It was a pretty mixed day in VIX land. Pre-FOMC, the VIX managed moderate morning gains to 14.95, but with the uncertainty of the FOMC out of the way, the VIX was whacked lower to 13.50, settling -1.4% @ 13.77. Near term outlook offers the sp'2060s, which would likely equate to VIX 15/16s.

VIX'60min

VIX'daily3

Summary

Suffice to add.. VIX remains broadly subdued, and right now, even if the sp'2060s are seen into the weekly/monthly close.. all it will achieve is VIX in the mid teens.

Sustained action above the key 20 threshold looks out of range until the latter half of May.

--

more later... on the indexes

Wednesday, 27 April 2016

Closing Brief

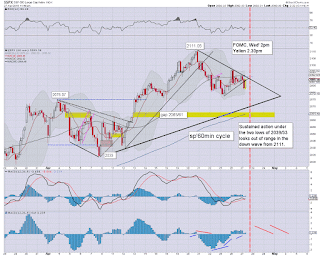

US equity indexes closed moderately mixed, sp +3pts @ 2095 (intra low 2082). The two leaders - Trans/R2K, settled higher by 0.1% and 0.3% respectively. Near term outlook offers downside to the 2065/61 zone before the weekend. Anything in the 2050/40s now looks out of range until next week/May.

sp'60min

Summary

*closing hour action: pretty bullish, with a new intra high of 2099... with some cooling into the close.

--

So... that's the April FOMC out of the way.

Clearly, a day for the equity bull maniacs... as we came within 0.5% of breaking the 2111 high.

With just two trading days left of the week/month, the bears should be desperate to see that bear flag play out.. with April settling in the 2060s.. but that will still make for a net monthly gain.

Broadly.. its still a very borderline situation as the equity bulls are still YET to break a new high.. whilst bears are still utterly unable to muster any sig/sustained downside action.

--

**earnings due from FB and EBAY in AH.......................

--

more later... on the VIX

sp'60min

Summary

*closing hour action: pretty bullish, with a new intra high of 2099... with some cooling into the close.

--

So... that's the April FOMC out of the way.

Clearly, a day for the equity bull maniacs... as we came within 0.5% of breaking the 2111 high.

With just two trading days left of the week/month, the bears should be desperate to see that bear flag play out.. with April settling in the 2060s.. but that will still make for a net monthly gain.

Broadly.. its still a very borderline situation as the equity bulls are still YET to break a new high.. whilst bears are still utterly unable to muster any sig/sustained downside action.

--

**earnings due from FB and EBAY in AH.......................

--

more later... on the VIX

3pm update - tedious chop

With the FOMC announcing (not surprisingly) no policy change, US equities remain in moderate chop mode. With that event out of the way, the VIX is under downward pressure, having already imploded to 13.50. There is notable strength in the precious metals, Gold +$5, with Silver +0.8%.

sp'60min

VIX'60min

Summary

*ironically, the only thing unexpected about today was that there was no press conf. I normally check, but no... and I'm somewhat pissed at myself.

--

re: equities: price structure is offering a big bear flag.. with threat of closing upside to 2095/2100 zone. Considering tomorrow mornings GDP data (how the hell will they spin near zero/neg' growth as a positive?)... I doubt we'll open higher tomorrow.

So.. if the bulls are going to wash out the bears again.. it'll be into today's close.

-

re: VIX. With the FOMC out of the way, the VIX naturally cooled... currently choppy, and showing ZERO sign of breaking upward.

-

notable weakness.... NFLX -1.7%... sub $90 still looks due.. and relative to the main market.. it is one ugly stock.

--

3.09pm.. sp'2096... a mere 15pts (0.7%) from the recent key high...

I still think 2060s before the weekend, but any hope of <2060 is clearly out of range until next week.. which is almost as annoying as not realise there wasn't going to be a press conf............ urghhhhhhhh

3.20pm.. sp'2098.. right in the little target zone... we really should get stuck around here.

Oil +3.0% in the $45s... that is clearly part of the reason.

Gartman (still alive.. far as I know)... is bullish Oil now... from what I read on ZH.

sp'60min

VIX'60min

Summary

*ironically, the only thing unexpected about today was that there was no press conf. I normally check, but no... and I'm somewhat pissed at myself.

--

re: equities: price structure is offering a big bear flag.. with threat of closing upside to 2095/2100 zone. Considering tomorrow mornings GDP data (how the hell will they spin near zero/neg' growth as a positive?)... I doubt we'll open higher tomorrow.

So.. if the bulls are going to wash out the bears again.. it'll be into today's close.

-

re: VIX. With the FOMC out of the way, the VIX naturally cooled... currently choppy, and showing ZERO sign of breaking upward.

-

notable weakness.... NFLX -1.7%... sub $90 still looks due.. and relative to the main market.. it is one ugly stock.

