With US equities unravelling in the late afternoon, the VIX soared from the low 17s.. to above the key 20 threshold, settling +18.7% @ 20.44. Near term outlook offers a chance of continued equity weakness to the 200dma in the low sp'1970s.. which would likely equate to VIX in the 22/24 zone.

VIX'60min

VIX'daily3

VIX, weekly

Summary

*it is notable that the bigger VIX weekly cycle, upper bol' will be offering 23s this Thurs/Friday.

--

The market sure did unravel in the late afternoon, and the daily close in the 20s was certainly a surprise. The notion of 14/13s by the Friday close is now extremely unlikely.

Indeed, equity bears should be pushing for continued downside to the 200dma of the sp'1970s into the weekend... its certainly viable.. so long as the usual 'dip buyers' remain unwilling to jump aboard ahead of a spring rally.

--

more later... on the indexes

Wednesday, 28 January 2015

Closing Brief

US equities closed significantly lower, sp -27pts @ 2002 (intra low 2001). The two leaders - Trans/R2K, settled lower by -1.4% and -1.6% respectively. Equity bears have had to battle hard to get close to the 2K threshold. Near term outlook offers a hit of the 200dma in the sp'2070s

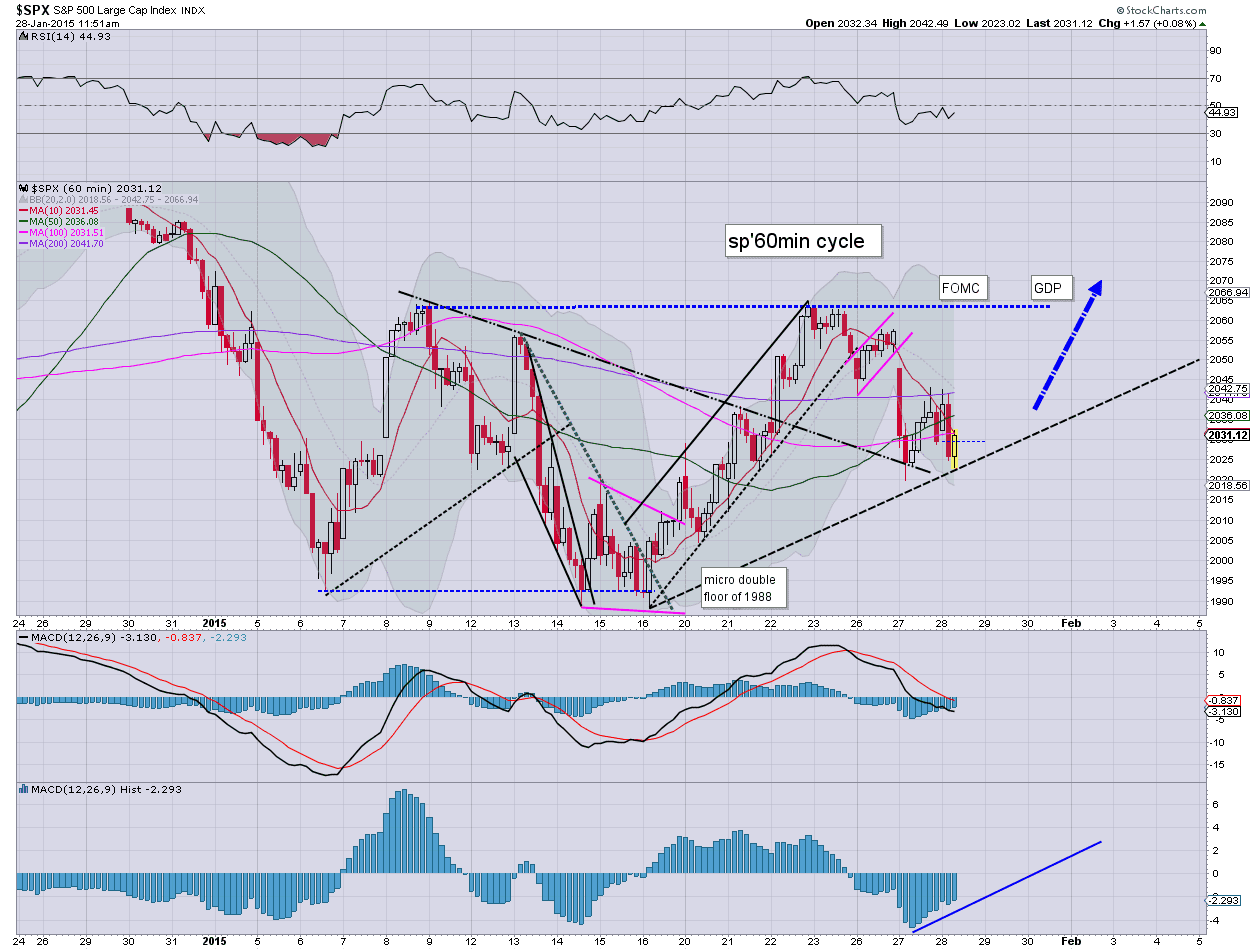

sp'60min

Summary

*the closing hour sure was a stinky one for the equity bull maniacs (yours truly included).

--

So... a new cycle low of sp'2001, and no doubt many are going to remain gunning for the 1970s - where the 200dma is lurking, in the coming days.

I'm pretty surprised at the post FOMC weakness.. it has been a fair while since we've seen that kind of price action.

--

UPDATE 4.04pm..

FB earnings.... better than expected.. stock swinging a fair bit... +2%... having been -4% (mere seconds)

-

more later.. on the VIX

sp'60min

Summary

*the closing hour sure was a stinky one for the equity bull maniacs (yours truly included).

--

So... a new cycle low of sp'2001, and no doubt many are going to remain gunning for the 1970s - where the 200dma is lurking, in the coming days.

I'm pretty surprised at the post FOMC weakness.. it has been a fair while since we've seen that kind of price action.

--

UPDATE 4.04pm..

FB earnings.... better than expected.. stock swinging a fair bit... +2%... having been -4% (mere seconds)

-

more later.. on the VIX

3pm update - resolutely bullish

