With equities closing significantly higher, the VIX was naturally back in cooling mode, settling -7.0% @ 22.54. Near term outlook offers the sp'2000s, and that will likely equate to VIX back under the 20 threshold. If sp'2040/50s, VIX will likely floor in the 17/15s.

VIX'daily3

Summary

Little to add.

Equities look set to continue higher into the FOMC... with VIX set to continue cooling.

*I will consider picking up a VIX-long postion within 2-5 trading days.

--

more later... on the indexes

Tuesday, 15 September 2015

Closing Brief

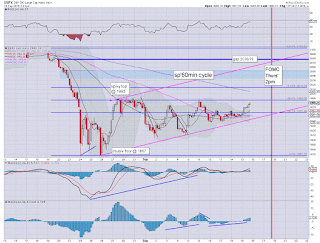

US equity indexes closed significantly higher, sp +25pts @ 1978 (intra high 1983). The two leaders - Trans/R2K, settled higher by 1.8% and 1.1% respectively. Near term outlook is for continued gains, at least to 2000/2010, but with almost equally viable 2040/50s.

sp'60min

Summary

*closing hour: moderate chop.... nothing for the bears to get excited about.

--

So.. sig' daily gains as based on... little vol'. Regardless... a day for the bulls.. and it brings within reach the sp'2000s.. something some have been proclaiming lately as 'not likely for the remainder of the year'.

To those currently short, I can only imagine.. today was indeed annoying.

--

more later... on the VIX

sp'60min

Summary

*closing hour: moderate chop.... nothing for the bears to get excited about.

--

So.. sig' daily gains as based on... little vol'. Regardless... a day for the bulls.. and it brings within reach the sp'2000s.. something some have been proclaiming lately as 'not likely for the remainder of the year'.

To those currently short, I can only imagine.. today was indeed annoying.

--

more later... on the VIX

3pm update - significant net daily gains

US equities look set to hold sig' gains into the close, with the sp'500 closing somewhere in the 1975/85 zone. VIX is naturally cooling, back in the 22s.... set to lose the 20 threshold this Thursday. Commodities are mixed, Gold -$5, whilst Oil is seeing some rather wild intraday swings, currently back to +1.0%.

sp'60min

USO'60min

Summary

All US indexes are set for sig' gains... and with today's gains, it makes the 2040/50s that much easier this Thurs/Friday.

To be clear.. 2040 IS within range this week.. and actually, I'd argue its more viable this week.. than next.

In any case... I can't be short this.

--

*I will hold a micro USO-long overnight.. and almost certainly into the FOMC of Thursday afternoon.

-

back at the close.

sp'60min

USO'60min

Summary

All US indexes are set for sig' gains... and with today's gains, it makes the 2040/50s that much easier this Thurs/Friday.

To be clear.. 2040 IS within range this week.. and actually, I'd argue its more viable this week.. than next.

In any case... I can't be short this.

--

*I will hold a micro USO-long overnight.. and almost certainly into the FOMC of Thursday afternoon.

-

back at the close.

2pm update - daily cycle bollingers

US equities have built rather significant gains, with the market making a play for a daily close in the sp'1980s. It is notable that the upper daily bollinger is (naturally) collapsing.. now at sp'2073.. and will likely be around 2040 by end week. The bull maniacs face a problem once the initial FOMC hysteria is out of the way.

sp'daily5

VIX'daily3

Summary

*naturally, the VIX remains in cooling mode, sub 20s look an easy target for this Thursday afternoon.

-

So.. we're still climbing... certainly stronger than I was expecting.

It makes the notion of breaking under rising support (1945 at the close) completely implausible.

Indeed.. we look headed for the 2000s... it remains a case of lets see how high the maniacs can drive it on the FOMC.