--

3.09pm.. sp'2096... a mere 15pts (0.7%) from the recent key high...

I still think 2060s before the weekend, but any hope of <2060 is clearly out of range until next week.. which is almost as annoying as not realise there wasn't going to be a press conf............ urghhhhhhhh

3.20pm.. sp'2098.. right in the little target zone... we really should get stuck around here.

Oil +3.0% in the $45s... that is clearly part of the reason.

Gartman (still alive.. far as I know)... is bullish Oil now... from what I read on ZH.

2pm update - a press release... and some Yellen

US equities are set to see price action get real dynamic across the rest of today. The algo-bots will have a press release to digest, but perhaps even more important, the subsequent press conf' with Yellen. Will Aunt J' inspire confidence in the bull maniacs.. or appear weak?

sp'60min

Summary

...standing by.

If the market wants to cause max initial confusion it'll spike to 2095/2100... before a very sharp reversal.

--

*frequent updates... across the rest of today.

--

2.02pm.. CRAZY ass VIX.. smacked to 13.50.... then rebounds...

So.. no rate increase of course.... and the market is moderately weak.

Now its a case of what the Yellen says....

2.06pm. metals are leaning higher... Gold +$7.. with Silver +0.7%.. Miners are naturally following, GDX +0.6%

2.21pm.. so.. there will NOT be a press' conf... as there was one at the March meeting.. and I failed to check.

Urghhh. Annoying.

2.23pm... sp'60min

A move to 2095/2100 zone almost hit already.... but without a press conf'.. other than pure cyclical reasons.. no reason to cool until tomorrow.

Price structure is arguably becoming a big bear flag... and as things are... a break <2060 looks out of range by the weekend.

-

2.28pm.. so.. next event are momo earnings from FB.. and the more balanced EBAY.

Q1 GDP tomorrow morning.. which I think I'm right about.. but maybe I need someone to confirm it.. as I couldn't even recall the fact that there was a press' conf' at the March FOMC.

2.35pm.. tedious micro chop... bulls will struggle to break to 2095/2100 tomorrow morning... today is likely their best chance.

sp'60min

Summary

...standing by.

If the market wants to cause max initial confusion it'll spike to 2095/2100... before a very sharp reversal.

--

*frequent updates... across the rest of today.

--

2.02pm.. CRAZY ass VIX.. smacked to 13.50.... then rebounds...

So.. no rate increase of course.... and the market is moderately weak.

Now its a case of what the Yellen says....

2.06pm. metals are leaning higher... Gold +$7.. with Silver +0.7%.. Miners are naturally following, GDX +0.6%

2.21pm.. so.. there will NOT be a press' conf... as there was one at the March meeting.. and I failed to check.

Urghhh. Annoying.

2.23pm... sp'60min

A move to 2095/2100 zone almost hit already.... but without a press conf'.. other than pure cyclical reasons.. no reason to cool until tomorrow.

Price structure is arguably becoming a big bear flag... and as things are... a break <2060 looks out of range by the weekend.

-

2.28pm.. so.. next event are momo earnings from FB.. and the more balanced EBAY.

Q1 GDP tomorrow morning.. which I think I'm right about.. but maybe I need someone to confirm it.. as I couldn't even recall the fact that there was a press' conf' at the March FOMC.

2.35pm.. tedious micro chop... bulls will struggle to break to 2095/2100 tomorrow morning... today is likely their best chance.

1pm update - it's oh so quiet

US equities remain broadly subdued.. as the market is naturally in a holding pattern ahead of the 2pm FOMC announcement. Arguably, more important than the press release, will be how the market interprets Yellen in the press conf' (due around 2.30pm).

sp'60min

VIX60min

Summary

... enjoy the quiet... its soon to get rowdy... one way or another.

-

--

back at 2pm

sp'60min

VIX60min

Summary

... enjoy the quiet... its soon to get rowdy... one way or another.

-

--

back at 2pm

12pm update - sunshine ahead of the Fed

US equity price action remains relatively subdued ahead of the FOMC announcement. With earnings continuing to come in badly, some of the bull maniacs are naturally getting twitchy.. but they are still holding to the underlying belief that the Fed can negate such issues.

sp'60min

Nasdaq comp' daily

Summary

... suffice to add.. the chop continues.

Nasdaq remains under strong pressure... and has already taken out the 200dma.. equiv' to sp'2014.

notable weakness: NFLX -1.3% in the $91s.... further weakness to $80 looks due if main market does unravel.

-

Meanwhile in London city....

Its one of those days when its difficult to decide whether to wear shorts and sunshades.. or a winter jacket. There were snow showers yesterday here... with some lightning bolts. Is that bullish for late April?

Somewhat appropriately, the new homes by 'Fairview homes' now have a Fair being built next to it. Are next door theme rides bullish for property values?

