With the indexes closing higher, the VIX slipped again, closing lower by 2.9%, to settle @ 15.06. On any basis we're surely close to seeing a multi-day up cycle in the VIX, and there will then again be the issue of whether we can see a break through the concrete wall that is the VIX 20 threshold

VIX'60min

VIX'daily

Summary

At some point we're going to see some really large up moves in the VIX. It might be next week, but it might not be until next year. It really is difficult to say.

What is clear though, the VIX is at a VERY low level, and thus options (especially front month, and out to Jan/Feb) are relatively cheap.

If there is a 'surprise' upset - especially if its related to lack of resolution of the fiscal cliff, then the VIX is going to see a number of 20, even 30% up days. Although as noted a few times recently, even a 30% VIX move wouldn't quite get us to VIX 20!

More later...on the indexes.

Thursday, 29 November 2012

Closing Brief

The market again closed higher, although a little below the morning highs. The weakness in the closing hour was nothing significant, but everything is now set up for the next down cycle across Friday, and into early next week.

Dow'60min

Sp'60min

Trans'60min

Summary

Despite the choppy closing hour, everything is set up for some degree of down cycle tomorrow, and that may last into early next week.

What is critical to realise is that a break of the sp'1400 level would break the current up trend from the sp'1343 low.

All those bears who have been shorting today - and indeed across the past few days, only need to see a move back <1400 for some major downside action to occur.

--

So, I will hold short into tomorrow, and look to be short across (at least) the first half of December. As ever though, there will up cycles to avoid, regardless of whether I'm right about the broader (much anticipated) down trend.

The usual bits and pieces across the evening.

Dow'60min

Sp'60min

Trans'60min

Summary

Despite the choppy closing hour, everything is set up for some degree of down cycle tomorrow, and that may last into early next week.

What is critical to realise is that a break of the sp'1400 level would break the current up trend from the sp'1343 low.

All those bears who have been shorting today - and indeed across the past few days, only need to see a move back <1400 for some major downside action to occur.

--

So, I will hold short into tomorrow, and look to be short across (at least) the first half of December. As ever though, there will up cycles to avoid, regardless of whether I'm right about the broader (much anticipated) down trend.

The usual bits and pieces across the evening.

3pm update - closing hour weakness?

It still looks like we're in a levelling out phase, as best seen on the hourly index charts. So long as we don't break new highs >1420 in the closing hour, bears who were shorting into today's rally should be okay.

sp'60min

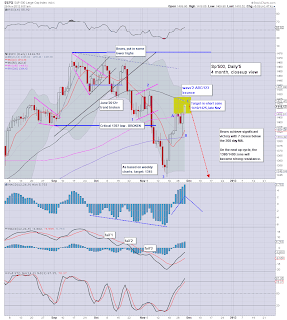

sp'daily5

Summary

It will always be a tricky market, and we could still break to new highs by the close, but on balance, I'm guessing no.

The hourly MACD (blue bar histogram) cycle is unquestionably on the upper side, and thus the next move should be to the downside.

*FB broke 27, so a lot of the 'big money' has just been stopped out, hence the rapid 4% rise in the last few hours. Still a lot of hysteria surrounds that company.

UPDATE 3.25pm Transports - which has been my 'clean wave' guide for the last few weeks, showing weakness, a snap lower into the close very possible. Bears have a real chance of a major gap lower at the Friday lower, where I'm seeking any weakness enhanced by PMI data at 9.45am.

Trans'60min

back after the close

sp'60min

sp'daily5

Summary

It will always be a tricky market, and we could still break to new highs by the close, but on balance, I'm guessing no.

The hourly MACD (blue bar histogram) cycle is unquestionably on the upper side, and thus the next move should be to the downside.

*FB broke 27, so a lot of the 'big money' has just been stopped out, hence the rapid 4% rise in the last few hours. Still a lot of hysteria surrounds that company.

UPDATE 3.25pm Transports - which has been my 'clean wave' guide for the last few weeks, showing weakness, a snap lower into the close very possible. Bears have a real chance of a major gap lower at the Friday lower, where I'm seeking any weakness enhanced by PMI data at 9.45am.