US equities have marginally taken out the morning floor (although not on all indexes).. with sp'2017 and VIX 18.85. Hourly cycles remain on the low/exhausted side, and there remains high risk of a Thursday snap higher. Metals remain weak, Gold -$9, whilst Oil has broken a new cycle low of $44.08, now -3.1%

sp'60min

sp'daily5

Summary

*I'm pretty adverse to labelling/counting any of today's nonsense, not least since it is a fed day, which are notoriously unreliable.

-

So much for the 2019 low holding... oh well.

In any case, price action is still far stronger than yesterday, and as a few recognise, there remains the relentless threat of new highs in the very near term.

--

yours... resolutely bullish. (you can call it whatever you want, but I can't short this madness, with the monthly cycles still pushing upward).

updates into the close..........

3.20pm.. new cycle low 2014.. .approaching (arguably) support around 2012/10.

Certainly... no sign of buyers yet... Hmmm... VIX 19s.... a daily close in the 20s would be a real surprise.

3.36pm.. sp'2008... VIX +14% @ 19.65.... hmm.... things are getting more interesting. Even AAPL is cooling, now +6% in the $115s

FB +0.9%... ahead of earnings.. due at the close... will be one to watch... with implications for TWTR (-3.9%)

3.41pm.. Rats getting washed out now... sp'2005... VIX 20s

Momo stocks and energy... really having major problems this afternoon. FCX -5% in the low $17s.

3.48pm.. A pretty NASTY hourly candle.... sp'2001... the giant 2k threshold in imminent danger....

To those who were short (for whatever reason)... congrats... I sure read this one wrong.

... back at the close.. to wrap up the day.

sp'60min

sp'daily5

Summary

*I'm pretty adverse to labelling/counting any of today's nonsense, not least since it is a fed day, which are notoriously unreliable.

-

So much for the 2019 low holding... oh well.

In any case, price action is still far stronger than yesterday, and as a few recognise, there remains the relentless threat of new highs in the very near term.

--

yours... resolutely bullish. (you can call it whatever you want, but I can't short this madness, with the monthly cycles still pushing upward).

updates into the close..........

3.20pm.. new cycle low 2014.. .approaching (arguably) support around 2012/10.

Certainly... no sign of buyers yet... Hmmm... VIX 19s.... a daily close in the 20s would be a real surprise.