-

2.02pm

notable weakness, DIS -0.6% in the $103s... but well above the early low of $101.82

Oil has turned red.. USO -0.1%... hmm

2.32pm.. Oil back +1.0%... crazy market... real twitchy ahead of the FOMC.

sp'daily5

VIX'daily3

Summary

*naturally, the VIX remains in cooling mode, sub 20s look an easy target for this Thursday afternoon.

-

So.. we're still climbing... certainly stronger than I was expecting.

It makes the notion of breaking under rising support (1945 at the close) completely implausible.

Indeed.. we look headed for the 2000s... it remains a case of lets see how high the maniacs can drive it on the FOMC.

-

2.02pm

notable weakness, DIS -0.6% in the $103s... but well above the early low of $101.82

Oil has turned red.. USO -0.1%... hmm

2.32pm.. Oil back +1.0%... crazy market... real twitchy ahead of the FOMC.

1pm update - Oil remains set to push upward

Despite some weakness since last week, Oil remains on track for another significant push higher. Broader price structure remains a clear bull flag. As ever, the EIA oil report (due Wed' 10.30am) will be a key determinent.

First target is a daily close in the $45s.. then a snap to the 47/48s... which seem viable this Thursday.

USO' 60min

USO, daily

Summary

Little to add.

Oil looks set to break upward... WTIC @ the $50 threshold looks a reasonable target in the near term... whether it can keep on pushing into the 55s or even higher... difficult to say. The latter would likely need sp'2050/70s.. to have any chance.

-

Even the cheerleaders on clown finance TV see it...

One of the guest (Jim Muriel, I believe), was noting a break above the flag would open up $57. There is a price gap zone around $55.. and I could see that.... before renewed downside.

*I continue to hold a micro USO-long position, and will hold into the FOMC.

--

back at 2pm

First target is a daily close in the $45s.. then a snap to the 47/48s... which seem viable this Thursday.

USO' 60min

USO, daily

Summary

Little to add.

Oil looks set to break upward... WTIC @ the $50 threshold looks a reasonable target in the near term... whether it can keep on pushing into the 55s or even higher... difficult to say. The latter would likely need sp'2050/70s.. to have any chance.

-

Even the cheerleaders on clown finance TV see it...

One of the guest (Jim Muriel, I believe), was noting a break above the flag would open up $57. There is a price gap zone around $55.. and I could see that.... before renewed downside.

*I continue to hold a micro USO-long position, and will hold into the FOMC.

--

back at 2pm

12pm update - holding gains

US equities are holding moderate gains, with the sp +16pts @ 1969. The VIX is naturally cooling, -5% in the 22s.. sub' 20 looks highly probable later this week. Metals are weak, Gold -$4, whilst Oil is trying to build gains of 1.5%.. but still in the $44s.

sp'60min

VIX'60min

Summary

So... market has some gains, and the equity bears are no doubt getting real annoyed, as the big sp'2K threshold is looming for later this week.

Frankly, who the hell wants to be short ahead of the Fed?

--

As for me... I'm merely holding a micro USO-long position. I'm reasonably confident it'll be in the 15s given a few days... but that will mean I hold through the FOMC.

I've eyes on DIS, but there are increasingly broader bearish issues in the market.. and I'm generally inclined to just be on the sidelines until the next cycle peak.

In any case.... at least I'm not short.

--

VIX update from Mr T.

--

time for tea :)

sp'60min

VIX'60min

Summary

So... market has some gains, and the equity bears are no doubt getting real annoyed, as the big sp'2K threshold is looming for later this week.

Frankly, who the hell wants to be short ahead of the Fed?

--

As for me... I'm merely holding a micro USO-long position. I'm reasonably confident it'll be in the 15s given a few days... but that will mean I hold through the FOMC.

I've eyes on DIS, but there are increasingly broader bearish issues in the market.. and I'm generally inclined to just be on the sidelines until the next cycle peak.

In any case.... at least I'm not short.

--

VIX update from Mr T.