Trans'60min

back after the close

2pm update - afternoon chop

The market remains in a choppy phase after the earlier political chatter. It remains entirely possible that the wave'2 bounce is now complete, and we'll see some weakness into the close. The 50 MA @ 1423 will pose significant resistance, if we somehow see a short-stop cascade >1420

sp'60min

VIX'60min

Summary

So..we're hovering close to the early morning highs, where now?

Well, the bulls are no doubt seeking a close >1420, on hopes that the politicians will come to an agreement within short order.

The bears should be seeking a close within the next few days, back <1400.

VIX remains subdued, but so far, despite the index gains, its not broken below the Nov'21 lows.

With two hours to go, lets see who can take command into the close.

UPDATE 2.30pm Tranny is stuck under the morning spike high.

I'd really like to see things start to tick lower from these levels. If I'm wrong, I can live with it, but at least I'm short with VIX cycle low, and indexes on the upper side.

Trans'60min

Perhaps we're looking at some kind of micro double-top today.

sp'60min

VIX'60min

Summary

So..we're hovering close to the early morning highs, where now?

Well, the bulls are no doubt seeking a close >1420, on hopes that the politicians will come to an agreement within short order.

The bears should be seeking a close within the next few days, back <1400.

VIX remains subdued, but so far, despite the index gains, its not broken below the Nov'21 lows.

With two hours to go, lets see who can take command into the close.

UPDATE 2.30pm Tranny is stuck under the morning spike high.

I'd really like to see things start to tick lower from these levels. If I'm wrong, I can live with it, but at least I'm short with VIX cycle low, and indexes on the upper side.

Trans'60min

Perhaps we're looking at some kind of micro double-top today.

1pm update - What is best in life?

The market is getting moody, after the US politicians are again seen as nothing less than squabbling little children. A few more days of this, and the mainstream consensus may shift to realising no agreement will be made this side of Christmas. If that is the case, we'll be quickly back <1400.

sp'60min

sp'daily5

Summary

Bears need to break the rising hourly 10MA @ 1407/08.

A close of 1405/00 would be preferred, but so long as don't break >1420, I'm very content with how things have turned out.

I remain short, and seeking my first exit either tomorrow or Monday, somewhere around 1400, or under.

What would be best in life..a Monday collapse into the sp'1200s. I can dream, right?

back at 2pm

sp'daily5

Summary

Bears need to break the rising hourly 10MA @ 1407/08.

A close of 1405/00 would be preferred, but so long as don't break >1420, I'm very content with how things have turned out.

I remain short, and seeking my first exit either tomorrow or Monday, somewhere around 1400, or under.

What would be best in life..a Monday collapse into the sp'1200s. I can dream, right?

back at 2pm

12pm update - waiting for a rollover

The hourly cycles are very close to rolling over, and we might see strong confirmation by the close. Red indexes are viable in the late afternoon.

sp'60min

trans'60min

Summary

Kinda tired, its been a busy few days. Now its just a case of waiting.

*I am now also short the overhyped and overvalued FB from 26.50. Seeking $20 within 3-6 weeks.

time for lunch :)

--

UPDATE 12.30pm With the politicians talking again, Mr Market is all over the place.

updated 60min chart, with possible new down channel.

I'd like a close today 1405/00. I certainly don't want any breaks >1420, but I can sustain that..if necessary. I am pretty confident of the overall outlook. So long as we don't break and hold the 1440s, should be good.

What is important to recognise, a daily close <1400, would be significant, and probably confirm that wave'2 is complete.

sp'60min

trans'60min

Summary

Kinda tired, its been a busy few days. Now its just a case of waiting.

*I am now also short the overhyped and overvalued FB from 26.50. Seeking $20 within 3-6 weeks.

time for lunch :)

--

UPDATE 12.30pm With the politicians talking again, Mr Market is all over the place.

updated 60min chart, with possible new down channel.

I'd like a close today 1405/00. I certainly don't want any breaks >1420, but I can sustain that..if necessary. I am pretty confident of the overall outlook. So long as we don't break and hold the 1440s, should be good.

What is important to recognise, a daily close <1400, would be significant, and probably confirm that wave'2 is complete.

11am update - Punch it!

Mr Market has seen a reaction from the opening rally around sp'1420. This is just two points shy of the important 50 day MA, and 5pts below my original target. There are divergences on a lot of the hourly charts, and I'm looking for a confirmed rollover as the day proceeds. We could very easily close red.

sp'60min

sp'daily5

Summary

Well, I've made my move, its a significant move, and now I sit back for a few days, lets see what happens.

