which should equate to VIX in the 14s. The momo stocks are again broken, the third time in 8 trading days.

sp'60min

vix'60min

Summary

It is kinda interesting, and I can only hope that many of the doomer bears don't get overly excited about what is surely just a minor retracement.

With new historic highs in the Dow, sp'500, NYSE Comp', and the Transports, the default trade is unquestionably to the upside.

The weekly/monthly trends are bullish, and the weekly is offering the 1900s next week.

-

updates into the close, if I can clear the sand from my eyes

3.05pm.. Hourly lower bol' 1878..and it won't be easy to hold under that for very long.

I still have the hunch that we'll trundle into the 1870s tomorrow..at which point I might get involved.

Momo stocks remain weak..FB/TWTR, both -5% or so.

3.20pm. . minor chop in the mid 1880s....it still looks like a brief foray into the 1870s early tomorrow, before a weekly close in the 1880s.

Notable strength: Oil, with USO +0.95%.

3.32pm... sp'1888, hmm, I'd be real surprised if we close flat..or higher. The momo stocks are pretty indicative at least some weakness in the broader market.

Oh well, I remain on the sidelines, will see how the market reacts to the jobs data.

I will consider a long in the 1870s...with a stop somewhere in the 1850/40s, depends on the price action tomorrow.

DRYS -1.5%, and looks like it will slip into the $2s this summer...which is pretty lousy, considering the current indexes!

3.47pm.. Another stock... AMZN -2.6% @ $333, which is 15% lower than just 3/4 weeks ago.

Dow turns green......no doubt the cheer leaders on clown finance TV will be waving flags..where is Pisani? Wrapped up in HFT cables?

sp'60min

vix'60min

Summary

It is kinda interesting, and I can only hope that many of the doomer bears don't get overly excited about what is surely just a minor retracement.

With new historic highs in the Dow, sp'500, NYSE Comp', and the Transports, the default trade is unquestionably to the upside.

The weekly/monthly trends are bullish, and the weekly is offering the 1900s next week.

-

updates into the close, if I can clear the sand from my eyes

3.05pm.. Hourly lower bol' 1878..and it won't be easy to hold under that for very long.

I still have the hunch that we'll trundle into the 1870s tomorrow..at which point I might get involved.

Momo stocks remain weak..FB/TWTR, both -5% or so.

3.20pm. . minor chop in the mid 1880s....it still looks like a brief foray into the 1870s early tomorrow, before a weekly close in the 1880s.

Notable strength: Oil, with USO +0.95%.

3.32pm... sp'1888, hmm, I'd be real surprised if we close flat..or higher. The momo stocks are pretty indicative at least some weakness in the broader market.

Oh well, I remain on the sidelines, will see how the market reacts to the jobs data.

I will consider a long in the 1870s...with a stop somewhere in the 1850/40s, depends on the price action tomorrow.

DRYS -1.5%, and looks like it will slip into the $2s this summer...which is pretty lousy, considering the current indexes!

3.47pm.. Another stock... AMZN -2.6% @ $333, which is 15% lower than just 3/4 weeks ago.

Dow turns green......no doubt the cheer leaders on clown finance TV will be waving flags..where is Pisani? Wrapped up in HFT cables?

2pm update - B wave bounce?

US indexes see a micro bounce from sp'1884 to 89, which could easily be a small B wave of a minor retracement. Downside target zone remains 1880/75, which seems viable by 11am Friday. Metals remain weak, Gold -$4.

sp'60min

Summary

We've bounced on what is rising soft support, I'd look for that to get busted late today/early tomorrow.

Regardless, I'd be much more content to go long the indexes...after the jobs data is out of the way.

--

*notable weakness in most of the momo stocks...

TWTR, daily

An ugly stock as I've been highlighting lately. Obvious target remains 40/38.

-

2.42pm.. sp'1882...so...an 11pt swing..so far. next support is 1880.

sp'60min

Summary

We've bounced on what is rising soft support, I'd look for that to get busted late today/early tomorrow.

Regardless, I'd be much more content to go long the indexes...after the jobs data is out of the way.

--

*notable weakness in most of the momo stocks...

TWTR, daily

An ugly stock as I've been highlighting lately. Obvious target remains 40/38.

-

2.42pm.. sp'1882...so...an 11pt swing..so far. next support is 1880.