--

time to cook

sp'60min

Nasdaq comp' daily

Summary

... suffice to add.. the chop continues.

Nasdaq remains under strong pressure... and has already taken out the 200dma.. equiv' to sp'2014.

notable weakness: NFLX -1.3% in the $91s.... further weakness to $80 looks due if main market does unravel.

-

Meanwhile in London city....

Its one of those days when its difficult to decide whether to wear shorts and sunshades.. or a winter jacket. There were snow showers yesterday here... with some lightning bolts. Is that bullish for late April?

Somewhat appropriately, the new homes by 'Fairview homes' now have a Fair being built next to it. Are next door theme rides bullish for property values?

--

time to cook

11am update - moderately weak

US equities are a little weak, but still... price action is broadly muted as most traders are naturally waiting for the FOMC at 2pm. VIX itself remains broadly subdued... and its been some months since we've seen any real upside kick. As things are, equity bears should be seeking a daily close in the sp'2060s with VIX 15/16s.

sp'daily5

VIX'daily3

Summary

Little to add.

The market being what it is.. falling ahead of the 2pm announcement usually bodes against the bears.. at least initially.

There will be HIGH threat of an initial spike higher.. but we should then resume lower.. and significantly.. once Yellen appears.

--

notable weakness... TWTR, weekly

Seen on a 2.6yr chart... its one momo/hysteria stock that has lost almost all market respect. The market is demanding more than TWTR can possibly offer.

Hell, the fact that CEO Dorsey won't even up the char' limit >140... its utterly bizarre.

--

time for some sun.

sp'daily5

VIX'daily3

Summary

Little to add.

The market being what it is.. falling ahead of the 2pm announcement usually bodes against the bears.. at least initially.

There will be HIGH threat of an initial spike higher.. but we should then resume lower.. and significantly.. once Yellen appears.

--

notable weakness... TWTR, weekly

Seen on a 2.6yr chart... its one momo/hysteria stock that has lost almost all market respect. The market is demanding more than TWTR can possibly offer.

Hell, the fact that CEO Dorsey won't even up the char' limit >140... its utterly bizarre.

--

time for some sun.

10am update - opening chop

US equities open in minor chop mode.. and that will likely remain the case into the 2pm FOMC announcement. From there.. things will no doubt get rather dynamic. First downside target remains the gap zone of sp'2065/61.. along with VIX 15/16s.

sp'60min

VIX'60min

Summary

*awaiting EIA report at 10.30am.

--

Well.. we've four hours of likely micro chop for the broader market.

For now.. there is little to add.

-

notable weakness.... AAPL, daily

An ugly gap lower... and there really isn't any support until the 92/90 zone. If you are of the mindset that the market is going to FAIL to break new highs... then the first core target should be $70.

I realise for now.. anyone in the mainstream would consider that 'crazy talk'.

Hell.. maybe Gartman will go MAX margin long AAPL this morning?

--

stay tuned... we have an exciting afternoon ahead!

sp'60min

VIX'60min

Summary

*awaiting EIA report at 10.30am.

--

Well.. we've four hours of likely micro chop for the broader market.

For now.. there is little to add.

-

notable weakness.... AAPL, daily

An ugly gap lower... and there really isn't any support until the 92/90 zone. If you are of the mindset that the market is going to FAIL to break new highs... then the first core target should be $70.

I realise for now.. anyone in the mainstream would consider that 'crazy talk'.

Hell.. maybe Gartman will go MAX margin long AAPL this morning?

--

stay tuned... we have an exciting afternoon ahead!

Pre-Market Brief

Good morning. US equity futures are fractionally lower, sp -1pt, we're set to open at 2090. USD is -0.1% in the DXY 94.40s. Metals continue to broadly climb, Gold +$3, with Silver +1.0%. Oil is +2.0% in the $44s, ahead of the latest EIA report.

sp'60min

sp'weekly8e

Summary

Well, its Fed day. The market will be highly inclined to churn all the way to 2pm.

After some wild min' to min' swings, we'll likely see a clear direction be taken by 2.15pm.

Considering the hourly/daily/weekly cycles, I'm inclined to see sig' downside by the close of today... a hit of 2065/61 is within range.

Right now, a logical short-stop remains the recent sp'2111 high, the Nov' high of 2116.... or the ultimate sand line of 2134.

--

early movers...

AAPL -8% in the $95s..... post earnings distress

TWTR -14% in the $15s... as above

CMG -5%

BWLD (Buffalo Wild Wings) -12%

Update from Mr C.

re: weekly8e. If correct, downside should be at least to the sp'1600/1500s... and that would no doubt freak the mainstream out. How would the central banks respond? There would be more QE from the BoJ and ECB, and even the US Fed might move to NIRP.