My first target exit is <1400 by early Monday.

--

UPDATE 11.20am Tranny sure looks like its toppy, with a possible castle top (as I like to call it) 5100 was my prime target, so thats good to see.

A rollover 'should' be seen on the MACD within the next hour or two. Then its just a case of how far we fall into early Monday.

sp'60min

sp'daily5

Summary

Well, I've made my move, its a significant move, and now I sit back for a few days, lets see what happens.

My first target exit is <1400 by early Monday.

--

UPDATE 11.20am Tranny sure looks like its toppy, with a possible castle top (as I like to call it) 5100 was my prime target, so thats good to see.

A rollover 'should' be seen on the MACD within the next hour or two. Then its just a case of how far we fall into early Monday.

10am update - almost there

The market is comfortably holding on to opening gains, and is very close to hitting my sp'1425 target. It could easily get stuck around the 50 day MA @ 1422. I would imagine the market will get stuck...imminently in the 10-11am hour.

sp'60min

sp'daily5

Summary

Well, I been waiting patiently since the 1343 low, almost 2 full weeks ago, and we are indeed almost at the target I was seeking on a wave'2 'stupid bounce'.

Standing by for a re-short, once the 60min charts level out, which frankly, is probably VERY close.

We're almost there...

updates..as necessary ;)

UPDATE 10.10am

SHORT from sp'1414.

We're seeing a reaction here. I may be a touch early..but I'm satisfied with my entry.

Tranny, looking like its done. Should see a confirmed rollover on the MACD cycle by early afternoon.

sp'60min

sp'daily5

Summary

Well, I been waiting patiently since the 1343 low, almost 2 full weeks ago, and we are indeed almost at the target I was seeking on a wave'2 'stupid bounce'.

Standing by for a re-short, once the 60min charts level out, which frankly, is probably VERY close.

We're almost there...

updates..as necessary ;)

UPDATE 10.10am

SHORT from sp'1414.

We're seeing a reaction here. I may be a touch early..but I'm satisfied with my entry.

Tranny, looking like its done. Should see a confirmed rollover on the MACD cycle by early afternoon.

Pre-Market Brief

Good morning. Futures are sp +8pts, we're set to open around 1418. We are now within immediate striking range of my 1425 target, from the 1343 low. A peak on the hourly cycle is viable at ANY time this morning.

GDP Q3 (revision'1): 2.7%, an upgrade from 2.0%.

Jobless claims: 393k, pretty lousy though.

sp'60min

sp'daily5

Summary

Its pretty exciting seeing the market already suggesting we'll open around 1418, a mere 7pts from my target.

Lets be clear...

I am not going to get overly fixated on a particular target today. If we get stuck around 1418, 20, or 23, I don't much care.

I will short via the hourly cycle, and when it levels out, that's when I'm hitting buttons.

Also, I will pay particular attention to the Transports. It has the cleanest waves, and is a good guide for the other indexes.

The best wishes for Thursday trading !

--

UPDATE 9.35am.. we're almost there, should see this level out by 10.30/11am

Almost there

Trans...60min

GDP Q3 (revision'1): 2.7%, an upgrade from 2.0%.

Jobless claims: 393k, pretty lousy though.

sp'60min

sp'daily5

Summary

Its pretty exciting seeing the market already suggesting we'll open around 1418, a mere 7pts from my target.

Lets be clear...

I am not going to get overly fixated on a particular target today. If we get stuck around 1418, 20, or 23, I don't much care.

I will short via the hourly cycle, and when it levels out, that's when I'm hitting buttons.

Also, I will pay particular attention to the Transports. It has the cleanest waves, and is a good guide for the other indexes.

The best wishes for Thursday trading !

--

UPDATE 9.35am.. we're almost there, should see this level out by 10.30/11am

Trans...60min

Wave'2 bounce almost complete

The main indexes saw a very strong morning reversal, and closed around 0.75% higher. Today's low was probably the B' wave of an ABC formation, that constitutes the wave'2 bounce that was expected from the recent sp'1343 low. Despite the bullish hysteria out there, I find it near impossible to conceive of sp'1440s any time soon.

sp'daily3 - news to come

sp'weekly2, rainbow

sp'monthly3, rainbow

Summary

The daily and weekly rainbow charts are both green, but there is of course considerable technical damage from the recent wave'1 decline. I'm still guessing this current bounce doesn't get any higher than the mid sp'1420s, where the 50 day MA is lurking @ 1423

Looking ahead into tomorrow, we have GDP Q3 'first revision' data, where market is expecting 2.8%, after the initial 'guess' of 2.0%. However, I'm more looking towards the Chicago PMI data on Friday.