3.36pm.. sp'2008... VIX +14% @ 19.65.... hmm.... things are getting more interesting. Even AAPL is cooling, now +6% in the $115s

FB +0.9%... ahead of earnings.. due at the close... will be one to watch... with implications for TWTR (-3.9%)

3.41pm.. Rats getting washed out now... sp'2005... VIX 20s

Momo stocks and energy... really having major problems this afternoon. FCX -5% in the low $17s.

3.48pm.. A pretty NASTY hourly candle.... sp'2001... the giant 2k threshold in imminent danger....

To those who were short (for whatever reason)... congrats... I sure read this one wrong.

... back at the close.. to wrap up the day.

2pm update - time for some fed nonsense

US equities are naturally in a holding pattern ahead of the fed press release at 2pm. The hourly equity MACD cycles remain negative cycle, and frankly.. this makes for a lousy setup for those currently short. There remains high risk of a daily close in the sp'2050s. Metals remain weak, Gold -$8

sp'60min

VIX'60min

Summary

*there is NO Yellen press conf. so after some initial swings.. we'll likely have a clear direction by 2.15pm or so.

-

Best guess... a daily close in the 2048/52 area.. which will easily keep open the 2070s by the Friday close.

*I realise many are still seeking the 1970/60s in the near term, but from a pure cyclical perspective...the bears look in real danger here.

-

2.01pm.. 'Fed to remain patient'..... make of that bizarre headline.. as you wish.

Indexes a touch higher.. but what matters.. is how we close!

2.11pm.. sp'2026... chop chop... unless 2019 fails.... those short are getting a chance to bail.

Certainly, price action doesn't appear particularly weak...

2.22pm... sp'2028.... tick tock............... bears had their chance.... looks like a fail.

Hourly cycle offering a snap higher at the Thursday open (for whatever reason you wish to attribute).

2.26pm.. Oil and the metals are unravelling... Oil breaks a new cycle low of $44.08. Gold -$13

2.34pm... new cycle low of sp'2017.... lower oil prices are wrecking the energy stocks... which is causing particular trouble for the energy laden R2K, -1.0%

Hmm... possible support around sp'2012.... but clearly.. any day-trading bulls.. .should already have got the boot.

sp'60min

VIX'60min

Summary

*there is NO Yellen press conf. so after some initial swings.. we'll likely have a clear direction by 2.15pm or so.

-

Best guess... a daily close in the 2048/52 area.. which will easily keep open the 2070s by the Friday close.

*I realise many are still seeking the 1970/60s in the near term, but from a pure cyclical perspective...the bears look in real danger here.

-

2.01pm.. 'Fed to remain patient'..... make of that bizarre headline.. as you wish.

Indexes a touch higher.. but what matters.. is how we close!

2.11pm.. sp'2026... chop chop... unless 2019 fails.... those short are getting a chance to bail.

Certainly, price action doesn't appear particularly weak...

2.22pm... sp'2028.... tick tock............... bears had their chance.... looks like a fail.

Hourly cycle offering a snap higher at the Thursday open (for whatever reason you wish to attribute).

2.26pm.. Oil and the metals are unravelling... Oil breaks a new cycle low of $44.08. Gold -$13

2.34pm... new cycle low of sp'2017.... lower oil prices are wrecking the energy stocks... which is causing particular trouble for the energy laden R2K, -1.0%

Hmm... possible support around sp'2012.... but clearly.. any day-trading bulls.. .should already have got the boot.

12pm update - chop ahead of the fed

US equities have put in a morning floor of sp'2023, with VIX maxing out at 18.52. The next two hours look set for minor chop as market awaits the fed press release (due 2pm). Metals remain weak, Gold -$8. Energy prices remain weak, with Oil lower by a rather significant -2.1% in the $45s.

sp'60min

sp'daily5

Summary

Little to add.

Market looks set to remain in a holding pattern ahead of the Fed. Regardless of any initial 'twitchy' price action at the time of the announcement, I expect some late afternoon strength. A daily close in the sp'2050s remains viable.

*it is notable that the upper bol' on the daily is now down to 2080... so even if we break 2064... bulls will be facing a wall around 2070/75 by the Friday close.

--

VIX update from Mr T

--

time for lunch... back just before the FOMC.

sp'60min

sp'daily5

Summary

Little to add.