Oscar didn't say it, but if correct, higher Gold will have massive implications for the related mining stocks.

--

Doomer chat... Hunter with Mr Williams.

I like Williams, but I remain NOT on the 'dollar doomer' train.

--

Have a VERY entertaining and profitable Wednesday.

sp'60min

sp'weekly8e

Summary

Well, its Fed day. The market will be highly inclined to churn all the way to 2pm.

After some wild min' to min' swings, we'll likely see a clear direction be taken by 2.15pm.

Considering the hourly/daily/weekly cycles, I'm inclined to see sig' downside by the close of today... a hit of 2065/61 is within range.

Right now, a logical short-stop remains the recent sp'2111 high, the Nov' high of 2116.... or the ultimate sand line of 2134.

--

early movers...

AAPL -8% in the $95s..... post earnings distress

TWTR -14% in the $15s... as above

CMG -5%

BWLD (Buffalo Wild Wings) -12%

Update from Mr C.

re: weekly8e. If correct, downside should be at least to the sp'1600/1500s... and that would no doubt freak the mainstream out. How would the central banks respond? There would be more QE from the BoJ and ECB, and even the US Fed might move to NIRP.

Oscar didn't say it, but if correct, higher Gold will have massive implications for the related mining stocks.

--

Doomer chat... Hunter with Mr Williams.

I like Williams, but I remain NOT on the 'dollar doomer' train.

--

Have a VERY entertaining and profitable Wednesday.

Awaiting yet another FOMC

Once again traders across the world await the latest policy statement from the US branch of PRINT central. Even more important will be how the market perceives Yellen in the subsequent press conference. Price action looks set to get dramatically more dynamic.. one way or another.

sp'weekly

Nasdaq comp' weekly

Summary

So... two days into the week, with the sp'500 effectively flat.

The Nasdaq comp' remains the weakest index/sector... how AAPL trades post-earnings will really help shape the weekly/monthly close.

--

Looking ahead

Wed' will see intl' trade, pending home sales, and the latest EIA report.

The FOMC will issue a press release at 2pm.. with Yellen set to appear around 2.30pm.. which will likely last around an hour.

--

Market/Fed chatter from Schiff

Indeed, there won't be any rate hike tomorrow... nor at the June 15th meeting. There is already the realisation within many market watchers that the Fed will use the excuse of the looming BREXIT vote (June 23rd) not to risk rocking the market.

--

A note on AAPL

Earnings were a clear miss, but more so... the outlook is lousy for at least another 3-6 months. Not surprisingly, the stock failed to hold the $102s... and (as of writing) is trading in the $95s. Next support is the 92/91 zone.

AAPL, monthly

If the main market does re-implode into the summer - to the sp'1600/1500s... AAPL would likely be around $70.

Goodnight from London

sp'weekly

Nasdaq comp' weekly

Summary

So... two days into the week, with the sp'500 effectively flat.

The Nasdaq comp' remains the weakest index/sector... how AAPL trades post-earnings will really help shape the weekly/monthly close.

--

Looking ahead

Wed' will see intl' trade, pending home sales, and the latest EIA report.

The FOMC will issue a press release at 2pm.. with Yellen set to appear around 2.30pm.. which will likely last around an hour.

--

Market/Fed chatter from Schiff

Indeed, there won't be any rate hike tomorrow... nor at the June 15th meeting. There is already the realisation within many market watchers that the Fed will use the excuse of the looming BREXIT vote (June 23rd) not to risk rocking the market.

--

A note on AAPL

Earnings were a clear miss, but more so... the outlook is lousy for at least another 3-6 months. Not surprisingly, the stock failed to hold the $102s... and (as of writing) is trading in the $95s. Next support is the 92/91 zone.

AAPL, monthly

If the main market does re-implode into the summer - to the sp'1600/1500s... AAPL would likely be around $70.

Goodnight from London

Daily Index Cycle update

US equity indexes closed fairly mixed, sp +3pts @ 2091 (intra high

2096). The two leaders - Trans/R2K, both settled higher by around 1.0%.

Near term outlook offers a post-FOMC break to the 2065/61 gap zone.

There is a viable April close in the 2050/40s.. with VIX in the 17-19

zone.

sp'daily5

R2K

Trans

Summary

sp'500: another day of micro chop... holding under broken trend.

R2K: a notable new cycle high of 1150... now within the resistance zone 1150/60s.

Trans: a sig' net daily gain... price structure is a clear bull flag.. would be negated on a break <7900.

--

a little more later...

sp'daily5

R2K

Trans

Summary

sp'500: another day of micro chop... holding under broken trend.

R2K: a notable new cycle high of 1150... now within the resistance zone 1150/60s.

Trans: a sig' net daily gain... price structure is a clear bull flag.. would be negated on a break <7900.

--

a little more later...

Subscribe to:

Comments (Atom)