1pm update - sandy retracement

Whilst the Saharan sand consumes the city of London, the US indexes continue to slip, in what is probably now half of a retracement. Downside target zone by early Friday remains sp'1880/75, from there, a Friday close in the 1890s still looks likely.

sp'60min

Summary

So far then, a swing from 1893 to 1885, and we're sitting on what is soft rising support. I don't expect that to hold.

I could just about stomach going long the indexes (probably via ETF of SSO), somewhere in the 1870s...although I'd prefer to wait until the jobs data is out of the way.

--

*As for the sand.....take a look...

I'm not sure what is worse, seeing the market on the edge of the sp'1900s, or breathing in part of the Sahara desert.

sp'60min

Summary

So far then, a swing from 1893 to 1885, and we're sitting on what is soft rising support. I don't expect that to hold.

I could just about stomach going long the indexes (probably via ETF of SSO), somewhere in the 1870s...although I'd prefer to wait until the jobs data is out of the way.

--

*As for the sand.....take a look...

I'm not sure what is worse, seeing the market on the edge of the sp'1900s, or breathing in part of the Sahara desert.

12pm update - minor weakness

US indexes have slipped a little lower, after another set of new historic highs. Retracement target zone is sp'1880/75. The 1860s look out of range, even if the monthly jobs number comes in <150k tomorrow. VIX remains crushed, and at best..perhaps the mid 14s.

sp'60min

Summary

*for those who use it, yes, stockcharts is having some 'issues' right now, but I did manage to grab the above chart.

--

I remain on the sidelines, would feel more comfortable going long AFTER the jobs data is released..preferably around the typical morning turn of 11am.

So for now.....I'm waiting.

--

VIX update from Mr T

--

time for tea..and other things.

12.35pm.. sp'1886.... the more I look at this..the more 1875 looks a very natural target for early tomorrow.

sp'60min

Summary

*for those who use it, yes, stockcharts is having some 'issues' right now, but I did manage to grab the above chart.

--

I remain on the sidelines, would feel more comfortable going long AFTER the jobs data is released..preferably around the typical morning turn of 11am.

So for now.....I'm waiting.

--

VIX update from Mr T

--

time for tea..and other things.

12.35pm.. sp'1886.... the more I look at this..the more 1875 looks a very natural target for early tomorrow.

11am update - retracement ?

Equities flip marginally negative, and there remains an arguably overdue retracement. Primary retrace target zone is now 1880/75, with a VIX that should see a small spike into the 14s. Metals remain weak, Gold -$4, and this is not helping the miners, GDX -1.4%

sp'60min

Summary

An interesting hourly candle, but then..we saw much the same yesterday in the 1pm hour..and see how they turned out.

-

As things are, I'm only interesting in going long, if 1880/75, if this nonsense doesn't fall at least for a few hours, I ain't interested.

*notable strength: GOOG, +2.8%, having seen an effective 2 for 1 stock split.

11.41am.. Well, its a break of the hourly 10MA...I guess its a start.

Seeking 1880/75...no later than early tomorrow.

sp'60min

Summary

An interesting hourly candle, but then..we saw much the same yesterday in the 1pm hour..and see how they turned out.

-

As things are, I'm only interesting in going long, if 1880/75, if this nonsense doesn't fall at least for a few hours, I ain't interested.

*notable strength: GOOG, +2.8%, having seen an effective 2 for 1 stock split.

11.41am.. Well, its a break of the hourly 10MA...I guess its a start.

Seeking 1880/75...no later than early tomorrow.

10am update - opening minor gains

For the tenth day running (I think), the market opens to the upside. The Dow has finally broken above the Dec'31st high of 16588, and the 17000s look likely in May. Metals are moderately lower, Gold -$5. Despite the index gains, VIX is a little higher, but still..in the low 13s.

sp'daily5

Dow, weekly

Summary

*the bigger weekly chart should be a sobering image for the bears. Despite getting stuck in the 16500s,

--

So..Dow 16600s, and really, no one should be in doubt now at the recent break higher.

If we do get a retrace, I might jump aboard, otherwise, I'm content to sit on the sidelines, and at least not get nailed on the short side.

-

Notable weakness: TWTR, -1.4%, looking headed for 40/38

10.28am.. ohh the humanity, the sp' might lose the 1890s! VIX turns green

sp'daily5

Dow, weekly

Summary

*the bigger weekly chart should be a sobering image for the bears. Despite getting stuck in the 16500s,

--

So..Dow 16600s, and really, no one should be in doubt now at the recent break higher.

If we do get a retrace, I might jump aboard, otherwise, I'm content to sit on the sidelines, and at least not get nailed on the short side.