Market looks set to remain in a holding pattern ahead of the Fed. Regardless of any initial 'twitchy' price action at the time of the announcement, I expect some late afternoon strength. A daily close in the sp'2050s remains viable.

*it is notable that the upper bol' on the daily is now down to 2080... so even if we break 2064... bulls will be facing a wall around 2070/75 by the Friday close.

--

VIX update from Mr T

--

time for lunch... back just before the FOMC.

11am update - shaky gains

US equities are turning to the downside, lead lower by the R2K (-0.6%). VIX has battled 5% higher.. back into the 18s. However, with the Fed due at 2pm... those getting excited about a possible break of the sp'2019 low... are likely in for a disappointing afternoon. Metals remain weak, Gold -$6.

sp'60min

GLD, daily

Summary

*Gold is an interesting one.. price structure is a bull flag.. but I'm looking for a daily close under the 10MA, which keep open the notion that we have a multi-week up wave... complete.

--

So... red indexes... but price action is clearly a lot stronger than yesterday.

Unless the Fed say something real stupid in the press release about interest rates, the market looks set for late afternoon strength.

**It is also the typical turn/floor time of 11am... arguably, the prime opportunity of a break <2019 is right now.. or not at all today.

-

Notable gains: AAPL +6.8%.. still comfortably holding the bulk of the opening gains.

-

11.40am.. chop chop.. back to sp'2029.... not much to expect between now and 2pm

sp'60min

GLD, daily

Summary

*Gold is an interesting one.. price structure is a bull flag.. but I'm looking for a daily close under the 10MA, which keep open the notion that we have a multi-week up wave... complete.

--

So... red indexes... but price action is clearly a lot stronger than yesterday.

Unless the Fed say something real stupid in the press release about interest rates, the market looks set for late afternoon strength.

**It is also the typical turn/floor time of 11am... arguably, the prime opportunity of a break <2019 is right now.. or not at all today.

-

Notable gains: AAPL +6.8%.. still comfortably holding the bulk of the opening gains.

-

11.40am.. chop chop.. back to sp'2029.... not much to expect between now and 2pm

10am update - opening minor gains

US equities start the day with minor gains, back into the sp'2040s. R2K is suggestive the gains are shaky.. having already turned fractionally red. VIX is similarly offering an opening reversal. However, market looks set to churn ahead of the FOMC.

sp'60min

R2K, daily

Summary

*I generally don't dismiss a black-fail candle... but the one on the R2K, I am not overly concerned about. Besides, market will likely churn ahead of the fed press release, and then see renewed gains into the close.

--

Not much to add. AAPL sure is helping the tech stocks, with what were very impressive earnings data.

Just consider $3 EPS.. x4... $12 a year... the current PE is barely 10. How the hell could anyone consider that over priced?

Maybe a hyper-bubble top with AAPL @ $200/250 or so ?

--

Four hours until the fed press release.... is it time for lunch yet?

sp'60min

R2K, daily

Summary

*I generally don't dismiss a black-fail candle... but the one on the R2K, I am not overly concerned about. Besides, market will likely churn ahead of the fed press release, and then see renewed gains into the close.

--

Not much to add. AAPL sure is helping the tech stocks, with what were very impressive earnings data.

Just consider $3 EPS.. x4... $12 a year... the current PE is barely 10. How the hell could anyone consider that over priced?

Maybe a hyper-bubble top with AAPL @ $200/250 or so ?

--

Four hours until the fed press release.... is it time for lunch yet?

Pre-Market Brief

Good morning. Futures are rebounding, sp +15pts, we're set to open at 2044, just 3pts shy of the key 50dma. A daily close in the 2050s would be useful, and re-open the door to a weekly close in the 2070s. Metals are a little weak ahead of the FOMC, Gold -$4.

sp'daily5

Summary

So, we're set to jump back into the 2040s... ahead of this afternoon's FOMC announcement at 2pm. That should go okay, and if so.. market has a fair chance of a daily close in the 2050s.

Lets be clear... despite yesterday's stronger than expected down wave... there remains the chance that we'll close in the sp'2070s.

--

Update from Mr C.

I will add, Gold certainly does look vulnerable (along with the miners) into the summer.

--

Notable early gains...

AAPL, +7.8% in the $117s... set to challenge the Nov' high of $119. The broad rising channel on the daily/monthly charts is offering the $125/27 zone by mid Feb.