--

time for tea :)

11am update - market grinding out the bears

US equities see some distinct renewed strength, with the sp'500 breaking into the 1970s. Next target is the 1988 high... then 1993. Rising support will be 1945 at the Tue' close.. and that now looks very secure. Further upside into the 2000s looks a given.. regardless of FOMC decision.

sp'60min

VIX'daily3

Summary

VIX looks set to lose the 20 threshold.. and we could even see a flash-print in the mid teens this Thursday afternoon.

--

So... equities are showing some strength, as there simply isn't any sustained downside power (well, except in DIS, and a few others).

I can't short this market at these levels. There is simply VERY serious threat of 2010... or even higher.. by the Friday close.

--

RE: DIS. Looking at the daily chart (I'll cover it more later)... DIS is again a likely early warning of market strain.

sp'60min

VIX'daily3

Summary

VIX looks set to lose the 20 threshold.. and we could even see a flash-print in the mid teens this Thursday afternoon.

--

So... equities are showing some strength, as there simply isn't any sustained downside power (well, except in DIS, and a few others).

I can't short this market at these levels. There is simply VERY serious threat of 2010... or even higher.. by the Friday close.

--

RE: DIS. Looking at the daily chart (I'll cover it more later)... DIS is again a likely early warning of market strain.

10am update - Disney having problems

US equities open moderately higher, but are already starting to cool. Meanwhile, there is notable weakness in Disney (DIS), which broke rising trend (equiv' to <sp'1935)... into the $101s... unable to clear the 200dma in the $104s. DIS, an early warning of trouble.. as it was a month ago?

DIS'60min

sp'15min

Summary

*early lunch... back soon.

---

10.01am.. lunch was good........... messy opening 30mins in the casino...

RE: DIS.. the Cramer noted some Morgan Stanley report.. which has upset some.

-

Oil.... battling to break higher..

but until USO is above $15.00.. it remains unclear

-

10.34am.. Bears getting squeezed out... sp' +10pts.. 1963.... the big 2K threshold is easily within range by the Thursday close.

notable weakness, DIS -1.2%

DIS'60min

sp'15min

Summary

*early lunch... back soon.

---

10.01am.. lunch was good........... messy opening 30mins in the casino...

RE: DIS.. the Cramer noted some Morgan Stanley report.. which has upset some.

-

Oil.... battling to break higher..

but until USO is above $15.00.. it remains unclear

-

10.34am.. Bears getting squeezed out... sp' +10pts.. 1963.... the big 2K threshold is easily within range by the Thursday close.

notable weakness, DIS -1.2%

Pre-Market Brief

Good morning. Equity futures are moderately higher, sp +4pts, we're set to open at 1957. USD is u/c in the DXY 95.20s. Metals are weak, Gold -$4, whilst Oil is +0.4% in the $44s.

sp'60min

sp'weekly'2

Summary

*awaiting a considerable amount of econ-data this morning, not least retail sales.

--

At today's close, rising support will be 1945... so.. we can't fall too much today.

All things considered, I don't expect support to be broken in the near term.... not before sp'2000s are hit first.

--

re: weekly'2. Note the second blue candle... offering further upside... with the 10MA now at 2028. In some ways the weekly chart is suggestive the market will get stuck at 2000/2010, rather than manage a test of the 50dma (2040s).

-

Overnight China action: A second day of declines, with the Shanghai settling -3.5% @ 3005... having briefly lost the big 3k threshold. There remains threat of renewed upside to the 3400/500s.. but regardless.. the 2500/2000 zone looks probable.

Have a good Tuesday

-

8.31am retail sales, +0.2%.... certainly nothing for the equity bears to get excited about.... but neither for the bulls either... its a light number.

Empire state manufacturing -14.7 (vs 14.9 Aug).... lousy.... really really lousy

-

9.00am. sp +6pts... 1959.

What should be clear though.. we'll likely see chop all the way into Thursday afternoon.

9.16am. Indust' prod, -0.4%... another lousy number for the econ-bulls.

market doesn't much care.. sp +7pts.. 1960.