-

Notable weakness: TWTR, -1.4%, looking headed for 40/38

10.28am.. ohh the humanity, the sp' might lose the 1890s! VIX turns green

Pre-Market Brief

Good morning. Futures are a touch lower, sp -1pt, we're set to open around 1889. Metals are weak, Gold -$7, with Silver -0.7%. Having rallied from 1842 to 93, a minor retrace - back to the 1875/65 zone, remains a valid possibility, before the 1900s.

sp'60min

Summary

With new historic highs in the sp' and Transports, any hope of <1840 should have been thrown out Tue/Wednesday.

Yes, a minor retracement is possible, but that is all it will surely be.

For those wanting to jump aboard the long train, the train might briefly stop later today/early tomorrow.

--

Naturally, Mr Permabull..is bullish

-

Good wishes for Thursday trading.

sp'60min

Summary

With new historic highs in the sp' and Transports, any hope of <1840 should have been thrown out Tue/Wednesday.

Yes, a minor retracement is possible, but that is all it will surely be.

For those wanting to jump aboard the long train, the train might briefly stop later today/early tomorrow.

--

Naturally, Mr Permabull..is bullish

-

Good wishes for Thursday trading.

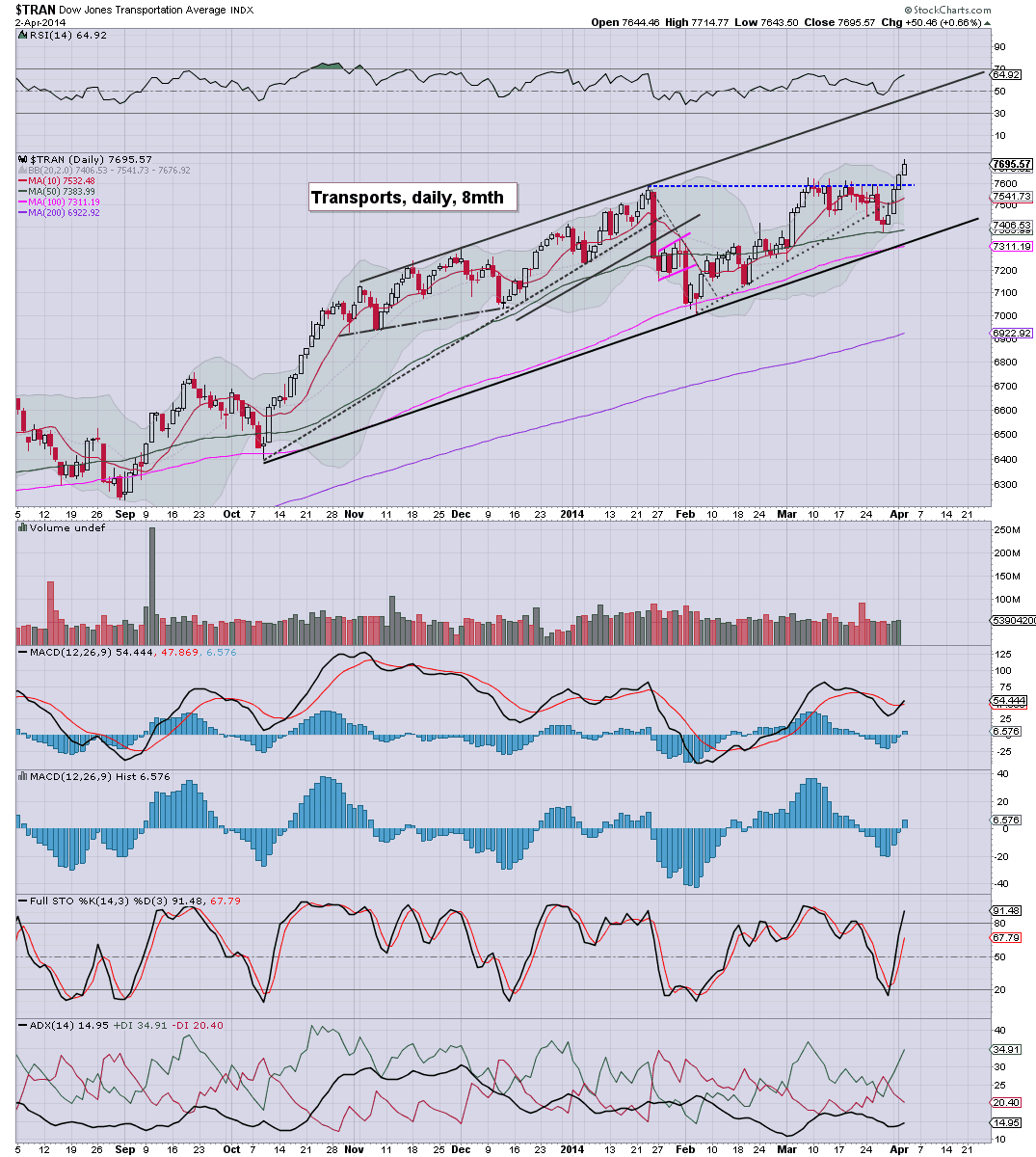

Transports is leading the way

The Transports broke a new historic high for the second consecutive day, with an intraday peak of 7714. Since the October 2011 low (Trans' 3950), the Transports has rallied an extraordinary 95%. The big 8000 level looks viable as early as mid/late May.

Trans, monthly

Trans, weekly

Summary

So, the 'old leader' has almost doubled, in what is now month 31 of the giant wave from Oct'2011. A truly incredible climb, and that is despite having churned sideways across all of 2012 in the low 5000s.

As many recognise, the modern economy is reflected most clearly by the strength..or weakness, of the transportation sector. One aspect helping the Trans sector stocks are the somewhat subdued oil prices (if you can consider $90/100 Oil as relatively low).

I did note last year that by late 2015/early 2016 (which remains my target peak of this economic cycle), that perhaps the Trans' will break the giant 10000 threshold. That would be a gain of over 350% since the March 2009 low of 2134.

Looking ahead

We have the usual weekly jobs data, PMI and ISM service sector reports.

*next sig' Qe-pomo is not until next Thursday.

-

Gods help the market now

With the break to new highs, yours truly is considering going long the main indexes within the next few trading days. Is this the ultimate sign of permabear capitulation, or the best contrarian 'SELL' signal out there?

Regardless, if I do go long, the long-stop for me would be no lower than the rising weekly 10MA, currently around sp'1844.