---

Have a good Wednesday

sp'daily5

Summary

So, we're set to jump back into the 2040s... ahead of this afternoon's FOMC announcement at 2pm. That should go okay, and if so.. market has a fair chance of a daily close in the 2050s.

Lets be clear... despite yesterday's stronger than expected down wave... there remains the chance that we'll close in the sp'2070s.

--

Update from Mr C.

I will add, Gold certainly does look vulnerable (along with the miners) into the summer.

--

Notable early gains...

AAPL, +7.8% in the $117s... set to challenge the Nov' high of $119. The broad rising channel on the daily/monthly charts is offering the $125/27 zone by mid Feb.

---

Have a good Wednesday

Powerful EU equities

Whilst both US and EU equity markets were whacked lower today, it remains highly notable that the EU equity indexes are looking extremely bullish for the coming spring. With the DAX already having broken 'up and away', the UK FTSE looks set to break the giant 7K threshold.... with the CAC similarly pushing powerfully upward.

*with 3 trading days left of the month... lets take a look at three of the EU equity markets...

France, monthly

Germany, monthly

UK, monthly

Summary

Frankly, the monthly gains are extremely important for both long term investors.. and the short term traders to keep in mind.

The DAX has clearly already broken the 2000/2007 double top.. with an effective back test in the 8000s last October - whilst sp' floored at 1820.

The CAC is powering higher, the giant 5k level looks due this spring.

The FTSE has been stuck just under the Dec'1999 high for TWO years, but now looks set to finally break out. A monthly close in the 7000s.. whether Feb' or March... will be a HUGE bullish signal for the broader world equity market.

--

Looking ahead

Wednesday will be all about the FOMC, which is set to announce at 2pm. Int' rates will of course be left unchanged, but Mr Market will most certainly be ready to assess the latest fed statement.

*I believe there will NOT be a Yellen press conference (those are usually every second meeting)

--

Goodnight from London

*with 3 trading days left of the month... lets take a look at three of the EU equity markets...

France, monthly

Germany, monthly

UK, monthly

Summary

Frankly, the monthly gains are extremely important for both long term investors.. and the short term traders to keep in mind.

The DAX has clearly already broken the 2000/2007 double top.. with an effective back test in the 8000s last October - whilst sp' floored at 1820.

The CAC is powering higher, the giant 5k level looks due this spring.

The FTSE has been stuck just under the Dec'1999 high for TWO years, but now looks set to finally break out. A monthly close in the 7000s.. whether Feb' or March... will be a HUGE bullish signal for the broader world equity market.

--

Looking ahead

Wednesday will be all about the FOMC, which is set to announce at 2pm. Int' rates will of course be left unchanged, but Mr Market will most certainly be ready to assess the latest fed statement.

*I believe there will NOT be a Yellen press conference (those are usually every second meeting)

--

Goodnight from London

Daily Index Cycle update

US equities opened sharply lower on a number of lousy earnings data, but saw something of a latter day rally, sp -27pts @ 2029 (intra low 2019). The two leaders - Trans/R2K, settled -1.2% and -0.5% respectively. Near term outlook offers renewed upside... so long as the FOMC don't say anything... 'stupid'.

sp'daily5

R2K

Trans

Summary

*a notable classic (hollow red) reversal candle on the second market leader - the R2K, bodes in favour of the equity bulls for FOMC Wednesday.

--

Suffice to say... I had my eyes closely on the R2K across today. Certainly, it did not reflect the broader market declines. The 'old leader' - Trans, certainly closed lower, but then Oil was higher, and will usually help pressure the Transport stocks lower.

All things considered, new historic highs still look due.

--

Closing update from Riley

--

a little more later... on the EU equity markets.

sp'daily5

R2K

Trans

Summary

*a notable classic (hollow red) reversal candle on the second market leader - the R2K, bodes in favour of the equity bulls for FOMC Wednesday.

--

Suffice to say... I had my eyes closely on the R2K across today. Certainly, it did not reflect the broader market declines. The 'old leader' - Trans, certainly closed lower, but then Oil was higher, and will usually help pressure the Transport stocks lower.

All things considered, new historic highs still look due.

--

Closing update from Riley

--

a little more later... on the EU equity markets.

Subscribe to:

Comments (Atom)