Special note...

I would REALLY want to see at least a blue candle on the monthly rainbow index charts. So, I probably need a close at least <1410 by this Friday close - which is the end of the trading month.

That would allow for a giant red candle in December, on the next attempt to break lower - via a wave'3 decline into the 1200s.

--

Well, today was a bit of a twisted trading day, I'm sure Thursday will be at least 'marginally' simpler :).

Goodnight from London

sp'daily3 - news to come

sp'weekly2, rainbow

sp'monthly3, rainbow

Summary

The daily and weekly rainbow charts are both green, but there is of course considerable technical damage from the recent wave'1 decline. I'm still guessing this current bounce doesn't get any higher than the mid sp'1420s, where the 50 day MA is lurking @ 1423

Looking ahead into tomorrow, we have GDP Q3 'first revision' data, where market is expecting 2.8%, after the initial 'guess' of 2.0%. However, I'm more looking towards the Chicago PMI data on Friday.

Special note...

I would REALLY want to see at least a blue candle on the monthly rainbow index charts. So, I probably need a close at least <1410 by this Friday close - which is the end of the trading month.

That would allow for a giant red candle in December, on the next attempt to break lower - via a wave'3 decline into the 1200s.

--

Well, today was a bit of a twisted trading day, I'm sure Thursday will be at least 'marginally' simpler :).

Goodnight from London

Daily Index Cycle update

The indexes saw a very strong morning reversal, with the sp' flipping from 1385 to 1410. It would appear that the move from 1409 to 1385 was a likely B' wave, and that this is now complete. The final C' wave will probably get stuck around 1420/25 tomorrow, or into Friday.

IWM, daily

sp'daily5

Trans

Summary

It was quite a day wasn't it! I had certainly expected a bounce from the opening declines, although the size of the bounce surprised even me.

I'm sure many traders are bemused at today's action, but from a cycle perspective, it made a lot of sense. However, had we broken the 200 day MA @1383, and broken into the 1370s, I can't imagine the market would have managed to recover - regardless of anything some random politician said.

This remains a shaky and twitchy market, one of these days it'll snap/gap massively lower - for whatever reason, and scare the hell out of a lot of people, not least those cheer leading maniacs on clown network TV.

Where now?

Well, I'm sticking with the original outlook which was the 1410/25 zone. We've been brushing against the base of that zone since last Friday. As seen on daily'4, a backtest of the Oct'2011 (now broken) rising support would be a very natural ceiling for this wave'2 bounce.

sp'daily4 - original outlook

Assuming today was indeed the completion of a B' wave (also see hourly charts), then a C' wave is underway.

I remain on the sidelines, and waiting for a major re-short, somewhere around 1420/25, which may indeed occur as early as tomorrow.

A little more later.

IWM, daily

sp'daily5

Trans

Summary

It was quite a day wasn't it! I had certainly expected a bounce from the opening declines, although the size of the bounce surprised even me.

I'm sure many traders are bemused at today's action, but from a cycle perspective, it made a lot of sense. However, had we broken the 200 day MA @1383, and broken into the 1370s, I can't imagine the market would have managed to recover - regardless of anything some random politician said.

This remains a shaky and twitchy market, one of these days it'll snap/gap massively lower - for whatever reason, and scare the hell out of a lot of people, not least those cheer leading maniacs on clown network TV.

Where now?

Well, I'm sticking with the original outlook which was the 1410/25 zone. We've been brushing against the base of that zone since last Friday. As seen on daily'4, a backtest of the Oct'2011 (now broken) rising support would be a very natural ceiling for this wave'2 bounce.

sp'daily4 - original outlook

Assuming today was indeed the completion of a B' wave (also see hourly charts), then a C' wave is underway.

I remain on the sidelines, and waiting for a major re-short, somewhere around 1420/25, which may indeed occur as early as tomorrow.

A little more later.

Subscribe to:

Comments (Atom)