9.32am.. Why is DIS getting smacked lower? Hmmm

9.34am.. DIS -1.8%... breaking hourly trend support.... not pretty.. $101s.

sp'60min

sp'weekly'2

Summary

*awaiting a considerable amount of econ-data this morning, not least retail sales.

--

At today's close, rising support will be 1945... so.. we can't fall too much today.

All things considered, I don't expect support to be broken in the near term.... not before sp'2000s are hit first.

--

re: weekly'2. Note the second blue candle... offering further upside... with the 10MA now at 2028. In some ways the weekly chart is suggestive the market will get stuck at 2000/2010, rather than manage a test of the 50dma (2040s).

-

Overnight China action: A second day of declines, with the Shanghai settling -3.5% @ 3005... having briefly lost the big 3k threshold. There remains threat of renewed upside to the 3400/500s.. but regardless.. the 2500/2000 zone looks probable.

Have a good Tuesday

-

8.31am retail sales, +0.2%.... certainly nothing for the equity bears to get excited about.... but neither for the bulls either... its a light number.

Empire state manufacturing -14.7 (vs 14.9 Aug).... lousy.... really really lousy

-

9.00am. sp +6pts... 1959.

What should be clear though.. we'll likely see chop all the way into Thursday afternoon.

9.16am. Indust' prod, -0.4%... another lousy number for the econ-bulls.

market doesn't much care.. sp +7pts.. 1960.

9.32am.. Why is DIS getting smacked lower? Hmmm

9.34am.. DIS -1.8%... breaking hourly trend support.... not pretty.. $101s.

China remains shaky

The China market began the week on a bearish note, settling -2.7% @ 3114. Price structure is a giant bear flag, and regardless of any upside into the 3400/500s, the Shanghai comp' looks on track for the 2500/2000 zone. How the communist leadership deal with some autumnal upset... will be interesting to see.

China, daily

China, monthly

Summary

*a notable fourth consecutive net monthly decline, with a very clear double spike top in May/June.

--

Increasingly, many are now expecting some kind of major fiscal AND monetary stimulus in China. After all.. much like the fed... the level of the equity market is seen as what really matters.

Sure.. some will tout the economy as being key 'data dependant' variable of the central banks, but we know better... don't we?

--

Looking ahead

Tuesday will see a broad array of data... retail sales, empire state manu', indust' prod', and busi' invent'

That will be more than enough to give the market an excuse for some morning action.

--

Goodnight from London

China, daily

China, monthly

Summary

*a notable fourth consecutive net monthly decline, with a very clear double spike top in May/June.

--

Increasingly, many are now expecting some kind of major fiscal AND monetary stimulus in China. After all.. much like the fed... the level of the equity market is seen as what really matters.

Sure.. some will tout the economy as being key 'data dependant' variable of the central banks, but we know better... don't we?

--

Looking ahead

Tuesday will see a broad array of data... retail sales, empire state manu', indust' prod', and busi' invent'

That will be more than enough to give the market an excuse for some morning action.

--

Goodnight from London

Daily Index Cycle update

US equities closed moderately weak, sp -8pts @ 1953 (intra low 1948).

The two leaders - Trans/R2K, both settled lower by around -0.4%. Near

term outlook is for subdued price action into Thursday, before a major

break... to the upside. The sp'2000s still look probable before the

bears have another opportunity of downside.

sp'daily5

Trans

Summary

Little to add.

Daily MACD line remains exceptionally low. Sustained equity downside does not look possible from current levels.

Best guess... the market to break into the sp'2000s.. before rolling over into end month.

--

a little more later...

sp'daily5

Trans

Summary

Little to add.

Daily MACD line remains exceptionally low. Sustained equity downside does not look possible from current levels.

Best guess... the market to break into the sp'2000s.. before rolling over into end month.

--

a little more later...

Subscribe to:

Comments (Atom)