Goodnight from London

Trans, monthly

Trans, weekly

Summary

So, the 'old leader' has almost doubled, in what is now month 31 of the giant wave from Oct'2011. A truly incredible climb, and that is despite having churned sideways across all of 2012 in the low 5000s.

As many recognise, the modern economy is reflected most clearly by the strength..or weakness, of the transportation sector. One aspect helping the Trans sector stocks are the somewhat subdued oil prices (if you can consider $90/100 Oil as relatively low).

I did note last year that by late 2015/early 2016 (which remains my target peak of this economic cycle), that perhaps the Trans' will break the giant 10000 threshold. That would be a gain of over 350% since the March 2009 low of 2134.

Looking ahead

We have the usual weekly jobs data, PMI and ISM service sector reports.

*next sig' Qe-pomo is not until next Thursday.

-

Gods help the market now

With the break to new highs, yours truly is considering going long the main indexes within the next few trading days. Is this the ultimate sign of permabear capitulation, or the best contrarian 'SELL' signal out there?

Regardless, if I do go long, the long-stop for me would be no lower than the rising weekly 10MA, currently around sp'1844.

Goodnight from London

Daily Index Cycle update

US indexes closed with some notable strength, sp +5pts @ 1890, having broken a new historic high of 1893.17. The two leaders - Trans/R2K, settled higher by 0.7% and 0.3% respectively. Near term outlook is offering a minor retrace to the sp'1875/65 zone.

sp'daily5

R2K

Trans

Summary

In many ways, the Transports - old leader, is indeed leading the way, and with the break into the 7700s this morning, the obvious question now is 'when are the 8000s' going to be hit?

The big 8k psy' level will be difficult to hit, but the break has been achieved, and the trend is very much to the upside.

The Dow is yet to break the Dec'31st high of 16588.25 - it came within 0.06pts this afternoon. There is little doubt now that the Dow will push into the 17000s by mid/late May.

-

a little more later...

sp'daily5

R2K

Trans

Summary

In many ways, the Transports - old leader, is indeed leading the way, and with the break into the 7700s this morning, the obvious question now is 'when are the 8000s' going to be hit?

The big 8k psy' level will be difficult to hit, but the break has been achieved, and the trend is very much to the upside.

The Dow is yet to break the Dec'31st high of 16588.25 - it came within 0.06pts this afternoon. There is little doubt now that the Dow will push into the 17000s by mid/late May.

-

a little more later...

Subscribe to:

Comments (Atom)